January 2019

Credit Information Bureau of Sri Lanka strengthens financial infrastructure with Creditinfo Group

PRESS RELEASE

Credit Information Bureau of Sri Lanka (CRIB) and CreditInfo enter into strategic partnership to enhance its credit bureau services in the country.

New insurance claims database launched in Iceland

As of January 15 2019, the four Icelandic general (non-life) insurance companies will start using a new claims database for the Icelandic Financial Services Association (SFF) run by Creditinfo. The database will be used to counter organized insurance fraud, as it has been on the increase in relation to organized crime. According to a statement by the Icelandic Police, these groups seem to have found a loop hole in insurance fraud cases in Iceland.

Creditinfo combats Synthetic Identity Fraud for the Kenyan mobile lending market

PRESS RELEASE

According to a recent article by Mckinsey, many fraudsters are now using fictitious, synthetic IDs to draw credit. Applying for credit using a combination of real and fake, or sometimes entirely fake, information creates synthetic IDs. The act of applying for credit automatically creates a credit file at the bureau in the name of the synthetic ID, so a fraudster can now set up accounts in this name and begin to build credit.

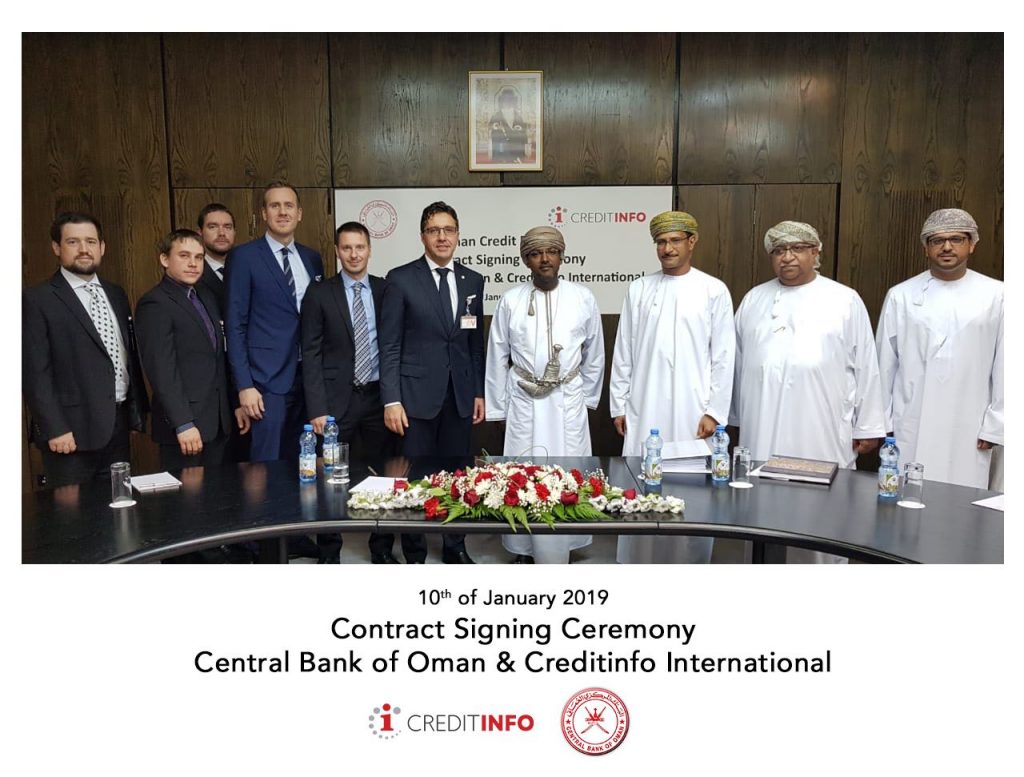

Creditinfo Group wins contract with Central Bank of Oman for the Implementation & Support of Oman Credit Bureau “OCB”

PRESS RELEASE

Creditinfo joins forces with Central Bank of Oman (CBO) to implement a world class Credit Bureau in the Sultanate