Creditinfo launches new platform to boost African businesses’ access to credit and global opportunities

Creditinfo’s Business Information Platform Africa aims to strengthen local economies and foster global partnerships

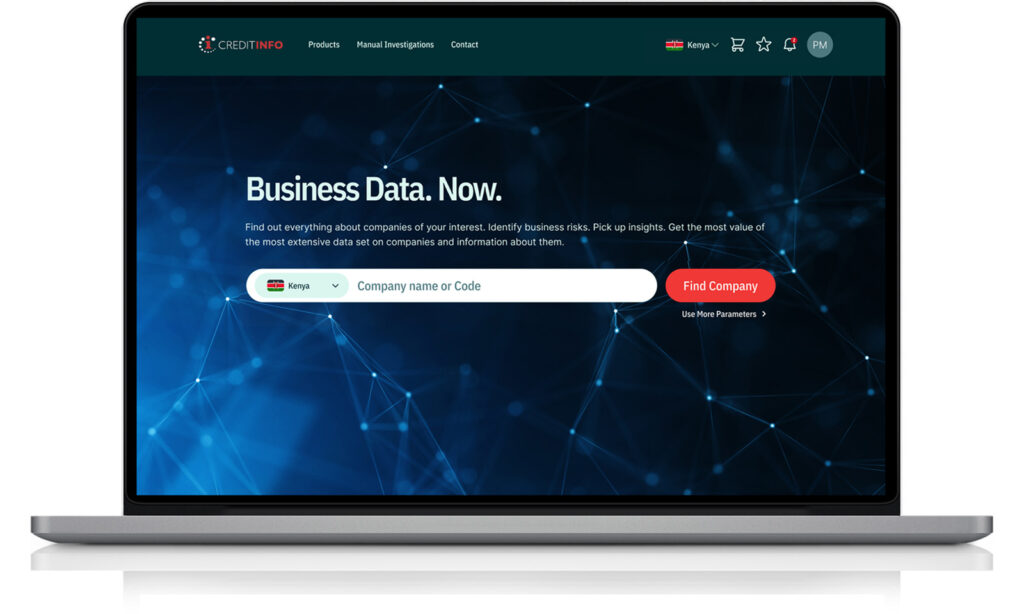

London – 14 May 2025 – Creditinfo has today announced the launch of Business Information Platform Africa (BI Africa) to help African businesses and financial services access trade credit more easily and build stronger relationships with global partners. The platform will be rolled out in Kenya in June, with more markets to follow.

The move builds on Creditinfo’s success in the Baltics, where its business information tools have helped companies navigate partnerships and manage risk for over a decade. Now, that same model is being brought to Africa – starting with Kenya – where access to verified, independent business data has often been a challenge.

‘This launch isn’t just about data. It’s about unlocking opportunity,’ said Satrajit Saha, CEO at Creditinfo. ‘When businesses have the right information at their fingertips, they can make smarter, faster decisions that drive growth, close more deals and build lasting confidence – both locally and globally.’

The BI Africa platform offers reports on over one million African companies, presented in a simple, globally standardised format. Users can check key facts about potential partners or customers, everything from credit health to company history, making it easier to assess risk and build trust. Additionally, as an added service, Kenyan businesses will have access to company reports on over 430 million international companies – empowering them to confidently verify both new and existing clients through Creditinfo and its network of global partners.

‘We want to make it easier for African businesses to prove their value, compete globally, and grow with confidence,’ added Saha. ‘Greater transparency leads to stronger trust and improved access to finance – benefits that extend across economies and communities. And that’s a win for everyone.’

It also includes a Manual Investigation Service for those who need deeper insight. Users can request tailored research into specific companies, providing information that goes beyond the numbers, like ownership structures, litigation history, or up-to-date financials. Crucially, the platform isn’t just for large institutions. It’s been designed to support SMEs and individual entrepreneurs, too – those who often struggle the most with gaining access to trade credit.

‘By bridging critical trust and information gaps, our robust platform will redefine what is possible for businesses, of all sizes, in Kenya and beyond. What once took three to five working days to verify a potential business partner can now happen in seconds, without compromising on regulatory compliance. That’s a game-changer for companies, particularly in the SME sector, who need to make quick decisions in competitive markets,’ said Kamau Kunyiha, Regional CEO East and Southern Africa at Creditinfo.

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com