April 2023

The Role of Artificial Intelligence and Machine Learning in Credit Scoring

Executive Summary

The use of artificial intelligence (AI) and machine learning (ML) in credit scoring is revolutionizing the lending industry. By leveraging vast amounts of data and advanced algorithms, lenders are able to more accurately predict credit risk, improve operational efficiency, and expand access to credit for underbanked individuals and small businesses. This white paper explores the benefits and challenges of AI and ML credit scoring, and provides guidance for lenders on how to successfully integrate these technologies into their lending processes.

Introduction

Traditional credit scoring models rely on a limited set of data points, such as payment history, outstanding debt, and length of credit history, to assess creditworthiness. These models are effective for many borrowers, but they can be limiting for individuals with thin credit files or non-traditional sources of income. AI and ML credit scoring models, on the other hand, can analyze a vast array of data points, including non-traditional data sources, to develop a more accurate and comprehensive picture of a borrower’s creditworthiness.

Benefits of AI and ML Credit Scoring:

1. Improved accuracy: AI and ML algorithms can analyze a wide range of data points, including non-traditional data sources such as social media activity and utility bill payments, to develop a more accurate picture of a borrower’s creditworthiness. This can result in more accurate credit scores and better loan decisions.

2. Expanded access to credit: Traditional credit scoring models can be limiting for individuals with thin credit files or non-traditional sources of income. By analyzing a broader range of data points, AI and ML credit scoring models can expand access to credit for underbanked individuals and small businesses.

3. Increased efficiency: AI and ML credit scoring models can automate many aspects of the lending process, reducing the need for manual underwriting and improving operational efficiency. This can result in faster loan decisions and a better borrower experience.

Challenges of AI and ML Credit Scoring:

1. Data privacy and security: As AI and ML credit scoring models rely on vast amounts of data, data privacy and security are critical concerns. Lenders must ensure that they are collecting and using data in compliance with applicable laws and regulations, and that they have robust cybersecurity measures in place to protect sensitive borrower data.

2. Bias and discrimination: AI and ML algorithms are only as good as the data they are trained on, and if that data is biased, the algorithms can perpetuate that bias. Lenders must be mindful of potential biases in their data and take steps to mitigate any potential discrimination in their lending decisions.

3. Explainability: AI and ML algorithms can be complex and difficult to interpret, which can make it challenging for lenders to explain their lending decisions to borrowers. Lenders must be able to provide clear explanations of their credit scoring models and lending decisions to borrowers.

Conclusion

AI and ML credit scoring has the potential to revolutionize the lending industry, providing more accurate credit scores, expanding access to credit, and improving operational efficiency. However, lenders must be mindful of the potential challenges, including data privacy and security, bias and discrimination, and explainability, and take steps to mitigate these risks. By investing in AI and ML technologies and developing robust risk management practices, lenders can successfully integrate these technologies into their lending processes and provide better loan decisions and a better borrower experience.

Samuel White

Director of Direct Marekts, Creditinfo Group.

ESG and the Banking Industry: Why Sustainability Matters

As the world grapples with environmental and social challenges such as climate change, social inequality, and governance failures, the importance of ESG (Environmental, Social, and Governance) considerations has never been more apparent. For banks, ESG is becoming an increasingly important aspect of doing business, as it can help to manage risks, enhance reputation, meet regulatory requirements, drive innovation and increase access to capital. In this blog post, we’ll explore each of these points in more detail.

- Risk management: ESG risks are significant and multifaceted, ranging from physical risks such as climate change-related natural disasters to transition risks stemming from legal and policy risks from greenhouse gas emissions and governance or social issues such as human rights abuses. By integrating ESG considerations into their risk management frameworks, banks can better anticipate and manage these risks, which can have a positive impact on their financial performance. For example, banks that fail to properly assess and manage climate-related risks could face stranded assets or lawsuits, which could impact their bottom line. Regulatory frameworks in Europe have taken note of this and the European Banking Authority now requires banks to disclose multiple data-points regarding ESG risks in their risk reports (Pillar III).

- Reputation: ESG is increasingly important to customers, investors, and other stakeholders who want to see banks acting as responsible corporate citizens. Banks that take ESG seriously and demonstrate their commitment to sustainability and social responsibility are more likely to attract and retain customers, as well as to access funding from ESG-focused investors. For example, a bank that invests in renewable energy projects or supports social programs in its local community is likely to be viewed more favorably than a bank that does not prioritize ESG. Mismanaging ESG factors to increase reputation may have negative effects, which became evident in some high-profile cases in 2022, both in the EU and US.

- Regulatory pressure: Regulators around the world are increasingly focusing on ESG issues and requiring banks to integrate these considerations into their business practices. For example, the European Union has introduced regulations such as the Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation, which require banks to disclose ESG-related information and align their investments with environmental objectives. Banks that fail to comply with these regulations could face fines or other penalties, which could impact their financial performance, reputation, and limit access to capital.

- Innovation: Banks that prioritize ESG are more likely to drive innovation and develop new products and services that address environmental and social challenges. By supporting the transition to a low-carbon economy and promoting social inclusion, banks can help to create a more sustainable and equitable future. For example, a bank that issues green bonds or sustainable investment products can help to finance renewable energy projects or other environmentally beneficial initiatives, potentially at better rates. Similarly, a bank that offers financial services to underserved communities can help to promote financial inclusion and social equality.

- Green bond issuance offers several benefits for banks, such as accessing a growing pool of socially responsible investors, improving their reputation as sustainable financial institutions, and supporting the transition to a low-carbon economy. The growth of the green bond market has been impressive, with a record-high issuance of $269.5 billion in 2021, up 4.6% from 2020. The cumulative issuance from 2007 to 2021 surpassed $1.5 trillion, with the US, China, and France being the largest issuers. The increase in green bond issuance is driven by investor demand and regulatory measures promoting sustainable finance.

In conclusion, ESG considerations are becoming increasingly important to the banking industry to manage risk, enhance reputation, meet regulatory requirements, and drive innovation. Banks that prioritize ESG are likely to be better positioned for long-term success, as they can help to create a more sustainable and equitable future for all stakeholders. As individuals, we can also play a role in promoting ESG considerations by supporting banks and financial institutions that prioritize sustainability and social responsibility. By working together, we can help to build a more resilient and sustainable global economy.

This may be one of the most important feature of ESG in banking, where the green bond space has grown exponentially over the last years.

By Gary Brown

Head of Commercial Development – Creditinfo Group.

Webinar: Baltic Market Overview

Register and join Jekaterina Rojaka, COO Creditinfo Lietuva , as she hosts another session on the Baltic market overview.

During this session, you will get the latest updates on the following:

- Improving sentiments – will it strengthen economic growth?

- Rising interest rates – what is the impact on the market?

- Sectoral perspective – losers and winners

Please complete the registration form below to receive the event link. The session will be in English – http://ow.ly/MSjh50NHVVX

Lithuanian debts increased by €6.8 million since the beginning of 2023

According to Creditinfo Lithuania’s latest analysis, Lithuanian debts have increased by €6.8 million since the beginning of the year, reaching a total of €364.8 million.

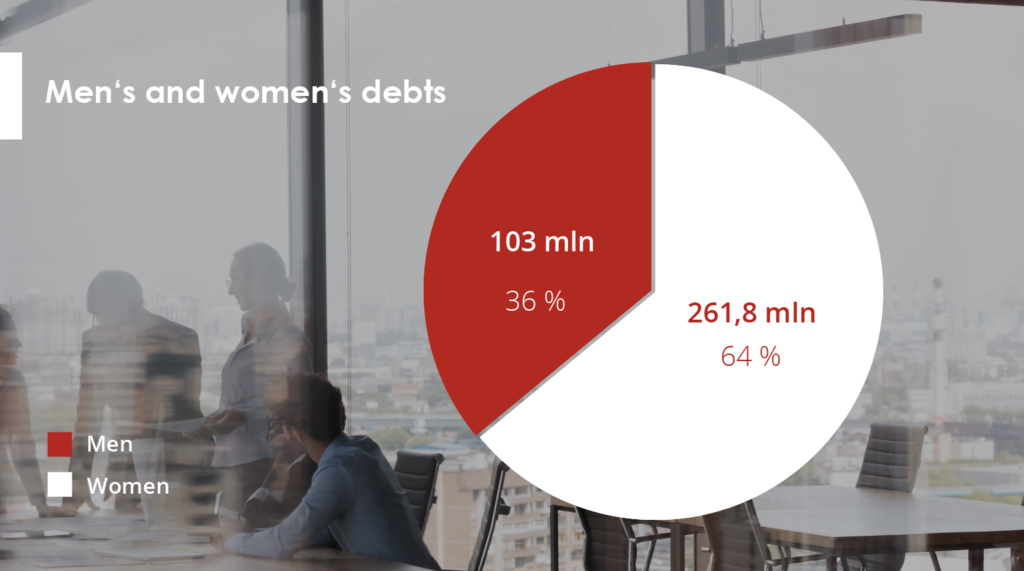

Of this amount, male’s debts stand at €261.8 million, while female’s debts are at €103 million. This is almost €6.8 million more than at the beginning of this year (€358 million). The total number of borrowers has also risen by 5,000 in the first quarter of this year, with the current total standing at almost 201,000.

Creditinfo Lithuania has recorded almost 201,000 debtors in its systems for March, with a total of 235,300 individuals having 235,300 debts in Lithuania.

After a more detailed examination of the debtor data, it was found that over 129,000 males and 72,000 females are currently in debt, making up 64% and 36% of all debtors respectively. Additionally, 32,500 males and almost 20,000 females have multiple debts, with 25.3% of male debtors and 27.7% of female debtors holding two or more debts.

On average, males owe €2,029, which is 30% more than the average debt owed by females (€1,435). This trend, coupled with the higher number of male debtors, results in men holding 78% of the total debt amount, while women hold only 22%.

During the first quarter, an additional 5,000 individuals in Lithuania fell into debt.

In March, the total number of individuals in debt amounted to 201,000, marking an increase of 5,000 from January’s 196,000. The total value of debt owed by all debtors also rose from €358 million to €364.8 million, with the total number of debts recorded in the credit bureau system increasing by 5,300. The largest number of new debts to households registered in the first quarter of this year, after debts to the financial sector, were for utilities and energy, with a total of 1,518 debts (12%).

“The analysis suggests that the majority of new debts recorded this year can be attributed to the energy and heat price crisis. Rising fuel costs have resulted in increased indebtedness, with people seeking short-term financing in order to balance consumption and expenses,” explains Aurimas Kačinskas, the Head of Creditinfo Lithuania. “Not everyone has had sufficient time to alter their financial habits, which has resulted in the growing number and value of debts.”

Men aged between 35 and 45 are considered to be the most high-risk debtors

Despite fluctuations in the number of borrowers and their levels of indebtedness, the typical borrower profile has remained consistent in recent years. Men aged 35-45 are the riskiest debtors, with debts amounting to €75 million, accounting for almost 29% of the total amount owed by men. The second riskiest group is men aged 45-55, with €61 million in debt, representing 23.3% of the total amount owed by men. In third place are men aged 25-35, who hold €55 million in debt, accounting for 21% of the total amount owed by men. Men aged 55-65 hold €43 million in debt, while those over 65 hold €17 million. Men under 25 hold the lowest amount of debt at almost €15 million.

Among female debtors, the under-25 age group has the lowest amount of debt, while other age groups have the following distribution: €29 million (45-55), €26 million (35-45), €20 million (55-65), and €17 million each (25-35 and over 65).

According to Mr Kačinskas, it is important for citizens to assume their financial obligations responsibly and meet them on time to maintain a positive credit history, which determines their access to financial services, loans, credit cards and payment provisions.

“Vera”, Creditinfo’s ESG platform, now available for customers in Iceland

Environmental, social, and governance (ESG) factors are increasingly becoming a key consideration for investors, stakeholders, and companies. These factors help measure the sustainability and societal impact of a business, and ESG data is crucial for decision-making in the investment and corporate world. However, the availability, quality, and accessibility of ESG data have been major challenges, making it difficult to obtain accurate and reliable insights. This is increasingly becoming a problem for small and medium sized businesses that do not have the resources available to access and produce accurate and reliable ESG data.

To address this growing need for ESG data services Creditinfo Iceland recently launched Vera, a new ESG data platform, for customers in Iceland. With Vera companies can access data about their customers and/or suppliers in an accessible way. The platform contains diverse sustainability information for all active companies in Iceland including data directly reported by companies as well as external sources such as media coverage, judicial information, and supply chain operations. Companies can easily update their own sustainability information through MyCreditinfo to ensure an accurate portrayal of information such as emissions, ESG ratings, and other relevant data.

What are the features Vera has to offer?

- Who can update sustainability information?

One of Vera characteristics is that much the data can be updated to increase accuracy. If a company has a dedicated in-house sustainability officer, this person can be given access to Vera to update its info. This is done through MyCreditinfo where anyone inside the company with edit access can forward the access to a relevant employee. The sustainability officer can then provide the needed input.

- Contact person

Sometimes it is difficult to reach the relevant person within companies regarding sustainability. This can happen during supplier assessments or during other processes where sustainability data is needed. It can also be time consuming to figure out who is responsible for this subject within companies. Vera helps with this process by offering companies to clarify who is the responsible person for sustainability related matters. This makes all communications easier and data flow quicker.

- Greenhouse gas emissions

Most companies are accountable for greenhouse gas emissions, either directly or indirectly. Some companies know how much is emitted and where. Vera can estimate the greenhouse gas emissions from company operations if she knows the industry companies operate in and their revenue. This data must be in place in order for Vera to run its calculations. If companies know however their emissions, they can update their profile to provide better information to the market.

- Emission intensity

Absolute greenhouse gas emissions tell a certain story regarding company operations. However, companies can emit the same amount of greenhouse gases while their size may differ. So understanding how much is emitted per revenue provides a better understanding of the sector. Emission intensity of the sector is therefore also a very relevant metric. Vera provides its users with an overview of the carbon intensity of the sector companies operate in. Sector emission intensity can initiate an interesting conversation between a lender/investor and the company where the company may want to demonstrate a better performance than the sector as a whole. Vera provides the sector carbon intensity on a scale which is easy to read and understand.

- Sustainability risks and opportunities

Sustainability risks vary between sectors. Material sustainability factors are those who may have financial implications on companies if mismanaged. Sustainability accounting standards board (SASB) which is now a part of the IFRS has defined which sustainability factors are material within sectors and why. Such an overview is important for companies in order to manage material factors instead of using resources to provide data on non-material factors.

Vera uses data from SASB to provide its users with an overview of material factors for individual companies and if the factors are considered climate risks. If a sustainability risk is classified as climate risk, Vera indicates the type of climate risk. This can be physical or transitional. Physical risks appear for example through extreme weather, ocean acidification etc. Transition risks appear through policy and legal risks. Vera provides an understanding regarding which sustainability risks companies are exposed to in a convenient manner.

- Sustainability in the value chain

Using public data it is possible to map out the international supply chain of sectors. Vera provides such overview but is clear regarding the pitfalls of the data as the sector does not represent individual companies. Companies can therefore update their supply chain data. By updating the data in Vera, companies gain a deeper insight into various sustainability related matter in their value chain.

Users of Vera can click on the value chain countries and redirect to the UN SDG website where even more detailed data is provided. In this way, the users of Vera and the reporting companies get a much better overview of the possible risk factors in the supply chain.

- Sustainability media information

Creditinfo maintains a media monitoring service in many of its markets. Using the data from Creditinfo, it is possible to monitor ESG related news articles involving individual companies. The ESG media monitor only monitors ESG related articles. Vera therefore utilizes the media quite effectively as a watchdog. Vera also provides ESG related media coverage regarding companies within the same sector.

- Sustainability media information in the supply chain

Vera understands which countries the sector mostly does business with. Using this data, Vera can monitor ESG related matters in the countries the company mostly does business with. If a company provides better data regarding its value chain, they have the possibility to understand better on a macro level the operating conditions in those countries. Such data can be used for decision making and supplier assessments.

- Sustainability documents

Companies often publish reports and documents related to sustainability. This data is often dispersed around their website and is time consuming to maintain in a single place. Companies may also have various certifications in place which they may want to put forward. Such reports can be uploaded to Vera, which makes their access easier. If a company does not upload its reports to Vera, Creditinfo staff manually gathers the data and uploads to Vera.

- Court cases

Vera provides an overview of court cases the company appears in for all court levels. It is possible to see the case abstract only or navigate to the official court document online. Vera also shows court cases for parent companies and subsidiaries. The ratio of ownership has to be 10% or more in both directions for Vera to show the cases. Vera therefore provides a better insight into related cases than the courts themselves.

- Diversity information

Diversity in management and staff is an important component of successful companies. Studies have shown that gender diversity in staff has a positive impact on companies. Vera offers information about gender ratios for employees, board members and executives for a company. This information can be updated via MyCreditinfo.

For more information visit www.creditinfo.com