Creditinfo’s commitment to Data Quality

Data is the new oil, but quality is paramount

In 2017, The Economist ran a cover story portraying data as the new oil, (certainly not last week’s oil), calling it “the world’s most valuable resource”. Data is pervasive and is collected regarding virtually everything that happens. Essentially it comes down to one simple cycle, as described in that 2017 issue: “By collecting more data, a firm has more scope to improve its products, which attracts more users, generating even more data, and so on…” Information is power (for credit bureaus, the power to enhance market lending effectiveness). But there is a catch; because not any kind of data will suffice. In the world of credit, for it to be valuable, data must be complete, high quality, regularly transmitted and verifiable. High-quality data has a deeper, more transformative power. In this industry, data quality and completeness are critical for the successful impact of credit bureaus, and Creditinfo has, since its founding, had a clear focus on this area to support banks, MFIs and other institutions for constant improvement.

Quantity is not a quality on its own

Simply possessing data is not enough for credit bureau success. Costs and indirect costs of incomplete and low-quality data have a substantial financial impact on credit grantors, these range from the granting of credit to high-risk persons, the turning away of low-risk persons, ineffective and wrongly targeted collection efforts (when directed using incorrect demographic data), loss of credibility with customers and regulators, and extra costs and delays related to its validation and cleaning. Data quality is much more than just having data. Data quality is a challenge for all credit bureaus globally and should be focused on from the start. Even in the United States, where “credit culture” is widespread and where credit bureaus are positive, large and mature, it is still an open-ended issue. Credit bureaus can deliver clear socio-economic benefits even when data has some weaknesses, but as data improves impact becomes greater. And weak data is harmful across the board: lenders receive less complete risk profiles, consumers are not assessed properly, and the full potential of the credit bureau’s predictive power is wasted. So, how to positively participate in the improvement of data?

[1]In its General Principles for Credit Reporting, the World Bank underlines that “information quality is the basic building block of an effective credit reporting environment”. In 2018, Experian found that 57 per cent of organizations consider being data-driven a competitive advantage because it enables better decision-making practices.

Creditinfo’s commitments

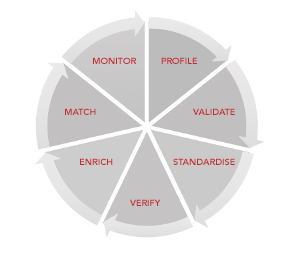

Creditinfo invests considerably in data quality and is specifically committed to three areas: multiple phases of checks of loaded data, periodic reviews with institutions providing updates of changes and reporting to senior management, and finally ongoing feedback to the regulatory body.

Regular checks each time data is uploaded are a fundamental first step. It is a crucial stage which happens in multiple phases and aims in preventing significant disruption down the line. Data quality rules refer to logical restrictions on the data which are sent to the credit bureau system. They validate dependencies between two or more data fields, as well as the data’s consistency with available history. The goal of data quality rules (and preventative checks) is to avoid: Errors in data (e.g. negative amounts), mistypes (e.g. wrong formats of the IDs), logical errors caused by inconsistency of data in the subscriber’s database (e.g. start date of the contract is in the future), lack of essential information (e.g. missing contact information, identification numbers), extreme cases, (e.g. huge number of collaterals, which could cause problems with report generation), inconsistent data compared to other historical data, etc.

Reviews are the second essential pre-requisite to a robust, high-quality data ecosystem. Their aim is to support subscribers to maximize their data quality for their own and the collective benefit of the banks. Indicators like the quality of snapshots and their regularity are verified and checked, as well as the way in which they are captured and updated. They directly engage lending institutions and are critical stages for persuasion and trust-building; to win buy-in for data quality. Creditinfo is a partner of lending institutions in four continents, regularly engages in data reviews and consistently aims higher in terms of data quality.

Finally, a healthy and robust work relationship with regulators, as well as its implication, are key. Only the regulator possesses the hard tools and moral suasion necessary to nudge financial and non-financial institutions in the right direction. Creditinfo, as a licensed credit bureau, has been closely working with regulators around the world to “push” data quality, especially in markets where the concept of credit bureaus is new, and where data quality is usually at the bottom of the list of priorities of lending institutions. Regulator plays crucial roles in persuading institutions, like through a data quality ranking, and by enforcement of relevant legislation, like pertaining to data submission. Furthermore, data quality is also in the regulator’s interest: systemic risk control and other supervisory activities are inextricably linked to a vigorous data quality ecosystem.

If converting data into intelligence is Creditinfo’s core business, data quality is an essential element at the heart of it. It has been Creditinfo’s commitment for the past 20 years., and it will be so going forward.

Nelson Madeddu, Global Consultant, Creditinfo Group.