The evolution of retail credit in the banking sector in UEMOA

Covid – 19 has hit the world with a “double shock”: an unprecedented contraction in supply and demand coupled with a health-economic conundrum. For Africa, and the UEMOA region, the immediate picture is bleak. However, there is hope if the financial sector uses the situation as a trigger for accelerated transformation of lending processes and products, taking the lead from other sub-Saharan markets and levering advantage of the robust financial infrastructure in place.

Thanks to Creditinfo, Estonia becomes the competence center of open banking

The Head of the company says a positive credit register is needed for boosting the Estonian credit market. Stefano Stoppani, Dubai-based Chairman of the Board of Creditinfo providing business information, solvency assessment and market analysis, intended to visit its offices in Estonia and the other Baltic countries in the beginning of March, but COVID-19 hampered with these plans. Europe is cautious in regulating both data protection and open banking. The aim of the PSD2 directive is to give third parties – licensed companies – access to a person’s bank account information. This is not done just because, but for providing better service, and obviously the account holder must authorize this. The third-party, for example, the creditor, can then see the income of the person and what the money is spent on. Information is needed to determine if the person is able to pay back the loan (s)he wants.

Creditinfo’s commitment to Data Quality

Data is the new oil, but quality is paramount

In 2017, The Economist ran a cover story portraying data as the new oil, (certainly not last week’s oil), calling it “the world’s most valuable resource”. Data is pervasive and is collected regarding virtually everything that happens. Essentially it comes down to one simple cycle, as described in that 2017 issue: “By collecting more data, a firm has more scope to improve its products, which attracts more users, generating even more data, and so on…” Information is power (for credit bureaus, the power to enhance market lending effectiveness). But there is a catch; because not any kind of data will suffice. In the world of credit, for it to be valuable, data must be complete, high quality, regularly transmitted and verifiable. High-quality data has a deeper, more transformative power. In this industry, data quality and completeness are critical for the successful impact of credit bureaus, and Creditinfo has, since its founding, had a clear focus on this area to support banks, MFIs and other institutions for constant improvement.

New “Creditinfo CO” system reports on debtors’ debtors

Press Release

April 28, 2020. Creditinfo Lithuania today introduced the new debtor reporting system “Creditinfo CO”. The system will give businesses the ability to learn, free of charge and in one place, how many companies are late with payments to their debtors and for what total amount starting from lock down period caused by COVID-19. The aim is to provide businesses with useful information that can help them make decisions on a more informed basis – whether to negotiate with debtors on payment terms, prepare documents for an assignment of debt, or initiate a judicial recovery process. It is also worthwhile checking what length deferments and what size trade credits are being granted to business partners.

Trusting Creditinfo Bureau Score in a Crisis

The quality of predictive algorithms plays a crucial role in Creditinfo operations. We strive to help our Clients perform efficient credit decisions through smart and innovative use of data.

The key to success (my humble opinion): Any lessons from credit-vibrant Iceland to small population countries?

By Reynir Finndal Grétarsson – Founder, Creditinfo Group

In 2010 I decided to go back to University and learn Anthropology. This is the discipline that deals with human behavior in wide and holistic manner. Why do humans behave as they do? After graduating in 2014 with a bachelor’s degree, my understanding of the complex organism that is the modern human being increased just a little bit. The most important thing I learnt was that different behavior of different groups of people could be explained by what we call culture.

Assessing credit risk of SME’s and how credit scoring can transform SME’s

Paul Randall was recently at the Kafalah SME Financing Conference in Riyadh, Saudi Arabia, and he tackled these 2 questions during the panel discussion.

What are the specific challenges of assessing credit risk of SMEs as compared to larger firms and how can fintech can help lenders address those?

Paul Randall at the Kafalah SME Financing Conference 2019

Kafalah SME Financing Conference was held in Riyadh, Saudi Arabia where they discussed current financing for SME’s in Saudi Arabia,how to build relationships between private and public FIs, government agencies and legislative bodies that support financing, current and future finance opportunities for specific business sectors and how to increase awareness of the most current international practices for financing SMEs.

How to use your credit score to negotiate better terms with your financial institution

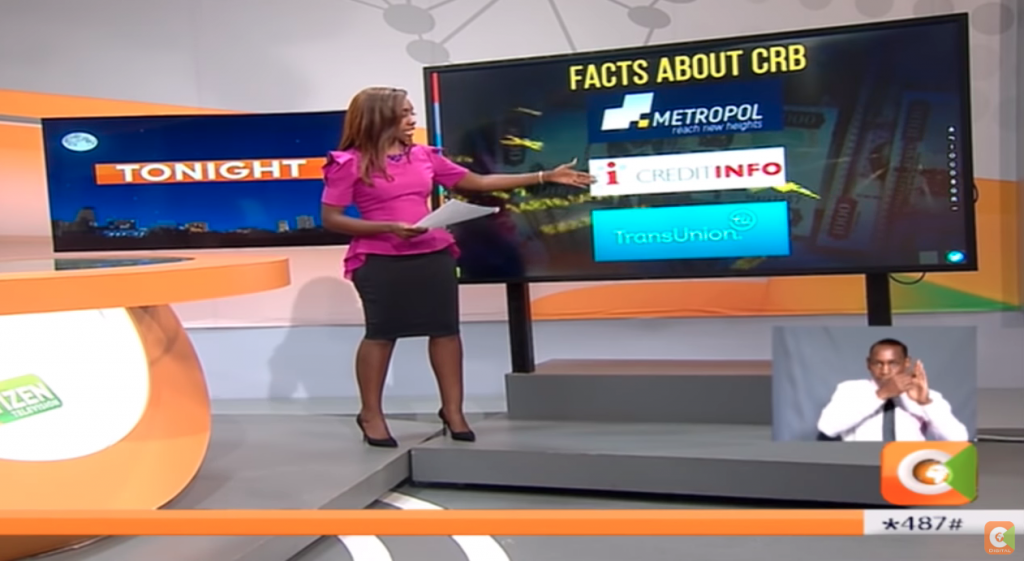

Last week, a leading TV station in Kenya – Citizen TV did a story on Digital Lending Apps and their impact in Kenya. There has been a sharp rise in the number of mobile lending apps in the country and the worry is about how people are accumulating debt and borrowing from the various apps simultaneously and defaulting therefore affecting their credit score.

New insurance claims database launched in Iceland

As of January 15 2019, the four Icelandic general (non-life) insurance companies will start using a new claims database for the Icelandic Financial Services Association (SFF) run by Creditinfo. The database will be used to counter organized insurance fraud, as it has been on the increase in relation to organized crime. According to a statement by the Icelandic Police, these groups seem to have found a loop hole in insurance fraud cases in Iceland.