March 2022

Closing the lending gender gap

To make our economy truly financially inclusive, there are many things we need to address – from ensuring people are paid equally to removing biases from the financial ecosystem. One of those biases that urgently needs to be tackled is in the lending market, to ensure that women are not disproportionately prevented from accessing credit and financing products.

Women are key contributors to the economy, making up 40 percent of the world’s workforce – particularly in developing economies. Not only are women typically responsible for the bulk of household purchasing, but their employment falls in sectors that are crucial for economic growth and development.

That said, we often find that women’s involvement in the flow of capital around the economy to be less than we might expect – with reasons stemming from cultural barriers to participation to structural issues in the financial ecosystem. While cultural issues may be more difficult to overcome, there are things we can be doing to address these structural issues holding back the female economy.

The credit industry, from regulators to lenders and to credit bureau all contribute to make changes. In this article, we discuss some of the challenges of the current situation to some of the potential solutions.

In some markets, the gender pay gap is particularly pronounced – a Creditinfo analysis of the Lithuanian market found that of the 81 sectors into which economic activity breaks down, men are paid more than women in 72, and average pay for men often exceeds women by 30-50 percent. In some sectors, such as air transport, gaming, and gambling, men’s pay can be up to 127 percent above their female colleagues. Closing this gap is going to be key to rebalancing the economy and realising a more financially inclusive world. There is work being done as part of the ESG initiatives (ESG = Environmental, social and corporate governance) that is starting to make salary gaps more transparent, as well as representation of women on company boards. Credit bureau, such as Creditinfo Lithuania, are providing specific segments on credit reports to ease access to this information.

However, even outside of pay issues, there are significant problems in the lending markets – and here data can help provide a way forward.

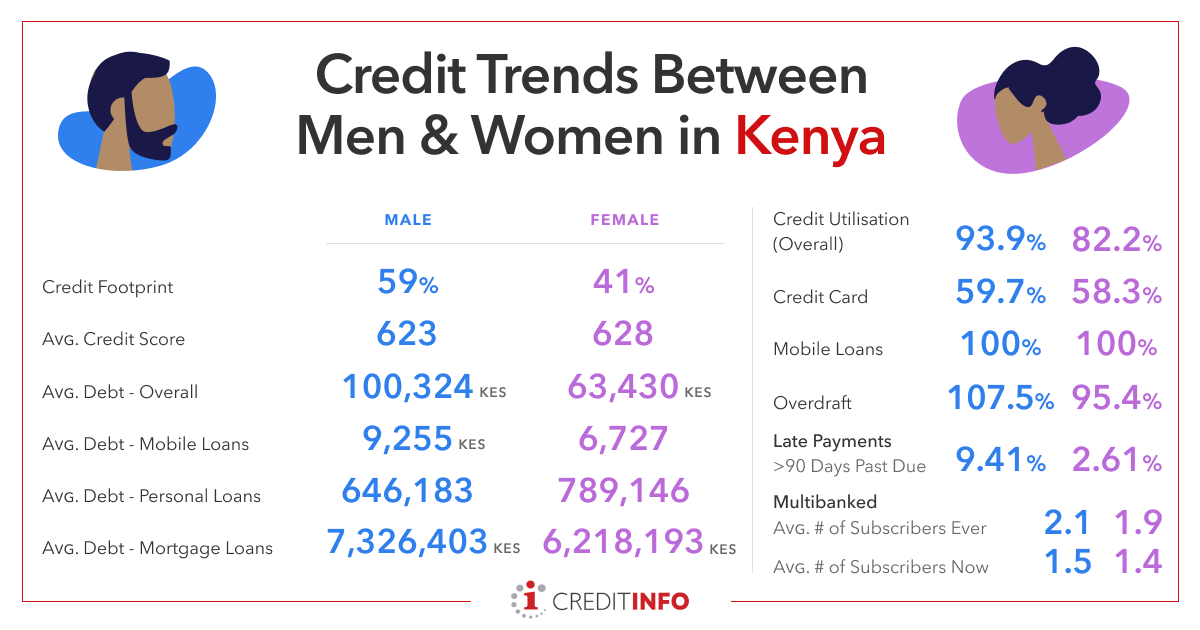

Creditinfo analysis of the lending market in Kenya yielded some very interesting findings. Despite women having higher average credit scores than men (628 vs 623), they have significantly smaller credit footprints (41% vs 59%) and utilisation (82.2% vs 93.9%). This is quite a marked difference and can have a widespread adverse impact.

If women are not able to access financing on a personal level, then their spending power is diminished and their non-participation in the economy will be felt. If they are not able to access financing on a professional level too, the effects are compounded – and the economic imbalance will continue to hold back economic growth and development.

Many other developing economies are experiencing the same issues. In Morocco, for example, the lending market similarly favours men, with women only making up 31% of the active borrowing market.

This needs to change.

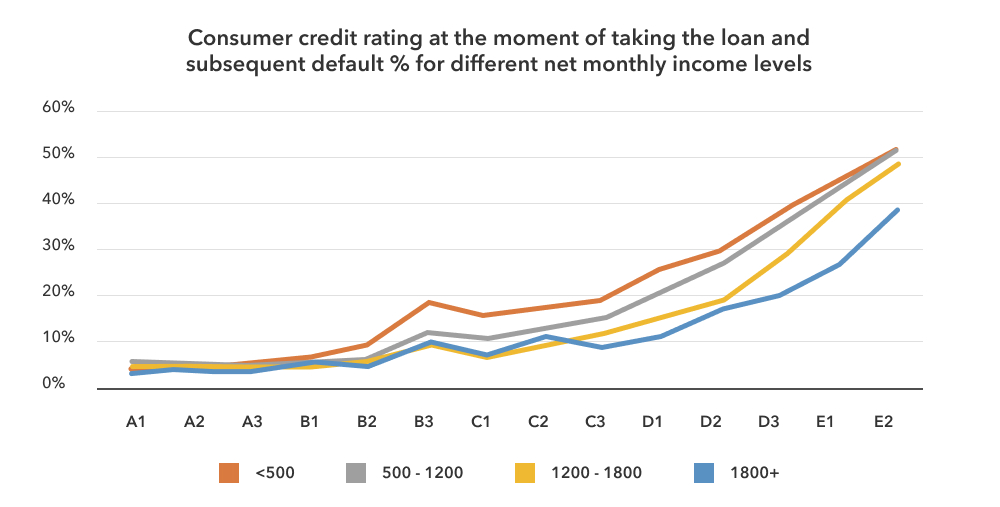

To make our world fairer and our economy work for everyone, we need to remove these structural barriers to financing. In general moving to digital lending and minimising subjective human intervention in lending vastly improves the equality. Credit scores will reflect the actual risk of individuals based on actual data. It is important that historic bias is not built into algorithms, model developers need to be aware of the potential of this and remain vigilant.

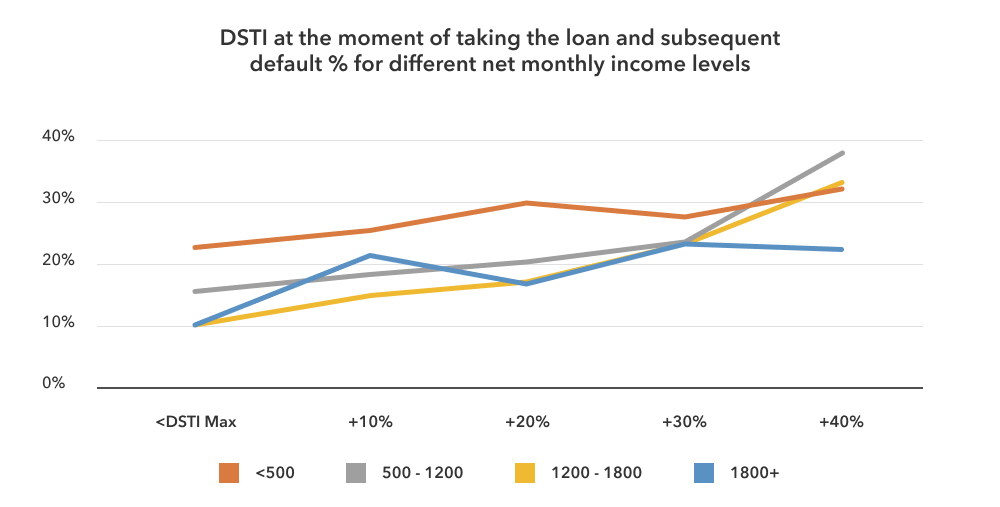

Regulators have a role as well, over dependence on DTI (debt to income) in their supervisory rules can build in a strong gender bias. The evidence has already been shown that women are lower paid. With DTI rules, large proportions of women can be forced to high interest rate lending or pushed out of formal market to the informal credit market without legal protection.

We see the evidence from Latvia where the credit score (fig 1) is highly predictive of future non-payment and should be a significant element of credit decision, it is proven to be predictive at all income levels. DTI ( Fig 2) is much less predictive and would eliminate many lower income women from formal credit where strict rules around DTI exist.

The best way to start making changes is by using data, whether ESG information or credit scoring. If we can understand the situation clearly and how the picture needs to change, we can begin to address it. We can also measure and manage progress against key performance indicators.

For lenders, this can be a significant opportunity – that a whole section of the economy, with good credit scores and low credit utilisation has been continually underserved, means they can be very targeted with new products and services that cater to that nascent market and generate new revenue streams while tackling financial inclusion.

This is something we believe very strongly in and are working with partners to help address. If we can help de-risk the lending ecosystem, we can make the economy fairer for all and reap the significant benefits that unlocks.

Visit www.creditinfo.com for more information.

Emma Camilleri,

HR Director, Creditinfo Group.

Top trends that will shape banking in 2022

We sat down with our Direct Markets Director at Creditinfo Group, Samuel White, to discuss some of the key trends that will shape banking in the MENA and Asia region. These were some of his thoughts:

New market players from non-traditional lenders such as telco or payment providers

We are seeing an increasingly number of non-banks entering the markets. There has been a clear sign that these companies have a wealth of internal data through their platforms and usually e-wallet transactions. It has been proven that this data is extremely valuable during the risk assessment process.

SME finance

SMEs are playing an instrumental role in local economies but still struggle to receive the access to banking products in a timely fashion. In the region every country is looking at how better to serve these customers and provide them with the solutions they require.

Digital Banks, Neo Banks, Born Digital Banks

Many of the traditional lenders are based on legacy technologies and we have seen an accelerated approach to digital transformation over the last 2 years. We have also seen some banks create new digital arms to their organization setup with new technology away from legacy portfolios. These Born Digital Banks are increasing in the region, and anybody left behind can expect to lose some market share in the future.

BNPL

Buy Now Pay Later (or as some are calling it Save now pay later) is not a new concept but there is no doubt it is growing with popularity. The demand for flexible payment offerings is at an all-time high. Typically, these smaller value loans are based on impulse buying so lenders must make sure they have the process in place to offer instant decisioning.

We also asked him how Creditinfo is playing a role in shaping these trends:

How is Creditinfo helping banks lead in the digital era?

At Creditinfo we are focusing on helping banks streamline and improve the credit process across the full credit lifecycle, from origination through scoring, risk, decisioning and portfolio management. We are offering enhanced digital channels to meet the customer demands and reach the underserved or unbanked segments. We recognize it has become more accessible for individuals and SMEs to make use of digital financial services and by working with Banks we can develop software and applications to deliver services that are more transparent and automated.

What is Creditinfo’s business model and how do you see this model shaping the banking industry?

Creditinfo is a provider of credit information and risk management solutions worldwide, one of our primary goals is to help facilitate access to finance. We have built credit bureaus globally and across different markets, giving us key insights and knowledge into best practices. Creditinfo has a vision to create successful partnerships with lenders, governments, central banks to help increase financial inclusion and generate economic growth by allowing credit access for individuals and SMEs.

Creditinfo wants to continue building products and working with partners to add further solutions and data to enable lenders to further lend in a responsible fashion. Lenders are shifting their attitude towards FinTechs to keep pace with change and remain competitive. There is a huge variety of FinTech offerings available today using wide range of data that’s delivered through applications to provide lending decisions in only a few seconds.