Transport business in the Baltics is in recession, with only Lithuania experiencing a slightly brighter picture

Coface records recovery in air transport, but pre-pandemic figures not yet reached.

The transport sector is the one with the highest improvement in risk scores in the latest Coface Quarterly Survey, although the global macroeconomic outlook remains uncertain. Coface experts note that air transport forecasts and new aircraft orders are providing greater optimism. Transport business is rated higher in Western Europe, the Middle East and Japan, while in Central and Eastern Europe (CEE), including the Baltic states, the transport sector continues to be rated the highest risk. The transport sector in Estonia and Latvia is facing more challenges this year, while in Lithuania the situation has started to improve since Q2, with a decrease in bankruptcies and an increase in the forecasts for businesses.

According to Coface experts, the higher scores in the transport sector are mainly due to the recovery of the Chinese economy and global tourism, as well as to public policy decisions, such as the priority given to rail traffic in Germany. However, overall risks to the transport sector remain very high due to high energy costs and demand still below pre-pandemic levels.

Head of Coface Baltics, Mindaugas Sventickas, points out that it is air transport that has been the activity most affected in the global transport sector, and that it is now recovering rapidly. This is due to the gradual economic recovery from the second half of 2021 onwards, significantly influenced by the opening up of Japan (end of 2022) and China (early 2023), which has facilitated travel conditions for international tourists.

The Coface survey shows that while the number of commercial flights has increased and is now even above pre-pandemic levels, seat occupancy rates remain lower. For example, in the Asia-Pacific region, total passenger traffic in April 2023 increased by 171% compared to April last year, thanks in particular to China. Despite the strong growth, demand in this region remains lower than in 2019 (-18% in April 2023 compared to April 2019).

New orders for Airbus and Boeing aircraft are rising: aiming to fly greener and save fuel

In Western Europe and the United States, Airbus and Boeing have also reported an increase in aircraft orders, reaching 774 Boeing and 820 Airbus aircraft in 2022. At the 2022 Paris Air Show, a number of new orders were announced, with Air IndiGo ordering 500 A320 aircraft and Air India ordering 250 Airbus and 220 Boeing aircraft. According to the experts at Coface, this acceleration in the aerospace industry has prompted the decision to improve the risk assessment of the transport sector in some countries, e.g. France. Many of the production processes of Airbus are carried out in France, with production sites spread over Germany, Spain and the United Kingdom. This has contributed to a better assessment of the transport sector across Western Europe.

“It is also worth noting that the main players in the air transport industry are pursuing a strategy that takes environmental concerns into account. On the one hand, this motivates manufacturers to innovate in order to develop ‘cleaner’ aircraft. On the other hand, it encourages airlines to upgrade their fleets to use less energy,” comments Sventickas.

Cargo transport by sea decreases by almost one third

The situation is different in maritime transport, where activity is slowing down slightly after two exceptional years. Declining sea freight rates, high energy costs and stagflation are adversely affecting the financial performance of sea carriers. The revenues of Maersk and CMA CGM in Q1 2023 decreased by 26% and 30% respectively compared to Q1 last year, although they remain significantly higher than in Q1 2019.

This drop in revenue is primarily due to price effects (a fall in freight rates), while the drop in volumes is smaller, with a 3% annual decrease in the container index for January–April 2023. This drop in volumes is partly passed on to rail and motor transport, which is primarily used for the transport of cargo from ports.

Passenger transport in the Baltic States has not yet reached pre-pandemic levels

When analysing air passenger flows in the Baltic states for the period 2019–2023, the highest passenger traffic is traditionally observed in Q3 of each year. After the pandemic, air passenger traffic in all of the Baltic states, although slowly increasing, has not yet reached the levels recorded in 2019. For example, in Q3 2019, the number of air passengers in Estonia reached 954,000, in Latvia 2,299,000 and in Lithuania 1,821,000. In the same period last year (Q3 2022), the figures were 841,000 (88%), 1,711,000 (71%) and 1,677,000 (92%) respectively. According to Eurostat and Coface, the total number of passengers carried by air in the Baltic states in 2022 was 13,434, compared to 6,094 in 2021, 4,657 in 2020 and 17,548 in 2019.

The situation in rail passenger transport is slightly better. For example, in Q3 2019, the number of passengers in Estonia was 2,105,000, in Latvia 5,256,000 and in Lithuania 1,287,000. In the same period last year, the figures were 1,837,000 (87%), 4,835,000 (92%) and 1,292,000 (100%) respectively. The total number of passengers carried by rail in the Baltic states in 2022 was 27,289, compared to 21,069 in 2021, 22,085 in 2020 and 31,986 in 2019. In Q1 of this year, the figure for the Baltic countries was 6,485.

Sventickas notes that the Lithuanian transport sector is distinguished from other Baltic countries by more optimistic forecasts for 2023: “Although the situation in the Lithuanian transport sector deteriorated in the first quarter of this year, we have seen some positive trends since the second quarter of this year: the transport of freight by sea and water has stabilised and the transport of freight by land has returned to almost pre-pandemic levels. Since February this year, the forecasts of transport companies in Lithuania have become more stable, while previously they had been declining for several months.”

Creditinfo: Optimism of Lithuanian transport companies is good news for almost 200,000 employees in the sector

According to 2022 data, Lithuania’s transport and storage sector generated 11.2% of the country’s GDP, which is 2.6 times more than the average for other EU countries. In total, there are currently 8,568 transport and logistics companies in Lithuania, employing 171,300 people, i.e. a quarter more than in 2019.

Jekaterina Rojaka, Head of Business Development and Strategy at Creditinfo Lietuva, points out that the majority (72%) of companies in the transport sector in Lithuania are involved in road freight transport. According to the data of July this year, even 6,195 out of 8,568 transport companies registered in Lithuania indicate that their main activity is transportation of goods by land. Transport accounts for over 55% of Lithuania’s total exports of services. The number of air and water transport companies is 21 and 37 respectively; 2,233 companies in the sector provide storage and transport-related activities and 82 companies provide postal and courier services.

“During the pandemic, the risk exposure of Lithuanian transport companies increased due to travel restrictions, changes in the demand for goods, and then the rise in fuel prices,” says Rojaka. “In 2022, there was a sharp increase in the number of bankruptcies in the transport sector, which started to stabilise this year. In the first half of this year, bankruptcies in the transport sector accounted for only 6% of all company bankruptcies, compared to 24% in the trade sector and 20% in the construction sector. In total, 35 transport service companies have gone bankrupt since the beginning of the year, compared to 50 companies in the sector that went into bankruptcy in the same period last year.”

Rojaka says that although the number of bankruptcies of transport companies has decreased, the number of new companies has slowed down slightly: last year, despite bankruptcies, new companies were actively registering, while in the first four months of this year that number has contracted by 2%. According to a representative of the credit bureau, transport companies have started to borrow more, and the average debt of a company has increased by approximately 35%. There is also a lower number of companies with a low risk of bankruptcy, that is 58.1%, compared to the overall assessment of Lithuanian business of 69.5%. The share of companies in the transport sector experiencing financial difficulties in 2022 is lower than the national average, and amounts to 13.2% (compared to 17.6% for the economy as a whole).

“With the slowdown in domestic consumption in the EU, transport service providers continue to face challenges this year, with competition in the sector increasing due to limited demand, and service fees shrinking. Waterborne transport has seen a particularly sharp fall: The Baltic Dry index contracted by 57% over the year, and this year similar trends have been observed in road transport,” explains Rojaka. “The best short-term prospects for the sector at the moment are for airlines, which are steadily both increasing the number of flights and trying to rebuild the revenues lost in the pandemic. With inflation gradually slowing and demand stabilising, the situation for land and water transport companies should improve next year.”

Creditinfo Lithuania.

Visit: www.lt.creditinfo.com

Risk Management Framework

Risk management is an essential function for any bank, as it helps to protect the bank’s financial position, reputation, and long-term viability. An effective risk management framework consists of several key components that work together to identify, assess, and manage risks.

Risk Governance

The first key component of an effective risk management framework is risk governance. This involves establishing clear risk management policies, procedures, and guidelines that align with the bank’s overall strategy and objectives. The bank’s board of directors and senior management should be actively involved in setting risk management policies and overseeing the bank’s risk management activities.

Risk Identification

The second key component is risk identification. The bank should have a comprehensive risk identification process in place to identify all potential risks associated with its business activities, products, and services. This includes identifying internal and external risks such as credit risk, operational risk, market risk, and compliance risk.

Risk Assessment

Once risks are identified, the bank should assess the likelihood and impact of each identified risk to determine its potential impact on the bank’s overall operations, financial position, and reputation. This includes assessing the potential impact of risks on the bank’s customers, employees, and other stakeholders.

Risk Mitigation

The bank should develop and implement risk mitigation strategies to manage and reduce the likelihood and impact of identified risks. This may include implementing internal controls, establishing risk limits, and developing contingency plans.

Risk Monitoring

An effective risk management framework should include ongoing risk monitoring to ensure that the framework is functioning as intended. This involves continuously monitoring the bank’s risk management activities to identify emerging risks and ensure that existing risks are being effectively managed.

Risk Reporting

The bank should have a robust risk reporting framework in place to provide timely and accurate information on risk exposures and mitigation activities to the board of directors, senior management, and other stakeholders. Effective risk reporting helps ensure that the bank’s management team has the information they need to make informed decisions about risk management activities.

Risk Culture

Finally, an effective risk management framework should foster a risk-aware culture throughout the organization. This involves ensuring that all employees understand their roles and responsibilities in managing risks and are held accountable for their actions. A strong risk culture helps to ensure that risk management activities are integrated into the bank’s day-to-day operations.

In conclusion, an effective risk management framework is essential for banks to identify, assess, and manage risks. The key components of such a framework include risk governance, risk identification, risk assessment, risk mitigation, risk monitoring, risk reporting, and risk culture. By implementing an effective risk management framework, banks can effectively manage risks and protect their financial position, reputation, and long-term viability.

Joe Bowerbank,

Business Development, Creditinfo Group.

Digital Transformation in Credit Risk Management: What You Need to Know

The rise of digital technologies is transforming the financial industry, and credit risk management is no exception. With the increasing use of digital channels for financial transactions, there is a growing need for credit risk management strategies that can effectively manage risks in these channels. In this blog post, we will explore the concept of digital transformation in credit risk management and discuss some of the key trends and best practices in this area.

What is Digital Transformation in Credit Risk Management?

Digital transformation in credit risk management involves the use of digital technologies to manage credit risk more effectively. This includes the use of advanced analytics and machine learning to analyze large amounts of data in real-time, as well as the development of digital platforms that enable faster and more efficient credit risk management processes.

One of the key benefits of digital transformation in credit risk management is the ability to analyze data more effectively. By using advanced analytics and machine learning algorithms, financial institutions can analyze large amounts of data in real-time, identifying trends and patterns that may be indicative of credit risk. This can help financial institutions make more informed lending decisions, reducing the risk of default on loans and other credit products.

Another benefit of digital transformation in credit risk management is the development of digital platforms that enable faster and more efficient credit risk management processes. For example, some financial institutions are developing digital platforms that enable borrowers to apply for loans online, with the platform automatically analyzing the borrower’s credit risk and providing a decision in real-time. This can significantly reduce the time and cost associated with traditional lending processes, making it easier for borrowers to access credit.

Key Trends and Best Practices in Digital Transformation in Credit Risk Management

There are several key trends and best practices in digital transformation in credit risk management that financial institutions should be aware of:

Use of advanced analytics and machine learning: Financial institutions should leverage advanced analytics and machine learning algorithms to analyze large amounts of data in real-time, identifying trends and patterns that may be indicative of credit risk.

Development of digital platforms: Financial institutions should develop digital platforms that enable faster and more efficient credit risk management processes. These platforms should be user-friendly and easy to access, making it easier for borrowers to apply for loans and access credit.

Integration with other digital platforms: Financial institutions should integrate their credit risk management platforms with other digital platforms, such as mobile banking apps and online marketplaces, to provide a seamless and integrated experience for borrowers.

Investment in cybersecurity: Financial institutions should invest in cybersecurity measures to protect against cyber threats and ensure the security of customer data.

Conclusion

Digital transformation is transforming the financial industry, and credit risk management is no exception. By leveraging digital technologies such as advanced analytics, machine learning, and digital platforms, financial institutions can manage credit risk more effectively, reducing the risk of default on loans and other credit products. As the financial landscape continues to evolve, it is likely that new digital technologies and best practices will emerge, requiring credit risk management professionals to stay up-to-date with the latest trends and developments.

Gary Brown,

Head of Commercial Development, Creditinfo Group.

Credit Bureaus and why they will remain important in the years to come

As the financial industry continues to evolve, credit bureaus need to continue to adapt. There are many compelling reasons why credit bureaus will continue to play a vital role in the future of lending and credit. In this blog, we’ll explore the benefits of credit bureaus and why they will remain important in the years to come.

1. Efficient and standardized credit data

Credit bureaus provide an efficient and standardized way to collect and store credit data. This allows lenders to quickly access the credit history and credit scores of potential borrowers, which is essential for making informed lending decisions. Without credit bureaus, lenders would need to spend more time and resources gathering credit data from various sources, which would slow down the lending process.

2. More accurate credit models

Credit bureaus are constantly refining their credit models to improve accuracy and predictiveness. By analysing large amounts of credit data, credit bureaus can develop more sophisticated credit models that consider a wide range of factors, such as payment histories, outstanding debts, and length of credit history. These models provide lenders with a more accurate picture of a borrower’s creditworthiness, helping to reduce the risk of defaults and delinquencies.

3. Increased access to credit

Credit bureaus play a critical role in expanding access to credit. By providing lenders with access to credit data, credit bureaus make it easier for individuals and businesses to obtain loans and credit cards. This is particularly important for people with limited credit histories or who have had past credit problems, as credit bureaus provide lenders with a way to evaluate these borrowers’ creditworthiness.

4. Protection against fraud and identity theft

Credit bureaus also play a key role in protecting consumers against fraud and identity theft. By monitoring credit reports for suspicious activity, credit bureaus can help detect and prevent fraudulent activity. Additionally, credit freezes and fraud alerts can be placed on credit reports to prevent unauthorized access to credit data.

5. Continued relevance in a changing industry

While the financial industry is evolving rapidly, credit bureaus will continue to be relevant in the future. As new technologies and data sources emerge, credit bureaus will adapt and incorporate these changes into their credit models. Additionally, credit bureaus will likely face increased competition from fintech startups and other companies, which will push them to innovate and improve their offerings.

In conclusion, credit bureaus are essential to the lending and credit industry. By providing lenders with access to credit data, credit bureaus make it easier for individuals and businesses to obtain loans and credit cards. Additionally, credit bureaus play a critical role in expanding access to credit, protecting consumers against fraud and identity theft, and adapting to a changing industry. As the financial industry continues to evolve, credit bureaus will remain a vital part of the lending and credit ecosystem.

Gary Brown,

Head of Commercial Development, Creditinfo Group.

Creditinfo Kenya partners with Letshego Kenya to launch lending app

Letshego Kenya launches “Letsgo Cash” in partnership with Creditinfo Kenya to take financial inclusion to a higher level.

· Minimum loan amount of KES 1,000 and a maximum of KES 100,000 and a loan repayment period of 30 days.

· LetsGo Cash increases access and supports customers who need quick and easy access to funds for emergency purposes.

· LetsGo Cash supports digital financial inclusion and enables the underserved and informal sector players to build their own credit records.

Nairobi, Kenya, 3rd May 2023 – Letshego Kenya Limited, a subsidiary of Letshego Holdings Limited (Letshego Group), has partnered with Creditinfo Kenya to launch LetsGo Cash, a self-service and short-term instant loan that gives customers access to KES 1,000 up to KES 100,000.

LetsGo Cash is payable in 30 days and geared towards consumers who need quick and easy access to funds for emergency purposes, including family emergencies, medical needs, home repairs, car breakdowns or funds to support entrepreneurs and small businesses. Creditinfo Kenya’s team brings decades of experience and practical knowledge in credit risk management to support the delivery of LetsGo Cash.

Letshego Kenya’s Chief Executive Officer, Adam Kasaine said: “LetsGo Cash is another way we are increasing access to product funds for more Kenyans. This is inclusive finance in action – it’s quick and hassle-free cash at a competitive price, accessible via your phone or web.”

The innovative LetsGo Cash is a potential game-changer, as it is accessible anytime, anywhere and is more competitive than traditional short-term cash advance providers, providing customers with immediate financial relief and the opportunity to participate in the digital economy in a sustainable and responsible manner.

Creditinfo’s Regional Manager for East Africa, Kamau Kunyiha added: “Creditinfo is proud to support LetsGo Cash assist customers who need quick and easy access to emergency funds the most, while also helping the underserved to build their own credit scores at the same time. Customers’ applications are submitted with a few swipes on a mobile phone, and the time to cash can be as short as a few minutes.”

LetsGo Cash provides a convenient, safe and affordable financial service to the underserved and informal sector players thereby helping to increase financial inclusion. It also helps them build their own credit record, since the better they manage their loan, the better their credit record, and the more cash they have access to going forward. This ensures that more people can access the service, including first-time borrowers who can now enjoy the benefits of a secure, regulated lending solution. Once approved, the money is disbursed directly into the customer’s mobile wallet. It can then be used as the customer desires, including for emergencies, such as purchasing prepaid electricity and water, paying bills, or sending money to friends and family.

LetsGo Cash can be accessed on Letshego’s LetsGo Digital Mall and downloadable via Android and Apple Play Store, or with one click, clicking on www.letsgo.letshego.com as well as via the USSD *435# on their mobile phone.

-ENDS-

NOTES TO EDITORS:

About Letshego Kenya Limited

Letshego Kenya Limited is the largest credit-only microfinance institution in Kenya and a licensed financial services provider in Kenya, providing loans to individuals across both the public and private sectors, as well as supporting Micro and Small Entrepreneurs (MSE). Since the conclusion of the successful acquisition by Letshego Holdings Ltd in February 2012, Micro Africa Group became a wholly owned subsidiary of Botswana-based Letshego Holdings Limited – an inclusive finance group with more than 21 years’ experience in Africa, and a current footprint of 11 Sub-Saharan Markets. Its contribution to the group has been to leverage the microfinance banking competencies and existing customer base, expand Letshego’s geographic coverage, and diversify its solution offering.

The company is founded on, and continues to strive towards, the principle of finding the most effective way to implement microfinance banking in an African context and transform the livelihoods of customers who carry out viable economic activity. Letshego Kenya Limited has a staff compliment of over 150 employees, spread across 25 branches. The company provides loans to over 20,000 customers who enjoy an expanded access through strategic partnerships, innovative technology and digital delivery channels. For more information on Letshego, please visit www.letshego.com/kenya

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in the field of credit risk management. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information on Creditinfo, please visit www.creditinfo.com

The Role of Artificial Intelligence and Machine Learning in Credit Scoring

Executive Summary

The use of artificial intelligence (AI) and machine learning (ML) in credit scoring is revolutionizing the lending industry. By leveraging vast amounts of data and advanced algorithms, lenders are able to more accurately predict credit risk, improve operational efficiency, and expand access to credit for underbanked individuals and small businesses. This white paper explores the benefits and challenges of AI and ML credit scoring, and provides guidance for lenders on how to successfully integrate these technologies into their lending processes.

Introduction

Traditional credit scoring models rely on a limited set of data points, such as payment history, outstanding debt, and length of credit history, to assess creditworthiness. These models are effective for many borrowers, but they can be limiting for individuals with thin credit files or non-traditional sources of income. AI and ML credit scoring models, on the other hand, can analyze a vast array of data points, including non-traditional data sources, to develop a more accurate and comprehensive picture of a borrower’s creditworthiness.

Benefits of AI and ML Credit Scoring:

1. Improved accuracy: AI and ML algorithms can analyze a wide range of data points, including non-traditional data sources such as social media activity and utility bill payments, to develop a more accurate picture of a borrower’s creditworthiness. This can result in more accurate credit scores and better loan decisions.

2. Expanded access to credit: Traditional credit scoring models can be limiting for individuals with thin credit files or non-traditional sources of income. By analyzing a broader range of data points, AI and ML credit scoring models can expand access to credit for underbanked individuals and small businesses.

3. Increased efficiency: AI and ML credit scoring models can automate many aspects of the lending process, reducing the need for manual underwriting and improving operational efficiency. This can result in faster loan decisions and a better borrower experience.

Challenges of AI and ML Credit Scoring:

1. Data privacy and security: As AI and ML credit scoring models rely on vast amounts of data, data privacy and security are critical concerns. Lenders must ensure that they are collecting and using data in compliance with applicable laws and regulations, and that they have robust cybersecurity measures in place to protect sensitive borrower data.

2. Bias and discrimination: AI and ML algorithms are only as good as the data they are trained on, and if that data is biased, the algorithms can perpetuate that bias. Lenders must be mindful of potential biases in their data and take steps to mitigate any potential discrimination in their lending decisions.

3. Explainability: AI and ML algorithms can be complex and difficult to interpret, which can make it challenging for lenders to explain their lending decisions to borrowers. Lenders must be able to provide clear explanations of their credit scoring models and lending decisions to borrowers.

Conclusion

AI and ML credit scoring has the potential to revolutionize the lending industry, providing more accurate credit scores, expanding access to credit, and improving operational efficiency. However, lenders must be mindful of the potential challenges, including data privacy and security, bias and discrimination, and explainability, and take steps to mitigate these risks. By investing in AI and ML technologies and developing robust risk management practices, lenders can successfully integrate these technologies into their lending processes and provide better loan decisions and a better borrower experience.

Samuel White

Director of Direct Marekts, Creditinfo Group.

Lithuanian debts increased by €6.8 million since the beginning of 2023

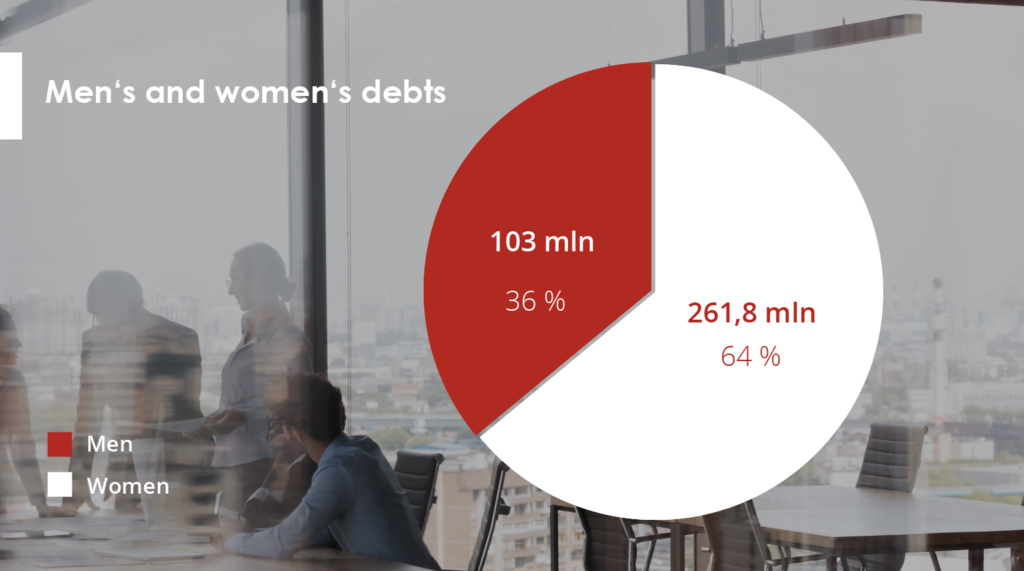

According to Creditinfo Lithuania’s latest analysis, Lithuanian debts have increased by €6.8 million since the beginning of the year, reaching a total of €364.8 million.

Of this amount, male’s debts stand at €261.8 million, while female’s debts are at €103 million. This is almost €6.8 million more than at the beginning of this year (€358 million). The total number of borrowers has also risen by 5,000 in the first quarter of this year, with the current total standing at almost 201,000.

Creditinfo Lithuania has recorded almost 201,000 debtors in its systems for March, with a total of 235,300 individuals having 235,300 debts in Lithuania.

After a more detailed examination of the debtor data, it was found that over 129,000 males and 72,000 females are currently in debt, making up 64% and 36% of all debtors respectively. Additionally, 32,500 males and almost 20,000 females have multiple debts, with 25.3% of male debtors and 27.7% of female debtors holding two or more debts.

On average, males owe €2,029, which is 30% more than the average debt owed by females (€1,435). This trend, coupled with the higher number of male debtors, results in men holding 78% of the total debt amount, while women hold only 22%.

During the first quarter, an additional 5,000 individuals in Lithuania fell into debt.

In March, the total number of individuals in debt amounted to 201,000, marking an increase of 5,000 from January’s 196,000. The total value of debt owed by all debtors also rose from €358 million to €364.8 million, with the total number of debts recorded in the credit bureau system increasing by 5,300. The largest number of new debts to households registered in the first quarter of this year, after debts to the financial sector, were for utilities and energy, with a total of 1,518 debts (12%).

“The analysis suggests that the majority of new debts recorded this year can be attributed to the energy and heat price crisis. Rising fuel costs have resulted in increased indebtedness, with people seeking short-term financing in order to balance consumption and expenses,” explains Aurimas Kačinskas, the Head of Creditinfo Lithuania. “Not everyone has had sufficient time to alter their financial habits, which has resulted in the growing number and value of debts.”

Men aged between 35 and 45 are considered to be the most high-risk debtors

Despite fluctuations in the number of borrowers and their levels of indebtedness, the typical borrower profile has remained consistent in recent years. Men aged 35-45 are the riskiest debtors, with debts amounting to €75 million, accounting for almost 29% of the total amount owed by men. The second riskiest group is men aged 45-55, with €61 million in debt, representing 23.3% of the total amount owed by men. In third place are men aged 25-35, who hold €55 million in debt, accounting for 21% of the total amount owed by men. Men aged 55-65 hold €43 million in debt, while those over 65 hold €17 million. Men under 25 hold the lowest amount of debt at almost €15 million.

Among female debtors, the under-25 age group has the lowest amount of debt, while other age groups have the following distribution: €29 million (45-55), €26 million (35-45), €20 million (55-65), and €17 million each (25-35 and over 65).

According to Mr Kačinskas, it is important for citizens to assume their financial obligations responsibly and meet them on time to maintain a positive credit history, which determines their access to financial services, loans, credit cards and payment provisions.

Creditinfo Partners With VisionFund International to Provide Analytics and Automation Solutions

Creditinfo Group, the leading global service provider for credit information and risk management solutions, today announces a multi-market partnership with VisionFund International to provide analytics and automation solutions throughout their global Microfinance Network.

Creditinfo’s credit risk analytics and automation solution will help VisionFund to expand their customer base whilst controlling costs. This will enable VisionFund to increase financial inclusion and improve economic conditions for lower income clients around the world.

Creditinfo will draw upon its global and regional experts to support the implementation of these solutions over a three-year period. Initially, Creditinfo will provide its solutions to six of VisionFund’s markets with a view to extending them to additional VisionFund’s markets in due course.

Paul Randall, CEO at Creditinfo said: “We are delighted to have been selected by VisionFund International to provide IDM Decision Automation solution to their global network of MFIs (Microfinance institutions). Our understanding and experience of working across over 20 markets is strongly aligned with VisionFund’s experience as one of the largest multinational networks of MFIs with its operations spanning 28 countries and reaching over 1 million active customers. We are excited about the journey ahead and helping VisionFund realize its goal of enabling clients to grow their livelihoods and secure their futures.”

Karen Lewin, Director of Credit Risk at Vision Fund International said: “With Creditinfo’s solution, we will increase our outreach, and improve both lending efficiency and our credit risk assessment capabilities, to better meet the needs of all our customers. Creditinfo’s team of global and local experts will provide us with the level of support we need to achieve these goals and increase financial inclusion in the markets where we operate.”

For information visit www.creditinfo.com

Travel agencies in Lithuania are slowly rising from the ashes

Revenues doubled in a year but remained three times lower than before the pandemic.

Vilnius, Lithuania, 24/01/2023. Travel agencies in Lithuania that declared their income in 2021 earned almost twice as much as in the previous year. However, compared to income in 2019, they earned almost three times less, according to an analysis carried out by the credit bureau Creditinfo Lietuva. Almost 100 tourism companies were loss-making. With the increase in travel flows, the number of debts increases and their average size grows.

There are currently 783 companies in Lithuania for which tour organisation is the main activity. In 2021, travel agencies declaring revenues collectively earned more than €171 million, almost double (82%) the pandemic year 2020 (~€94 million). However, travel agencies are still a long way from a real recovery – for example, in 2019, their revenues were almost €474 million, but fell more than fivefold in the aftermath of the pandemic.

According to 2021 data, the largest annual revenue was earned by the following companies: Novaturas (€108,995 million), Tez Tour (~€60 million), Itaka Lietuva (€12.5 million), Coral Travel Lithuania (€9.5 million), Kidy Tour (€8.9 million), Estravel Vilnius (€6.3 million), Estekspress (€4 million), Traveldeals LT (€4 million), Glotera (€3.6 million) and ZIP Travel (€2.9 million).

The top ten most profitable travel agencies are Novaturas (€909 thousand), Baltic Tours Group (€633 thousand), Vestekspress (€530 thousand), Glotera (€336 thousand), Traveldeals LT (€307 thousand), Baltic Clipper (€288 thousand), Baltic Travel Service (€271 thousand), TEZ Tour (€215 thousand), Estravel Vilnius (€158 thousand), Riviera Tours (€148 thousand) and ZIP Travel (€123 thousand).

Staff numbers shrink by a quarter

In total, travel agencies currently employ almost 2,000 employees (1,850). While the number of enterprises has remained almost constant over the past few years (776 in 2019, 787 in 2021), the number of employees has fallen by almost a quarter since 2019, from 2,426 to 1,850.

Travel agencies are more often headed by women, accounting for almost 56% of all managers. The average age of a travel agency manager is 49 years and the average age of a travel agency is over 15 years.

In the travel sector, men’s salaries are higher than women’s – as of November 2022, the average salary for men was €2,659 per month, while for women it was €2,014 per month. At the start of 2022, the average salary for women was €2,053 per month and for men was €2,364 per month.

State support has prevented more bankruptcies

Since 2004, a total of 94 travel agencies have gone bankrupt in Lithuania, with the highest number of bankruptcies recorded in 2009 (10) and in 2015 (12). In 2022, there were 5 travel agency bankruptcies, while there were 3 in 2021 and 4 in 2019. No travel agency bankruptcy was recorded in pandemic year 2020.

“The travel sector was one of the hardest hit by the pandemic, along with hotels and restaurants. During the pandemic, when revenues from tour operators dropped fivefold, it was state support that saved the sector from bankruptcy,” explains Aurimas Kačinskas. But the challenges of the pandemic were replaced last year by new challenges – the war in Ukraine and the sanctions imposed on Russia have exacerbated the energy crisis, fuel prices have risen and many travel routes have been disrupted. The slower-than-expected recovery of the air transport sector, with a sharp increase in fares, is having a negative impact on the business of tour operators, preventing them from recovering faster.

According to the head of the credit bureau, it was state support that determined the stability of the number of enterprises and the discipline of submitting financial statements – compared to other sectors, only 90 travel agencies did not submit their financial statements for 2021, making them ineligible for state support.

However, a risk analysis of travel agencies shows that there have been both positive and worrying signs in the recent period. For example, as of January this year, 9% of companies were in the high and highest classes of bankruptcy, compared with 12% a year ago. In terms of delayed payments, 17% of companies are currently in the high and highest risk classes, down from 21% last year.

Compared to 2020 and 2021, the recent increase in debt is slightly higher and the average amount of debt per person is growing. At present, 306 debts have been registered in the credit bureau system, amounting to more than €349 thousand, with an average debt of €1,141. A year ago, the number of debts was 316, amounting to €351 thousand, with an average debt of €1,112. In January 2020, 255 debts amounting to €203 thousand were registered, with an average debt of €798. 335 travel agencies mostly owe money to Sodra (€3 million). The debt of 158 travel agencies to telecommunications companies amounts to €222 thousand. 8 travel agencies owe €74 thousand to financial companies.

“The tour operator business is recovering, but revenue growth is slower than expected in the wake of the pandemic due to the many geopolitical and economic shocks around the world. The tourism sector is currently encompassed by a number of risks, so it is advisable to keep a close eye on the changing financial indicators of partners organising the trips,” concludes the head of the credit bureau.

More information:

Aurimas Kačinskas, CEO of Creditinfo Lithuania (aurimas.kacinskas@creditinfo.com)

JSC “International Bureau of Credit Histories” launched the chatbot “MBKI online” in order to provide Ukrainians and migrants from Ukraine with access to their credit histories.

Lending is one of the main elements of the modern financial system. In one way or another, most people rely on loans from banks – whether these are credits, mortgages, installments, credit cards to pay for critical goods and services. An important role in this process is played by credit bureaus that collect, store, process and transmit information on borrowers’ payment discipline, credit scoring and current obligations.

However, when people move to a new country or are forcibly evicted from their homes due to occupation or fleeing war – this is what many Ukrainians are currently experiencing – it becomes much more difficult to access financial and other services. This unfortunately disadvantages refugees and adds to the problem regardless of whether they had good or bad credit history before.

Aiming to resolve issues related to solvency confirmation of the tenant from Ukraine and checking the credit history of Ukrainians when applying for a loan or employment, JSC “IBCH” (one of the largest Credit History Bureaus in Ukraine, a member of the international Creditinfo Group since May 2021) created the “MBKI online” chatbot.

For more than 16 years IBCH (Creditinfo Ukraine) has been cooperating with the largest banks and non-bank financial institutions, including foreign financial institutions and credit bureaus of other countries. The organization is now focusing its attention on supporting Ukrainians, both in Ukraine and abroad, with getting access to credit reports.

Kateryna Danylchenko, CEO of JSC “IBCH” (Creditinfo Ukraine), stated, “Since the beginning of the war in Ukraine, over 6 million people – including myself, my fellow colleagues and partners– have been forced to leave the country at short notice with no idea if or when they will return. Displaced Ukrainian refuges face a whole host of challenges without necessary documentation or access to registries. While JSC “IBCH” (MBKI, Creditinfo Ukraine) became the first Ukrainian bureau to launch cross-border data sharing with bureaus from 5 countries, it is also important to assure easy and mobile direct-to-consumer gate to credit history reports. “MBKI online” is so important in helping Ukrainians staying in country and abroad gain online access to their credit histories (also in English), so they can prove their ability to make payments on time to landlords or new employers, follow their credit history updates and bureau score change, as well as to report about lost identification documents.”

“Creditinfo was set up to aid financial inclusion through making credit information more easily accessible and digestible for borrowers and lenders.” – comments Paul Randall, CEO Creditinfo Group. “I’m so glad that there’s something practical we’ve been able to do to help Ukrainian refugees across Europe to access financial services. The creation of this chatbot is an important development in our journey to make the lives of everyone forcibly displaced by this war that tiny bit easier.”

The “MBKI online” chatbot, available on Viber and Telegram, gives Ukrainians access to their own credit history and offers an easy way of identification including using BankID.

Chatbot enables the customer:

• To get a certificate about credit history (in Ukrainian and English);

• To find out personal credit score;

• To get answers to basic questions about credit history;

• To inform the Bureau about the loss of a passport or other identity document;

• To ask for a loan and find out available offers.

Chatbot accepts different payment methods (including bank card, Apple Pay and Google Pay). For more information and to start working with the service, follow the link: https://credithistory.com.ua/bots/