The Creditinfo Chronicle

Creditinfo Launches ESG Hub to Fast-track Baltic Companies’ Access to Reliable Sustainability Data

New one-stop-shop solution aggregates information from more than 20 external sources, helping banks and businesses boost their ESG strategies, manage risk, and streamline their supply-chain transparency.

Creditinfo unveiled ESG Hub, the Baltic region’s first pan-regional platform that gives lenders and businesses instant, standardised access to the environmental, social and governance (ESG) data they need to comply with regulations, assess counterparties and execute sustainability strategies.

Building on Creditinfo’s long track-record of turning complex business information into accessible actionable insight, ESG Hub consolidates data from 20-plus public and proprietary data sources from Estonia, Latvia and Lithuania into one standardised API feed and ready-to-use report. By merging country-specific registries into a single, harmonised view, the platform lets banks and businesses manage ESG data uniformly across all three markets. Users can pull company-level metrics—from carbon emissions and energy intensity to board diversity and community impact—within seconds, eliminating the need to piece together separate national datasets manually.

“We want to accelerate the sustainability journey for the Baltic economies, and it all starts with easy access to trusted information. Until now, assembling ESG data has been difficult and time-consuming; companies have spent substantial time on these tasks, and the process has been inefficient,” said Elari Tammenurm, Regional Director, Continental Europe at Creditinfo. “With ESG Hub, any financial institution or company can integrate harmonised data directly into their existing workflows, cutting cost and complexity while improving decision speed.”

Proven model, now scaled to the Baltics

Creditinfo first introduced an ESG data service in Iceland in 2023; rapid adoption by local banks and corporates highlighted the growing importance of reliable sustainability intelligence. “The strong uptake we saw in Iceland showed us how big the need is,” noted Reynir Smári Atlason, Managing Director of Sustainability at Creditinfo. “We’re now bringing those learnings, and a richer dataset, to the Baltic markets.”

The company will continue to expand ESG Hub’s data source coverage and analytical modules over the coming months. Future roll-outs in additional Creditinfo markets are also planned.

For more information visit ESG Hub

Creditinfo & Little App Partner To Enhance financial Inclusion In Kenya

Little App’s new feature gives individuals and businesses instant, on-the-go access to their credit information

Nairobi, 18th June 2025 – Creditinfo, a global service provider for credit information and risk management solutions, has partnered with Little App, one of Africa’s most forward-thinking super apps, to enable Little App users to access their credit reports and monitor their credit scores instantly and securely within the app’s Financial Services section.

With the integration of Creditinfo’s credit bureau data into the app, individuals and businesses can conveniently view their credit information through their mobile devices. Whether applying for a loan, improving creditworthiness, or monitoring one’s financial health, this new feature makes it simple, fast, and user-friendly. Having this information available in one place will help people in Kenya to take control of their finances, make more informed decisions, and access credit with confidence.

“Our partnership with Little reflects more than just a shared goal; it’s a concrete step toward increasing financial inclusion and transparency across Kenya and the African region in the foreseeable future. Data is key to unlocking financial opportunity for people, and our priority is to make access to real-time, reliable credit information simpler and more intuitive. We’re immensely proud to deliver a solution that brings tangible benefits to people’s financial journeys,” said Kamau Kunyiha, Regional CEO East and Southern Africa at Creditinfo.

Kamal Budhabhatti, CEO at Little said: “Africa is undergoing a remarkable digital evolution, with mobile technology transforming how people live and engage with services. Through our collaboration with Creditinfo, we’ve built a solution that meets people where they are – on their phones – and fits seamlessly into their daily lives. We want to demystify complex financial data for everyone, empowering users to make informed decisions while driving lasting social and economic impact.”

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

About Little

Little App is a pan-African super app that has been transforming everyday experiences since 2016. With nearly a decade of innovation, Little offers a wide range of tech-driven solutions across mobility, payments, delivery, healthcare, and lifestyle services.

Operating in multiple African countries, Little serves both individual users and organizations—delivering convenience, affordability, and efficiency. From ride-hailing to enterprise transport solutions and digital wallets, Little is at the forefront of enabling digital and financial inclusion across the continent.

For more information, please visit www.little.bz

Creditinfo Kenya and Kamoa Join Forces to Expand Access to Credit Through Alternative Data

NAIROBI, Kenya – June 13, 2025 – Creditinfo Kenya (CIK), a credit information and risk management solutions provider, and Kamoa have announced a strategic partnership to improve credit decisioning and financial inclusion in Kenya.

The partnership will see Creditinfo Kenya leverage Kamoa’s alternative data technology to build more comprehensive credit profiles for individuals and SMEs. This approach aims to unlock lending opportunities for both the banked and underbanked, while enhancing the quality and inclusiveness of credit assessments.

Through this collaboration, Creditinfo Kenya and Kamoa aim to:

- Accelerate financial inclusion,

- Support the growth of SME lending

- Enable lenders to make more accurate, data-driven decisions

‘At Creditinfo, we’re committed to broadening access to financial services for individuals and businesses. Our partnership with Kamoa marks a key milestone in improving credit decisioning and inclusive financial solutions in Kenya. By using broader data, lenders can make smarter lending decisions, enabling more people to access the financial services they need to grow and prosper financially. Together, we’re setting a new standard in credit decisioning while fostering financial empowerment across Kenya,” said Kamau Kunyiha, Regional CEO East and Southern Africa at Creditinfo.

The agreement marks a significant step toward a more inclusive and data-enriched credit ecosystem in Kenya.

FIND THE WHITE PAPER HERE – Boosted Score - White Paper

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

About Kamoa

Kamoa is a data technology company on a mission to unlock access to finance and financial opportunity across Africa. We harness the power of data to help individuals, small businesses, and financial institutions make smarter, more inclusive decisions. By building intelligent systems that connect and interpret diverse data sources, we aim to close information gaps and enable better financial outcomes across lending, savings, insurance, and beyond.

Founded in 2023, Kamoa began in stealth with a bold ambition: by 2030, to become a leading infrastructure layer for financial innovation across the continent — empowering players from microfinance institutions to major banks, and serving customers from every corner of the market.

For more information, please visit https://kamoa.app/enterprise

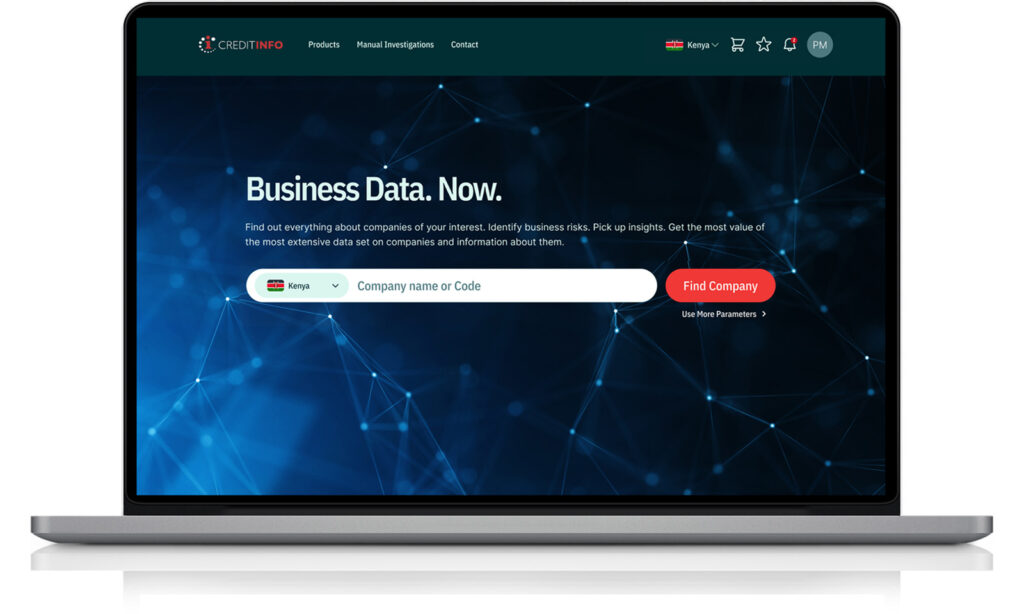

Creditinfo launches new platform to boost African businesses’ access to credit and global opportunities

Creditinfo’s Business Information Platform Africa aims to strengthen local economies and foster global partnerships

London – 14 May 2025 – Creditinfo has today announced the launch of Business Information Platform Africa (BI Africa) to help African businesses and financial services access trade credit more easily and build stronger relationships with global partners. The platform will be rolled out in Kenya in June, with more markets to follow.

The move builds on Creditinfo’s success in the Baltics, where its business information tools have helped companies navigate partnerships and manage risk for over a decade. Now, that same model is being brought to Africa – starting with Kenya – where access to verified, independent business data has often been a challenge.

‘This launch isn’t just about data. It’s about unlocking opportunity,’ said Satrajit Saha, CEO at Creditinfo. ‘When businesses have the right information at their fingertips, they can make smarter, faster decisions that drive growth, close more deals and build lasting confidence – both locally and globally.’

The BI Africa platform offers reports on over one million African companies, presented in a simple, globally standardised format. Users can check key facts about potential partners or customers, everything from credit health to company history, making it easier to assess risk and build trust. Additionally, as an added service, Kenyan businesses will have access to company reports on over 430 million international companies – empowering them to confidently verify both new and existing clients through Creditinfo and its network of global partners.

‘We want to make it easier for African businesses to prove their value, compete globally, and grow with confidence,’ added Saha. ‘Greater transparency leads to stronger trust and improved access to finance – benefits that extend across economies and communities. And that’s a win for everyone.’

It also includes a Manual Investigation Service for those who need deeper insight. Users can request tailored research into specific companies, providing information that goes beyond the numbers, like ownership structures, litigation history, or up-to-date financials. Crucially, the platform isn’t just for large institutions. It’s been designed to support SMEs and individual entrepreneurs, too – those who often struggle the most with gaining access to trade credit.

‘By bridging critical trust and information gaps, our robust platform will redefine what is possible for businesses, of all sizes, in Kenya and beyond. What once took three to five working days to verify a potential business partner can now happen in seconds, without compromising on regulatory compliance. That’s a game-changer for companies, particularly in the SME sector, who need to make quick decisions in competitive markets,’ said Kamau Kunyiha, Regional CEO East and Southern Africa at Creditinfo.

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

Lucinity & Creditinfo Partner To Integrate PEP Screening Seamlessly Into AI Workflows

Reykjavik, Iceland – May 6th, 2025 – Lucinity, a global leader in AI-driven compliance software, has partnered with Creditinfo, a trusted and leading provider of credit and risk intelligence solutions, to integrate access to localized Know Your Customer (KYC) data from Creditinfo directly into Lucinity’s end-to-end compliance platform. This strategic partnership enables financial institutions to automate KYC checks—including PEP screening, watchlist monitoring, reliability assessments, and UBO insights—across onboarding, ongoing monitoring, and investigations, all within a single, intuitive interface.

Until now, many compliance teams have struggled with fragmented workflows when it comes to Know Your Customer (KYC) checks. They’ve had to rely on standalone systems, manually reconcile KYC data with their case investigations, and perform periodic re-checks without automation.

Lucinity and Creditinfo are solving these challenges by embedding high-quality, localized KYC data from Creditinfo—including PEP screening, watchlist monitoring, reliability assessments, and UBO information—into Lucinity’s holistic case management and transaction monitoring systems, powered by AI. Within Lucinity’s AI workflows, KYC data becomes an actionable input—automatically adjusting risk scores, triggering alerts, and adapting recommendations as new information becomes available.

Through the integration with Creditinfo’s API, financial institutions can automate checks during onboarding, schedule periodic refreshes, and run on-demand lookups for counterparties. Key KYC indicators—such as PEP status—are also flagged directly in Case Management and Customer 360, helping analysts make better-informed decisions without switching between systems.

Already offering real-time fraud detection through a partnership with Sift and real-time sanctions screening through Neterium and Facctum, Lucinity continues to build a network of integrations that simplify compliance while strengthening effectiveness. By consolidating tools that were previously siloed, Lucinity helps financial institutions cut costs, reduce context-switching, and focus on high-value investigations.

Guðmundur Kristjánsson, Founder and CEO of Lucinity, shared his perspective: “We kept hearing the same story from our customers — they had great separate financial crime tools, but none of them were connected with each other. This integration with CreditInfo brings the data and workflow together so compliance teams can focus on analysis, not data gathering.”

Creditinfo brings its strengths in reliable, frequently updated, and geographically relevant PEP data, with a special emphasis on regional accuracy in markets like Iceland with their proprietary Icelandic PEP database. This partnership reflects Creditinfo’s growing role as an essential data provider in the global compliance ecosystem. Hrefna Ösp Sigfinnsdóttir, CEO of Creditinfo in Iceland, commented, “We believe compliance shouldn’t be complicated. By partnering with Lucinity, we’re putting the right data exactly where it’s needed.”

About Lucinity

Lucinity is an AI software company for financial crime operations, designed to accelerate compliance teams. Lucinity enhances intelligence gathering, analysis, and decision-making, allowing institutions to streamline operations and reduce costs. As an open, configurable, no-code platform, Lucinity offers a seamless integration of data, automated workflows, and a modern user interface, making it a crucial tool for enhancing productivity and operational efficiency in the financial sector.

About Creditinfo

Creditinfo is a global provider of credit information and risk management services, helping financial institutions, businesses, and governments make data-driven decisions with confidence. Its proprietary PEP data service delivers accurate, regularly updated insights tailored to local markets.

Visit creditinfo.is for more information.

The Importance of Trust in Digital Interactions: The Cornerstone of a Digital Economy

There’s a diversity in maturity in digitization across the globe – from markets that are almost universally digital, through markets with developing digital economies, to markets with embryonic digital ecosystems. Mature economies typically have more mature controls but remain attractive to fraudsters because of the scale of opportunity – emerging digital economies typically have less robust ecosystems and are attractive because of the inherent vulnerabilities in the controls – with a promise for future growth.

The anonymity and distance that digital platforms afford make it easier for fraudsters to operate undetected.

For bad actors, the business model is scalable – in a digital economy the unique skills of Frank Abagnale Jr (of “Catch Me If You Can” fame) become redundant. The ready availability of personal data through vast data breaches and social engineering, and online access to digital channels present an attractive proposition for the enterprising fraudster.

In fact, cybercrime has risen dramatically alongside digital transformation, with fraud rates increasing globally – and we’re increasingly seeing collaboration between cybercrime, fraud, organised crime and money laundering. Organizations face mounting challenges in protecting their digital infrastructure and customers from fraudulent activities. From identity theft to financial scams, fraudsters are leveraging a wide array of tactics to deceive individuals and organizations.

The digital economy’s vulnerability to fraud presents significant risks, not only for organizations, but also for consumers. When fraud occurs, it undermines the trust that is essential to the functioning of the digital economy. If consumers and businesses cannot trust the digital services they engage with, it will slow adoption, hinder growth, and damage reputations. Therefore, mitigating fraud risk is not just about protecting individual interactions – it’s about maintaining the integrity of the entire digital ecosystem.

The importance of trust in digital interactions cannot be overstated. From e-commerce to financial services and beyond, trust is the foundation upon which all successful digital interactions are built. At the core of this trust is the concept of identity verification. In a world where interactions are increasingly conducted online, it’s critical to ensure the presented identity is a real-world identity, not synthetic – and that the individual presenting the identity is the owner of that identity.

The need to assert identity in digital engagements goes beyond basic security – it forms the bedrock of confidence that drives the entire online ecosystem. Whether consumers are signing up for a new banking service, purchasing products, or enrolling in educational courses, verifying the authenticity of their identity is paramount. Identity verification serves not only to protect individuals but also to secure businesses from fraudulent activities, which, in turn, strengthens the broader digital economy.

The Role of Identity Verification in Mitigating Fraud Risk

At the heart of reducing fraud risk lies robust identity verification. This process ensures that the individual engaging with a digital platform is who they claim to be. It is a crucial step that lays the groundwork for every subsequent transaction, providing a layer of protection for both consumers and businesses. Without reliable identity verification, any digital interaction is susceptible to being manipulated by malicious actors.

Identity verification can be achieved through a variety of techniques, including biometric verification, document verification, and multi-factor authentication. These methods allow businesses to verify that a person is genuine, providing them with the confidence to proceed with transactions. This, in turn, enables a safer and more reliable digital environment for everyone involved.

However, while basic identity verification is a critical first step, it is only part of the solution.

The Power of Layering Fraud Defences

In a digital economy, an identity is far more than a name, address, date of birth and national id number.

From basic digital identity attributes such as mobile numbers, email addresses and IP addresses, through payment attributes such as bank details and credit card numbers, through connected messaging apps and service accounts, through device attributes such as screen size, make, model, time zone, location, installed apps, through biometric attributes such as facial patterns, to behavioural attributes such as physical device interactions. A digital identity is an extensive and interconnected web of many attributes.

The real strength in mitigating fraud risk lies in combining multiple layers of defence – a multifaceted approach that examines not only the traditional identity attributes, but the wider digital footprint and the connections between attributes across the identity graph. Consistency and conformity to normalised patterns help establish greater trust – inconsistency and anomalous patterns indicate greater risk. Machine learning and artificial intelligence techniques are increasingly used to examine attribute patterns – generating increasingly performant models.

The power of a layered approach lies in managing the balance between making life difficult for bad actors and removing friction in genuine interactions. In a digital economy consumers become increasingly intolerant of any friction in their interactions with organisations. Where consumers encounter even minor friction, they will abandon the sales process and look for alternative providers – in a competitive market, the winners will be the businesses who deliver the easiest way to interact – but without appropriate fraud defences, success will be short lived.

More accurate multifaceted risk assessments can be implemented based lighter data capture, drawing insights from a broad range of sources, reducing CX friction and abandonment, readily securing greater trust, more accurately exposing risk.

Summary

As the digital landscape continues to evolve, organizations must prioritize trust as the cornerstone of their interactions with consumers. Robust identity verification and a layered approach to fraud prevention are not just best practices – they are essential for maintaining the integrity of the digital economy. By effectively combining multiple layers of defence, businesses can balance security with convenience, reducing fraud risk without sacrificing customer experience. In the end, fostering trust in digital engagements is the key to enabling sustained growth and success in an increasingly complex and competitive online ecosystem.

For more information, please visit: www.creditinfo.com

or email info@creditinfo.com

Author : Robert Meakin – Director, Fraud & ID, Creditinfo Group

Creditinfo Launches New Global Fraud & ID Solution

Creditinfo’s new solution supports clients in mitigating the impact of fraud and supporting organisational growth.

London – 27th March 2025: Creditinfo, a global service provider for credit information and risk management solutions, has today announced the launch of its global identity, know your customer (KYC), and fraud and ID solution, set to help organisations tackle financial crime.

The overall global economic impact of financial crime has been estimated to be $5 trillion. What’s more, according to the 2024 Nasdaq global financial crime report, fraud losses totalled $485.6 billion worldwide, from fraud scams and bank fraud schemes alone. As such, organisations face a series of challenges, from eroding profit margins to reputational risks to data breaches. Creditinfo’s solution helps organisations to address these challenges by using credit bureau data, government information services, and other registries to establish trust in presented identities, without negatively impacting the customer experience.

The solution integrates identity proofing, digital risk signals and comprehensive international and domestic watchlists to deliver strong KYC compliance and reduce the risk of fraudulent activity. It also enables businesses to streamline risk management and ensures they meet stringent customer due diligence requirements under anti-money laundering (AML) regulations.

As a global solution, it is tailored to meet the unique needs and maturity-levels of different markets. By accounting for these differences, organisations that use the solution can adapt their fraud prevention strategies to specific local risks, strengthening security and promoting financial inclusion.

Creditinfo has appointed Rob Meakin as Director of Fraud & Identity to head up this service. He brings extensive experience in fraud prevention, identity management, and financial services. Meakin will lead efforts to help organisations counter fraud – leveraging advanced technologies and data analytics to enhance the customer experience and strengthen fraud and AML controls.

Rob Meakin, Director of Fraud and Identity at Creditinfo, said: “The growing presence of organised financial crime is significantly hindering economic growth on both a local and global scale, costing businesses huge sums of money each year – in fraud losses, lost sales and operational costs. That’s why, at Creditinfo, we’re pioneering a solution that provides a way for organisations to manage risk and maintain compliance while facilitating secure and easy access to financial products and services for consumers.”

John Cannon, Chief Commercial Officer at Creditinfo said: “By removing friction from both traditional and digital onboarding and origination processes, our solution helps organisations reduce fraud, improve conversion rates, and drive top-line growth while ensuring a seamless customer journey. As we strive to expand our global reach and enhance financial access for millions of consumers and businesses worldwide, having Rob join our team is an invaluable advantage, strengthening both our security capabilities and our ability to deliver innovative solutions.”

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

For inquiries email rob.meakin@creditinfo.com

Download Brochure HereJonas Lukošius New Creditinfo Lithuania CEO

Vilnius – 14th March, 2025: Creditinfo, a global service provider for credit information and risk management solutions, has announced the appointment of Jonas Lukošius as the new CEO of Creditinfo Lithuania. He will be responsible for shaping the business strategy, increasing operational efficiency, innovation and driving growth of Creditinfo Lithuania.

“Jonas Lukošius is an experienced manager with extensive experience in business transformation and performance improvement. His expertise will help us to strengthen our market position and further expand our credit risk management and analytics solutions services,” said Satrajit Saha, CEO of Creditinfo Group.

Mr. Lukošius joins Creditinfo Lithuania after more than 20 years of experience in leading various organizations. He has held the position of Managing Director at Žalgiris, as well as worked at TransUnion Baltics and DXC Technology, where he was responsible for strategic change, innovation and improving operational efficiency.

“I am honored to be the new CEO of Creditinfo Lithuania. Credit information and risk management solutions are critical to the business environment and I will strive to further strengthen the organization’s market position, promote innovation and enhance cooperation with clients,” said Mr Lukošius.

Mr Lukošius holds a Master’s degree in management from ISM University of Management and Economics and a Bachelor’s degree in Informatics from Vilnius University.

About Creditinfo:

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

Creditinfo actively cooperates with the World Bank, the International Finance Corporation (IFC), is a member of the international associations ACCIS and BIIA, as well as of the Lithuanian Banking Association and the Investors Forum. Creditinfo has offices on four continents in more than 30 countries, including Lithuania, Latvia and Estonia.

More information:

Aušrinė Motiejūnienė,

Marketing Manager,

Creditinfo Lithuania Analysis: In 2024, An Average of Three Companies Filed For Bankruptcy Daily

According to Creditinfo Lithuania’s analysis, 1,079 company bankruptcies were registered in Lithuania in 2024—a 16.1% increase compared to 929 cases in 2023. However, this figure is slightly lower than in 2022 when 1,087 bankruptcies were recorded (a 0.7% decrease).

Key Sectors Affected: Construction, Trade, Transport, and Manufacturing

Construction Sector Challenges

The construction sector faced the highest number of bankruptcies in 2024, with 243 cases, marking a 16.8% increase from 208 cases in 2023. However, this was a slight 2.5% decrease compared to 2022 (237 bankruptcies). Currently, 11,299 companies operate in the construction sector in Lithuania.

Dovilė Krikščiukaitė, Head of Legal at Creditinfo Lithuania, noted that the sector struggled with insufficient demand, particularly in real estate. However, engineering construction projects increased by 10.3%, and many companies remain optimistic, planning to hire more employees and anticipating growth.

Despite these challenges, economic analyst Aleksandras Izgorodinas from Citadele Bank projects fewer bankruptcies in 2025 due to declining interest rates in the eurozone. Improved real estate transactions and mortgage volumes are already evident, which could stabilize the construction sector further.

“However, I believe that in 2025, the number of bankruptcies in the construction sector will decline. With falling base interest rates in the eurozone, we are already observing a recovery in real estate transactions and mortgage volumes. Buyers are returning to the real estate market, and the cost of borrowing continues to decrease. This will lead to fewer bankruptcies in the construction sector in 2025. It is projected that the ECB will lower interest rates at least three more times this year, further supporting recovery in Lithuania’s construction and real estate sectors and reducing bankruptcy numbers,” said A. Izgorodinas.

Wholesale and Retail Trade

The wholesale and retail trade sector had the second-highest number of bankruptcies, with 237 cases, a 3.9% increase from 2023 (228 bankruptcies). However, this figure was lower than in 2022 (251 cases). With 23,601 companies, this sector remains the largest in Lithuania.

“Companies in this sector faced fluctuating demand, but recovering domestic consumption and increasing real wages resulted in higher revenues compared to the previous year,” explained D. Krikščiukaitė.

Transport Sector Under Pressure

The transport and logistics sector, comprising 8,684 companies, saw 134 bankruptcies—a dramatic 74% increase from 77 in 2023 and a 35.4% rise compared to 99 cases in 2022.

“Unlike the construction sector, where we see the first signs of recovery, the transport sector is yet to show improvement. For instance, Germany’s truck mileage index, which strongly correlates with Lithuania’s transport services export indicators, fell to its lowest level since the end of 2020 by the end of 2025, being 2% lower than at the end of 2024. This indicates that the transport sector will likely remain under pressure in the near future. The sector is highly sensitive to fuel price fluctuations and supply chain disruptions, which often create difficulties for smaller companies,” commented Citadele Bank’s economist.

Manufacturing Sector Struggles

The manufacturing sector, with 8,440 companies, recorded 121 bankruptcies in 2024—a 31.5% increase from 92 in 2023 and a nearly 25% rise compared to 97 in 2022.

According to Creditinfo Lithuania’s head of legal, reduced demand in European export markets, rising raw material costs, and higher energy expenses led to financial difficulties for many manufacturing companies.

Positive Developments in the Accommodation, Food Services, and Real Estate Sectors

Despite the rise in bankruptcies in the sectors, certain industries exhibited positive trends. In 2024, the number of bankruptcies in the accommodation and food services sector dropped by 20% to 66 cases compared to 82 cases in 2023. Moreover, this figure represents a 52% reduction compared to 2022, which saw 137 bankruptcies. Currently, 3,837 companies operate in this sector in Lithuania.

Similarly, the real estate (RE) operations sector, encompassing 6,621 companies, also demonstrated improvement. Bankruptcies in this sector decreased by 22.7% in 2024, from 44 cases in 2023 to 34 cases. In 2022, 33 insolvency cases were recorded in this sector.

Analysis of insolvent companies revealed that the total turnover of bankrupt companies in 2023 was €194.28 million, with the average annual turnover per company standing at €848,000. Notably, the workforce within these companies experienced a significant decline. At the beginning of 2023, these firms employed 7,292 workers; by October, this number had fallen to 5,551 employees.

“Monitoring the key operational metrics of business partners can help identify early warning signs. A decrease in workforce, reduction in the transport fleet, changes in management or shareholders, relocation of headquarters, or declining turnover are indicators that warrant close attention to ensure reliable partnerships and the fulfillment of financial commitments,” stated Dovilė Krikščiukaitė, Head of the Legal Department at Creditinfo Lietuva.

The head of Creditinfo Lietuva’s Legal Department also observed a trend toward younger companies becoming insolvent. In 2024, the average age of bankrupt companies was 10.58 years, compared to 11.68 years in 2023 and 12.31 years in 2022.

“This shift indicates that an increasing number of young companies are struggling to overcome market challenges and adapt to changing economic conditions. Young businesses often face financial management deficiencies, high costs, and intense competition, which exacerbate their difficulties,” added the Creditinfo Lietuva representative.

Lithuanian Paper Industry: Revenue Growth, Debt Increase & Decreasing Risk

Challenges from a Few Companies Distort the Overall Picture

An analysis by Creditinfo Lietuva reveals a controversial situation in Lithuania’s paper manufacturing sector. While the number of companies has decreased in recent years, the number of employees has grown. In 2023, sector revenues reached €829 million—a 51% increase compared to the beginning of 2021. However, there are worrying signs: the sector’s debt portfolio has grown nearly fivefold over four years. This negative trend is primarily driven by the difficulties of a few companies, while the sector itself demonstrates resilience. No bankruptcies have been recorded in the past three years, and the risk levels are nearly twice as low as the national business risk average.

Current State of the Sector

According to Creditinfo Lietuva, there are currently 176 companies operating in the Lithuanian paper manufacturing sector, employing 5,462 people. While the number of companies has gradually decreased from 191 in 2021 to 176 in November 2024, employee numbers have grown steadily, from 5,022 in January 2021 to 5,462 in November 2024.

Economic Indicators: Positive and Negative Trends In 2023, total sector revenues reached €829 million—4.6% less than at the start of the year (€869 million), but 21% higher than in 2022 (€684.6 million) and 51% higher than in 2021 (€548 million). Over a four-year period, average annual revenues per company increased from €4.2 million to €6.1 million.

The paper manufacturing sector includes companies producing pulp, paper, and cardboard, as well as corrugated paper and cardboard packaging, hygiene and household products, stationery, copy paper, envelopes, wallpapers, and other specialized products.

Debt Portfolio Increased

Fivefold At first glance, the sector has seen a significant increase in overdue financial obligations. Between 2021 and the end of 2024, the debt portfolio grew nearly fivefold, from €157.7K to €776.6K, while the number of debts increased only slightly, from 87 to 89 cases.

“A deeper analysis shows that the overall figures are skewed by issues faced by a few companies—one undergoing restructuring and another involved in legal proceedings. Excluding these, the sector remains stable, with the average debt amount per case decreasing from €2,999 in early 2024 to €2,803,” says Dovilė Krikščiukaitė, Head of Legal at Creditinfo Lietuva.

Bankruptcy Trends

From 2003 to the end of 2024, the paper manufacturing sector recorded 30 bankruptcies. However, insolvency cases have varied across periods. For instance, no bankruptcies occurred between 2022 and 2024 or from 2014 to 2015, while 2009–2010 saw 5 and 4 bankruptcies, respectively.

Risk Levels: Lower Than Other Sectors

Analyzing risk trends between 2022 and 2024, the paper manufacturing sector shows positive stabilization. Currently, 8% of companies are classified as high-risk for late

payments, and 5% are at high risk of bankruptcy. This means over 90% of companies are considered low- or medium-risk. In comparison, the national average bankruptcy risk is 9%, with 16% of companies at risk of payment delays.

“Aside from a few exceptions, Lithuanian paper manufacturers are relatively low risk. Compared to other sectors, this positions them as a stable part of the economy,” adds Krikščiukaitė.

Top Companies by Revenue and Employment

The top 10 Lithuanian paper manufacturers by revenue in 2023 are:

1. Nemuno banga (€178.2M)

2. Aurika (€70.3M)

3. DS Smith Packaging Lithuania (€59.4M)

4. Grigeo Klaipėda (€45.8M)

5. Grigeo Packaging (€36.4M)

6. Rietuva (€32.99M)

7. Pakmarkas (€27.1M)

8. Bigso (€24.9M)

9. Miko ir Tado leidykla (€24.3M)

10. Klaipėdos kartono tara (€23.8M)

Top employers in the sector include:

1. Nemuno banga (580 employees)

2. Aurika (481 employees)

3. Bigso (324 employees)

4. Grigeo Tissue (244 employees)

5. DS Smith Packaging Lithuania (214 employees)

Creditinfo and Esgrid Partner to Launch ESG Hub in the Baltics

PRESS RELEASE

03 December 2024 – Creditinfo, a global credit bureau and information services group, and Esgrid, a value chain sustainability platform, have joined forces to create ESG Hub, a centralised ESG data registry for the Baltic region. This one-of-a-kind platform is designed to simplify how businesses collect, analyse, and share Environmental, Social, and Governance (ESG) data—bridging the gap between rising sustainability demands and the practical challenges companies face in meeting them.

At present, ESG data remains fragmented, with no unified standard in place, complicating efforts for businesses and financial institutions alike. ESG Hub will address this gap by providing a comprehensive, single-source platform that combines quantitative and qualitative ESG insights. This will empower financiers and investors to make more transparent decisions while considering the environmental, social, and governance impacts of the companies they engage with.

Creditinfo will contribute its robust data collection capabilities by aggregating information from public and private registries, while Esgrid will work closely with businesses to capture and verify missing ESG data. Together, the partnership promises a reliable, end-to-end solution for ESG visibility and compliance.

Nele Roostalu, Product Development Manager at Creditinfo, highlighted the timeliness of the initiative:

“Integrating ESG metrics into the Baltic market is an essential step forward. By combining our expertise in trusted data management with ESG-focused solutions, we’re equipping businesses and financial institutions to operate more responsibly and transition to sustainable business models.”

Elari Tammenurm, Managing Director of Creditinfo Estonia, added:

“For over 30 years, we’ve empowered companies to make smarter business decisions. ESG data represents the next leap, enabling actionable solutions to promote sustainability.”

Oksana Tolmatshova, Co-Founder and CEO of Esgrid, emphasised the practical value of the new platform:

“Access to ESG data is critical for sustainable financing and procurement. Our collaboration with Creditinfo delivers a solution that significantly reduces bureaucracy and enhances companies’ competitiveness on both regional and international levels.”

ESG Hub is already in development, with the first phase set to roll out by the end of Q1 2025. This will include tools to help Baltic companies organise and share their ESG data while positioning themselves as sustainability leaders in their industries.

For further information:

Nele Roostalu

Product Development Manager

Creditinfo Estonia AS

Email: nele.roostalu@creditinfo.ee

Oksana Tolmatshova

CEO

Esgrid Technologies OÜ

Email: oksana.tolmatshova@esgrid.com

About Creditinfo

Creditinfo is a global credit bureau and information services group operating in over 30 countries. The company provides credit reporting, risk management, and decision-making tools to businesses, empowering them with reliable insights to make informed decisions and foster economic growth.

About Esgrid

Esgrid delivers value chain sustainability management solutions for large enterprises and financial institutions. The platform enables sustainability leaders to evaluate, manage, report, and improve the sustainability of their value chains while ensuring compliance with ESG standards. Founded in 2023 in Estonia, Esgrid’s investors include Lemonde Stand, Startup Wise Guys, EstBAN, and early employees of Pipedrive and Wise.

For more information, visit: ESG HUB BALTICS

Op-ed: Reliable Sustainability Information is only the first step

A thought-provoking discussion has taken place about corporate sustainability information and the increasing regulatory requirements of such frameworks. It is often pointed out that the cost of disclosure can be high and the process complicated. In this context, it is worth noting that corporate sustainability information goes beyond the data that public authorities require them to publish. Corporate sustainability data appear, for example, in lawsuits, the media, annual reports, and various forms throughout the value chains of companies, to name a few examples. To capture corporate sustainability data comprehensively, it is also important to place companies in the context of the industries they belong to and the risks they face, both directly and indirectly, through their value chains. While standardized data mandated by government requirements represent a significant step forward, they are only one piece of the puzzle of information needed by the financial market and, in some cases, are not even the most critical information that market participants need.

Sustainability Information Will Remain Unreliable

Corporate sustainability information has evolved from being a product of marketing departments to following guidelines generally accepted by market participants and ultimately falling under regulatory frameworks. Despite recent complex regulations related to sustainability disclosures (such as the CSRD, the EU Taxonomy Regulation, and SFDR), these are not exhaustive of the information that market participants need for informed decision-making. This means that if an analyst is to assess a company with sustainability in mind, there are other factors, beyond what the regulatory framework prioritizes and companies report. These include external factors in companies’ value chains, such as crop failures abroad, fluctuations in commodity prices due to weather anomalies, access to company products in key markets due to social instability, as well as information generated more frequently than annual reports can indicate (such as information from lawsuits and the media). The data companies will provide in line with regulatory frameworks represent a significant step forward, but only the first step toward more reliable sustainability disclosures.

Access to Data Would Have Been a Problem

Even though companies disclose information in accordance with regulations, this does not guarantee stakeholders’ access to it. Part of the problem is technical in nature, as sustainability information is published in, for example, scanned annual statements, various types of sustainability reports, and websites in formats that do not always comply with regulatory guidelines. The European Union has not addressed this issue clearly. At some point, the European Union will establish a database (the European Single Access Point, ESAP), which will receive reports in a predefined format. This database is expected to be operational earliest by 2027, according to official EU information. It is therefore important that sustainability data about companies are collected centrally. At Creditinfo, we proudly undertake this task as it involves critical corporate information.

Reducing the Burden on Companies

The Icelandic financial sector wants to access reliable sustainability information about companies. It seeks this information partly because legal requirements stipulate that financial institutions must have this data available, but also because financial industry employees take sustainability risk seriously, as clearly reflected in bank risk reports. Companies outside the financial market have also sent questionnaires to their suppliers to obtain sustainability information. As a result, companies often receive multiple such questionnaires every year from various sources. At Creditinfo, we see significant waste occurring here. Instead of having a multitude of questionnaires circulating, we realized that it would make more sense if companies answered one such questionnaire, making it accessible to all interested parties. That questionnaire is now available through Vera, Creditinfo’s sustainability platform, and hundreds of companies have filled it out, simultaneously minimizing the associated burden as interested parties can simply access the questionnaire via Vera.

Most companies in Iceland do not fall under the regulations that have been most widely discussed (such as the CSRD and the Taxonomy Regulation). However, this does not mean that this issue is being neglected by them—on the contrary. That is why we have made efforts to give these companies the opportunity to present their information on a larger platform than has been available to them before, through our sustainability platform, Vera.

The Reason for Collecting Data

The discussion about corporate sustainability information has focused more on the quantity and quality of the data than on the reason for its collection. The truth is that greenhouse gas emissions reached a historical high in 2022, at 54 billion tons of CO2 equivalent, about 30% of the global population lacks access to clean drinking water, 13% of individuals over the age of 15 are illiterate, and 10% of the global population is undernourished. In this regard, the financial system is in a key position to improve living conditions and our future. It is important not to lose sight of the goal and get lost in discussions about regulations and data. At Creditinfo, we want to continue to promote the reliability and accessibility of sustainability information about Icelandic companies so that informed decisions can be made for the benefit of all.

Authors:

Hrefna Sigfinnsdóttir, CEO of Creditinfo in Iceland

Reynir Smári Atlason, Head of Sustainability at Creditinfo

Construction sector in Lithuania twice as risky as other businesses

Despite rising incomes and headcount, seizures amount to almost EUR 110 million

19% of construction companies are in the high and top bankruptcy classes and 31% are at risk of late payment, according to a recent study by Creditinfo Lithuania. Despite the number of employees and the rapid growth in revenues, the sector has already recorded 169 company bankruptcies this year. Nearly 11,000 debts have been registered, totaling more than €91 million. 1049 companies are subject to asset seizures amounting to almost €110 million.

There are currently 19850 construction companies registered in Lithuania, employing a total of almost 110 000 workers. At the beginning of this year, the number of companies in the sector was 20367, creating 108.2 thousand workplaces, while in 2023 the figures were 19167 and 107.7 thousand respectively.

According to data provided to the Centre of Registers, in 2023, construction companies in Lithuania together generated revenues of more than EUR 10.6 billion, representing 14.7% of the country’s GDP. In comparison, in 2022, construction companies’ gross revenues were 22.6% lower at EUR 8.7 billion.

Following the data provided by the companies, the top ten construction companies in terms of revenue in 2023 are Kauno Tiltai (EUR 192.9 million), YIT Lietuva (EUR 191.1 million), Fegda (EUR 184.2 million), Conres LT (EUR 117.3 million), Infes (EUR 107.3 million), Green Genius (EUR 102.7 million), “Merko statyba (EUR 97.8 million), Žilinskis & Co (EUR 94.4 million), Autokausta (EUR 94.3 million), Stiemo (EUR 87.4 million).

Despite the year-on-year increase in revenues, the construction sector is twice as risky as any other business in Lithuania. Currently, 19% of construction companies are in the high and highest bankruptcy classes, while almost one third (31%) are at risk of default. The sector has a similar risk profile from the beginning of 2023. Over the last 5 years, the highest risk levels were reached in 2020 and 2021, when a quarter of construction companies were close to bankruptcy and almost half of the companies (47%) were at risk of default.

In comparison, the average riskiness of all Lithuanian businesses is twice as low: 9% of companies are in the high and highest risk classes, while 16% are at risk of default.

Since 2007, 4,497 construction companies have gone bankrupt in Lithuania, with an average of 254 each year. The highest number of bankruptcies was recorded in 2009, when 445 companies became insolvent. This year, 169 construction companies went bankrupt between January and September.

The average amount of seized assets increased by 34.7% to EUR 105 thousand

Currently, 10892 debts of construction companies are registered in the credit bureau system, with a total amount of EUR 91 million and an average debt of EUR 8 360. Compared to the beginning of January 2024, the number of debts exceeded 13,000, the total amount was €164 million, and the average debt size was 1,5 times higher (€12,602).

According to the data of the Credit Bureau, there are currently 2209 seizures on construction companies, including 1043 seizures with monetary value, for a total amount of EUR 109.8 million. The number of construction companies with at least one attachment is 1049 and the average attachment per company exceeds EUR 105 000. At the beginning of this year, the number of seizures was 2,702, with 1,293 seized companies, and the average amount of a single seizure was EUR 68.7 thousand, 1/3 (34.7%) lower than at present.

“If you notice in the credit bureau’s systems that a business partner or client has seizures, please be careful. It is a serious sign that the company is at risk of defaulting on its payments,” advises Rasa Rasickaitė, Risk Assessment and Management Expert at Creditinfo Lithuania. Asset seizure is a compulsory restriction of the ownership right to property, which can be applied by state authorities to secure evidence, civil action, possible confiscation of property, as well as the collection of fines and unpaid payments, satisfaction of creditors’ claims, and fulfilment of other claims and liabilities. Therefore, when you see a registered seizure, you should also pay attention to other available information, such as court information, debts to creditors, the tax authorities and the social security system.”

According to Rasickaitė, in the event of a seizure of assets, it is advisable to find out the reason for which the seizure has been registered, what assets have been seized, and whether the seized assets are allowed to be disposed of in the course of the company’s business. If there are doubts about the ability of the business partner to pay, it is advisable to ask for prepayment or guarantees.

Can Expanding the Role of CRBs Through Trade Data Sharing Enhance Business Credit and Improve Cash Flow Management?

There is a growing need to expand the information shared with Credit Reference Bureaus ( CRBs) to include trade data. Many manufacturers, wholesalers, and retailers have reported cash flow challenges due to difficulties in recovering debts from their customers. This often results in their ability to restock or pay suppliers, further straining their operations. In Kenya, trade agreements frequently rely on informal arrangements, with limited legal recourse due to delays in the judicial systems. Could CRBs play a more significant role in addressing these issues?

As businesses increasingly rely on data to drive decision-making, it’s evident that CRBs, which currently hold financial data related primarily to bank and mobile loans, could greatly enhance their scope. While the inclusion of traditional credit data has boosted financial inclusion, expanding this to cover trade credit information especially from manufacturers, service providers, and wholesalers could revolutionise how businesses extend and manage credit.

If this trade data were collected and shared under a regulatory framework, it could enhance credit trading, improve business relationships, and further financial inclusion. Regular purchasing and payment data, when synthesized, could help businesses evaluate potential customers, set credit limits, and make informed decisions beyond traditional borrowing data.

Accounts receivable teams often struggle to recover overdue debts from customers extended credit without proper risk assessment. Introducing legislation to compel specific entities to share trade data based on factors like turnover or invoice value could help manage risk, reduce legal disputes, and cut down on costs associated with unpaid receivables.

Moreover, the Kenya Revenue Authority could benefit from improved tax collection, as greater financial discipline would be encouraged to avoid negative CRB listings, which can impact a company’s ability to do business. This would also help reduce the burden on the Judiciary, where countless civil cases related to unpaid debts remain unresolved, leading to significant business losses.

Properly managing and sharing trade credit information could streamline the business environment, improving cash flow and financial planning. Additionally, incorporating trade credit data into CRB decision making tools could help boost an individual’s or entity’s creditworthiness when seeking traditional loans. On an individual level, high value asset purchase, such as land and vehicles, could also be evaluated using shared credit sales and receipts data, providing both buyers and sellers with insights into the financial reliability of potential customers.

In conclusion, expanding the data shared with CRBs could significantly improve risk management, debtor control, and financial stability, creating a more transparent and efficient trading environment for businesses of all sizes.

By Francis Shikuku

Accounts Assistant, Creditinfo Kenya

Creditinfo appoints Charles De Winnaar as Global Head of Sales Strategy and Sales Operations

Former Marsh Africa Sales Leader – Charles De Winnaar – brings a wealth of sales and leadership experience to drive Creditinfo’s international growth

London – 26th September 2024: Creditinfo, a global service provider for credit information and risk management solutions, announces the appointment of Charles De Winnaar as its Global Head of Sales Strategy and Sales Operations. As an experienced sales leader in financial services, Charles will lead Creditinfo’s global sales strategy and operations across its network of 30 credit bureaus. He joins the company from Marsh Africa, where he held the position of Sales & Distribution Leader.

In his role, Charles will be responsible for Creditinfo’s revenue growth, market expansion, and operational excellence to ensure scalability and enhance the customer experience across its different markets. From developing strategic partnerships to driving innovation in sales processes and technologies, he’ll play a key part in the next phase of Creditinfo’s international growth.

With over two decades of experience in sales and finance, Charles has a deep understanding of global financial markets and an impressive history of leading large-scale sales teams, bolstering business growth, implementing customer-centric solutions and transforming sales operations.

As Sales Leader at Marsh Africa, he executed the revenue and portfolio optimisation strategy across multiple Africa regions. Prior to joining Marsh Africa, he held various sales leadership roles at the National Bank of Kuwait and Barclay’s Bank Africa. During his time at Barclays, he led the development and launch of a first-to-market mobile payment wallet lending solution in Africa.

Charles De Winnaar, newly appointed Global Head of Sales Strategy and Sales Operations at Creditinfo said: “I’m delighted to join Creditinfo, a company that is committed to empowering people and businesses through financial inclusion. I look forward to working with the talented global team and contributing to Creditinfo’s long-term success.”

Satrajit Saha, Global CEO at Creditinfo said: “With his unmatched expertise in global markets and a proven track record of building strategic partnerships across different regions, Charles is a valuable addition to our leadership team. As we look to accelerate market expansion, harness digital transformation in our global strategy, and continue to facilitate access to finance for millions of individuals and businesses worldwide, Charles will be instrumental in helping us to achieve these goals.”

Charles will report directly to Satrajit Saha, Creditinfo’s Global CEO.

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com