Risk Management Framework

Risk management is an essential function for any bank, as it helps to protect the bank’s financial position, reputation, and long-term viability. An effective risk management framework consists of several key components that work together to identify, assess, and manage risks.

Risk Governance

The first key component of an effective risk management framework is risk governance. This involves establishing clear risk management policies, procedures, and guidelines that align with the bank’s overall strategy and objectives. The bank’s board of directors and senior management should be actively involved in setting risk management policies and overseeing the bank’s risk management activities.

Risk Identification

The second key component is risk identification. The bank should have a comprehensive risk identification process in place to identify all potential risks associated with its business activities, products, and services. This includes identifying internal and external risks such as credit risk, operational risk, market risk, and compliance risk.

Risk Assessment

Once risks are identified, the bank should assess the likelihood and impact of each identified risk to determine its potential impact on the bank’s overall operations, financial position, and reputation. This includes assessing the potential impact of risks on the bank’s customers, employees, and other stakeholders.

Risk Mitigation

The bank should develop and implement risk mitigation strategies to manage and reduce the likelihood and impact of identified risks. This may include implementing internal controls, establishing risk limits, and developing contingency plans.

Risk Monitoring

An effective risk management framework should include ongoing risk monitoring to ensure that the framework is functioning as intended. This involves continuously monitoring the bank’s risk management activities to identify emerging risks and ensure that existing risks are being effectively managed.

Risk Reporting

The bank should have a robust risk reporting framework in place to provide timely and accurate information on risk exposures and mitigation activities to the board of directors, senior management, and other stakeholders. Effective risk reporting helps ensure that the bank’s management team has the information they need to make informed decisions about risk management activities.

Risk Culture

Finally, an effective risk management framework should foster a risk-aware culture throughout the organization. This involves ensuring that all employees understand their roles and responsibilities in managing risks and are held accountable for their actions. A strong risk culture helps to ensure that risk management activities are integrated into the bank’s day-to-day operations.

In conclusion, an effective risk management framework is essential for banks to identify, assess, and manage risks. The key components of such a framework include risk governance, risk identification, risk assessment, risk mitigation, risk monitoring, risk reporting, and risk culture. By implementing an effective risk management framework, banks can effectively manage risks and protect their financial position, reputation, and long-term viability.

Joe Bowerbank,

Business Development, Creditinfo Group.

Digital Transformation in Credit Risk Management: What You Need to Know

The rise of digital technologies is transforming the financial industry, and credit risk management is no exception. With the increasing use of digital channels for financial transactions, there is a growing need for credit risk management strategies that can effectively manage risks in these channels. In this blog post, we will explore the concept of digital transformation in credit risk management and discuss some of the key trends and best practices in this area.

What is Digital Transformation in Credit Risk Management?

Digital transformation in credit risk management involves the use of digital technologies to manage credit risk more effectively. This includes the use of advanced analytics and machine learning to analyze large amounts of data in real-time, as well as the development of digital platforms that enable faster and more efficient credit risk management processes.

One of the key benefits of digital transformation in credit risk management is the ability to analyze data more effectively. By using advanced analytics and machine learning algorithms, financial institutions can analyze large amounts of data in real-time, identifying trends and patterns that may be indicative of credit risk. This can help financial institutions make more informed lending decisions, reducing the risk of default on loans and other credit products.

Another benefit of digital transformation in credit risk management is the development of digital platforms that enable faster and more efficient credit risk management processes. For example, some financial institutions are developing digital platforms that enable borrowers to apply for loans online, with the platform automatically analyzing the borrower’s credit risk and providing a decision in real-time. This can significantly reduce the time and cost associated with traditional lending processes, making it easier for borrowers to access credit.

Key Trends and Best Practices in Digital Transformation in Credit Risk Management

There are several key trends and best practices in digital transformation in credit risk management that financial institutions should be aware of:

Use of advanced analytics and machine learning: Financial institutions should leverage advanced analytics and machine learning algorithms to analyze large amounts of data in real-time, identifying trends and patterns that may be indicative of credit risk.

Development of digital platforms: Financial institutions should develop digital platforms that enable faster and more efficient credit risk management processes. These platforms should be user-friendly and easy to access, making it easier for borrowers to apply for loans and access credit.

Integration with other digital platforms: Financial institutions should integrate their credit risk management platforms with other digital platforms, such as mobile banking apps and online marketplaces, to provide a seamless and integrated experience for borrowers.

Investment in cybersecurity: Financial institutions should invest in cybersecurity measures to protect against cyber threats and ensure the security of customer data.

Conclusion

Digital transformation is transforming the financial industry, and credit risk management is no exception. By leveraging digital technologies such as advanced analytics, machine learning, and digital platforms, financial institutions can manage credit risk more effectively, reducing the risk of default on loans and other credit products. As the financial landscape continues to evolve, it is likely that new digital technologies and best practices will emerge, requiring credit risk management professionals to stay up-to-date with the latest trends and developments.

Gary Brown,

Head of Commercial Development, Creditinfo Group.

Credit Bureaus: Cross Border Data Sharing

In today’s globalized world, cross-border data sharing is becoming increasingly important for credit bureaus. By accessing data from multiple countries, credit bureaus can improve the accuracy and completeness of credit reports, assess the creditworthiness of non-citizens, and expand market opportunities for lenders. Let’s explore these benefits in more detail.

Improved accuracy and completeness of credit reports

Accessing data from multiple countries allows credit bureaus to gain a more comprehensive view of an individual’s credit history. For example, if someone has lived or worked in multiple countries, their credit history may be spread across different credit bureaus. Cross-border data sharing allows credit bureaus to combine this information into a single credit report, providing lenders with a more complete picture of the borrower’s creditworthiness. This can lead to more informed lending decisions and better risk management for lenders.

Assessment of creditworthiness for non-citizens

For non-citizens or individuals with limited credit histories, cross-border data sharing can be especially important. Without access to credit data from other countries, it can be difficult to assess their creditworthiness. Cross-border data sharing allows credit bureaus to access credit data from other countries, providing a more complete picture of the borrower’s credit history. This can help lenders make more informed lending decisions, expanding opportunities for creditworthy borrowers.

Increased market opportunities for lenders

By accessing data from multiple countries, credit bureaus can also help lenders expand into new markets. For example, a lender in one country may be interested in providing loans to individuals or businesses in another country. Without access to credit data from that country, it can be difficult to assess the creditworthiness of potential borrowers. Cross-border data sharing can provide lenders with the information they need to make informed lending decisions, opening up new opportunities and expanding their market reach.

Compliance with international regulations

In some cases, cross-border data sharing may be required by international regulations or agreements, such as the GDPR in the European Union. By complying with these regulations, credit bureaus can avoid legal and reputational risks. Additionally, complying with international regulations can help build trust with consumers and businesses, as it shows a commitment to ethical and responsible data practices.

In conclusion, cross-border data sharing is becoming increasingly important for credit bureaus. By providing access to a wider range of data sources, credit bureaus can improve the accuracy and completeness of credit reports, assess the creditworthiness of non-citizens, expand market opportunities for lenders, and comply with international regulations. As global data sharing becomes more common, it is likely that cross-border data sharing will become a standard practice for credit bureaus around the world.

Credit Bureaus and why they will remain important in the years to come

As the financial industry continues to evolve, credit bureaus need to continue to adapt. There are many compelling reasons why credit bureaus will continue to play a vital role in the future of lending and credit. In this blog, we’ll explore the benefits of credit bureaus and why they will remain important in the years to come.

1. Efficient and standardized credit data

Credit bureaus provide an efficient and standardized way to collect and store credit data. This allows lenders to quickly access the credit history and credit scores of potential borrowers, which is essential for making informed lending decisions. Without credit bureaus, lenders would need to spend more time and resources gathering credit data from various sources, which would slow down the lending process.

2. More accurate credit models

Credit bureaus are constantly refining their credit models to improve accuracy and predictiveness. By analysing large amounts of credit data, credit bureaus can develop more sophisticated credit models that consider a wide range of factors, such as payment histories, outstanding debts, and length of credit history. These models provide lenders with a more accurate picture of a borrower’s creditworthiness, helping to reduce the risk of defaults and delinquencies.

3. Increased access to credit

Credit bureaus play a critical role in expanding access to credit. By providing lenders with access to credit data, credit bureaus make it easier for individuals and businesses to obtain loans and credit cards. This is particularly important for people with limited credit histories or who have had past credit problems, as credit bureaus provide lenders with a way to evaluate these borrowers’ creditworthiness.

4. Protection against fraud and identity theft

Credit bureaus also play a key role in protecting consumers against fraud and identity theft. By monitoring credit reports for suspicious activity, credit bureaus can help detect and prevent fraudulent activity. Additionally, credit freezes and fraud alerts can be placed on credit reports to prevent unauthorized access to credit data.

5. Continued relevance in a changing industry

While the financial industry is evolving rapidly, credit bureaus will continue to be relevant in the future. As new technologies and data sources emerge, credit bureaus will adapt and incorporate these changes into their credit models. Additionally, credit bureaus will likely face increased competition from fintech startups and other companies, which will push them to innovate and improve their offerings.

In conclusion, credit bureaus are essential to the lending and credit industry. By providing lenders with access to credit data, credit bureaus make it easier for individuals and businesses to obtain loans and credit cards. Additionally, credit bureaus play a critical role in expanding access to credit, protecting consumers against fraud and identity theft, and adapting to a changing industry. As the financial industry continues to evolve, credit bureaus will remain a vital part of the lending and credit ecosystem.

Gary Brown,

Head of Commercial Development, Creditinfo Group.

Creditinfo Kenya partners with Letshego Kenya to launch lending app

Letshego Kenya launches “Letsgo Cash” in partnership with Creditinfo Kenya to take financial inclusion to a higher level.

· Minimum loan amount of KES 1,000 and a maximum of KES 100,000 and a loan repayment period of 30 days.

· LetsGo Cash increases access and supports customers who need quick and easy access to funds for emergency purposes.

· LetsGo Cash supports digital financial inclusion and enables the underserved and informal sector players to build their own credit records.

Nairobi, Kenya, 3rd May 2023 – Letshego Kenya Limited, a subsidiary of Letshego Holdings Limited (Letshego Group), has partnered with Creditinfo Kenya to launch LetsGo Cash, a self-service and short-term instant loan that gives customers access to KES 1,000 up to KES 100,000.

LetsGo Cash is payable in 30 days and geared towards consumers who need quick and easy access to funds for emergency purposes, including family emergencies, medical needs, home repairs, car breakdowns or funds to support entrepreneurs and small businesses. Creditinfo Kenya’s team brings decades of experience and practical knowledge in credit risk management to support the delivery of LetsGo Cash.

Letshego Kenya’s Chief Executive Officer, Adam Kasaine said: “LetsGo Cash is another way we are increasing access to product funds for more Kenyans. This is inclusive finance in action – it’s quick and hassle-free cash at a competitive price, accessible via your phone or web.”

The innovative LetsGo Cash is a potential game-changer, as it is accessible anytime, anywhere and is more competitive than traditional short-term cash advance providers, providing customers with immediate financial relief and the opportunity to participate in the digital economy in a sustainable and responsible manner.

Creditinfo’s Regional Manager for East Africa, Kamau Kunyiha added: “Creditinfo is proud to support LetsGo Cash assist customers who need quick and easy access to emergency funds the most, while also helping the underserved to build their own credit scores at the same time. Customers’ applications are submitted with a few swipes on a mobile phone, and the time to cash can be as short as a few minutes.”

LetsGo Cash provides a convenient, safe and affordable financial service to the underserved and informal sector players thereby helping to increase financial inclusion. It also helps them build their own credit record, since the better they manage their loan, the better their credit record, and the more cash they have access to going forward. This ensures that more people can access the service, including first-time borrowers who can now enjoy the benefits of a secure, regulated lending solution. Once approved, the money is disbursed directly into the customer’s mobile wallet. It can then be used as the customer desires, including for emergencies, such as purchasing prepaid electricity and water, paying bills, or sending money to friends and family.

LetsGo Cash can be accessed on Letshego’s LetsGo Digital Mall and downloadable via Android and Apple Play Store, or with one click, clicking on www.letsgo.letshego.com as well as via the USSD *435# on their mobile phone.

-ENDS-

NOTES TO EDITORS:

About Letshego Kenya Limited

Letshego Kenya Limited is the largest credit-only microfinance institution in Kenya and a licensed financial services provider in Kenya, providing loans to individuals across both the public and private sectors, as well as supporting Micro and Small Entrepreneurs (MSE). Since the conclusion of the successful acquisition by Letshego Holdings Ltd in February 2012, Micro Africa Group became a wholly owned subsidiary of Botswana-based Letshego Holdings Limited – an inclusive finance group with more than 21 years’ experience in Africa, and a current footprint of 11 Sub-Saharan Markets. Its contribution to the group has been to leverage the microfinance banking competencies and existing customer base, expand Letshego’s geographic coverage, and diversify its solution offering.

The company is founded on, and continues to strive towards, the principle of finding the most effective way to implement microfinance banking in an African context and transform the livelihoods of customers who carry out viable economic activity. Letshego Kenya Limited has a staff compliment of over 150 employees, spread across 25 branches. The company provides loans to over 20,000 customers who enjoy an expanded access through strategic partnerships, innovative technology and digital delivery channels. For more information on Letshego, please visit www.letshego.com/kenya

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in the field of credit risk management. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information on Creditinfo, please visit www.creditinfo.com

The Role of Artificial Intelligence and Machine Learning in Credit Scoring

Executive Summary

The use of artificial intelligence (AI) and machine learning (ML) in credit scoring is revolutionizing the lending industry. By leveraging vast amounts of data and advanced algorithms, lenders are able to more accurately predict credit risk, improve operational efficiency, and expand access to credit for underbanked individuals and small businesses. This white paper explores the benefits and challenges of AI and ML credit scoring, and provides guidance for lenders on how to successfully integrate these technologies into their lending processes.

Introduction

Traditional credit scoring models rely on a limited set of data points, such as payment history, outstanding debt, and length of credit history, to assess creditworthiness. These models are effective for many borrowers, but they can be limiting for individuals with thin credit files or non-traditional sources of income. AI and ML credit scoring models, on the other hand, can analyze a vast array of data points, including non-traditional data sources, to develop a more accurate and comprehensive picture of a borrower’s creditworthiness.

Benefits of AI and ML Credit Scoring:

1. Improved accuracy: AI and ML algorithms can analyze a wide range of data points, including non-traditional data sources such as social media activity and utility bill payments, to develop a more accurate picture of a borrower’s creditworthiness. This can result in more accurate credit scores and better loan decisions.

2. Expanded access to credit: Traditional credit scoring models can be limiting for individuals with thin credit files or non-traditional sources of income. By analyzing a broader range of data points, AI and ML credit scoring models can expand access to credit for underbanked individuals and small businesses.

3. Increased efficiency: AI and ML credit scoring models can automate many aspects of the lending process, reducing the need for manual underwriting and improving operational efficiency. This can result in faster loan decisions and a better borrower experience.

Challenges of AI and ML Credit Scoring:

1. Data privacy and security: As AI and ML credit scoring models rely on vast amounts of data, data privacy and security are critical concerns. Lenders must ensure that they are collecting and using data in compliance with applicable laws and regulations, and that they have robust cybersecurity measures in place to protect sensitive borrower data.

2. Bias and discrimination: AI and ML algorithms are only as good as the data they are trained on, and if that data is biased, the algorithms can perpetuate that bias. Lenders must be mindful of potential biases in their data and take steps to mitigate any potential discrimination in their lending decisions.

3. Explainability: AI and ML algorithms can be complex and difficult to interpret, which can make it challenging for lenders to explain their lending decisions to borrowers. Lenders must be able to provide clear explanations of their credit scoring models and lending decisions to borrowers.

Conclusion

AI and ML credit scoring has the potential to revolutionize the lending industry, providing more accurate credit scores, expanding access to credit, and improving operational efficiency. However, lenders must be mindful of the potential challenges, including data privacy and security, bias and discrimination, and explainability, and take steps to mitigate these risks. By investing in AI and ML technologies and developing robust risk management practices, lenders can successfully integrate these technologies into their lending processes and provide better loan decisions and a better borrower experience.

Samuel White

Director of Direct Marekts, Creditinfo Group.

Lithuanian debts increased by €6.8 million since the beginning of 2023

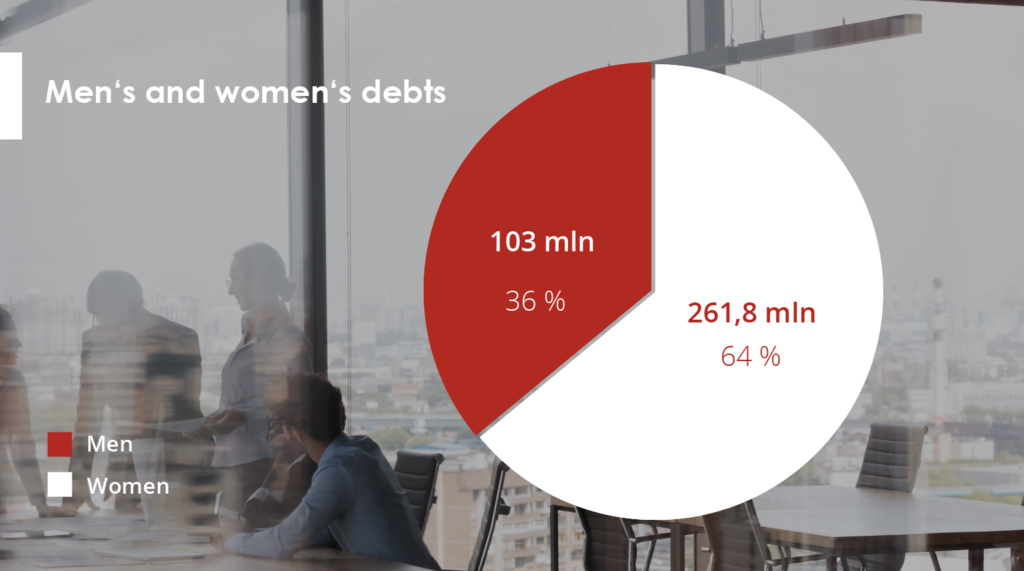

According to Creditinfo Lithuania’s latest analysis, Lithuanian debts have increased by €6.8 million since the beginning of the year, reaching a total of €364.8 million.

Of this amount, male’s debts stand at €261.8 million, while female’s debts are at €103 million. This is almost €6.8 million more than at the beginning of this year (€358 million). The total number of borrowers has also risen by 5,000 in the first quarter of this year, with the current total standing at almost 201,000.

Creditinfo Lithuania has recorded almost 201,000 debtors in its systems for March, with a total of 235,300 individuals having 235,300 debts in Lithuania.

After a more detailed examination of the debtor data, it was found that over 129,000 males and 72,000 females are currently in debt, making up 64% and 36% of all debtors respectively. Additionally, 32,500 males and almost 20,000 females have multiple debts, with 25.3% of male debtors and 27.7% of female debtors holding two or more debts.

On average, males owe €2,029, which is 30% more than the average debt owed by females (€1,435). This trend, coupled with the higher number of male debtors, results in men holding 78% of the total debt amount, while women hold only 22%.

During the first quarter, an additional 5,000 individuals in Lithuania fell into debt.

In March, the total number of individuals in debt amounted to 201,000, marking an increase of 5,000 from January’s 196,000. The total value of debt owed by all debtors also rose from €358 million to €364.8 million, with the total number of debts recorded in the credit bureau system increasing by 5,300. The largest number of new debts to households registered in the first quarter of this year, after debts to the financial sector, were for utilities and energy, with a total of 1,518 debts (12%).

“The analysis suggests that the majority of new debts recorded this year can be attributed to the energy and heat price crisis. Rising fuel costs have resulted in increased indebtedness, with people seeking short-term financing in order to balance consumption and expenses,” explains Aurimas Kačinskas, the Head of Creditinfo Lithuania. “Not everyone has had sufficient time to alter their financial habits, which has resulted in the growing number and value of debts.”

Men aged between 35 and 45 are considered to be the most high-risk debtors

Despite fluctuations in the number of borrowers and their levels of indebtedness, the typical borrower profile has remained consistent in recent years. Men aged 35-45 are the riskiest debtors, with debts amounting to €75 million, accounting for almost 29% of the total amount owed by men. The second riskiest group is men aged 45-55, with €61 million in debt, representing 23.3% of the total amount owed by men. In third place are men aged 25-35, who hold €55 million in debt, accounting for 21% of the total amount owed by men. Men aged 55-65 hold €43 million in debt, while those over 65 hold €17 million. Men under 25 hold the lowest amount of debt at almost €15 million.

Among female debtors, the under-25 age group has the lowest amount of debt, while other age groups have the following distribution: €29 million (45-55), €26 million (35-45), €20 million (55-65), and €17 million each (25-35 and over 65).

According to Mr Kačinskas, it is important for citizens to assume their financial obligations responsibly and meet them on time to maintain a positive credit history, which determines their access to financial services, loans, credit cards and payment provisions.

Creditinfo Partners With VisionFund International to Provide Analytics and Automation Solutions

Creditinfo Group, the leading global service provider for credit information and risk management solutions, today announces a multi-market partnership with VisionFund International to provide analytics and automation solutions throughout their global Microfinance Network.

Creditinfo’s credit risk analytics and automation solution will help VisionFund to expand their customer base whilst controlling costs. This will enable VisionFund to increase financial inclusion and improve economic conditions for lower income clients around the world.

Creditinfo will draw upon its global and regional experts to support the implementation of these solutions over a three-year period. Initially, Creditinfo will provide its solutions to six of VisionFund’s markets with a view to extending them to additional VisionFund’s markets in due course.

Paul Randall, CEO at Creditinfo said: “We are delighted to have been selected by VisionFund International to provide IDM Decision Automation solution to their global network of MFIs (Microfinance institutions). Our understanding and experience of working across over 20 markets is strongly aligned with VisionFund’s experience as one of the largest multinational networks of MFIs with its operations spanning 28 countries and reaching over 1 million active customers. We are excited about the journey ahead and helping VisionFund realize its goal of enabling clients to grow their livelihoods and secure their futures.”

Karen Lewin, Director of Credit Risk at Vision Fund International said: “With Creditinfo’s solution, we will increase our outreach, and improve both lending efficiency and our credit risk assessment capabilities, to better meet the needs of all our customers. Creditinfo’s team of global and local experts will provide us with the level of support we need to achieve these goals and increase financial inclusion in the markets where we operate.”

For information visit www.creditinfo.com

Kredītinformācijas Birojs and Citadel Bank Sign an Agreement to make It easier for Ukrainian citizens to receive Financial Services

It has already been reported that last year the “Credit Information Bureau” of Latvia (KIB) concluded an agreement with the “International Credit Information Bureau” in Ukraine ( Мидрождение бюро кредитних історий ) on the exchange of credit history data of Ukrainian nationals.

One of the safest businesses in Lithuania – Dental Services

The profitability of some companies is almost half their revenues, very few go bankrupt.

Vilnius, Lithuania 06/02/2023. Although most dental businesses are small and usually employ fewer than 10 people, this is one of the most stable businesses in Lithuania. Profitability often exceeds one-third of income and only a few become insolvent. Dental businesses are 7 times less likely to go bankrupt than the average insolvency across all other businesses, according to an analysis conducted by Creditinfo Lithuania.

According to data from January 2023, there are currently almost 2,000 dental businesses in Lithuania employing 9,500 people. The number of companies and their employees is growing year on year. Dental businesses are generally small, with more than half of them employing fewer than 10 people. Only 12 organisations have created more than 50 jobs, while the largest dental service companies are Vilnius University Hospital (293), SB Dental Clinic (168), Denticija (153), Smile Academy (126), Smile Laboratory (124), Vilnius Implantology Centre Clinic (93), Panevėžys City Dental Clinic (72), Laudenta (71), Pasirink (66) and Žvėrynas Dental Clinic (59).

Revenues grow year on year, profitability remains high

Despite the pandemic’s restrictions on the medical services sector between 2020 and 2021, the total revenue of dental companies has grown consistently year on year, reaching €294.6 million in 2021, an increase of 39.8% compared to 2020 (€210.7 million), which in turn is an increase of 76% compared to 2019 (€167 million).

The top 10 companies with the most revenue in 2021 are SB Dental Clinic (€8.2 million), Vilnius Implantology Centre Clinic (~€7 million), Denticija (€3.2 million), Smile Academy (€3.1 million), Prodenta (€3.1 million), Žvėrynas Dental Clinic (€3 million), Sveikatos Gija (€2.9 million), Šiauliai Implantology Centre (€2.8 million), Laudenta (€2.6 million) and Dental Harmony (€2.6 million).

Dental service companies are characterised by relatively high profitability, reaching up to 45%. The top ten companies with the highest profits in 2021 are Laudenta (€922 thousand), SB Dental Clinic (€917 thousand), Implantera (€739 thousand), Šiauliai Implantology Centre (€713 thousand), Smile Design (€688 thousand), Vilnius Implantology Centre Clinic (€644 thousand), Klaipėda Orthodontics Centre (€592 thousand), Dantima (€556 thousand), Donatas Jurgaicis Odontology Clinic (€529 thousand) and Teeth Centre (€512 thousand).

“The dental services business has advantages – patients usually pay for services immediately, which speeds up the turnover of funds. In addition, some dental services are subject to significant VAT exemptions, which reduces the tax burden and increases the profitability of the companies,” says Jekaterina Rojaka, Head of Business Development and Strategy at Creditinfo Lithuania.

However, not all companies were profitable, with 148 dental service providers declaring a loss in 2021, compared to 128 in pandemic year 2020 and 133 in pre-pandemic year 2019.

Dentists 7 times less likely to go bankrupt

The dental services sector has a particularly low risk of bankruptcy compared to all other sectors, with 1% of firms currently at high risk of bankruptcy and 0% at the highest risk. The high and highest risk classes for late payment are 3% and 2% of companies, respectively. The riskiness of dental firms was slightly higher at the beginning of 2021, with 4% of firms in the high bankruptcy risk class (none in the highest) and 11% in the high and highest delayed payment risk classes.

No dental companies went bankrupt in 2021 or 2022, while 26 firms have become insolvent since 2003, an average of 1-2 per year.

The dental business is characterised by a low level of debt. As of January 2023, there were 98 registered debts in the credit bureau’s system, totalling €95 thousand. The average debt was €971.

Compared to companies operating in other sectors in Lithuania, dental service companies are 7 times less risky. For example, in January this year, 1.3% of dental businesses were classified as high and highest risk, compared to an average of 9.5% for all other businesses in Lithuania. In terms of the risk of late payment, 4.5% of firms were in the high and highest risk classes, while the average for all other firms was 17.2%.

Almost a fifth of dental businesses (359) have not yet submitted their financial statements for 2021.

More information:

Jekaterina Rojaka, Head of Business Development and Strategy, Creditinfo Lithuania (jekaterina.rojaka@creditinfo.com)