April 2019

Creditinfo expands regionally, stores information in Jamaica

In his interview with The Gleaner, CEO of Creditinfo Jamaica – Craig Stephen highlighted on the regional success and the goal to venture into other caribbean markets in the near future.

When challenge meets opportunity: Meet Ruby, a Creditinfo success story

The true spirit of an entrepreneur comes down to passion and determination. At Creditinfo, we meet entrepreneurs every day, and it’s our goal to support these budding business men and women with the appropriate tools, knowledge and access to finance.

How to use your credit score to negotiate better terms with your financial institution

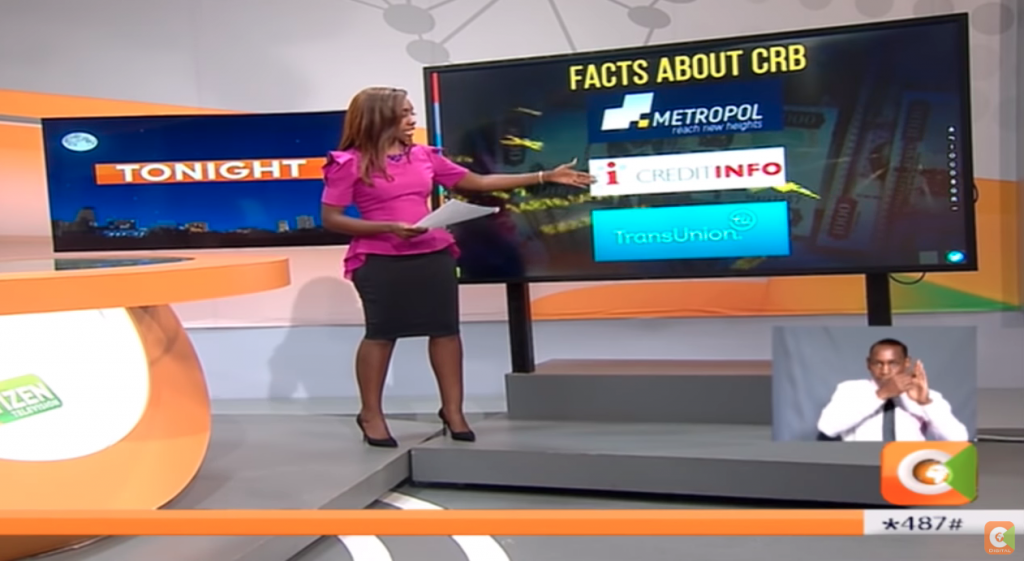

Last week, a leading TV station in Kenya – Citizen TV did a story on Digital Lending Apps and their impact in Kenya. There has been a sharp rise in the number of mobile lending apps in the country and the worry is about how people are accumulating debt and borrowing from the various apps simultaneously and defaulting therefore affecting their credit score.

Creditinfo Group awarded the Knowledge Prize 2019

The Association of Business and Economics has chosen Creditinfo as the Knowledge company of the year 2019. Creditinfo Group was chosen as the Knowledge Company of the Year by the Association of Business and Economics. During the selection process, companies that have excelled in their international markets in the recent years were considered. Other companies that also came at the top include CCP, Marel and Nox Medical.

Jamaicans urged to take credit scores seriously

Creditinfo Jamaica – Craig Stephen was interviewed by The Jamaica Gleaner on importance of Credit Scores

Credit reporting in Jamaica -Discussion with Creditinfo CEO- Craig Stephen

The Exchange on Jamaica News Network – Credit Reporting in Jamaica. CEO of Creditinfo Jamaica Limited- Mr. Craig Stephen along with Chief of Credit Risk Management, JN Bank Limited-Mrs. Keisha Melhado-Forest and Managing Director of a local microfinance company, Paradigm Capital Limited-Ms. Gail Dixon sat down to discuss Credit Reporting in Jamaica.