Creditinfo’s Account Information Service Product

In the spring of 2021, the Estonian Financial Supervision Authority authorized Creditinfo Estonia to offer Account Information Service in the Estonian market. In the autumn of 2021, the Estonian Financial Supervision Authority also granted the authorization to provide Account Information Service to the Latvian and Lithuanian markets. This act added to our product portfolio a new, exciting product that benefits our customers in the short and long run. As of today, we have had the Account Information Service in our cross-Baltic product portfolio for two years.

About the Account Information Service

The opportunity to provide Account Information Service emerged when the European Union (EU) Parliament and the EU Council adopted a new directive regulating payment services in the EU internal market on November 25, 2015 (PSD2), which emphasized the expansion of open banking in Europe.

Open Banking refers to provide third-party financial service providers open access to transactional data of bank and financial institution customers, using secure data transmission channels and customer consent.

The Account Information Service is a part of the Open Banking initiative, defined as an online service where the service user (customer) is identified and authenticated via strong identification and authentification means. The service itself means transmitting customer’s bank account data through a secure channel to third party from whom the customer wishes to apply a credit product.

How does Creditinfo provide the Account Information Service?

Using Creditinfo Estonia’s solution, both individuals, which is regulated by the aforementioned payment service directive, and companies can transmit their account information to third parties.

Beside financial sector the possibilities of the Account Information Service can be successfully used in application processes in various sectors. Previously mentioned customer consent is obviously obligatory.

Different sectors that can benefit from account information:

- Public sector companies that provide subsidies to individuals and businesses, where the information in the account details creates significant value when determining subsidies;

- Insurance sector companies, which can use behavioral information from the bank account for determining insurance premiums or simplifying the insurance incident evidence burden;

- Other sectors where value from account information help to create better personalized offers for their products and services.

The strength of our Account Information Service is categorization.

The greatest value of the Account Information Service provided by Creditinfo Estonia comes from categorizing account transactions, which our clients (data recipients) can conveniently use in their business decisions.

Categorization is a solution that can and should be continuously improved over time. Precise and detailed categorization is a top priority for Creditinfo Estonia’s Account Information Service.

The data from the Account Information Service serves also as an input for our Account Information Service Report. The report helps to make more informed business decisions both internally and towards our client’s customers. The report highlights all the key ratios, indicators, “green and red flags” and much more that can be extracted from account information.

The report is designed in a way that can be customized to meet the client’s needs, which make it a tool for everyday business decisions.

More information about the service: https://creditinfo.ee/en/avoid-debts/psd2/

Credit Scoring and Credit Control Conference 2023

Creditinfo Group participated in this year’s XVIII Credit Scoring and Credit Control Conference which took place in Edinburgh on 30th August – 1st September 2023. This year’s conference focused on current industry issues and the latest credit risk analytics research findings.

Dmitry Borodin, Head of Decision Analytics Creditinfo Group, and Guilhem Poucin, Senior Risk Analyst Creditinfo Group, presented on “A Winding Road to Credit – Access to Finance for Underbanked Populations”. During their session, they demonstrated how their research examined the issue of access to finance for underbanked populations and identified actionable high impact score-driven solutions:

1️) Using Creditinfo’s global credit bureau footprint, they have explored financial inclusion of the identified populations across various territories, identifying common challenges.

2️) They then introduced a framework to address the most common challenges that limit access to credit for underbanked populations. The framework is to a large extent driven by careful utilization of alternative predictive characteristics such as payment histories on mobile or small loans, telecom and utility data, data on associated parties, and self-reported information. Furthermore, they advocated for the application of thoughtful and unbiased model development methodologies ultimately helping to enhance financial inclusion and expand access to finance for underbanked populations.

Johann Haraldsson, Data Scientist, Creditinfo Group, together with Gunnar Gunnarsson – Executive Director and Analytics and Consultant – Creditinfo Group, presented on “Chunking – A Practical Approach to Manage Consent-based Data Sources in Credit Scoring”. In this session, they presented “chunking” – a methodology used for training a credit score which is designed to handle the fact that different data sources apply to different people at different times. This applies especially to data sources where individuals must opt-in and can opt-out whenever they want. This is to ensure to simplicity, fairness and consistency through time is maintained, while losing as little statistical power as possible.

Kjartan Palsson, Data Scientist, Creditinfo Group, spoke on “Networks- A Practical Graph-Based Approach to Corporate Default Modelling”. During his session, he focused on the network of company connections, specifically how information can be incorporated from neighboring companies to enhance the company credit score. He highlighted on the following:

1) How companies can be connected through various channels, such as ownership structures, common senior staff roles or supply chain relationships. He presented a practical approach to categorizing these channels into “edge strength”, where high strength indicates that defaults are likely to spread to neighboring companies.

2) Ways to use this information to create features which are highly predictive of defaults, particularly for newly founded companies with limited financial data.

Visit www.creditinfo.com for more information.

Creditinfo: “The BIC reform will make it possible to take a big step towards financial inclusion.”

Reform of BICs, impact of inflation on solvency, feedback from the Checkinfo service – an overview with Sidimohamed Abouchikhi, Regional Director for Francophone Africa of Creditinfo Group, and Director of the Board of Directors of Checkinfo.

Finance News Hebdo: In this inflationary context, what assessment do you make of individuals’ and businesses’ insolvency risks?

Article translated in English as first seen on Finance News Hebdo For more inofmormation visit: www.checkinfo.ma

Credit Bureaus: Cross Border Data Sharing

In today’s globalized world, cross-border data sharing is becoming increasingly important for credit bureaus. By accessing data from multiple countries, credit bureaus can improve the accuracy and completeness of credit reports, assess the creditworthiness of non-citizens, and expand market opportunities for lenders. Let’s explore these benefits in more detail.

Improved accuracy and completeness of credit reports

Accessing data from multiple countries allows credit bureaus to gain a more comprehensive view of an individual’s credit history. For example, if someone has lived or worked in multiple countries, their credit history may be spread across different credit bureaus. Cross-border data sharing allows credit bureaus to combine this information into a single credit report, providing lenders with a more complete picture of the borrower’s creditworthiness. This can lead to more informed lending decisions and better risk management for lenders.

Assessment of creditworthiness for non-citizens

For non-citizens or individuals with limited credit histories, cross-border data sharing can be especially important. Without access to credit data from other countries, it can be difficult to assess their creditworthiness. Cross-border data sharing allows credit bureaus to access credit data from other countries, providing a more complete picture of the borrower’s credit history. This can help lenders make more informed lending decisions, expanding opportunities for creditworthy borrowers.

Increased market opportunities for lenders

By accessing data from multiple countries, credit bureaus can also help lenders expand into new markets. For example, a lender in one country may be interested in providing loans to individuals or businesses in another country. Without access to credit data from that country, it can be difficult to assess the creditworthiness of potential borrowers. Cross-border data sharing can provide lenders with the information they need to make informed lending decisions, opening up new opportunities and expanding their market reach.

Compliance with international regulations

In some cases, cross-border data sharing may be required by international regulations or agreements, such as the GDPR in the European Union. By complying with these regulations, credit bureaus can avoid legal and reputational risks. Additionally, complying with international regulations can help build trust with consumers and businesses, as it shows a commitment to ethical and responsible data practices.

In conclusion, cross-border data sharing is becoming increasingly important for credit bureaus. By providing access to a wider range of data sources, credit bureaus can improve the accuracy and completeness of credit reports, assess the creditworthiness of non-citizens, expand market opportunities for lenders, and comply with international regulations. As global data sharing becomes more common, it is likely that cross-border data sharing will become a standard practice for credit bureaus around the world.

Creditinfo Kenya partners with Letshego Kenya to launch lending app

Letshego Kenya launches “Letsgo Cash” in partnership with Creditinfo Kenya to take financial inclusion to a higher level.

· Minimum loan amount of KES 1,000 and a maximum of KES 100,000 and a loan repayment period of 30 days.

· LetsGo Cash increases access and supports customers who need quick and easy access to funds for emergency purposes.

· LetsGo Cash supports digital financial inclusion and enables the underserved and informal sector players to build their own credit records.

Nairobi, Kenya, 3rd May 2023 – Letshego Kenya Limited, a subsidiary of Letshego Holdings Limited (Letshego Group), has partnered with Creditinfo Kenya to launch LetsGo Cash, a self-service and short-term instant loan that gives customers access to KES 1,000 up to KES 100,000.

LetsGo Cash is payable in 30 days and geared towards consumers who need quick and easy access to funds for emergency purposes, including family emergencies, medical needs, home repairs, car breakdowns or funds to support entrepreneurs and small businesses. Creditinfo Kenya’s team brings decades of experience and practical knowledge in credit risk management to support the delivery of LetsGo Cash.

Letshego Kenya’s Chief Executive Officer, Adam Kasaine said: “LetsGo Cash is another way we are increasing access to product funds for more Kenyans. This is inclusive finance in action – it’s quick and hassle-free cash at a competitive price, accessible via your phone or web.”

The innovative LetsGo Cash is a potential game-changer, as it is accessible anytime, anywhere and is more competitive than traditional short-term cash advance providers, providing customers with immediate financial relief and the opportunity to participate in the digital economy in a sustainable and responsible manner.

Creditinfo’s Regional Manager for East Africa, Kamau Kunyiha added: “Creditinfo is proud to support LetsGo Cash assist customers who need quick and easy access to emergency funds the most, while also helping the underserved to build their own credit scores at the same time. Customers’ applications are submitted with a few swipes on a mobile phone, and the time to cash can be as short as a few minutes.”

LetsGo Cash provides a convenient, safe and affordable financial service to the underserved and informal sector players thereby helping to increase financial inclusion. It also helps them build their own credit record, since the better they manage their loan, the better their credit record, and the more cash they have access to going forward. This ensures that more people can access the service, including first-time borrowers who can now enjoy the benefits of a secure, regulated lending solution. Once approved, the money is disbursed directly into the customer’s mobile wallet. It can then be used as the customer desires, including for emergencies, such as purchasing prepaid electricity and water, paying bills, or sending money to friends and family.

LetsGo Cash can be accessed on Letshego’s LetsGo Digital Mall and downloadable via Android and Apple Play Store, or with one click, clicking on www.letsgo.letshego.com as well as via the USSD *435# on their mobile phone.

-ENDS-

NOTES TO EDITORS:

About Letshego Kenya Limited

Letshego Kenya Limited is the largest credit-only microfinance institution in Kenya and a licensed financial services provider in Kenya, providing loans to individuals across both the public and private sectors, as well as supporting Micro and Small Entrepreneurs (MSE). Since the conclusion of the successful acquisition by Letshego Holdings Ltd in February 2012, Micro Africa Group became a wholly owned subsidiary of Botswana-based Letshego Holdings Limited – an inclusive finance group with more than 21 years’ experience in Africa, and a current footprint of 11 Sub-Saharan Markets. Its contribution to the group has been to leverage the microfinance banking competencies and existing customer base, expand Letshego’s geographic coverage, and diversify its solution offering.

The company is founded on, and continues to strive towards, the principle of finding the most effective way to implement microfinance banking in an African context and transform the livelihoods of customers who carry out viable economic activity. Letshego Kenya Limited has a staff compliment of over 150 employees, spread across 25 branches. The company provides loans to over 20,000 customers who enjoy an expanded access through strategic partnerships, innovative technology and digital delivery channels. For more information on Letshego, please visit www.letshego.com/kenya

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in the field of credit risk management. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information on Creditinfo, please visit www.creditinfo.com

ESG and the Banking Industry: Why Sustainability Matters

As the world grapples with environmental and social challenges such as climate change, social inequality, and governance failures, the importance of ESG (Environmental, Social, and Governance) considerations has never been more apparent. For banks, ESG is becoming an increasingly important aspect of doing business, as it can help to manage risks, enhance reputation, meet regulatory requirements, drive innovation and increase access to capital. In this blog post, we’ll explore each of these points in more detail.

- Risk management: ESG risks are significant and multifaceted, ranging from physical risks such as climate change-related natural disasters to transition risks stemming from legal and policy risks from greenhouse gas emissions and governance or social issues such as human rights abuses. By integrating ESG considerations into their risk management frameworks, banks can better anticipate and manage these risks, which can have a positive impact on their financial performance. For example, banks that fail to properly assess and manage climate-related risks could face stranded assets or lawsuits, which could impact their bottom line. Regulatory frameworks in Europe have taken note of this and the European Banking Authority now requires banks to disclose multiple data-points regarding ESG risks in their risk reports (Pillar III).

- Reputation: ESG is increasingly important to customers, investors, and other stakeholders who want to see banks acting as responsible corporate citizens. Banks that take ESG seriously and demonstrate their commitment to sustainability and social responsibility are more likely to attract and retain customers, as well as to access funding from ESG-focused investors. For example, a bank that invests in renewable energy projects or supports social programs in its local community is likely to be viewed more favorably than a bank that does not prioritize ESG. Mismanaging ESG factors to increase reputation may have negative effects, which became evident in some high-profile cases in 2022, both in the EU and US.

- Regulatory pressure: Regulators around the world are increasingly focusing on ESG issues and requiring banks to integrate these considerations into their business practices. For example, the European Union has introduced regulations such as the Sustainable Finance Disclosure Regulation (SFDR) and the Taxonomy Regulation, which require banks to disclose ESG-related information and align their investments with environmental objectives. Banks that fail to comply with these regulations could face fines or other penalties, which could impact their financial performance, reputation, and limit access to capital.

- Innovation: Banks that prioritize ESG are more likely to drive innovation and develop new products and services that address environmental and social challenges. By supporting the transition to a low-carbon economy and promoting social inclusion, banks can help to create a more sustainable and equitable future. For example, a bank that issues green bonds or sustainable investment products can help to finance renewable energy projects or other environmentally beneficial initiatives, potentially at better rates. Similarly, a bank that offers financial services to underserved communities can help to promote financial inclusion and social equality.

- Green bond issuance offers several benefits for banks, such as accessing a growing pool of socially responsible investors, improving their reputation as sustainable financial institutions, and supporting the transition to a low-carbon economy. The growth of the green bond market has been impressive, with a record-high issuance of $269.5 billion in 2021, up 4.6% from 2020. The cumulative issuance from 2007 to 2021 surpassed $1.5 trillion, with the US, China, and France being the largest issuers. The increase in green bond issuance is driven by investor demand and regulatory measures promoting sustainable finance.

In conclusion, ESG considerations are becoming increasingly important to the banking industry to manage risk, enhance reputation, meet regulatory requirements, and drive innovation. Banks that prioritize ESG are likely to be better positioned for long-term success, as they can help to create a more sustainable and equitable future for all stakeholders. As individuals, we can also play a role in promoting ESG considerations by supporting banks and financial institutions that prioritize sustainability and social responsibility. By working together, we can help to build a more resilient and sustainable global economy.

This may be one of the most important feature of ESG in banking, where the green bond space has grown exponentially over the last years.

By Gary Brown

Head of Commercial Development – Creditinfo Group.

SOLUS, SID and Creditinfo Group Conference 2022

On June 1, 2022, a conference on the current topics in the financial market took place in Prague. This conference was organized by SOLUS, SID, and Creditinfo. The attendees, primarily from the banking, payday lender, telco, and utility sectors were able to get insights into areas of Ukrainian Cross-border reports exchange, the new Consumer Credit Directive, PSD2/Open banking services including transactional scoring, new trends in Device Fraud mitigation, and many more from international speakers who frequently used case studies and demos of solutions created by Creditinfo, SID and its partners to address particular risk management and sales expansion challenges.

Let us provide you with insights gained from the presented topics. As readers of our newsletter are from many markets, we have selected topics which are valid for the financial services community and not limited only to particular geographies:

Key trends in the financial and credit bureau industry

Seth Marks, Managing Director, Creditinfo Central & Southern Europe and Head of Affiliated Markets in his intro focused on financial inclusion and Creditinfo’s mission to improve access to credit to more than 2 billion financially excluded people worldwide. He also described 5 trends which are common themes from Creditinfo’s experiences gained from running credit bureaus in more than 30 markets:

· The growing Importance of Data and Data-driven insights

· Digitalization

· Analytics and Decisioning

· Portfolio Management

· KYC and Fraud mitigation

Digital Corridors Initiative of IFC and Ukrainian cross-border report exchange

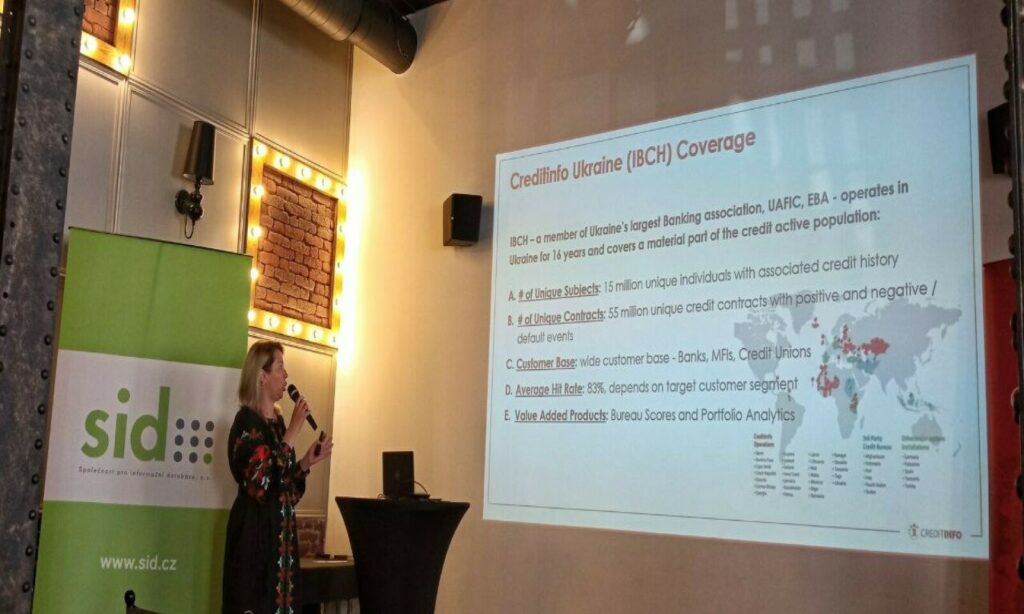

Fabrizio Fraboni, Global Specialist from IFC/World Bank together with Kateryna Danylchenko, CEO of Creditinfo Ukraine addressed the topic of how to support the financial inclusion of millions of Ukrainian refugees by providing access to their identification and credit histories via Creditinfo’s newly-established Cross-border Reports Exchange Service, a part of IFC’s Digital Data Corridors initiative. Mr. Fraboni also spoke about IFC’s global challenges around access to finance for consumers and SMEs, including World Bank Group’s global engagement in building Credit Infrastructure together with strategic industry partners (such as Creditinfo). Ms. Danylchenko then gave an overview of Creditinfo’s Credit Bureau in Ukraine (IBCH), which is part of the Digital Data Corridors initiative and covers more than 75% of the credit active population of Ukraine.

The live version of the Cross-border Reports Platform was also presented at the conference. The service is now available in 7 markets, in collaboration with local credit bureaus.

Power of Open Banking in Risk Assessment

Marc Gaudart, an independent consultant formerly of Experian and McKinsey & co, presented the power of Open Banking in credit risk assessment. He addressed the main

benefits which the EU PSD2 directive and national regulations enable, such as greater transparency, security, innovation, and market competition. He referred to consumer lending as one of the main use cases for Open Banking, where customers can gain better access to credit when sharing their data. He demonstrated how Open Banking can transform lending decisions using examples in consumer, business, mortgage lending, debt consolidation, and Buy Now Pay Later services. He also demonstrated Open Banking data as being powerful predictors of credit risk, providing an example of the performance of a scorecard developed on Open Banking data. ‘Given the granularity of income and outgoing transactions information available, Open Banking provide a precise, accurate and up to date affordability measure’ said Gaudart.

Aleš Černý, Head of Retail Risk at AIR BANK, topic by sharing his experience in building transactional scores based on Open Banking Data for the Peer-to-Peer lending platform Zonky. He demonstrated that the best performance is via the enrichment of credit bureau scoring models with transactional data sourced from Open Banking. Such an approach is also recommended by Creditinfo scoring experts and Creditinfo itself has long-time expertise in building such models. Černý also mentioned his ambition and interest to build and promote a ‘Personal Score’ in the Czech Republic, following similar approaches from the US and UK markets.’

Trends in digital fraud mitigation

Jürgen Brandt, VP of Business Development, and Lars Schumann, Anti-Fraud Consultant from Creditinfo partner RISK.IDENT, a leading German device fraud mitigation provider, addressed current trends in the digital fraud area supported by case studies from the German telco and e-commerce segment. They covered three areas:

i) area of Account takeover (ATO) in the Telco Sector where fraudsters steal credentials of existing customers, change passwords and shipment addresses or arrange contract renewal/extension and then order new hardware, with ATO-specific scoring model based on the collection of device fingerprint date as solution helping to mitigate such risk.

ii) areas focused on the Buy Now Pay Later (BNPL) and E-commerce Sector, where the challenge sits in fraudsters using stolen identities with good credit ratings, creating a new account, buying goods using BNPL then picking and reselling. Such challenges can be addressed by Data enrichment and linkages (Credit agency data combined with Device fingerprinting).

iii) area of Refund Fraud, where fraudsters buy goods and pay them, then complain about a non-existing problem to launch a return process during which they redirect the return address to a fake one and steal goods. Device fingerprinting with monitoring of the value chain will help to reveal and prevent such challenges.

If you want to get more insights about mentioned conference and topic please email: tesa.vitelj@creditinfo.com

The fintech movement in the banking industry

Is fintech an enabler or disruptor in the banking industry? Fintech the new technology that improves and digitalizes the delivery and services of the banking industry. These solutions can include software helping connect with customers, businesses, and banks through agile processes to manage financial services better. Or better use of data to offer a more personalized and customer centric offering.

The lending landscape has gone through some major changes in recent years, and this shift does not appear to be slowing down. Based on the latest information from the World Bank, about 76% of adults have a bank or mobile account, this is up from 51% in just over a decade. The rise of mobile money solutions, which allow users to turn their smartphones in digital wallets and use it to pay for services, have played an important role tapping into the unbanked segment and supporting this improvement.

Fintechs are realizing the opportunities to disrupt the challenges faced by traditional banking and offering new solutions that better suit the needs of customers and businesses. By embracing technology, fintech companies can collect and store more data on customers so they can offer personalized solutions with greater choice of products. Unlike traditional banks, fintechs can move with speed and deliver digital solutions improving the user experience.

The increase in fintech players has increased competition between traditional banks and fintechs. Traditional banks are paving the way to collaborate with fintechs while others are implementing teams to focus on in-house projects. Older generation customers may value trust over the latest trends and will therefore remain loyal customers to traditional banks., However, younger generations will demand more and swifter solutions because that is what they are familiar with. Traditional banks embracing fintech solutions will see them provide the flexible solutions that customers are looking for.

One of the biggest reason the banking industry has adapted to fintechs, is due to their ability to connect with customers 24/7 through an omnichannel approach. This not only increases customer reach and convenience but also allows banks not to rely solely on customers visiting a branch.

It is expected that we will continue to see changes in the banking industry for years to come, the speed of change will depend on how much and how fast customers continue to adapt to fintech solutions. It’s clear, traditional banks are no longer the monopoly in this industry, with more digital banks, neo– banks and new players such as telcos and payment companies entering the lending landscape. Nobody is expecting the traditional banks to be replaced but it is likely that banks and fintechs partnering with one another will allow the traditional banks to enhance technologies and by coming together both the fintechs and the banks can benefit in this highly competitive market.

Samuel White,

Direct Markets Director, Creditinfo Group.

Open Banking in the MENA region

We recently sat down with the Commercial Director at Creditinfo Group, Gary Brown, where he highlighted his thoughts on Open Banking in the MENA (Middle East and North Africa) region. These were some of his insights:

What is Open Banking?

Open Banking is a service that provides third-party financial service providers open access to consumer banking transactional data from banks and financial institutions using application programming interfaces (APIs). Open Banking is growing with popularity globally and in the MENA and could soon become the latest source of FinTech to shape the banking industry.

Delivered through open banking, banks allow access and control of customers personal and financial data to third-party service providers. Of course, customers are required to grant consent to allow the bank access and permission to share. Lenders are then able to use customers data and transaction history to drive insights such as spending habits and regular payments. This will enable more competition and innovation to financial services which will lead to better products to help consumers manage their money.

What are the benefits to Open Banking?

Open Banking allows lenders to add an additional layer of data and complete a more accurate and comprehensive picture of a customer’s financial situation to offer more competitive and profitable loan products. It can also benefit the consumer and help them manage their own expenses and accounts. An open Banking application can display all the consumers banking accounts in one place and display their spending habits and behaviors.

Open Banking is a straight-forward solutions with low integration costs that can greatly benefit large and established banks, small banks and digital banks. It can reduce operational costs and provide a wider customer outreach through digital channels, hugely important in the MENA with such a high percentage of the population with access to a digital smartphone. This new technology can strengthen customer relationships and customer retention by helping consumers manage their expenses and connect with them through digitalization.

How will Open Banking improve the customer experience in the MENA?

With such high smartphone usage across MENA, Open Banking will provide consumers the ability to have full control over their finances under one view, as well provide them with a better range of products and services personalized to their financial situation. Consumers across the MENA are requesting more flexible and forward-looking systems that support fintech innovation. Open Banking allows consumers to be in control and empowers them and small businesses by creating a simple platform for accessing, controlling, and sharing their data so they can benefit from it. With connected accounts across the financial services landscape, consumers and small businesses can put their data to work, whether it’s for one specific purpose or across multiple apps and services.

Data exchange is crucial across any financial ecosystem and Open Banking plays a vital role by providing a new additional layer of data. Enabling a secure and safe flow of data across accounts and apps efficiently will fuel innovation for banks and provide many new benefits across the industry, such as improving financial literacy and extend financial inclusion to the underserved.

Can you explain the differences between Open Banking and Open Finance?

Open Banking and Open Finance are the latest buzz topics when it comes to fintechs and innovations in the Banking industry. Open Finance has been developed from Open Banking and will provide an extra layer of data available to consumers and organizations, Open Finance will include other financial data, such as mortgages, savings, pensions, insurance, utilities, etc. This will enable consumers to provide access to their entire financial footprint and provide them with an even better customer experience.

To better serve the unbanked or underserved, Open Finance will further level the playing field and make it easier for these consumers to have access to affordable and sustainable credit, providing everyone access to the services they require and deserve. With more access to finance, we can expect to see better economic growth across MENA.

Closing the lending gender gap

To make our economy truly financially inclusive, there are many things we need to address – from ensuring people are paid equally to removing biases from the financial ecosystem. One of those biases that urgently needs to be tackled is in the lending market, to ensure that women are not disproportionately prevented from accessing credit and financing products.

Women are key contributors to the economy, making up 40 percent of the world’s workforce – particularly in developing economies. Not only are women typically responsible for the bulk of household purchasing, but their employment falls in sectors that are crucial for economic growth and development.

That said, we often find that women’s involvement in the flow of capital around the economy to be less than we might expect – with reasons stemming from cultural barriers to participation to structural issues in the financial ecosystem. While cultural issues may be more difficult to overcome, there are things we can be doing to address these structural issues holding back the female economy.

The credit industry, from regulators to lenders and to credit bureau all contribute to make changes. In this article, we discuss some of the challenges of the current situation to some of the potential solutions.

In some markets, the gender pay gap is particularly pronounced – a Creditinfo analysis of the Lithuanian market found that of the 81 sectors into which economic activity breaks down, men are paid more than women in 72, and average pay for men often exceeds women by 30-50 percent. In some sectors, such as air transport, gaming, and gambling, men’s pay can be up to 127 percent above their female colleagues. Closing this gap is going to be key to rebalancing the economy and realising a more financially inclusive world. There is work being done as part of the ESG initiatives (ESG = Environmental, social and corporate governance) that is starting to make salary gaps more transparent, as well as representation of women on company boards. Credit bureau, such as Creditinfo Lithuania, are providing specific segments on credit reports to ease access to this information.

However, even outside of pay issues, there are significant problems in the lending markets – and here data can help provide a way forward.

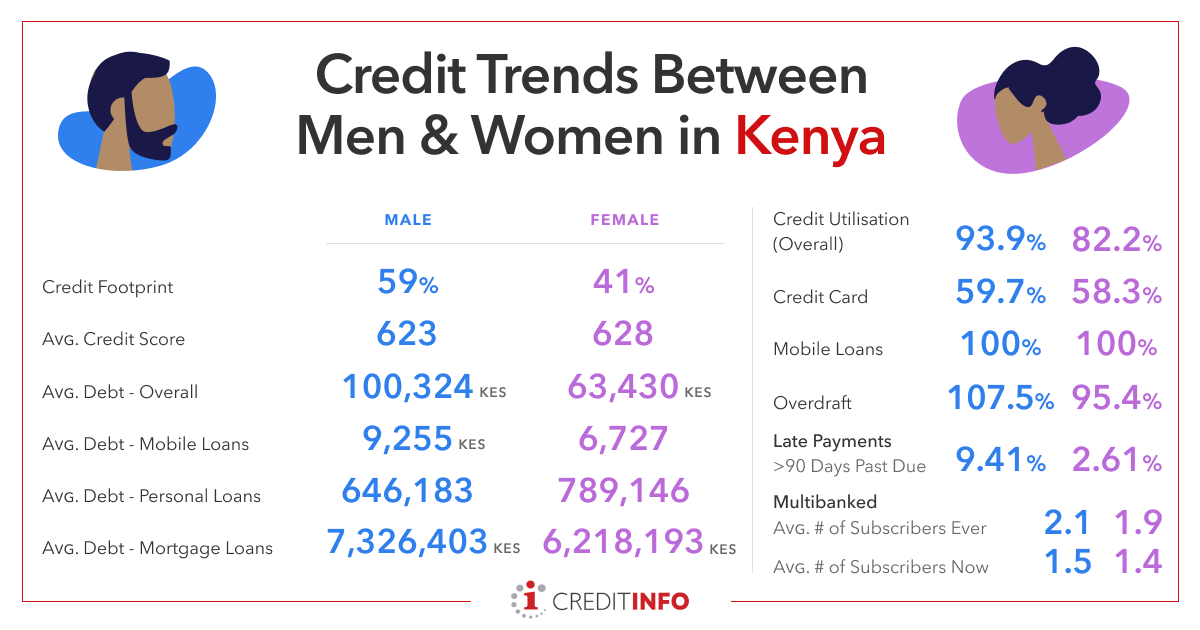

Creditinfo analysis of the lending market in Kenya yielded some very interesting findings. Despite women having higher average credit scores than men (628 vs 623), they have significantly smaller credit footprints (41% vs 59%) and utilisation (82.2% vs 93.9%). This is quite a marked difference and can have a widespread adverse impact.

If women are not able to access financing on a personal level, then their spending power is diminished and their non-participation in the economy will be felt. If they are not able to access financing on a professional level too, the effects are compounded – and the economic imbalance will continue to hold back economic growth and development.

Many other developing economies are experiencing the same issues. In Morocco, for example, the lending market similarly favours men, with women only making up 31% of the active borrowing market.

This needs to change.

To make our world fairer and our economy work for everyone, we need to remove these structural barriers to financing. In general moving to digital lending and minimising subjective human intervention in lending vastly improves the equality. Credit scores will reflect the actual risk of individuals based on actual data. It is important that historic bias is not built into algorithms, model developers need to be aware of the potential of this and remain vigilant.

Regulators have a role as well, over dependence on DTI (debt to income) in their supervisory rules can build in a strong gender bias. The evidence has already been shown that women are lower paid. With DTI rules, large proportions of women can be forced to high interest rate lending or pushed out of formal market to the informal credit market without legal protection.

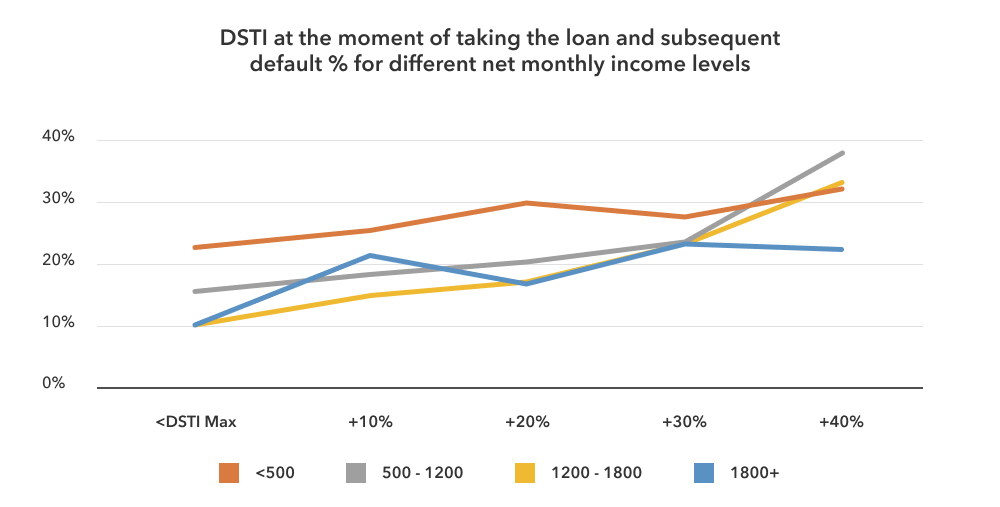

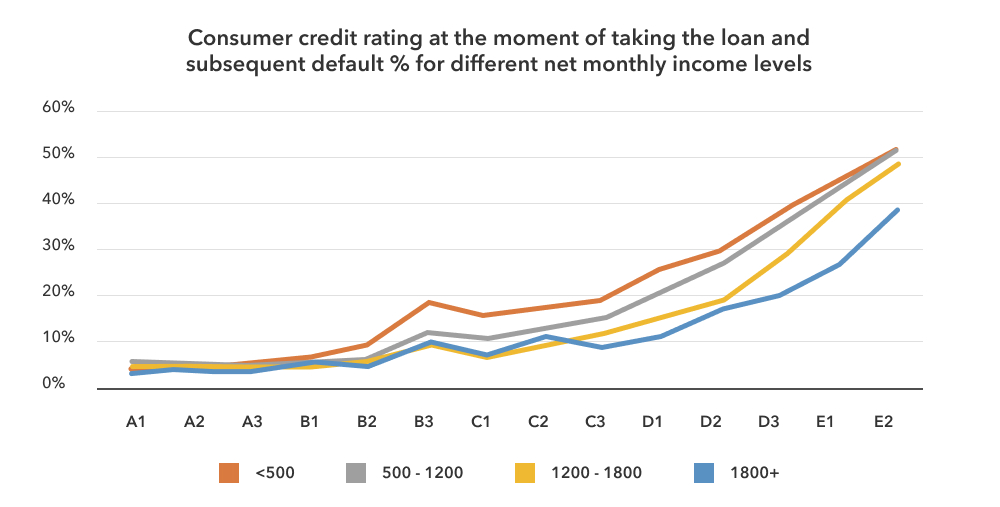

We see the evidence from Latvia where the credit score (fig 1) is highly predictive of future non-payment and should be a significant element of credit decision, it is proven to be predictive at all income levels. DTI ( Fig 2) is much less predictive and would eliminate many lower income women from formal credit where strict rules around DTI exist.

The best way to start making changes is by using data, whether ESG information or credit scoring. If we can understand the situation clearly and how the picture needs to change, we can begin to address it. We can also measure and manage progress against key performance indicators.

For lenders, this can be a significant opportunity – that a whole section of the economy, with good credit scores and low credit utilisation has been continually underserved, means they can be very targeted with new products and services that cater to that nascent market and generate new revenue streams while tackling financial inclusion.

This is something we believe very strongly in and are working with partners to help address. If we can help de-risk the lending ecosystem, we can make the economy fairer for all and reap the significant benefits that unlocks.

Visit www.creditinfo.com for more information.

Emma Camilleri,

HR Director, Creditinfo Group.