New Creditinfo Jamaica Country Manager encourages Jamaicans to be proactive

Christopher R. Brown who was appointed as the new Country Manager for Creditinfo Jamaica on August 11, 2021, is encouraging Jamaicans to “be vigilant in guarding their credit history and their credit data and in managing them” to ensure there are no surprises when individuals or businesses seek to access services which require a credit report.

Brown, in an interview with the Jamaica Observer, reminded Jamaicans that they are entitled to one free copy of their credit report each year by law. He said Jamaicans should go to any of the credit bureaus and request their credit report each year and scrutinise it for “errors or outdated information” and where these are found, “they can then lodge a formal dispute after which it is the responsibility by law for the institution that they have lodged the complaint against, to investigate and correct it, once it is proven that it is an inaccurate record that is kept for that individual”.

He said errors can occur in the case where people may “have closed an account and completed payments on a loan account or a mortgage account, or a hire purchase agreement, and unfortunately it is not updated in the system and it is negatively impacting their credit score. So even after you have closed an account or some contract, or some credit cards or loans that you have paid, it is good to check to ensure those information are updated in the system so that your credit report is always current and up to date, because managing your credit is very essential in these days where credit is king and so fundamental to economic livelihood and, by extension, economic growth.”

He told Sunday Finance that if the entity against which the error complaint is brought, investigates and validates that there was an error, the law requires an updated credit report to be generated and dispatched to the institution which the individual had sought to do business with in the last six months. Whether terms or conditions of any agreements change after the updated information is then to be negotiated with the entity with which the individual is doing business. He stressed the importance of having the records updated because entries stay on the report for seven years.

Brown said getting Jamaicans to be vigilant in guarding their credit data is the message Credit Info Jamaica is pushing.

Credit Info Jamaica is the first credit bureau that was established in the country following the passage of the Credit Reporting Act in 2010. The company, which started its Jamaica operation in 2011, is part of a global network which has operations in Europe, Africa and sections of the Caribbean. In the region it also has facilities in Barbados, Guyana and the Eastern Caribbean.

“We see ourselves as an important part of the local financial infrastructure…part of the push for economic growth,” he outlined. Credit bureaus “have been a fundamental part of the whole improvement in how individuals and institutions now manage their risk in an integrated way. Whereas in the past, institutions would have to take the information that is given to them either by the client and other sources that they have to use intelligence to gather, now they can get it instantly, automated and at the click of a button, they can have the information of a customer sitting infront of them. It makes the application process more efficient and faster. It allows institutions to know how and who they can market their products to and what type of products they can market to individuals. It allows them to determine the credit terms that they will offer based on the credit history associated with the individual,” he added. He indicated that this has seen Jamaicans being more responsible because the list of institutions which credit bureaus collect information from to create a credit profile on an individual is extensive.

Article was originally published on the Jamaica Observer

Edwin Urasa appointed new CEO of Creditinfo Tanzania

New CEO Creditinfo Tanzania

Press Release

London, UK.

30/11/2021

Creditinfo Group is pleased to announce the appointment of Mr. Edwin Urasa as new CEO and Executive Director of Creditinfo Tanzania effective 01st November 2021. He is replacing Mr. Van Reynders whose tenure ended in April 2021.

Edwin brings 10 years of experience from the local banking industry having spent significant time around credit and risk management, recently before joining he was responsible for the Retail and Micro-SME segment at NBC Bank as Head of Retail Credit.

“I am especially excited to join Creditinfo Tanzania, which has been in operation for the last 9 years and has over the years continued to grow rapidly enabling small to large organizations effectively manage risk and support the government and banking community providing responsible lending in Tanzania. I am looking forward to expanding the companies’ product portfolio and services through application of best practices while leveraging Creditinfo global knowledge and expertise”.

“We are very excited to have Edwin Urasa join us as the new Creditinfo Tanzania CEO. With his vast knowledge and experience in the Tanzanian banking and credit industry, we have no doubt that he will lead Creditinfo Tanzania to greater heights and move the company’s journey forward in pushing our innovative solutions to the Tanzania market as well as pushing one of our core pillars – financial literacy, to the public at large”, says Paul Randall, CEO of Creditinfo Group.

Edwin holds a Bachelor Degree in Commerce (Hons), Majoring in Finance from the University of Dar es Salaam, an MBA from Edinburgh Business School at Heriot-Watt University-UK and has also several certifications namely, a Mortgage advisor (CeMAP)-UK, Modules in Commercial Credit from Moody’s Analytics-USA, and Risk Management from City University -UK.

ENDS.

PR contacts:

Marketing Manager/ PR for East Africa

Phidi Mwatibo

Email: Phidi.mwatibo@creditinfo.com

Creditinfo Group, TASDEEQ, PACRA and APL partner with Pakistan Banks’ Association to facilitate wider access to housing finance

Consortium will develop a market-level application scorecard and income estimation model to boost financial inclusion in Pakistan

LONDON, UK, 21st October 2021 – Pakistan Banks’ Association (PBA) recently announced that it has entered into a strategic partnership with a consortium of leading financial services and technology businesses to improve access to finance for low-income segments of the population currently excluded from traditional housing finance.

The consortium, comprised of Creditinfo Group, a global credit information and fintech service provider; TASDEEQ, Pakistan’s first SBP Licensed Credit bureau, offering cutting-edge reports, statistical scores, and analytical tools for the financial industry for efficient credit risk and strategic decision making; Pakistan Credit Rating Agency (PACRA) and Analytics Pvt Ltd, a leading Artificial Intelligence, Business Analytics, Big Data Analytics and Data Sciences solutions provider, will work together to develop for PBA a market-level application scorecard and income estimation model aimed at streamlining risk assessments and enabling a wider pool of applicants to access financing for their housing needs.

The consortium brings together industry-leading credit risk analytics knowledge, alongside extensive experience in Pakistan and emerging markets globally. The development and deployment of the automated income estimation & credit assessment methodology will be overseen through the PBA platform.

This project is being managed by the PBA Technology Working Group, comprising CEOs and members of Bank Alfalah, HBL and Faysal Bank as well as the CEO of PBA and a senior official of State Bank of Pakistan. This is a novel and unique project, and the first of its kind in Pakistan, where a scorecard will be developed using an alternative source of data.

The scorecard project will support the Naya Pakistan Housing Programme (NPHP), a government-backed initiative providing low-cost, affordable housing to deserving individuals in Pakistan that is expected to be a catalyst to accelerated economic activity and increased job opportunities in the region following the negative impact of Covid-19.

Mr. Tawfiq Husain, CEO, PBA stated, “We are very excited with the transformational impact this project can have on our members’ consumer lending and credit initiation and risk management capabilities. Starting with Low Cost Housing Financing, we hope to be able to put this model to use for other products in consumer lending.”

Mr. Omar Khalid, COO TASDEEQ commented: “TASDEEQ, PACRA and Analytics together bring a diverse array of expertise to the project. This synergy coupled with Creditinfo’s comprehensive global experience will be vital in development of low-cost housing credit scoring and income estimation models for the existing as well as new-to-bank customers utilizing alternative data sources. We are excited to be working with PBA to provide the banks with tools for quick and accurate risk decision making and working towards a more financially inclusive Pakistan.”

Mr. Samuel White, Regional Director, Creditinfo, commented on the partnership: “Our unique global experience will be complemented by the consortium partners’ local market knowledge to develop a robust credit risk and affordability solution in Pakistan. The project will provide PBA members with the required tools to make accurate risk decisions on underserved segments of the population, which is fundamental to increasing access to housing finance. Creditinfo is excited to work with the PBA to support the expansion of financial inclusion in Pakistan and help drive economic activity in the region”.

-ENDS-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the largest global presence in the field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally – all with the aim of increasing financial inclusion and generating economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

About TADSDEEQ

TASDEEQ is Pakistan’s first SBP Licensed Credit bureau and a leading credit information services company that leverages data analytics, technology, and industry knowledge to enable financial and non-financial institutions achieve their strategic goals with minimizing their credit risk and help consumers secure their future.

For more information, please visit www.tasdeeq.com

About PACRA

PACRA is, transforming both the rating business and the industry in line with the best practices. Today PACRA has more than 450 opinions outstanding and covering 60+ sectors and sub-sectors of economy.

Since inception, PACRA has over 8,000 rating opinion a testament of PACRA’s expertise, exceptional command, market leadership, and the confidence reposed in its opinions. PACRA rates more than 40% of KSE-100 index companies and 25% of the private sector debt, translating into a rating opinion on every 4th Rupee of debt raised in Pakistan.

The same trust and confidence have also been reposed by foreign regulators in PACRA’s ability and expertise as a CRA. PACRA has entered into a Technical Collaboration Agreements for the formation and operations of CRAs in Bangladesh (National Credit Ratings) and Sri Lanka (Lanka Rating Agency).

For more information, please visit www.pacra.com

About APL

Analytics (branded as Tenx.ai in North America) is a leading Artificial Intelligence, Business Analytics, Big Data Analytics and Data Sciences solutions provider. Having customers in the United States, Middle East and Pakistan, the company has accomplished a proven track record of successfully delivering high impact and complex projects.

For more information, please visit www.analytics.com.pk

About PBA

Pakistan Banks’ Association is a private limited company incorporated under the Companies Act 1913, (now the Companies Act 2017). The principal activity of the Association is to promote, advance and protect rights, privileges and interests of member banks/ financial institutions. Currently, it has 44 members on all Pakistan basis.

For more information, please visit www.pakistanbanks.org.pk

Media Contacts:

Matt Silver

Babel PR for Creditinfo

T: +44 (0)207 199 3977

Average pay for women grows in Lithuania

The average pay for women has grown in 56 sectors after starting releasing information on gender pay gap. Within a matter of three months women’s average monthly pay increased by EUR 20, compared against an EUR 15 increase for men.

After Sodra (Lithuanian Social Security Authority) started publishing sectoral data on average gender pay gap, women’s average pay has grown in 56 sectors out of 81 within the past three months. Women’s monthly average pay increased from EUR 2 to EUR 325 in various sectors. In 13 sectors women’s pay grew by over 10% despite some economic activities where gender pay gap continued to grow for men, these are: insurance, re-insurance, pension accumulation companies, power generation, gas and air conditioning companies, and the pharmaceutical industry.

According to the analysis conducted by Creditinfo Lithuania, from April to July women’s average pay grew from 0.1% to 36.1%, or from EUR 2 to EUR 325 per month. In thirteen business sectors, women’s pay increased by over 10%, with the most remarkable growth reported in accommodation (16.8%), catering and supply of beverages (21.6%), gambling or betting industry (36.1%).

An increase from 10 to 14% in women’s average pay was reported in leather production and water transport, postal and courier activities, organisation of travels, sports activities, and events management, as well as several other sectors, manufacturing of coke and refined petrochemicals, cinema and television programme production, wastewater treatment, programme production and broadcasting, manufacturing of chemicals, extraction of oil and gas.

However, from the already listed sectors only in two of them (postal and courier services, oil and gas extraction) women’s average pay is higher than men’s amounting to EUR 1,856 (cf. men’s pay of EUR 1,552) and EUR 2,851 (cf. men’s pay of EUR 2,248), respectively; whereas in all the other sectors men earn more than women on average.

An average men’s pay is EUR 185 higher than women’s, but the gender gap has been narrowing

Despite the narrowing gender pay gap reported from April to July, in Lithuania men used to earn EUR 185 more than women: men’s average pay currently stands at EUR 1,596 against EUR 1,411 for women. Last April the gap reached EUR 190, with men’s average pay standing at EUR 1,581 against women’s EUR 1,391.

Aurimas Kačinskas, CEO of Creditinfo Lithuania, notes that in the absence of a more in-depth analysis, it is not feasible to assess gender pay gap; examination must be made into the types of positions held by men and women in order to identify the reasons behind differences in salaries.

“Publication of average pay is yet another indicator which can be used by future employees or partners to assess companies; knowledge of this information encourages a better understanding and awareness of the specificities of every company”, A. Kačinskas said.

The gap continues to grow in insurance, reinsurance, financial and telecommunication services, and pharmaceutical industry

Against the background of growing women’s average pay in most of the sectors, in 22 economic sectors the gender pay gap is widening. An average women’s pay dropped by 17.9% in insurance, reinsurance, and pension accumulation sector, where men earned EUR 3,179 per month on average compared to EUR 2,284 earned by women. A gender pay gap widened further from 11.1 to 11.5% in research and technical activities, pharmaceutical industry, power and gas supply, and air conditioning.

Gender pay gap continues to enlarge in the beverages’ industry, immovable property, construction of buildings, telecommunications, and financial sectors.

For instance, in telecommunications an average monthly women’s pay in July stood at EUR 1,602 compared against EUR 2,154 for men, in the financial sector these figures were EUR 2,433 and EUR 3,620, respectively.

The yawning gender pay gap is reported in air transport, where men earn EUR 3,932 per month on average, compared with women’s average monthly pay of EUR 2,385. Human resource management experts put this gap down to a higher number of men engaged in the aviation sector in better paid positions of pilots, whereas women work as flight attendants.

Meanwhile, it is worth mentioning that over three months the number of economic sectors with women earning more than men grew from 9 to 11. The sectors of education, libraries, land transport and transport via pipelines, social work, care services, furniture production, postal and courier services, tobacco and metal production were recently joined by fisheries and aquaculture companies, and motor vehicle manufacturing.

Earlier last June it was reported that, as of last April, out of 81 economic sectors in as many as 72 men receive higher pay than women.

For more information please contact:

Aurimas Kačinskas, CEO of Creditinfo Lithuania, (aurimas.kacinskas@creditinfo.lt; +37061810110).

Hrefna Ösp appointed new CEO of Creditinfo Iceland

Press Release

LONDON, UK, 23rd September, 2021

Hrefna Ösp Sigfinnsdóttir has been appointed as the new CEO of Creditinfo Iceland. She previously held the position of Managing Director of Asset Management and Brokerage at Landsbankinn. She has over 27 years of experience in the finance industry and will bring her wealth of knowledge and expertise to Creditinfo Iceland and the company at large.

‘We warmly welcome Hrefna Ösp to work and we are very happy to have her join us. Hrefna has extensive experience and a clear vision of the functioning of financial markets, which will be a major driver in moving Creditinfo’s journey forward. Hrefna joins a team of highly motivated staff who are also excited to have her on board’ says Paul Randall, CEO of Creditinfo Group.

“I am especially excited to join Creditinfo. I have followed the company since its establishment and have been a loyal customer. I know that Creditinfo has a very strong team that provides excellent service with powerful solutions. It is exciting to become part of an international ecosystem such as Creditinfo Group which is widespread throughout four continents, I foresee many growth opportunities for me as a professional and Creditinfo Iceland as a team. I am especially keen to further develop and provide solutions the market needs, such as open banking and increased demand for knowledge of customers and the origin of capital” says Hrefna Ösp.

Hrefna holds a Degree in Business Administration from the University of Iceland and a certification exam in securities trading.

She resigned from Landsbankinn this autumn after having been there since 2010. Before that, she worked as a fund manager at Arev Securities Company from 2007. She also worked as the Director of the Listing Division and as an expert on the same at the Iceland Stock Exchange from 1998-2006. Hrefna previously worked as the Director of Personal Services at Fjárvangur and was also an employee of the Central Bank of Iceland’s Monetary Policy Department.

Hrefna has also served on the boards of several companies both in Iceland and abroad and is also one of the founding members of IcelandSIF, an independent forum for discussion and education on responsible and sustainable investments.

The Creditinfo Team welcomes Hrefna and is looking forward to start collaborating with her.

PR contacts:

Caterina Ponsicchi,

Marketing Director,

Lithuanian corporate immunisation level is as high as 90% while others are below 30%

The share of immunised staff in different commercial companies may vary several times, the survey by Creditinfo Lithuania suggests. According to Statistics Lithuania (SL), the least immunised retailers (from 36.9 to 52%) work at markets and kiosks. The largest proportion of immunised staff after vaccination (up to 74.7%) has been reported in pharmacies, optics and supermarkets. Among all the sectors, the least active are construction and transport companies, but this indicator may well be explained by a large share of foreign nationals on their staff list.

According to SL data, in terms of the share of immunised staff in the commercial sector, companies selling bread, buns and confectionaries in specialty bakery shops take the last place, with slightly over one third (36.9%) of immunised staff. In other commercial segments, the percentage of fully immunised staff is within the range of 52–64%, with 60–87.2% of staff having received at least one vaccination doze.

Jekaterina Rojaka, Head of Business Development and Strategy at Creditinfo Lithuania, says that after the Statistics Lithuania launched publication of immunisation indicators on a company level, Creditinfo followed suit and started reflecting them in its information systems, while a growing number of users look for information on immunisation of potential business partners.

More staff got infected and recovered from the virus where the vaccination pace is slow

It appears from the publicly available data that in companies with staff delaying vaccination the proportion of staff infected or having recovered from the virus is higher. Obviously, the analysis of recovery indicators among staff suggests that many of these people (up to 12%) are among market and kiosk retailers. Within the category, the sub-category of textile, clothing and footwear retailers stands out where the full immunity (two vaccine dozes) within this group has been acquired by 52% of staff, another 12% of staff became immune after getting infected and recovering from the virus, bringing the overall immunisation level to 64%.

In comparison to workers in supermarkets, pharmacies and optics with 75% of fully vaccinated staff, the immunity after getting infected with the virus was reported from 1 to 5% of the labour force.

The largest number of immunised staff work for the financial services sector, the smallest number – in transport companies

The analysis of companies from other economic sectors suggests that among companies with 70–100% of immunisation level, those engaged in financial activities and services take the lead with 87.1% of immunised staff. Companies at the bottom of this group are from construction (38.7%) and transport sectors (30.3%). According to J. Rojaka, a low level of vaccination there may be explained by a relatively high number of foreign staff working in these sectors, leaving their immunisation indicators outside the scope of the national statistics.

Compared to other economic sectors, extractive industry and agricultural companies are moving at the slowest pace towards the set immunisation target of 70–100%, accounting for 46.6 and 47.8% of immunised staff, respectively.

In restaurants and hotels, which had been very actively promoting vaccination among their staff, at the end of August the immunisation indicator approached to 71.5 and 71.6%, respectively. J. Rojaka notes that these two sectors have achieved the major quality progress in terms of staff vaccination pace, reporting an increase of 45 percentage points in the number of staff vaccinated in August.

For more information:

Jekaterina Rojaka,

Head of Business Development and Strategy, Creditinfo Lithuania

Email: jekaterina.rojaka@creditinfo.lt;

Tel: +370 612 73515

Creditinfo Lithuania included immunization levels into its list of corporate indicators

After the Department of Statistics launched publication of immunization levels in specific companies, credit office Creditinfo Lithuania immediately included this indicator into its corporate reports. From now on, clients ordering detailed information about a selected company will be able to see the proportion of immunized staff.

“The inclusion of immunization indicator into corporate reports will facilitate a better risk analysis of potential disruptions of activities due to staff illnesses which will help a business partner, or a client make further business decisions”, Aurimas Kačinskas, CEO of Creditinfo Lithuania said.

The first ever publication of immunization levels has demonstrated that, e.g., the largest share of immunized staff (80%) work for the IT sector, and the least immunized staff (as little as 27%) work for transportation companies. In comparison, as many as 80% of Creditinfo Lithuania staff have already been vaccinated.

Moreover, the official information published by the Department of Statistics will soon enable comparison of the share of immunized staff in one enterprise with counterpart organizations in the same business sector. To this end, an additional indicator is published as well – the so-called percentile. For instance, if an enterprise’s percentile is 100, it means that it is among one percent of companies with the highest immunization level. The lower the percentile, the fewer employees have immunity, i.e., have been vaccinated with at least one doze or have recovered from the coronavirus.

According to the Department of Statistics, for the purpose of confidentiality the percentage of immunization is indicated only for those workplaces with over 10 members of staff.

“We believe that monitoring these indicators contributes to the national fight against the Covid-19 pandemic, encouraging companies to take a more proactive approach with regard to staff vaccination”, A. Kačinskas said adding that “we always try to include new indicators into our reports in a timely manner so that our clients could benefit from exhaustive information about other companies”.

As of last May, Creditinfo Lithuania included into the list of monitored indicators information about average gender pay, and soon is planning to introduce yet another one – the sustainability indicator.

TOP 1000: Lithuanian leaders demonstrated outstanding resilience

In Lithuania, Creditinfo actively cooperates with business media, providing diverse analytical information in the form of various sectoral reviews and highlighting trends in the key business performance indicators. Every year the main business media channel, the Verslo žinios (Business News), publishes a list of TOP 1,000 largest Lithuanian companies reflecting on the changes that took place over the last year.

In July, the Verslo žinios published its latest update of TOP 1,000 list of business companies compiled based on Creditinfo’s data and corporate financial statements filed in 2020. Luckily, a positive trend can be seen: as many as 59 percent of companies saw their income grow over the last year, which was stimulated also by decision of the global leaders aiming at economic recovery.

At the courtesy of the Verslo žinios editorial staff we are publishing a part of the exhaustive publication; the link to the original article is provided at the end of the text.

—————————————————————————————————————————————————

Published on 16 July 2021.

- The Verslo žinios presents the latest update of TOP 1,000 list of Lithuanian companies.

- Major businesses have successfully adjusted to the new reality.

- Business leaders generated 24.7% more pre-tax income in 2020 than before the pandemic.

- According to Creditinfo’s data, one third of TOP 1,000 companies reduced the likelihood of delayed payments.

- Biotechnological company UAB “Thermo Fisher Scientific Baltics” skyrocketed to the third position on the list.

Contrary to the gloomy pandemic predictions, the pre-tax income of the 1,000 largest Lithuanian companies in 2020 grew by a quarter. Although some of the major corporations were hit really hard by COVID-19, a substantial proportion of them rose up to the challenge transforming themselves and reporting unexpected returns.

These trends are reflected in the TOP 1,000 list of the largest Lithuanian companies drawn jointly by the Verslo žinios and Creditinfo based on income data for 2020. The list includes companies which filed their financial statements in time, i.e., by 31 May, with the Centre of Registers (CR).

Income plummeted against growing profit

Traditionally, the TOP 1,000 list is dominated by companies from three economic sectors, such as: wholesale and retail (381 company), manufacturing (263 companies), transportation and storage (136 companies). All these taken together account for more than three fourths of all the companies on the list.

Almost 500 of businesses are located in Vilnius county, another third operates in Kaunas and Klaipėda counties (223 and 107 companies, respectively). The list includes 76 companies with fewer than 10 employees.

Last year 1,000 of the largest Lithuanian companies generated EUR 51.3 bln. income, i.e., 1.3% less than in 2019. However, in aggregate, these companies earned EUR 3.3 bln. of pre-tax profit, which is an increase of 24.7% from 2019.

Profit of major companies grew the fastest

The growth of TOP 1,000 companies was far more robust than that of the reminder businesses. According to preliminary estimates of the Department of Statistics, in 2020 in Lithuania non-financial companies generated EUR 96.3 bln. income and EUR 6.7 bln. pre-tax profit: in comparison to 2019, the income shrank by 0.4%, while pre-tax profit grew by 3.9%.

Last year 10 companies passed a symbolic threshold of 0.5 bln. of sales income, five of which are retail or wholesale companies. Thermo Fisher Scientific Baltics, UAB skyrocketed to the third place on the list, reporting EUR 1.26 bln. in turnover.

“Despite the prevailing trend of moderately shrinking income amongst the largest 1,000 Lithuanian companies compared against 2019, and a decreasing number of staff, companies generated almost 25% higher profit before tax. An obvious leader in this category is the biotechnological company Thermo Fisher Scientific Baltics, UAB – a manufacturer of COVID-19 reagents and vaccine components. Its pre-tax profit reached EUR 472.6 mln., thus securing the company the first place among the leading companies in terms of this indicator”, said Jekaterina Rojaka, head of business development and strategy at Creditinfo.

According to Indrė Genytė-Pikčienė, chief economist at INVL Asset Management, UAB, a more rapid profit growth among the top 1,000 companies demonstrates the success of major companies in making the best out of the pandemic situation.

Usually, due to the advantage of scale, large companies have more leverage and freedom of manoeuvre than the smaller ones in the face of unexpected circumstances, when they have to negotiate with creditors, suppliers, and other partners”, she explained.

The original publication may be accessed here: https://vz.lt/finansai-apskaita/2021/07/16/top-1000-lietuvos-verslo-lyderiai-parode-neitiketina-atsparuma

Authors:

Eglė Markevičienė

Jovita Budreikienė

Creditinfo launches SME blended scorecard in Kenya

Credit information leader launches pan-African SME initiative, ahead of global rollout

LONDON, UK, 21st July 2021 – Creditinfo Group, the leading global credit information and decision analytics provider, is today announcing the launch of a scorecard solution tailored for small to medium-sized enterprises (SMEs). Through its unique approach to data and algorithms, this scorecard will help financial institutions improve their credit assessment and facilitate financing to the SME market, which has typically been less able to access finance.

Creditinfo, recognizing the importance of SME risk assessment across the world is aiming to roll out a global solution to address this challenge. The company will first launch the SME scorecard in Kenya, ahead of a wider rollout across countries in Africa, and several other key economies across the globe.

The unique modeling approach Creditinfo have developed significantly reduces, and in some cases eliminates, the human effort needed to assess customers’ risk profile based on credit data. It is delivered in a software platform which unifies, streamlines, automates and centralizes the risk evaluation process. Creditinfo’s SME scorecard is considerably stronger at predicting business failure than existing traditional models.

Burak Kilicoglu, Director of Global Markets at Creditinfo, commented, “SMEs drive innovation and push digitalization forward for many people by providing services to underserved segments of the population and creating job opportunities. SME scorecards will accelerate access to finance for the benefit of whole economic ecosystem. At Creditinfo we have access to a wealth of credit bureau data as a starting point, and so are uniquely positioned to offer this solution in global markets.”

Kamau Kunyiha, CEO of Creditinfo CRB Kenya, added, “Kenya is the most dynamic and receptive market for SME lending innovation, demonstrated by the successful adoption of mobile wallets and microloans. We look forward to seeing the economic impact of this new solution as it comes into full effect and we see more capital flowing through the SME economy.”

-ENDS-

About Creditinfo

Established in 1997 and headquartered in Reykjavík, Iceland, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

PR contacts:

Marketing Manager/ PR for East Africa

Phidi Mwatibo

Email: Phidi.mwatibo@creditinfo.com

Increased use of credit bureau data in Lithuania

The use of credit bureau data is growing along with economic activity, although businesses tend to undertake additional precautions

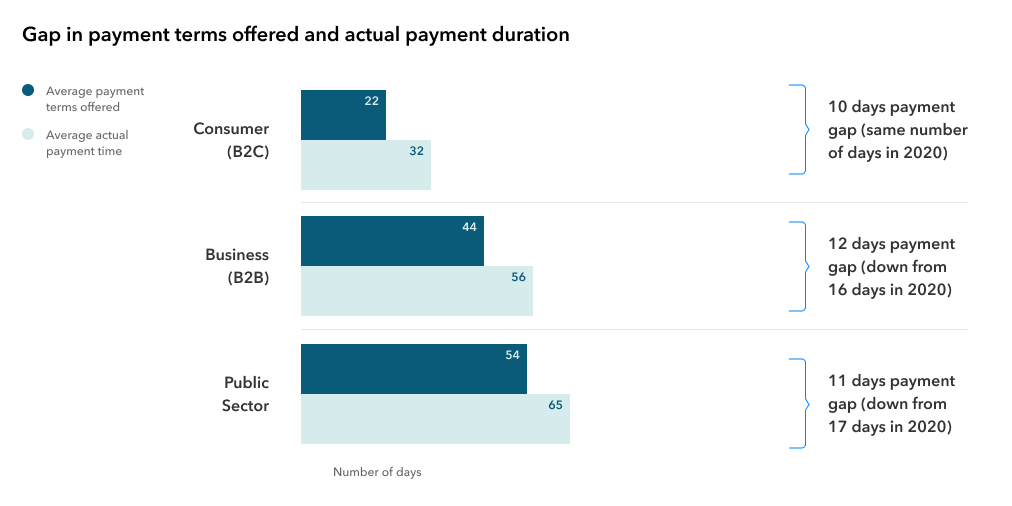

The INTRUM EPR 2021 survey published in June reported on the growing demand for pre-payments against a decreasing trend of conventional risk management measures, such as credit history screening, insurance and factoring.

The current situation in the business sector could benefit from some clarifications and comments. In turbulent and uncertain times – and lockdown could rightly be said as being one of these – entrepreneurs tend to undertake additional safeguards, e.g. pre-payments. However, any quantitative easing measures, such as material support offered in the form of soft credits or subsidies, enabled many businesses to maintain their liquidity at least for some time. This is why the corporate performance results were not as devastating as they were during the Great Recession, when manufacturers importing commodities were forced to allocate all of their funds for pre-payments to their suppliers.

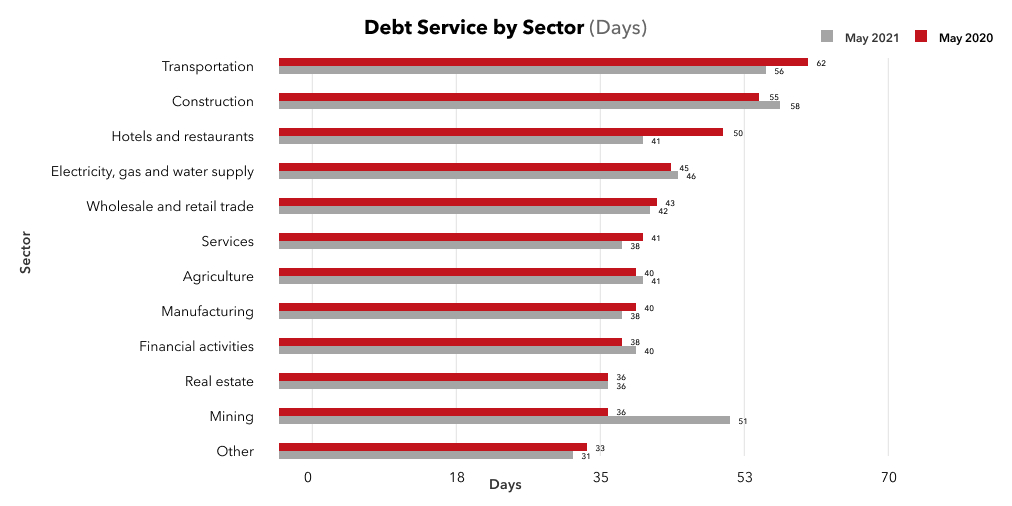

Meanwhile, the statistics demonstrates some late payments to the partners in 2021 in the sector of hospitality industry (by 9 days, from 41 to 50), in transport (from 56 to 62 days), in services (from 38 to 41 days), in processing industry (from 38 to 40 days). In contrast, in the financial operations sector, the payment terms have become shorter.

Quite reasonably, one may wonder what are the reasons behind shorter payment terms – can these be explained by precautions taken by the suppliers or by an improving economic situation?

I would like to draw the attention to the fact that in the times of the pandemic shareholders would recommend public sector representatives tightening payment gaps to enable the business sector to improve liquidity in the private sector. In the private sector the medium-term payment gaps were affected by a more resilient economic structure, as businesses suffering from liquidity shortage made only a fraction of all businesses.

Moreover, account needs to be taken of the fact that as many as 60 percent of companies responding to the INTRUM survey in Lithuania admitted anticipating recession in contrast to economic forecasts showing a clear recovery.

Lithuanian business market is rather optimistic: the economic evaluation index in Lithuania has already reached its pre-pandemic level (116 vs. 110), this indicator was higher only in 2007 on the eve of the Great Recession. In addition, all sectors last May demonstrated a growing confidence index. Commercial confidence index grew by 9 percentage points, while in the service, industry, and construction sectors it grew by 7, 4, and 1 percentage points, respectively. Only the consumer confidence index dropped by 3 percentage points.

In parallel, a rapid growth in the real estate prices and demand is being reported along with the signs of growth in the prices of commodities and inflation. All these factors may signal the approaching peak in an economic cycle, which explains the lingering anxiety about a possible recession due to the phasing-out of economic stimulus measures.

One of the most popular support measures – tax deferrals – are drawing to an end: default interests and tax recovery procedures will not be calculated until 31 August 2021 and for two subsequent months; one may expect to see a more realistic state of business health towards the end of the year.

Nevertheless, the following conclusion has to be drawn as a comment on the use of credit office information systems by the organizations: the number of inquiries recently has been changing along with the economic activity – within the first 5 months the number of inquiries increased by 12 percent compared to 2020 year-on-year, and by as many as 25 percent compared to 2019 year-on-year.

Jekaterina Rojaka,

Head of Business Development and Strategy,

Creditinfo Lithuania.