Interest Rate Capping, Market Killer or Innovation Catalyst?

The Central Bank of Kenya (CBK) is set to conclude a study on the law capping interest rates and its impact on the economy, CBK Chairman Mr. Mohamed Nyaoga announced on Tuesday, April 25th. On the same day, Creditinfo Kenya and Creditinfo Academy organised an exclusive meeting for professionals from the financial sector to acquire inspirational observations and insights on the current situation in the Kenyan credit risk management market and acquaint themselves with solutions to the challenges faced by the need to reduce losses and improve productivity.

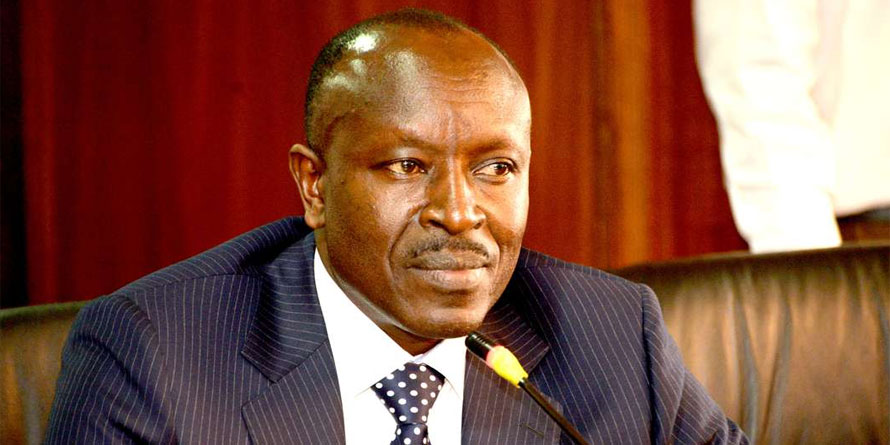

The main topic was called Interest Rate Capping, Market Killer or Innovation Catalyst? Special guest of this event was Mr. Mohamed Nyaoga, Chairman of Central Bank of Kenya (CBK). The opening speech was held by Kiprono Kittony, Chairman of Creditinfo CRB Kenya Ltd. Paul Randall, Executive Director of Decision Analytics at Creditinfo Group and Kamau Kunyiha, CEO Creditinfo CRB Kenya Ltd delivered their excellent presentation on the topic mentioned above.

You can read more on the interest rate capping in the articles of Business Daily Africa: Banks almost triple loan sizes for good borrowers | CBK to finalise study on law capping rates

Photo courtesy: Business Daily Africa | NMG