Creditinfo Group Expands Middle Eastern Presence with New Regional Office

PRESS RELEASE

Creditinfo opens new facility in Muscat, Oman to enhance services offered to customers in region

Muscat, Oman, 12 March 2019 – Today, Creditinfo Group, a leading provider of global credit information and fintech services, announces that it is expanding its footprint in the Middle East with the creation of Creditinfo Gulf, the organisation’s regional hub in Muscat, Oman. The new office will support current and prospective Creditinfo clients, with access to a wealth of global expertise, knowledge and technology to enhance the existing financial infrastructure in the region.

Creditinfo inks contract with Housing Finance Kenya

The Housing Finance Company in Kenya have introduced mobile lending this summer and chose to use Creditinfo’s Instant Decisions as the one and only decision-making tool. They chose an in-house installation back in June and then, after several weeks of consultancy and strategy design project, we have come together with the customer to the point where we have a very complex strategy with 3 different Credit Limit Allocation matrices, matching competition’s limit and limit allocation as a function of previously received loans. After successful pilot in July, August they opened it for a wider population, and just recently, in November, to the entire Kenyan population, through all channels – iOS, Android and USSD – and they had a big marketing campaign for USSD customers that had its apogees last week, starting November 18th 2018.

Creditinfo & Alternative Circle

Creditinfo Kenya has been instrumental in helping us build our mobile lending platform – Shika, which is a micro-lending app, through assisting us with building our credit rating technology that we use to score our users when giving out loans. They have been extremely helpful partners with a team that is committed, reliable and solution driven. We are glad to be associated with them.

— Kevin Mutiso, CEO Alternative Circle

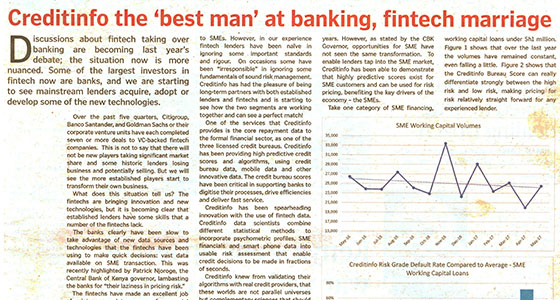

Business Daily: Creditinfo – the "best man" at banking and fintech marriage

“Discussions about fintech taking over banking are becoming last year’s debate; the situation is now more nuanced. Some of the largest investors in fintech now are banks, and we are staring to see mainstream leaders acquire, adopt or develop some of the new technologies. ”

Article by Paul Randall, Executive Director at Creditinfo Decision Analytics; Steven Kunyiha, CEO of Creditinfo Kenya and Alexandra Aproyants, Senior Consultant at Creditinfo Decision Analytics.

Read more here.