October 2016

Compuscan partners with Coremetrix to bring innovative personality-based credit assessment to South Africa

Strategic partnership with Coremetrix, a company powered by Creditinfo, to improve financial inclusion amongst underserved consumers in South Africa.

Compuscan, one of the largest independent credit bureaus in Africa, has established a strategic partnership with Coremetrix, a UK-based company powered by Creditinfo, the world’s leading creator of psychometric data for consumer risk assessment. The new initiative will enable Compuscan’s clients to assess consumers with limited credit information and those who are considered a marginal risk using a psychometric quiz that will complement traditional scoring techniques.

Lithuanian Credit bureau opens up data to innovative companies

Credit bureau Creditinfo is opening up its data to startups and other innovative companies. Company data as well as population statistical data that are held by the credit bureau can be used for developing value-added products: apps, customer behavior predictive models and other solutions that require information.

Consumer Finance Holdings and Coremetrix, a company powered by Creditinfo, open up access to credit in Slovakia

Coremetrix psychometric quiz testing to be used to improve access to mainstream credit amongst underserved consumers in Slovakia. Consumer Finance Holdings (‘CFH’) in Slovakia part of the VUB Group – is the first client in Slovakia to sign up to an exciting new initiative from Coremetrix, the leading provider of psychometric testing for the credit risk sector. The new initiative will enable ‘CFH’ to assess its thin-file and marginal customers with a psychometric quiz besides traditional credit check and scoring techniques.

WCCRC 2016: A curious conference of the FinTech (in the nighttime)

First, I apologise for the caption, but thinking about this conference reminds me of the Sherlock Holmes story, where the dog did not bark (Google it, if needed), which was curious indeed, I think.

Coremetrix, a company powered by Creditinfo, and Admiral collaborate to explore the impact of personality on motor insurance risk assessment

Coremetrix, powered by Creditinfo, the world’s leading creator of psychographic data, and Admiral, a leading provider of insurance products in the UK, have established a working group to evaluate how psychometric scoring can support the assessment of risk in motor insurance in the UK.

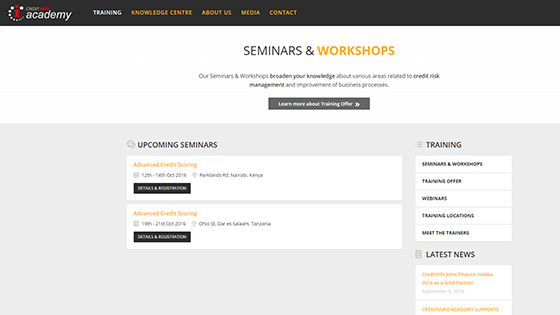

Creditinfo Group launches Creditinfo Academy website

Creditinfo Academy, part of Creditinfo Group, is a skills development and training provider that delivers generic and customized training services. Our focus, at Creditinfo Academy, is to provide training for clients wanting to develop their skills to improve operational efficiency and overall business performance; as well as train consumers and assist public sector in their quest for financial inclusion.