April 2018

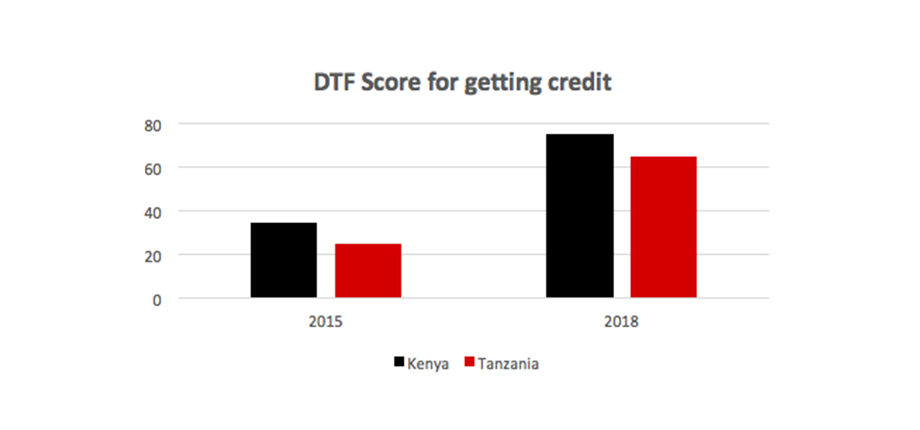

Proof that Credit Bureaus Improve Countries’ Distance to Frontier Score for Getting Credit

Within the Credit Bureau industry, we often talk about better financial inclusion and ways to facilitate access to finance, especially in light of the 2 billion “unbanked” population – a number reported in the Worldwide Findex Database by the World Bank and escalated by many industry players.

Atlas Mara instantly increased their credit limits thanks to Instant Decision Module

Our decision to partner with Creditinfo for Risk Management Services is hinged on their innovative value-added services, risk consulting and overall commitment of the leadership team. Creditinfo is a leader in automated risk-decisioning systems, data analytics and scoring services. Their risk consulting services is world class and manned by the best.

We use Instant Decision Module (IDM), their flagship product for risk-decisioning in our micro-lending business. IDM provides us the means to securely protect our risk decisioning rules, which, equates to our IP; IDM also enables us to set risk decisioning rules at granular level, and to track/measure outcomes for post-mortem reviews. It has a web-service interface that enables our loan application to interact with it in real-time. With IDM, risk becomes measurable and controllable.

— Ikedichi Kanu, Country Head at Atlas Mara Digital, Kenya

Bank Al-Maghrib signs an agreement for the Centralization Service for Irregular Checks

In order to contribute in strengthening the credibility of checks and reducing the risk of unpaid checks, Bank Al-Maghrib has signed an agreement, with Creditinfo Checks, for the management of the Irregular Check Centralization Service (SCCI), following expressed interest.