July 2021

Creditinfo launches SME blended scorecard in Kenya

Credit information leader launches pan-African SME initiative, ahead of global rollout

LONDON, UK, 21st July 2021 – Creditinfo Group, the leading global credit information and decision analytics provider, is today announcing the launch of a scorecard solution tailored for small to medium-sized enterprises (SMEs). Through its unique approach to data and algorithms, this scorecard will help financial institutions improve their credit assessment and facilitate financing to the SME market, which has typically been less able to access finance.

Creditinfo, recognizing the importance of SME risk assessment across the world is aiming to roll out a global solution to address this challenge. The company will first launch the SME scorecard in Kenya, ahead of a wider rollout across countries in Africa, and several other key economies across the globe.

The unique modeling approach Creditinfo have developed significantly reduces, and in some cases eliminates, the human effort needed to assess customers’ risk profile based on credit data. It is delivered in a software platform which unifies, streamlines, automates and centralizes the risk evaluation process. Creditinfo’s SME scorecard is considerably stronger at predicting business failure than existing traditional models.

Burak Kilicoglu, Director of Global Markets at Creditinfo, commented, “SMEs drive innovation and push digitalization forward for many people by providing services to underserved segments of the population and creating job opportunities. SME scorecards will accelerate access to finance for the benefit of whole economic ecosystem. At Creditinfo we have access to a wealth of credit bureau data as a starting point, and so are uniquely positioned to offer this solution in global markets.”

Kamau Kunyiha, CEO of Creditinfo CRB Kenya, added, “Kenya is the most dynamic and receptive market for SME lending innovation, demonstrated by the successful adoption of mobile wallets and microloans. We look forward to seeing the economic impact of this new solution as it comes into full effect and we see more capital flowing through the SME economy.”

-ENDS-

About Creditinfo

Established in 1997 and headquartered in Reykjavík, Iceland, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

PR contacts:

Marketing Manager/ PR for East Africa

Phidi Mwatibo

Email: Phidi.mwatibo@creditinfo.com

Increased use of credit bureau data in Lithuania

The use of credit bureau data is growing along with economic activity, although businesses tend to undertake additional precautions

The INTRUM EPR 2021 survey published in June reported on the growing demand for pre-payments against a decreasing trend of conventional risk management measures, such as credit history screening, insurance and factoring.

The current situation in the business sector could benefit from some clarifications and comments. In turbulent and uncertain times – and lockdown could rightly be said as being one of these – entrepreneurs tend to undertake additional safeguards, e.g. pre-payments. However, any quantitative easing measures, such as material support offered in the form of soft credits or subsidies, enabled many businesses to maintain their liquidity at least for some time. This is why the corporate performance results were not as devastating as they were during the Great Recession, when manufacturers importing commodities were forced to allocate all of their funds for pre-payments to their suppliers.

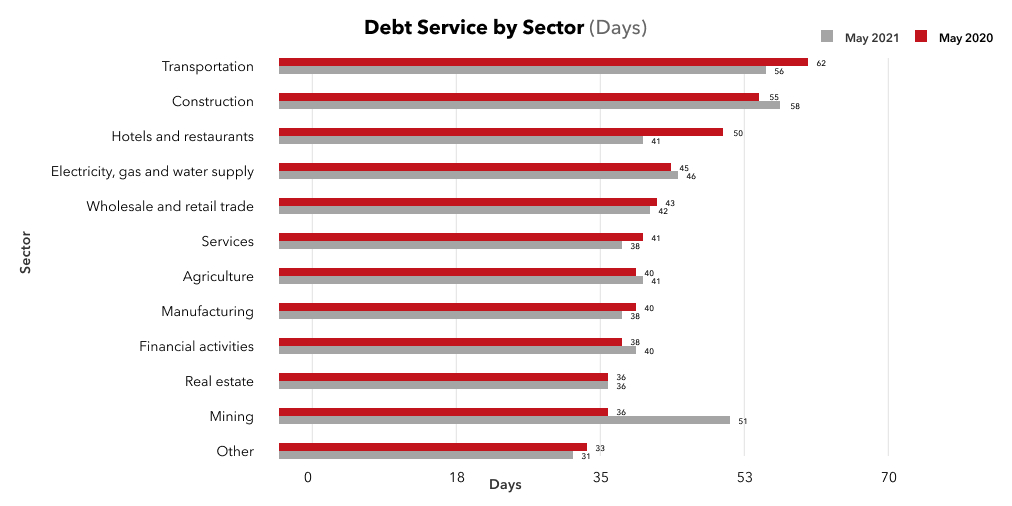

Meanwhile, the statistics demonstrates some late payments to the partners in 2021 in the sector of hospitality industry (by 9 days, from 41 to 50), in transport (from 56 to 62 days), in services (from 38 to 41 days), in processing industry (from 38 to 40 days). In contrast, in the financial operations sector, the payment terms have become shorter.

Quite reasonably, one may wonder what are the reasons behind shorter payment terms – can these be explained by precautions taken by the suppliers or by an improving economic situation?

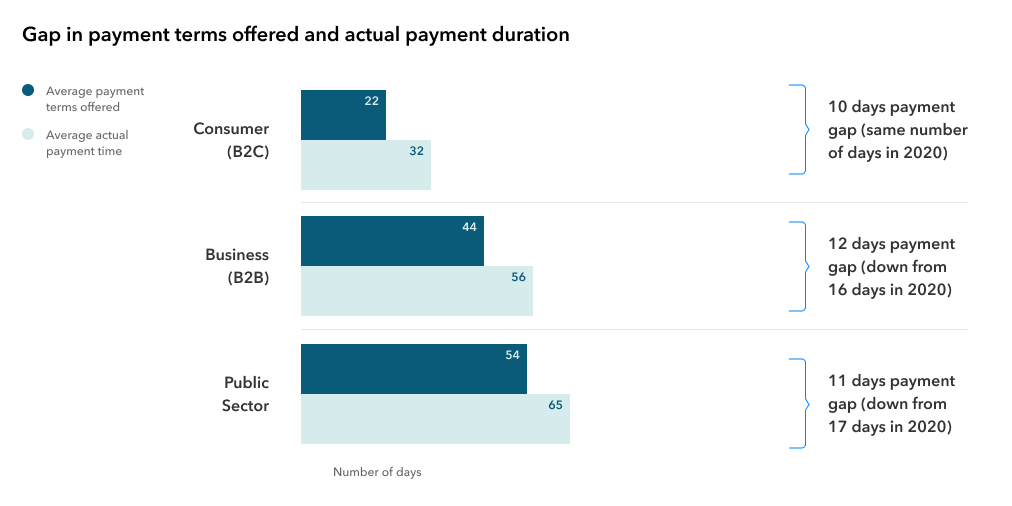

I would like to draw the attention to the fact that in the times of the pandemic shareholders would recommend public sector representatives tightening payment gaps to enable the business sector to improve liquidity in the private sector. In the private sector the medium-term payment gaps were affected by a more resilient economic structure, as businesses suffering from liquidity shortage made only a fraction of all businesses.

Moreover, account needs to be taken of the fact that as many as 60 percent of companies responding to the INTRUM survey in Lithuania admitted anticipating recession in contrast to economic forecasts showing a clear recovery.

Lithuanian business market is rather optimistic: the economic evaluation index in Lithuania has already reached its pre-pandemic level (116 vs. 110), this indicator was higher only in 2007 on the eve of the Great Recession. In addition, all sectors last May demonstrated a growing confidence index. Commercial confidence index grew by 9 percentage points, while in the service, industry, and construction sectors it grew by 7, 4, and 1 percentage points, respectively. Only the consumer confidence index dropped by 3 percentage points.

In parallel, a rapid growth in the real estate prices and demand is being reported along with the signs of growth in the prices of commodities and inflation. All these factors may signal the approaching peak in an economic cycle, which explains the lingering anxiety about a possible recession due to the phasing-out of economic stimulus measures.

One of the most popular support measures – tax deferrals – are drawing to an end: default interests and tax recovery procedures will not be calculated until 31 August 2021 and for two subsequent months; one may expect to see a more realistic state of business health towards the end of the year.

Nevertheless, the following conclusion has to be drawn as a comment on the use of credit office information systems by the organizations: the number of inquiries recently has been changing along with the economic activity – within the first 5 months the number of inquiries increased by 12 percent compared to 2020 year-on-year, and by as many as 25 percent compared to 2019 year-on-year.

Jekaterina Rojaka,

Head of Business Development and Strategy,

Creditinfo Lithuania.