Lithuanian Paper Industry: Revenue Growth, Debt Increase & Decreasing Risk

Challenges from a Few Companies Distort the Overall Picture

An analysis by Creditinfo Lietuva reveals a controversial situation in Lithuania’s paper manufacturing sector. While the number of companies has decreased in recent years, the number of employees has grown. In 2023, sector revenues reached €829 million—a 51% increase compared to the beginning of 2021. However, there are worrying signs: the sector’s debt portfolio has grown nearly fivefold over four years. This negative trend is primarily driven by the difficulties of a few companies, while the sector itself demonstrates resilience. No bankruptcies have been recorded in the past three years, and the risk levels are nearly twice as low as the national business risk average.

Current State of the Sector

According to Creditinfo Lietuva, there are currently 176 companies operating in the Lithuanian paper manufacturing sector, employing 5,462 people. While the number of companies has gradually decreased from 191 in 2021 to 176 in November 2024, employee numbers have grown steadily, from 5,022 in January 2021 to 5,462 in November 2024.

Economic Indicators: Positive and Negative Trends In 2023, total sector revenues reached €829 million—4.6% less than at the start of the year (€869 million), but 21% higher than in 2022 (€684.6 million) and 51% higher than in 2021 (€548 million). Over a four-year period, average annual revenues per company increased from €4.2 million to €6.1 million.

The paper manufacturing sector includes companies producing pulp, paper, and cardboard, as well as corrugated paper and cardboard packaging, hygiene and household products, stationery, copy paper, envelopes, wallpapers, and other specialized products.

Debt Portfolio Increased

Fivefold At first glance, the sector has seen a significant increase in overdue financial obligations. Between 2021 and the end of 2024, the debt portfolio grew nearly fivefold, from €157.7K to €776.6K, while the number of debts increased only slightly, from 87 to 89 cases.

“A deeper analysis shows that the overall figures are skewed by issues faced by a few companies—one undergoing restructuring and another involved in legal proceedings. Excluding these, the sector remains stable, with the average debt amount per case decreasing from €2,999 in early 2024 to €2,803,” says Dovilė Krikščiukaitė, Head of Legal at Creditinfo Lietuva.

Bankruptcy Trends

From 2003 to the end of 2024, the paper manufacturing sector recorded 30 bankruptcies. However, insolvency cases have varied across periods. For instance, no bankruptcies occurred between 2022 and 2024 or from 2014 to 2015, while 2009–2010 saw 5 and 4 bankruptcies, respectively.

Risk Levels: Lower Than Other Sectors

Analyzing risk trends between 2022 and 2024, the paper manufacturing sector shows positive stabilization. Currently, 8% of companies are classified as high-risk for late

payments, and 5% are at high risk of bankruptcy. This means over 90% of companies are considered low- or medium-risk. In comparison, the national average bankruptcy risk is 9%, with 16% of companies at risk of payment delays.

“Aside from a few exceptions, Lithuanian paper manufacturers are relatively low risk. Compared to other sectors, this positions them as a stable part of the economy,” adds Krikščiukaitė.

Top Companies by Revenue and Employment

The top 10 Lithuanian paper manufacturers by revenue in 2023 are:

1. Nemuno banga (€178.2M)

2. Aurika (€70.3M)

3. DS Smith Packaging Lithuania (€59.4M)

4. Grigeo Klaipėda (€45.8M)

5. Grigeo Packaging (€36.4M)

6. Rietuva (€32.99M)

7. Pakmarkas (€27.1M)

8. Bigso (€24.9M)

9. Miko ir Tado leidykla (€24.3M)

10. Klaipėdos kartono tara (€23.8M)

Top employers in the sector include:

1. Nemuno banga (580 employees)

2. Aurika (481 employees)

3. Bigso (324 employees)

4. Grigeo Tissue (244 employees)

5. DS Smith Packaging Lithuania (214 employees)

Lithuanian debts increased by €6.8 million since the beginning of 2023

According to Creditinfo Lithuania’s latest analysis, Lithuanian debts have increased by €6.8 million since the beginning of the year, reaching a total of €364.8 million.

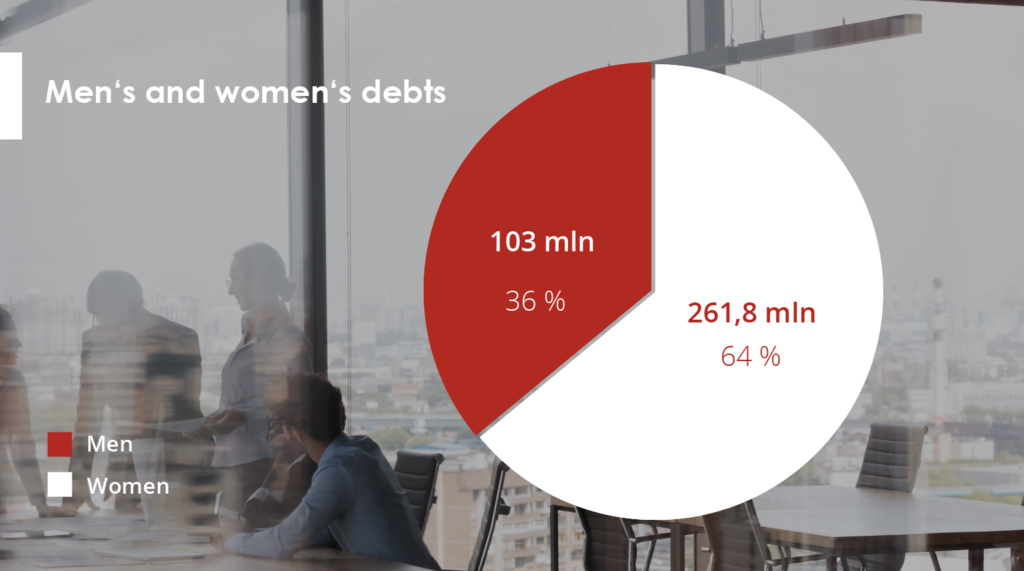

Of this amount, male’s debts stand at €261.8 million, while female’s debts are at €103 million. This is almost €6.8 million more than at the beginning of this year (€358 million). The total number of borrowers has also risen by 5,000 in the first quarter of this year, with the current total standing at almost 201,000.

Creditinfo Lithuania has recorded almost 201,000 debtors in its systems for March, with a total of 235,300 individuals having 235,300 debts in Lithuania.

After a more detailed examination of the debtor data, it was found that over 129,000 males and 72,000 females are currently in debt, making up 64% and 36% of all debtors respectively. Additionally, 32,500 males and almost 20,000 females have multiple debts, with 25.3% of male debtors and 27.7% of female debtors holding two or more debts.

On average, males owe €2,029, which is 30% more than the average debt owed by females (€1,435). This trend, coupled with the higher number of male debtors, results in men holding 78% of the total debt amount, while women hold only 22%.

During the first quarter, an additional 5,000 individuals in Lithuania fell into debt.

In March, the total number of individuals in debt amounted to 201,000, marking an increase of 5,000 from January’s 196,000. The total value of debt owed by all debtors also rose from €358 million to €364.8 million, with the total number of debts recorded in the credit bureau system increasing by 5,300. The largest number of new debts to households registered in the first quarter of this year, after debts to the financial sector, were for utilities and energy, with a total of 1,518 debts (12%).

“The analysis suggests that the majority of new debts recorded this year can be attributed to the energy and heat price crisis. Rising fuel costs have resulted in increased indebtedness, with people seeking short-term financing in order to balance consumption and expenses,” explains Aurimas Kačinskas, the Head of Creditinfo Lithuania. “Not everyone has had sufficient time to alter their financial habits, which has resulted in the growing number and value of debts.”

Men aged between 35 and 45 are considered to be the most high-risk debtors

Despite fluctuations in the number of borrowers and their levels of indebtedness, the typical borrower profile has remained consistent in recent years. Men aged 35-45 are the riskiest debtors, with debts amounting to €75 million, accounting for almost 29% of the total amount owed by men. The second riskiest group is men aged 45-55, with €61 million in debt, representing 23.3% of the total amount owed by men. In third place are men aged 25-35, who hold €55 million in debt, accounting for 21% of the total amount owed by men. Men aged 55-65 hold €43 million in debt, while those over 65 hold €17 million. Men under 25 hold the lowest amount of debt at almost €15 million.

Among female debtors, the under-25 age group has the lowest amount of debt, while other age groups have the following distribution: €29 million (45-55), €26 million (35-45), €20 million (55-65), and €17 million each (25-35 and over 65).

According to Mr Kačinskas, it is important for citizens to assume their financial obligations responsibly and meet them on time to maintain a positive credit history, which determines their access to financial services, loans, credit cards and payment provisions.