3rd Regional CIS Conference in Kenya

Credit Information Sharing association (CIS) regional conferences are held in Nairobi to help create awareness on the developments of CIS in Kenya and the region. This is a 2 day regional conference arranged by CIS Kenya, followed by a 2 day National Business Community Summit.

Þórhallur Jóhannsson joined the Creditinfo family as Chief Finance Officer for the Group

On the 15th February, Þórhallur Jóhannsson joined the Creditinfo family as Chief Finance Officer for the Group. We have to admit, we took rather a long time in finding the right person, but we believe it was worth the wait. This means that Tryggvi can finally go back to focusing on the Icelandic operation. We are grateful for him for basically doing two jobs at the same time and feel a bit (but only a bit!) guilty about taking so long in making the change.

On the 15th February, Þórhallur Jóhannsson joined the Creditinfo family as Chief Finance Officer for the Group. We have to admit, we took rather a long time in finding the right person, but we believe it was worth the wait. This means that Tryggvi can finally go back to focusing on the Icelandic operation. We are grateful for him for basically doing two jobs at the same time and feel a bit (but only a bit!) guilty about taking so long in making the change.

Central bank of Belarus presented Creditinfo model for commercial banks

The National Bank of the Republic of Belarus recently presented the Creditinfo developed credit score in a specialized banking magazine.

Winning in Morocco – Sign agreement

On Wednesday 17th February, Creditinfo and Bank Al-Maghrib (the Moroccan central bank), represented by its Managing Director (pictured centre), signed the new delegation management contract related to the Moroccan Credit Bureau, this agreement allows Creditinfo to continue the operation of the Moroccan credit bureau for a period of 25 years, and to provide banks; finance institutions and microfinance institutions with credit information on consumers and companies through standard Credit reports in addition to value added products that should be implemented in the coming months. Kristinn (Kiddi) Agnarsson, Head of Credit Bureau Exoansion signed on behalf of Creditinfo (pictured left).

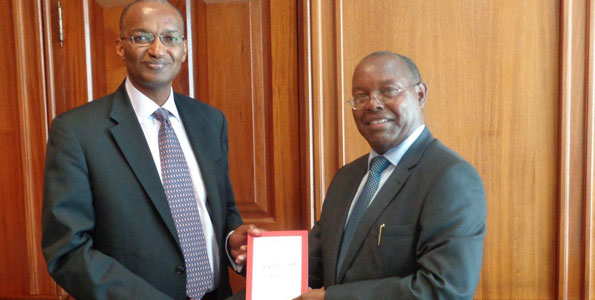

Creditinfo Kenya and HELB partnership launch

Joint Press Release by HELB and CreditInfo CRB Kenya Ltd – Nairobi 4th February 2016

The Higher Education Loans Board (HELB) together with the Creditinfo CRB Kenya Ltd (CIK) have launched strategic a partnership that aims to support HELB to make faster, better and more informed credit decisions, champion responsible lending, promote financial inclusion and facilitate expansion of credit to the education sector. The partnership will be a first of its kind in Kenya meaning that HELB can use credit scoring and other Creditinfo CRB systems and services to lend to mature students who may already be employed and who have credit profiles at the CRB. Continue reading »

The Higher Education Loans Board (HELB) together with the Creditinfo CRB Kenya Ltd (CIK) have launched strategic a partnership that aims to support HELB to make faster, better and more informed credit decisions, champion responsible lending, promote financial inclusion and facilitate expansion of credit to the education sector. The partnership will be a first of its kind in Kenya meaning that HELB can use credit scoring and other Creditinfo CRB systems and services to lend to mature students who may already be employed and who have credit profiles at the CRB. Continue reading »

As soon on tv!

Creditinfo Kenya’s, CEO, Daniel Kanyi made his first tv debut this month. He was invited to partake in not one but two interviews on national television. The first one was in English (see link below) and was LIVE. Talk about a baptism of fire! The second one was done in a vernacular language (Kikuyu), this tv station has substantial viewership especially outside the city of Nairobi.

This is great promotion and advertising for Crediitnfo that reaches the masses and it was FREE! Nicely done, Daniel!

Creditinfo CRB Kenya launching its risk management products and services

Creditinfo CRB Kenya Ltd. is a credit reference bureau licensed by the Central Bank of Kenya. Recently, the company has launched its risk management products and services into the market. You can read more in the article by Stellar Murumba following this link.

Creditinfo acquire Credit Bureau in Estonia from Experian

Creditinfo are pleased to announce that they have entered into a definitive agreement to acquire a credit bureau operation in Estonia from Experian, Krediidiinfo. Krediidiinfo has been operating since 1993 and is engaged in corporate economic and financial data collection, processing and analysis. Hosting Estonia’s largest corporate and private database, Krediidiinfo currently has more than 16,000 companies, both domestically and abroad, utilising their credit reporting services.

For every business objective there is an answer: How to choose your scorecard?

With more than 5 years of experience and over 200 scorecards behind, our team of analytical professionals is fully focused on Scorecards development to provide you with the best predictive models for your business needs. The primary beneficiaries of Creditinfo’s scoring model developments are Credit Bureaus and Financial Institutions including banks and non-banking lenders. Debt collection agencies, telecommunication companies and other utilities providers, on-line and in-store retailers are also amongst Creditinfo’s scorecard customers. Outsource your scorecard development with us to rely on our professional experience to make better business decisions.

Written by Alexandra Aproiants

Improving Credit Risk Management in Tanzania

Creditinfo Tanzania, in cooperation with the Creditinfo Academy, recently delivered a 2 day training course in Dar Es Salaam, Tanzania entitled “Improving your Credit Risk Management through the Incorporation of Credit Bureau Solutions.”