Creditinfo Group wins contract with Central Bank of Oman for the Implementation & Support of Oman Credit Bureau “OCB”

PRESS RELEASE

Creditinfo joins forces with Central Bank of Oman (CBO) to implement a world class Credit Bureau in the Sultanate

PRESS RELEASE: Know your credit score to make better informed financial decisions

PRESS RELEASE

DPI, Guyana, Thursday, November 22, 2018

– all lending agencies are mandated by law to share all credit data with the credit bureau

– “a lender cannot pull your credit report without your consent”

– know your credit score – it prevents over-indebtedness and encourages responsible borrowing and brings stability to the financial sector

– credit bureau was established in 2013 and operates under the Credit Report Act of 2010 and the Credit Reporting [Amendment] Act of 2016

Creditinfo inks contract with Housing Finance Kenya

The Housing Finance Company in Kenya have introduced mobile lending this summer and chose to use Creditinfo’s Instant Decisions as the one and only decision-making tool. They chose an in-house installation back in June and then, after several weeks of consultancy and strategy design project, we have come together with the customer to the point where we have a very complex strategy with 3 different Credit Limit Allocation matrices, matching competition’s limit and limit allocation as a function of previously received loans. After successful pilot in July, August they opened it for a wider population, and just recently, in November, to the entire Kenyan population, through all channels – iOS, Android and USSD – and they had a big marketing campaign for USSD customers that had its apogees last week, starting November 18th 2018.

Consumer lenders in Latvia obliged to exchange full positive credit history via Credit Bureaus

PRESS RELEASE

Changes in Consumer Protection Law adopted by Saeima (Latvian Parliament) obliging consumer lenders to exchange positive credit information about consumer and to use this information in assessment of creditworthiness is a positive step, said “Kredītinformācijas Birojs”.

Creditinfo Estonia celebrates the 25th anniversary

Creditinfo Estonia – the oldest company in the Creditinfo Group – celebrates the 25th anniversary this year. Creditinfo Eesti AS was established in 1993 (operated under the name Krediidiinfo AS until December 2016). Many years’ experience has helped the company to become the largest and most professional Estonian supplier of credit information.

Creditinfo Estonia has been a loyal long-term partner to Estonian companies helping them to make smart and intelligent business decisions. Creditinfo Eesti AS is the Estonian market leader in the sector of information collection, processing and intermediation.

On 17th of October, Creditinfo Estonia celebrated its 25th anniversary with the clients in a client-conference: Creditinfo 2.0.43. Our goal was to look back to the eventful history, and to begin with the creation of a new version of Creditinfo Estonia for the next 25 years – Creditinfo, version 2.0.43!

The main topics of the conference covered the preview into the next years – possibilities of using alternative data solutions in credit ratings and cross-border data exchange, we talked about innovations and advances in data ecosystems and analytics. Additionally, we took a closer look into what is happening in the credit-industry in the world.

The conference was a perfect thank you gesture for all the clients, who are the roots of our success. Trust and loyalty from the clients give us the inspiration and courage to create innovative solutions impacting the business and social environment around us.

From Unemployed to Financially Empowered: Meet Dorah, Creditinfo Success Story

So many great stories on financial inclusion across the globe are left untold. So rewarding to be able to share with you at least some of those, where Creditinfo can contribute and make a difference. Watch the story of Dorah.

Micro-lenders should work with regulators

Recently, there has been much publicity about the 1.5 million Kenyans who have been negatively listed on the Credit Reference Bureau (CRB) as a result of borrowing from micro-lenders.

— by Kevin Mutiso

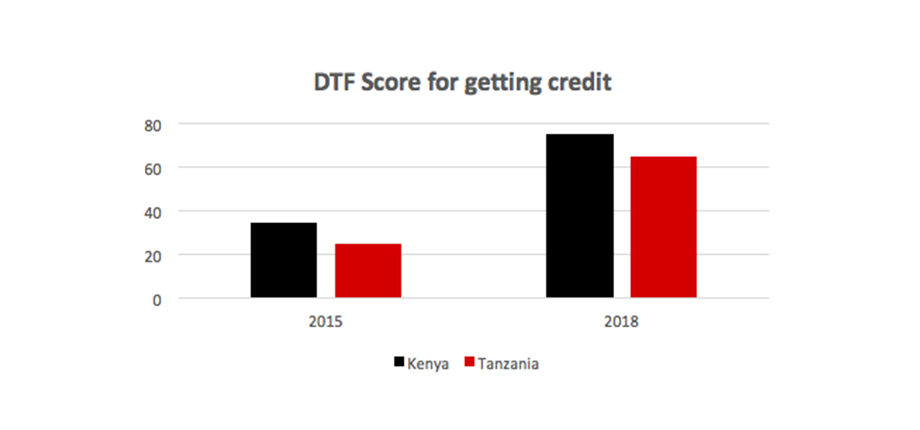

Proof that Credit Bureaus Improve Countries’ Distance to Frontier Score for Getting Credit

Within the Credit Bureau industry, we often talk about better financial inclusion and ways to facilitate access to finance, especially in light of the 2 billion “unbanked” population – a number reported in the Worldwide Findex Database by the World Bank and escalated by many industry players.