Creditinfo & Little App Partner To Enhance financial Inclusion In Kenya

Little App’s new feature gives individuals and businesses instant, on-the-go access to their credit information

Nairobi, 18th June 2025 – Creditinfo, a global service provider for credit information and risk management solutions, has partnered with Little App, one of Africa’s most forward-thinking super apps, to enable Little App users to access their credit reports and monitor their credit scores instantly and securely within the app’s Financial Services section.

With the integration of Creditinfo’s credit bureau data into the app, individuals and businesses can conveniently view their credit information through their mobile devices. Whether applying for a loan, improving creditworthiness, or monitoring one’s financial health, this new feature makes it simple, fast, and user-friendly. Having this information available in one place will help people in Kenya to take control of their finances, make more informed decisions, and access credit with confidence.

“Our partnership with Little reflects more than just a shared goal; it’s a concrete step toward increasing financial inclusion and transparency across Kenya and the African region in the foreseeable future. Data is key to unlocking financial opportunity for people, and our priority is to make access to real-time, reliable credit information simpler and more intuitive. We’re immensely proud to deliver a solution that brings tangible benefits to people’s financial journeys,” said Kamau Kunyiha, Regional CEO East and Southern Africa at Creditinfo.

Kamal Budhabhatti, CEO at Little said: “Africa is undergoing a remarkable digital evolution, with mobile technology transforming how people live and engage with services. Through our collaboration with Creditinfo, we’ve built a solution that meets people where they are – on their phones – and fits seamlessly into their daily lives. We want to demystify complex financial data for everyone, empowering users to make informed decisions while driving lasting social and economic impact.”

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

About Little

Little App is a pan-African super app that has been transforming everyday experiences since 2016. With nearly a decade of innovation, Little offers a wide range of tech-driven solutions across mobility, payments, delivery, healthcare, and lifestyle services.

Operating in multiple African countries, Little serves both individual users and organizations—delivering convenience, affordability, and efficiency. From ride-hailing to enterprise transport solutions and digital wallets, Little is at the forefront of enabling digital and financial inclusion across the continent.

For more information, please visit www.little.bz

Creditinfo Kenya and Kamoa Join Forces to Expand Access to Credit Through Alternative Data

NAIROBI, Kenya – June 13, 2025 – Creditinfo Kenya (CIK), a credit information and risk management solutions provider, and Kamoa have announced a strategic partnership to improve credit decisioning and financial inclusion in Kenya.

The partnership will see Creditinfo Kenya leverage Kamoa’s alternative data technology to build more comprehensive credit profiles for individuals and SMEs. This approach aims to unlock lending opportunities for both the banked and underbanked, while enhancing the quality and inclusiveness of credit assessments.

Through this collaboration, Creditinfo Kenya and Kamoa aim to:

- Accelerate financial inclusion,

- Support the growth of SME lending

- Enable lenders to make more accurate, data-driven decisions

‘At Creditinfo, we’re committed to broadening access to financial services for individuals and businesses. Our partnership with Kamoa marks a key milestone in improving credit decisioning and inclusive financial solutions in Kenya. By using broader data, lenders can make smarter lending decisions, enabling more people to access the financial services they need to grow and prosper financially. Together, we’re setting a new standard in credit decisioning while fostering financial empowerment across Kenya,” said Kamau Kunyiha, Regional CEO East and Southern Africa at Creditinfo.

The agreement marks a significant step toward a more inclusive and data-enriched credit ecosystem in Kenya.

FIND THE WHITE PAPER HERE – Boosted Score - White Paper

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

About Kamoa

Kamoa is a data technology company on a mission to unlock access to finance and financial opportunity across Africa. We harness the power of data to help individuals, small businesses, and financial institutions make smarter, more inclusive decisions. By building intelligent systems that connect and interpret diverse data sources, we aim to close information gaps and enable better financial outcomes across lending, savings, insurance, and beyond.

Founded in 2023, Kamoa began in stealth with a bold ambition: by 2030, to become a leading infrastructure layer for financial innovation across the continent — empowering players from microfinance institutions to major banks, and serving customers from every corner of the market.

For more information, please visit https://kamoa.app/enterprise

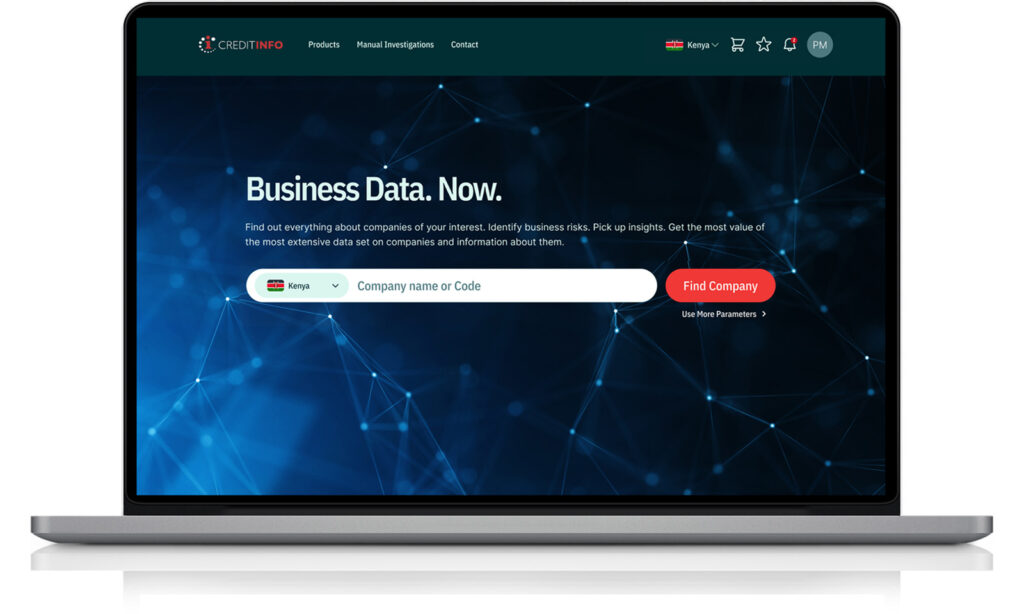

Creditinfo launches new platform to boost African businesses’ access to credit and global opportunities

Creditinfo’s Business Information Platform Africa aims to strengthen local economies and foster global partnerships

London – 14 May 2025 – Creditinfo has today announced the launch of Business Information Platform Africa (BI Africa) to help African businesses and financial services access trade credit more easily and build stronger relationships with global partners. The platform will be rolled out in Kenya in June, with more markets to follow.

The move builds on Creditinfo’s success in the Baltics, where its business information tools have helped companies navigate partnerships and manage risk for over a decade. Now, that same model is being brought to Africa – starting with Kenya – where access to verified, independent business data has often been a challenge.

‘This launch isn’t just about data. It’s about unlocking opportunity,’ said Satrajit Saha, CEO at Creditinfo. ‘When businesses have the right information at their fingertips, they can make smarter, faster decisions that drive growth, close more deals and build lasting confidence – both locally and globally.’

The BI Africa platform offers reports on over one million African companies, presented in a simple, globally standardised format. Users can check key facts about potential partners or customers, everything from credit health to company history, making it easier to assess risk and build trust. Additionally, as an added service, Kenyan businesses will have access to company reports on over 430 million international companies – empowering them to confidently verify both new and existing clients through Creditinfo and its network of global partners.

‘We want to make it easier for African businesses to prove their value, compete globally, and grow with confidence,’ added Saha. ‘Greater transparency leads to stronger trust and improved access to finance – benefits that extend across economies and communities. And that’s a win for everyone.’

It also includes a Manual Investigation Service for those who need deeper insight. Users can request tailored research into specific companies, providing information that goes beyond the numbers, like ownership structures, litigation history, or up-to-date financials. Crucially, the platform isn’t just for large institutions. It’s been designed to support SMEs and individual entrepreneurs, too – those who often struggle the most with gaining access to trade credit.

‘By bridging critical trust and information gaps, our robust platform will redefine what is possible for businesses, of all sizes, in Kenya and beyond. What once took three to five working days to verify a potential business partner can now happen in seconds, without compromising on regulatory compliance. That’s a game-changer for companies, particularly in the SME sector, who need to make quick decisions in competitive markets,’ said Kamau Kunyiha, Regional CEO East and Southern Africa at Creditinfo.

-END-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

The Importance of Trust in Digital Interactions: The Cornerstone of a Digital Economy

There’s a diversity in maturity in digitization across the globe – from markets that are almost universally digital, through markets with developing digital economies, to markets with embryonic digital ecosystems. Mature economies typically have more mature controls but remain attractive to fraudsters because of the scale of opportunity – emerging digital economies typically have less robust ecosystems and are attractive because of the inherent vulnerabilities in the controls – with a promise for future growth.

The anonymity and distance that digital platforms afford make it easier for fraudsters to operate undetected.

For bad actors, the business model is scalable – in a digital economy the unique skills of Frank Abagnale Jr (of “Catch Me If You Can” fame) become redundant. The ready availability of personal data through vast data breaches and social engineering, and online access to digital channels present an attractive proposition for the enterprising fraudster.

In fact, cybercrime has risen dramatically alongside digital transformation, with fraud rates increasing globally – and we’re increasingly seeing collaboration between cybercrime, fraud, organised crime and money laundering. Organizations face mounting challenges in protecting their digital infrastructure and customers from fraudulent activities. From identity theft to financial scams, fraudsters are leveraging a wide array of tactics to deceive individuals and organizations.

The digital economy’s vulnerability to fraud presents significant risks, not only for organizations, but also for consumers. When fraud occurs, it undermines the trust that is essential to the functioning of the digital economy. If consumers and businesses cannot trust the digital services they engage with, it will slow adoption, hinder growth, and damage reputations. Therefore, mitigating fraud risk is not just about protecting individual interactions – it’s about maintaining the integrity of the entire digital ecosystem.

The importance of trust in digital interactions cannot be overstated. From e-commerce to financial services and beyond, trust is the foundation upon which all successful digital interactions are built. At the core of this trust is the concept of identity verification. In a world where interactions are increasingly conducted online, it’s critical to ensure the presented identity is a real-world identity, not synthetic – and that the individual presenting the identity is the owner of that identity.

The need to assert identity in digital engagements goes beyond basic security – it forms the bedrock of confidence that drives the entire online ecosystem. Whether consumers are signing up for a new banking service, purchasing products, or enrolling in educational courses, verifying the authenticity of their identity is paramount. Identity verification serves not only to protect individuals but also to secure businesses from fraudulent activities, which, in turn, strengthens the broader digital economy.

The Role of Identity Verification in Mitigating Fraud Risk

At the heart of reducing fraud risk lies robust identity verification. This process ensures that the individual engaging with a digital platform is who they claim to be. It is a crucial step that lays the groundwork for every subsequent transaction, providing a layer of protection for both consumers and businesses. Without reliable identity verification, any digital interaction is susceptible to being manipulated by malicious actors.

Identity verification can be achieved through a variety of techniques, including biometric verification, document verification, and multi-factor authentication. These methods allow businesses to verify that a person is genuine, providing them with the confidence to proceed with transactions. This, in turn, enables a safer and more reliable digital environment for everyone involved.

However, while basic identity verification is a critical first step, it is only part of the solution.

The Power of Layering Fraud Defences

In a digital economy, an identity is far more than a name, address, date of birth and national id number.

From basic digital identity attributes such as mobile numbers, email addresses and IP addresses, through payment attributes such as bank details and credit card numbers, through connected messaging apps and service accounts, through device attributes such as screen size, make, model, time zone, location, installed apps, through biometric attributes such as facial patterns, to behavioural attributes such as physical device interactions. A digital identity is an extensive and interconnected web of many attributes.

The real strength in mitigating fraud risk lies in combining multiple layers of defence – a multifaceted approach that examines not only the traditional identity attributes, but the wider digital footprint and the connections between attributes across the identity graph. Consistency and conformity to normalised patterns help establish greater trust – inconsistency and anomalous patterns indicate greater risk. Machine learning and artificial intelligence techniques are increasingly used to examine attribute patterns – generating increasingly performant models.

The power of a layered approach lies in managing the balance between making life difficult for bad actors and removing friction in genuine interactions. In a digital economy consumers become increasingly intolerant of any friction in their interactions with organisations. Where consumers encounter even minor friction, they will abandon the sales process and look for alternative providers – in a competitive market, the winners will be the businesses who deliver the easiest way to interact – but without appropriate fraud defences, success will be short lived.

More accurate multifaceted risk assessments can be implemented based lighter data capture, drawing insights from a broad range of sources, reducing CX friction and abandonment, readily securing greater trust, more accurately exposing risk.

Summary

As the digital landscape continues to evolve, organizations must prioritize trust as the cornerstone of their interactions with consumers. Robust identity verification and a layered approach to fraud prevention are not just best practices – they are essential for maintaining the integrity of the digital economy. By effectively combining multiple layers of defence, businesses can balance security with convenience, reducing fraud risk without sacrificing customer experience. In the end, fostering trust in digital engagements is the key to enabling sustained growth and success in an increasingly complex and competitive online ecosystem.

For more information, please visit: www.creditinfo.com

or email info@creditinfo.com

Author : Robert Meakin – Director, Fraud & ID, Creditinfo Group

Op-ed: Reliable Sustainability Information is only the first step

A thought-provoking discussion has taken place about corporate sustainability information and the increasing regulatory requirements of such frameworks. It is often pointed out that the cost of disclosure can be high and the process complicated. In this context, it is worth noting that corporate sustainability information goes beyond the data that public authorities require them to publish. Corporate sustainability data appear, for example, in lawsuits, the media, annual reports, and various forms throughout the value chains of companies, to name a few examples. To capture corporate sustainability data comprehensively, it is also important to place companies in the context of the industries they belong to and the risks they face, both directly and indirectly, through their value chains. While standardized data mandated by government requirements represent a significant step forward, they are only one piece of the puzzle of information needed by the financial market and, in some cases, are not even the most critical information that market participants need.

Sustainability Information Will Remain Unreliable

Corporate sustainability information has evolved from being a product of marketing departments to following guidelines generally accepted by market participants and ultimately falling under regulatory frameworks. Despite recent complex regulations related to sustainability disclosures (such as the CSRD, the EU Taxonomy Regulation, and SFDR), these are not exhaustive of the information that market participants need for informed decision-making. This means that if an analyst is to assess a company with sustainability in mind, there are other factors, beyond what the regulatory framework prioritizes and companies report. These include external factors in companies’ value chains, such as crop failures abroad, fluctuations in commodity prices due to weather anomalies, access to company products in key markets due to social instability, as well as information generated more frequently than annual reports can indicate (such as information from lawsuits and the media). The data companies will provide in line with regulatory frameworks represent a significant step forward, but only the first step toward more reliable sustainability disclosures.

Access to Data Would Have Been a Problem

Even though companies disclose information in accordance with regulations, this does not guarantee stakeholders’ access to it. Part of the problem is technical in nature, as sustainability information is published in, for example, scanned annual statements, various types of sustainability reports, and websites in formats that do not always comply with regulatory guidelines. The European Union has not addressed this issue clearly. At some point, the European Union will establish a database (the European Single Access Point, ESAP), which will receive reports in a predefined format. This database is expected to be operational earliest by 2027, according to official EU information. It is therefore important that sustainability data about companies are collected centrally. At Creditinfo, we proudly undertake this task as it involves critical corporate information.

Reducing the Burden on Companies

The Icelandic financial sector wants to access reliable sustainability information about companies. It seeks this information partly because legal requirements stipulate that financial institutions must have this data available, but also because financial industry employees take sustainability risk seriously, as clearly reflected in bank risk reports. Companies outside the financial market have also sent questionnaires to their suppliers to obtain sustainability information. As a result, companies often receive multiple such questionnaires every year from various sources. At Creditinfo, we see significant waste occurring here. Instead of having a multitude of questionnaires circulating, we realized that it would make more sense if companies answered one such questionnaire, making it accessible to all interested parties. That questionnaire is now available through Vera, Creditinfo’s sustainability platform, and hundreds of companies have filled it out, simultaneously minimizing the associated burden as interested parties can simply access the questionnaire via Vera.

Most companies in Iceland do not fall under the regulations that have been most widely discussed (such as the CSRD and the Taxonomy Regulation). However, this does not mean that this issue is being neglected by them—on the contrary. That is why we have made efforts to give these companies the opportunity to present their information on a larger platform than has been available to them before, through our sustainability platform, Vera.

The Reason for Collecting Data

The discussion about corporate sustainability information has focused more on the quantity and quality of the data than on the reason for its collection. The truth is that greenhouse gas emissions reached a historical high in 2022, at 54 billion tons of CO2 equivalent, about 30% of the global population lacks access to clean drinking water, 13% of individuals over the age of 15 are illiterate, and 10% of the global population is undernourished. In this regard, the financial system is in a key position to improve living conditions and our future. It is important not to lose sight of the goal and get lost in discussions about regulations and data. At Creditinfo, we want to continue to promote the reliability and accessibility of sustainability information about Icelandic companies so that informed decisions can be made for the benefit of all.

Authors:

Hrefna Sigfinnsdóttir, CEO of Creditinfo in Iceland

Reynir Smári Atlason, Head of Sustainability at Creditinfo

Construction sector in Lithuania twice as risky as other businesses

Despite rising incomes and headcount, seizures amount to almost EUR 110 million

19% of construction companies are in the high and top bankruptcy classes and 31% are at risk of late payment, according to a recent study by Creditinfo Lithuania. Despite the number of employees and the rapid growth in revenues, the sector has already recorded 169 company bankruptcies this year. Nearly 11,000 debts have been registered, totaling more than €91 million. 1049 companies are subject to asset seizures amounting to almost €110 million.

There are currently 19850 construction companies registered in Lithuania, employing a total of almost 110 000 workers. At the beginning of this year, the number of companies in the sector was 20367, creating 108.2 thousand workplaces, while in 2023 the figures were 19167 and 107.7 thousand respectively.

According to data provided to the Centre of Registers, in 2023, construction companies in Lithuania together generated revenues of more than EUR 10.6 billion, representing 14.7% of the country’s GDP. In comparison, in 2022, construction companies’ gross revenues were 22.6% lower at EUR 8.7 billion.

Following the data provided by the companies, the top ten construction companies in terms of revenue in 2023 are Kauno Tiltai (EUR 192.9 million), YIT Lietuva (EUR 191.1 million), Fegda (EUR 184.2 million), Conres LT (EUR 117.3 million), Infes (EUR 107.3 million), Green Genius (EUR 102.7 million), “Merko statyba (EUR 97.8 million), Žilinskis & Co (EUR 94.4 million), Autokausta (EUR 94.3 million), Stiemo (EUR 87.4 million).

Despite the year-on-year increase in revenues, the construction sector is twice as risky as any other business in Lithuania. Currently, 19% of construction companies are in the high and highest bankruptcy classes, while almost one third (31%) are at risk of default. The sector has a similar risk profile from the beginning of 2023. Over the last 5 years, the highest risk levels were reached in 2020 and 2021, when a quarter of construction companies were close to bankruptcy and almost half of the companies (47%) were at risk of default.

In comparison, the average riskiness of all Lithuanian businesses is twice as low: 9% of companies are in the high and highest risk classes, while 16% are at risk of default.

Since 2007, 4,497 construction companies have gone bankrupt in Lithuania, with an average of 254 each year. The highest number of bankruptcies was recorded in 2009, when 445 companies became insolvent. This year, 169 construction companies went bankrupt between January and September.

The average amount of seized assets increased by 34.7% to EUR 105 thousand

Currently, 10892 debts of construction companies are registered in the credit bureau system, with a total amount of EUR 91 million and an average debt of EUR 8 360. Compared to the beginning of January 2024, the number of debts exceeded 13,000, the total amount was €164 million, and the average debt size was 1,5 times higher (€12,602).

According to the data of the Credit Bureau, there are currently 2209 seizures on construction companies, including 1043 seizures with monetary value, for a total amount of EUR 109.8 million. The number of construction companies with at least one attachment is 1049 and the average attachment per company exceeds EUR 105 000. At the beginning of this year, the number of seizures was 2,702, with 1,293 seized companies, and the average amount of a single seizure was EUR 68.7 thousand, 1/3 (34.7%) lower than at present.

“If you notice in the credit bureau’s systems that a business partner or client has seizures, please be careful. It is a serious sign that the company is at risk of defaulting on its payments,” advises Rasa Rasickaitė, Risk Assessment and Management Expert at Creditinfo Lithuania. Asset seizure is a compulsory restriction of the ownership right to property, which can be applied by state authorities to secure evidence, civil action, possible confiscation of property, as well as the collection of fines and unpaid payments, satisfaction of creditors’ claims, and fulfilment of other claims and liabilities. Therefore, when you see a registered seizure, you should also pay attention to other available information, such as court information, debts to creditors, the tax authorities and the social security system.”

According to Rasickaitė, in the event of a seizure of assets, it is advisable to find out the reason for which the seizure has been registered, what assets have been seized, and whether the seized assets are allowed to be disposed of in the course of the company’s business. If there are doubts about the ability of the business partner to pay, it is advisable to ask for prepayment or guarantees.

Can Expanding the Role of CRBs Through Trade Data Sharing Enhance Business Credit and Improve Cash Flow Management?

There is a growing need to expand the information shared with Credit Reference Bureaus ( CRBs) to include trade data. Many manufacturers, wholesalers, and retailers have reported cash flow challenges due to difficulties in recovering debts from their customers. This often results in their ability to restock or pay suppliers, further straining their operations. In Kenya, trade agreements frequently rely on informal arrangements, with limited legal recourse due to delays in the judicial systems. Could CRBs play a more significant role in addressing these issues?

As businesses increasingly rely on data to drive decision-making, it’s evident that CRBs, which currently hold financial data related primarily to bank and mobile loans, could greatly enhance their scope. While the inclusion of traditional credit data has boosted financial inclusion, expanding this to cover trade credit information especially from manufacturers, service providers, and wholesalers could revolutionise how businesses extend and manage credit.

If this trade data were collected and shared under a regulatory framework, it could enhance credit trading, improve business relationships, and further financial inclusion. Regular purchasing and payment data, when synthesized, could help businesses evaluate potential customers, set credit limits, and make informed decisions beyond traditional borrowing data.

Accounts receivable teams often struggle to recover overdue debts from customers extended credit without proper risk assessment. Introducing legislation to compel specific entities to share trade data based on factors like turnover or invoice value could help manage risk, reduce legal disputes, and cut down on costs associated with unpaid receivables.

Moreover, the Kenya Revenue Authority could benefit from improved tax collection, as greater financial discipline would be encouraged to avoid negative CRB listings, which can impact a company’s ability to do business. This would also help reduce the burden on the Judiciary, where countless civil cases related to unpaid debts remain unresolved, leading to significant business losses.

Properly managing and sharing trade credit information could streamline the business environment, improving cash flow and financial planning. Additionally, incorporating trade credit data into CRB decision making tools could help boost an individual’s or entity’s creditworthiness when seeking traditional loans. On an individual level, high value asset purchase, such as land and vehicles, could also be evaluated using shared credit sales and receipts data, providing both buyers and sellers with insights into the financial reliability of potential customers.

In conclusion, expanding the data shared with CRBs could significantly improve risk management, debtor control, and financial stability, creating a more transparent and efficient trading environment for businesses of all sizes.

By Francis Shikuku

Accounts Assistant, Creditinfo Kenya

Central Bank of Seychelles awards Creditinfo contract to Develop and Implement a new Credit Information System (SCIS)

PRESS RELEASE

Victoria– September 11, 2024 – The Central Bank of Seychelles (CBS) has today launched the Seychelles Credit Information System (SCIS) in accordance with the Credit Reporting Act, 2023, to improve credit information sharing across the financial system.

The SCIS will be administered by CBS, which will be responsible for overall supervision of the operation of the system, as well as providing awareness on the system and its governing law. The contract to develop and implement the SCIS was awarded to Creditinfo CEE a.s., a company based in the Czech Republic, through an open bidding method as per the CBS procurement process in April 2021.

The SCIS – which replaces the previous Credit Information System established under the Credit Reporting Regulations 2012 – is an improved credit information system which will enhance credit reporting and data exchange between participating institutions. It incorporates automated features requiring minimal manual processing, hence mitigating potential risks of inaccuracies in the credit information of customers.

The current participants of the SCIS include the commercial banks, Seychelles Credit Union, Development Bank of Seychelles and the Housing Finance Company (HFC). The SCIS will continue to expand with the addition of other participants through a phased approach, to include Government entities, utility companies, hire purchase and credit sales, financial leasing companies, and insurance companies. The addition of these other entities – that are also engaged in activities that provide for payment arrangements – will give a more accurate indication of the repayment history and level of indebtedness of customers, information which is essential in the decision-making process for granting credit and loan facilities.

To note that only participating institutions can access the credit information of an individual, at the consent of the individual, in compliance with the Credit Reporting Act, 2023. Individuals holding accounts with these institutions will also be able to access their own credit report through the Customer Credit Portal, which is expected to be launched in the first quarter of 2025.

To watch a news clip of the event, click here.

Visit our websites for more information

ENDS.

Experian MicroAnalytics and Creditinfo unite to launch groundbreaking new fintech solutions

NAIROBI, Kenya, Aug 12, 2024 – Experian MicroAnalytics, a global leader in mobile financial services, and Creditinfo Group, a leading global service provider for credit information and risk management solutions, have partnered to combine Experian MicroAnalytics’ mobile financial services platform with Creditinfo’s scoring models and local market expertise, providing innovative new solutions that facilitate access to finance for individuals and businesses across Africa.

Experian MicroAnalytics, renowned for its risk management solutions utilized by major telcos worldwide, brings its expertise in mobile financial services to the partnership. Their solutions, such as mobile money loans, advanced analytics and machine learning, help to support underserved populations who don’t have access to traditional banking services. Experian’s technology not only facilitates seamless financial transactions but also generates additional revenue streams for telecommunications operators and banks, if present as fund providers.

“Experian is dedicated to driving financial inclusion globally, and our partnership with Creditinfo strengthens our ability to deliver impactful solutions,” said Sammy Hamoudi, General Manager of Experian MicroAnalytics. “Together, we aim to empower telecommunications operators and fintechs to extend their services to previously underserved populations.”

Creditinfo provides comprehensive credit bureau solutions to enable informed decision-making in the financial sector. With this partnership, Creditinfo will further establish itself as the leading credit bureau provider in Africa, enhancing its business risk assessment capabilities and customer insights.

“At Creditinfo, we recognize the transformative power of data-driven solutions in fostering financial inclusion,” stated Kamau Kunyiha, Regional Manager, East and Southern Africa at Creditinfo. “Our collaboration with Experian will help individuals and businesses across Africa gain access to finance, underscoring our shared vision to drive positive change and improve the standards of credit assessment.”

As joint Gold Sponsors of Africa Fintech Festival 2024, Experian MicroAnalytics and Creditinfo showcased their partnership at the event held in Kenya in early June. The festival provided an ideal platform for them to demonstrate their collaborative efforts. Through fireside chats and conference discussions, participants were able to explore opportunities to enhance financial inclusion in Africa through future collaboration.

About Experian MicroAnalytics

Experian MicroAnalytics is a global leader in mobile financial services, providing risk management and marketing solutions to telecom operators and fintechs around the world. Our AI cloud platform increases consumer engagement, reduces churn, manages lending exposure and optimises conversion rates.

With over $4.5 billion in loans already provided by Experian MicroAnalytics, we deliver personalized financial experiences to consumers, empowering financial inclusion while minimizing bad debt.

For more information, please visit www.e-microanalytics.com

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in the field of credit risk management. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

Open Banking Solutions at Creditinfo

In 2020 Creditinfo Group decided to be part of the Open Banking initiative by starting to investigate the options of using customers’ bank account statements in their offering. The account information service is based on the PSD2 directive. For known reasons, it is not possible and acceptable to have access to customer bank account data without consent.

Creditinfo have tackled the opportunity in two different ways. In the Baltics and Iceland, the chosen route was to apply for an FSA licence to offer end-to-end customer account statements transfer from their home bank to a third party, from whom the customer applies for credit , e.g. car loan. In the Czech Republic and Slovakia namely due to the long and cost-intensive process of “passporting” CI’s Estonian license, the chosen route was collaboration with a local technical partner called Sokordia Tech.

A little bit more about above-mentioned two ways to offer Open Banking solutions in Creditinfo Group.

In 2021 Spring, Creditinfo Estonia received permission from the Financial Supervision Authority to start offering account information services in Estonia, which later in Autumn expanded to the markets of Latvia and Lithuania. Today, Creditinfo has been offering the account information service in the Baltic market for almost three years. Creditinfo have real-time access to the transaction data of customers of banks and financial institutions using a secure data transmission channel and customer consent.

In Spring 2024, Creditinfo Estonia finalised the Iceland licence application process from Estonian FSA and can officially offer account information service in Iceland.

Beside regulative and compliance part, Creditinfo also has full technical integration and capability in developing categorization when offering account informatoin service. With opportunity to access customers bank account data, the aim is to offer more transparent credit risk evaluation to customers and third parties, who find high value from the knowledge of their customers account information to make data-driven, intelligent credit and business decisions.

As mentioned above, Creditinfo also have Open Banking cooperation and partnership in the Czech Republic and Slovakia with fintech company Sokordia Tech, teaming up to capitalize on Creditinfo’s market position whilst leveraging Sokordia Tech’s AISP and PISP licenses and Open Banking services platform to provide PSD2/Open Banking services to several financial services clients in the market.

In the Czech Republic and Slovakia market, Creditinfo currently has 5 customers utilizing the Open Banking platform, processing more than 1.2 million open banking transactions per month. Depending on the specific requirements, pain points, and use case of the Client, Creditinfo has developed a “Categorization In-a-Box” , Multi-Service platform called Transaction Analysis Service replete with 40,000 pre-installed business rules that can sit atop and work with any Open Banking Open APIs in any country. The service is comprised of 6 unique methods/services (AIS+CIS+PIS) & PDF tools via one API as detailed below:

- PSD2parser: extracting raw data from PSD2 bank statements

- PSD2tags: tag each bank transaction with one to N identifying tags

- PDFparser: Extracting raw data from PDF bank statements

- PDFtags: Tag each bank transaction with one to N identification tags

- 1UnitPay: Verification PSD2 payment (the advantage is that the payment is made in one step with statement extraction)

- Bank Account Views: Repeated viewing of bank accounts without the need for customer re-authentication

Together with our partner Sokordia Tech, we currently have Open Banking APIs and are able to provide all these services under one single API for the following countries: Czech Republic, Slovakia, Hungary, Romania, and Poland.

Development work on the 3rd generation of the Transaction Analysis Service is currently in development, highlighted by:

- Deeper AI involvement in processes & rules & analysis

- Expansion of new online data inputs into transactional analytics

- Multi-language analytical tools

- GUI for clients to manage and report transactional analytics themselves

For more information, please visit: www.creditinfo.com

Authors:

Seth Marks – Regional Director Central, Eastern & Southern Europe, Creditinfo Group

Ivo Vallau – Open Banking Product Manager, Creditinfo Group