A challenger strengthens positions in Asia: Creditinfo opens a subsidiary in Singapore

After several years of actively listening to the market’s needs and expectations, the international innovator in credit risk management solutions’ – Creditinfo – opens a subsidiary in Asia. Counting the success of the full scope credit bureau solution implementation in Indonesia, launched back in 2017, as well as the positive results from various decision analytics and consultancy services in the region, Creditinfo opens its doors with a dedicated team of top-level professionals based in Singapore to meet the increasing demand for a fresh and innovative approach in credit risk management and fintech, as well to be closer to the company’s existing clients in order to serve them better.

THE CREDITINFO STORY – a real story about a really good company

Today is a special day as we have a movie premiere to announce: THE CREDITINFO STORY – a real short documentary about Creditinfo, or Creditinfo philosophy to be exact, and all of this through the eyes of the company’s founder and Chairman of the Board, Reynir Gretarsson.

The Creditinfo Story is a genuine documentary telling an authentic business story, that started back in 1997. It includes flashbacks on how the business was founded, reminds of what its roots were and displays the core if its DNA, which remains unchanged.

You are welcome to check it out right here.

Insights on how blockchain identity management simplifies personal security

“When users have to share identifying data with a third party, security risk is high. A new tool puts users in charge of their identity and attempts to make ID management seamless.” Check article by Priyanka Ketkar at TechTarget.

COREMETRIX launches collections scorecard

COREMETRIX, the world’s leading provider of psychographic data, has announced the launch of a new product allowing lenders and debt collection agencies to assess the likelihood of customers recovering after they fall into arrears.

Creditinfo Group becomes member of BIIA

Starting June 2017 Creditinfo Group becomes member of the Business Information Industry Association (BIIA), which is a trade association for providers of business information services helping businesses manage growth and reduce risk.

BIIA members’ services include information content, platforms, workflow software, decision systems, identity and authentication services, compliance and risk assessment tools. The largest member segments represent consumer credit bureaus, commercial credit information companies, business information and software providers supporting digital commerce.

More information about BIIA is available at www.biia.com

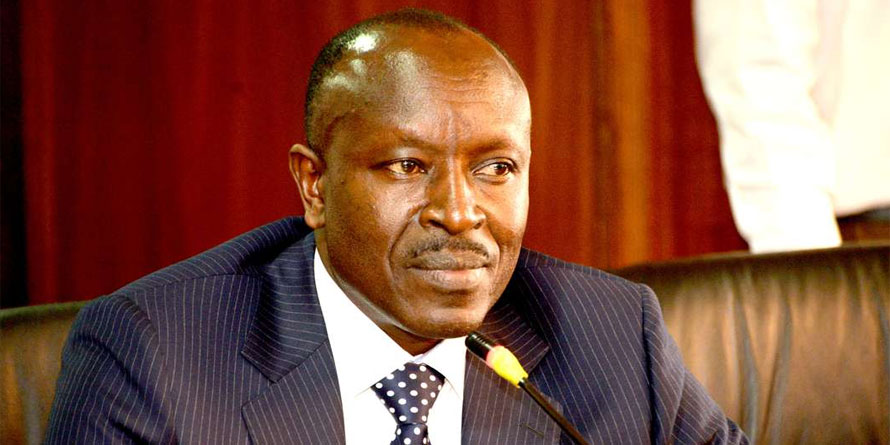

Interest Rate Capping, Market Killer or Innovation Catalyst?

The Central Bank of Kenya (CBK) is set to conclude a study on the law capping interest rates and its impact on the economy, CBK Chairman Mr. Mohamed Nyaoga announced on Tuesday, April 25th. On the same day, Creditinfo Kenya and Creditinfo Academy organised an exclusive meeting for professionals from the financial sector to acquire inspirational observations and insights on the current situation in the Kenyan credit risk management market and acquaint themselves with solutions to the challenges faced by the need to reduce losses and improve productivity.

Creditinfo to power Azerbaijan’s First Credit Information Bureau

Baku, Azerbaijan, April 19, 2017 – IFC, a member of the World Bank Group, over 20 local financial institutions and Creditinfo have teamed-up in launching Azerbaijan’s first private credit bureau to enable local financial institutions to better share credit information, manage lending risks, and boost access to finance for borrowers, including SMEs.

Featuring Tearsheet: Are you too neurotic? Lenders test personalities to determine loan eligibility

Lenders in emerging markets are increasingly looking towards personality-based methods when a customer’s credit history is insufficient for traditional risk analysis. Coremetrix believes that psychometric data can play a vital role in opening up access to vital financial services and matching lenders with profitable, new customers.

Clare McCaffery’s recent interview in TEARSHEET explains some of the methodology behind how Coremetrix can predict real-life financial outcomes and unlock access to credit and other financial products worldwide.

Check this out right here.

Trade Credit Decision Making Webinar

Creditinfo Academy invites you to a “Trade Credit Decision Making” webinar. On February 9th 2017, 15:00 CET, Andryi Sichka, Managing Partner of Credit Engineering and Development Director of The Association of Credit for Central and Eastern Europe will share with you his insights on the topic.

Trade Credit Decision Making webinar

On Tuesday 8th November 2016 at 15h00 CET, join us for a Creditinfo Academy webinar presented by Andriy Sichka on Trade Credit Decision Making. The first in a series presented by Andriy in association with Creditinfo Academy, ACCEE The Association of Credit for CEE, PICM and credit engineering More details here on how to join this open webinar: