The Creditinfo Chronicle

Creditinfo Solutions is celebrating its 10th anniversary

Creditinfo Solutions is celebrating its 10th anniversary. A decade ago, on 1st December, 2006, we opened our doors, not knowing what was about to happen. Since then, we have grown from just a couple of employees to in excess of 100 employees. The company’s initial focus working with just local clients changed after a short period of time. Creditinfo Solutions, with the support and backing from our parent company, Creditinfo Group, soon began to successfully sign a number of sizeable deals to deliver credit bureau solutions in Sudan, Tanzania, Afghanistan, Iraq, Indonesia, Latvia and South Sudan. Now, our clientbase spans more than 40 countries around the world.

Coremetrix for financial inclusion

Financial Technology is often seen as a sector that works for those who are already winning: something to help sophisticated users of personal and commercial finance streamline their access. It performs that function, of course, and many of us have seen our professional and personal lives enriched as a result. But FinTech also has an essential role to play in opening access, as well as improving it.

At Coremetrix, we are committed to realising that potential. Part of the Creditinfo Group, we believe data on individuals – obtained voluntarily, and focusing on personality rather than the information used for traditional credit scoring – can broaden access to financial products of all kinds. Lenders and other financial institutions across international markets agree with us, and we are partnering with a number of them to provide access to credit and other services based on who people are, not what they can prove. Continue reading »

The largest provider of business information in Estonia – Krediidiinfo AS – changes name to Creditinfo Eesti AS

Starting today the largest provider of business information in Estonia – Krediidiinfo AS has been renamed to Creditinfo Eesti AS and will start using the corporate trademark Creditinfo. The change of name relates to the fact that at the beginning of this year 100% of company’s shares have been acquired by Creditinfo Group, the international credit information and credit risk management services provider.

Continue reading »

Benefits of a Credit Bureau in Azerbaijan outlined at the Banking Forum in Baku

The Banking Forum in Baku, Azerbaijan, organized by the Azerbaijan Banks Association, focused on the challenges and perspectives related to the development of the banking system in post-oil period and covered the benefits of opening a credit bureau in the country. This major industry event took place on the 24th and 25th of November, 2016.

Trade Credit Decision Making Webinar

Creditinfo Academy invites you to a “Trade Credit Decision Making” webinar. On February 9th 2017, 15:00 CET, Andryi Sichka, Managing Partner of Credit Engineering and Development Director of The Association of Credit for Central and Eastern Europe will share with you his insights on the topic.

Risk Challenge 2016: Big Data Big Money

The First Credit Bureau’s experts and the partners companies have presented the main trends of the lending market and innovations in the banking sector during the Risk Challenge 2016: Big Data Big Money – the largest banking conference in Kazakhstan. The annual event Risk Challenge brings together all participants of the financial market to discuss and exchange views on major issues of the financial sector.

Coremetrix are hiring!

As you may know, Coremetrix recently became part of the Creditinfo Group of companies and also moved into lovely new offices in Central London W1. They are now hiring for 2 new roles:

- Risk Modeling Specialist – see more info about the role and how to apply here

- Sales Manager – see more info about the role and how to apply here

- DevOps Manager – see more info about the role and how to apply here

You can find out about Coremetrix at www.coremetrix.com

Trade Credit Decision Making webinar

On Tuesday 8th November 2016 at 15h00 CET, join us for a Creditinfo Academy webinar presented by Andriy Sichka on Trade Credit Decision Making. The first in a series presented by Andriy in association with Creditinfo Academy, ACCEE The Association of Credit for CEE, PICM and credit engineering More details here on how to join this open webinar:

Compuscan partners with Coremetrix to bring innovative personality-based credit assessment to South Africa

Strategic partnership with Coremetrix, a company powered by Creditinfo, to improve financial inclusion amongst underserved consumers in South Africa.

Compuscan, one of the largest independent credit bureaus in Africa, has established a strategic partnership with Coremetrix, a UK-based company powered by Creditinfo, the world’s leading creator of psychometric data for consumer risk assessment. The new initiative will enable Compuscan’s clients to assess consumers with limited credit information and those who are considered a marginal risk using a psychometric quiz that will complement traditional scoring techniques.

Lithuanian Credit bureau opens up data to innovative companies

Credit bureau Creditinfo is opening up its data to startups and other innovative companies. Company data as well as population statistical data that are held by the credit bureau can be used for developing value-added products: apps, customer behavior predictive models and other solutions that require information.

Consumer Finance Holdings and Coremetrix, a company powered by Creditinfo, open up access to credit in Slovakia

Coremetrix psychometric quiz testing to be used to improve access to mainstream credit amongst underserved consumers in Slovakia. Consumer Finance Holdings (‘CFH’) in Slovakia part of the VUB Group – is the first client in Slovakia to sign up to an exciting new initiative from Coremetrix, the leading provider of psychometric testing for the credit risk sector. The new initiative will enable ‘CFH’ to assess its thin-file and marginal customers with a psychometric quiz besides traditional credit check and scoring techniques.

WCCRC 2016: A curious conference of the FinTech (in the nighttime)

First, I apologise for the caption, but thinking about this conference reminds me of the Sherlock Holmes story, where the dog did not bark (Google it, if needed), which was curious indeed, I think.

Coremetrix, a company powered by Creditinfo, and Admiral collaborate to explore the impact of personality on motor insurance risk assessment

Coremetrix, powered by Creditinfo, the world’s leading creator of psychographic data, and Admiral, a leading provider of insurance products in the UK, have established a working group to evaluate how psychometric scoring can support the assessment of risk in motor insurance in the UK.

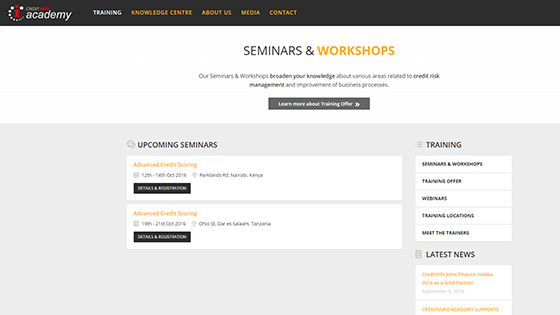

Creditinfo Group launches Creditinfo Academy website

Creditinfo Academy, part of Creditinfo Group, is a skills development and training provider that delivers generic and customized training services. Our focus, at Creditinfo Academy, is to provide training for clients wanting to develop their skills to improve operational efficiency and overall business performance; as well as train consumers and assist public sector in their quest for financial inclusion.

Creditinfo Academy supports Africa Fintech Awards 2016

Creditinfo Group is part of Africa Fintech Awards 2016, through its involvement with panel of judges.

Agata Szydlowska (Head of Financial Inclusion & CRB Awareness) was elected as a judge for the Fintech Awards Africa 2016 (http://www.fintech-africa.com/panel-of-judges) and joined the group of the seasoned investors, academics, marketers, entrepreneurs with an extensive track record in finance and/ or technology. Continue reading »