JSC “International Bureau of Credit Histories” launched the chatbot “MBKI online” in order to provide Ukrainians and migrants from Ukraine with access to their credit histories.

Lending is one of the main elements of the modern financial system. In one way or another, most people rely on loans from banks – whether these are credits, mortgages, installments, credit cards to pay for critical goods and services. An important role in this process is played by credit bureaus that collect, store, process and transmit information on borrowers’ payment discipline, credit scoring and current obligations.

However, when people move to a new country or are forcibly evicted from their homes due to occupation or fleeing war – this is what many Ukrainians are currently experiencing – it becomes much more difficult to access financial and other services. This unfortunately disadvantages refugees and adds to the problem regardless of whether they had good or bad credit history before.

Aiming to resolve issues related to solvency confirmation of the tenant from Ukraine and checking the credit history of Ukrainians when applying for a loan or employment, JSC “IBCH” (one of the largest Credit History Bureaus in Ukraine, a member of the international Creditinfo Group since May 2021) created the “MBKI online” chatbot.

For more than 16 years IBCH (Creditinfo Ukraine) has been cooperating with the largest banks and non-bank financial institutions, including foreign financial institutions and credit bureaus of other countries. The organization is now focusing its attention on supporting Ukrainians, both in Ukraine and abroad, with getting access to credit reports.

Kateryna Danylchenko, CEO of JSC “IBCH” (Creditinfo Ukraine), stated, “Since the beginning of the war in Ukraine, over 6 million people – including myself, my fellow colleagues and partners– have been forced to leave the country at short notice with no idea if or when they will return. Displaced Ukrainian refuges face a whole host of challenges without necessary documentation or access to registries. While JSC “IBCH” (MBKI, Creditinfo Ukraine) became the first Ukrainian bureau to launch cross-border data sharing with bureaus from 5 countries, it is also important to assure easy and mobile direct-to-consumer gate to credit history reports. “MBKI online” is so important in helping Ukrainians staying in country and abroad gain online access to their credit histories (also in English), so they can prove their ability to make payments on time to landlords or new employers, follow their credit history updates and bureau score change, as well as to report about lost identification documents.”

“Creditinfo was set up to aid financial inclusion through making credit information more easily accessible and digestible for borrowers and lenders.” – comments Paul Randall, CEO Creditinfo Group. “I’m so glad that there’s something practical we’ve been able to do to help Ukrainian refugees across Europe to access financial services. The creation of this chatbot is an important development in our journey to make the lives of everyone forcibly displaced by this war that tiny bit easier.”

The “MBKI online” chatbot, available on Viber and Telegram, gives Ukrainians access to their own credit history and offers an easy way of identification including using BankID.

Chatbot enables the customer:

• To get a certificate about credit history (in Ukrainian and English);

• To find out personal credit score;

• To get answers to basic questions about credit history;

• To inform the Bureau about the loss of a passport or other identity document;

• To ask for a loan and find out available offers.

Chatbot accepts different payment methods (including bank card, Apple Pay and Google Pay). For more information and to start working with the service, follow the link: https://credithistory.com.ua/bots/

The fintech movement in the banking industry

Is fintech an enabler or disruptor in the banking industry? Fintech the new technology that improves and digitalizes the delivery and services of the banking industry. These solutions can include software helping connect with customers, businesses, and banks through agile processes to manage financial services better. Or better use of data to offer a more personalized and customer centric offering.

The lending landscape has gone through some major changes in recent years, and this shift does not appear to be slowing down. Based on the latest information from the World Bank, about 76% of adults have a bank or mobile account, this is up from 51% in just over a decade. The rise of mobile money solutions, which allow users to turn their smartphones in digital wallets and use it to pay for services, have played an important role tapping into the unbanked segment and supporting this improvement.

Fintechs are realizing the opportunities to disrupt the challenges faced by traditional banking and offering new solutions that better suit the needs of customers and businesses. By embracing technology, fintech companies can collect and store more data on customers so they can offer personalized solutions with greater choice of products. Unlike traditional banks, fintechs can move with speed and deliver digital solutions improving the user experience.

The increase in fintech players has increased competition between traditional banks and fintechs. Traditional banks are paving the way to collaborate with fintechs while others are implementing teams to focus on in-house projects. Older generation customers may value trust over the latest trends and will therefore remain loyal customers to traditional banks., However, younger generations will demand more and swifter solutions because that is what they are familiar with. Traditional banks embracing fintech solutions will see them provide the flexible solutions that customers are looking for.

One of the biggest reason the banking industry has adapted to fintechs, is due to their ability to connect with customers 24/7 through an omnichannel approach. This not only increases customer reach and convenience but also allows banks not to rely solely on customers visiting a branch.

It is expected that we will continue to see changes in the banking industry for years to come, the speed of change will depend on how much and how fast customers continue to adapt to fintech solutions. It’s clear, traditional banks are no longer the monopoly in this industry, with more digital banks, neo– banks and new players such as telcos and payment companies entering the lending landscape. Nobody is expecting the traditional banks to be replaced but it is likely that banks and fintechs partnering with one another will allow the traditional banks to enhance technologies and by coming together both the fintechs and the banks can benefit in this highly competitive market.

Samuel White,

Direct Markets Director, Creditinfo Group.

Evolution of customer onboarding and risk assessment

This year, Creditinfo celebrated its 25-year anniversary, so I decided to look back on how the landscape in effective credit risk management has evolved.

While it was a little before my time, I’m sure there are still many people today who remember that the only way to open a bank account, apply for a loan or to be considered for a mortgage was to visit your local branch and sit with a loan officer. Though, this is still the case in many emerging markets even today, there will be some small differences on the data used and the risk assessment criteria that is in place.

Historically, a visit to the branch would involve meeting a loan officer who would then try to understand your circumstances before making an approval. If there was a past relationship or a connection (family member, friend, etc) with the loan officer, this would usually work in your favor. It was a direct relationship that usually lasted a lifetime. The loan officer would know or at least try to understand as much personal information on your employment, income, and expenses as possible and then would make a personal judgement to provide you with a form of credit. All of this was most likely completed and documented on papers and filed into a filing system for record.

Fast forward a few decades and not only are local branches disappearing, but also the idea of sharing personal information with a “stranger”, along with any supporting documents that validate your circumstances are a thing of the past. In a world of smartphones, tablets, and access to the internet 24/7, we have moved to a new wave of digital lending.

Lenders are implementing new strategies today to meet the end needs of customers by enabling access to credit instantly at their fingertips. Digitalization has become the new norm in lending and to succeed today, lenders need to adjust and transform their platforms. It is now a thing of the past to fill in an application form on paper when we have a smartphone in our pockets that can allow us to fill in the same information into a mobile application within a few minutes. As part of the loan onboarding, we can now validate our identity through biometric authentication options – fingerprint analysis, selfie/face recognition and document validation, etc. eliminating the need to do human to human verification.

The challenges from old-fashioned lending methods, i.e. understanding family ties or seeking information on employment and income would typically result in an unfair and inaccurate risk assessment. With the vast amount of information available today, either traditional or non-traditional, we can accurately assess everyone, even customers with limited credit history – “thin files”. These are often rejected due to the lack of evidence on how risk-tolerant or risk-averse they are. Usually, the absence of traditional information for these customers creates a challenge for them to receive the financial support they need. With the introduction of psychometric data, e-wallet data or open banking solutions, lenders can combine credit scoring methods with traditional models to provide accurate and reliable risk assessment.

The benefits and success of this digital transformation and innovative approach to lending is not just about delivering quick-fix money solutions. Instead, it is about empowering individuals, facilitating access to credit and growing our global economies.

If you are interested to reach the top and win the digital race with a state-of-the-art digital lending platform then reach out to Gary Brown, Commercial Director, Creditinfo Group.

Visit www.creditinfo.com for more information.

Paving the way for a brighter future through SME lending

Developing modern solutions and removing barriers, paves the way for a brighter future through SME lending

SMEs (Small and Medium-sized Enterprises) are known as one of the biggest business sectors in each economy, being important contributors to job creation and global economic development. They create more than 50% of employment worldwide.

SMEs have gained importance in developing economies. Although SMEs have some weaknesses, they are less affected by economic crises due to their flexibility and ability to keep up with changing conditions. SMEs are vital establishments to create an effective innovation ecosystemThis is shown by recent studies that SME’s can contribute to over 55% of GDP and over 50% of total employment.

SMEs can find it increasingly difficult to borrow money from traditional banks because of strict requirements. It is often seen that SMEs are riskier than large institutions as it is difficult for banks to evaluate them in the same way since they often do not have solid accounting systems. This difficulty in assessing their creditworthiness often impacts the bank’s ability to provide affordable credit. As a result, many SMEs are forced to look at alternative solutions such as expensive credit lines charging high interest rates or offering costly collateral. Neither of these options are sustainable for small businesses.

SMEs need fast decisions and a more agile, digital approach. This is where Creditinfo and local Fintechs are working in collaboration to support the sector. Together, we specialize in using technology to quickly assess each SME’s entire data footprint and then provide tailored financial solutions. Based on our experience in Africa, we can assess the credit risk an SME poses by using real-time data from multiple sources, including e-wallets, credit bureaus and credit scores. The traditional method, consisting of manual processes and hard copies, is now an outdated approach in the digital world.

Digital SME finance, using alternative data, offers an extraordinary opportunity for addressing some of the challenges. Every time SMEs and their customers use digital services, conduct banking transactions, make or accept digital payments, use their mobile phones, or manage their receivables and payables through a digital platform, they create alternative data. This real-time and verified data can be analyzed to determine both capacity and willingness to repay loans.

Specific SME assessment methodology can also be applied. For example, small companies tend to have a greater level of owner centricity. Therefore, blending business and personal data can enable the development of highly predictive blended scorecards that utilize the payment behaviour of business owners and managers and company credit data to produce a more comprehensive risk assessment.

Help is also needed from Central Banks to continue to support this sector. We are seeing reforms happening globally where Central Banks are implementing mandates for all banks to lend a set percentage of their credit portfolios to SMEs. Boosting the availability of finance for the SME sector, the reforms aim to ease the flow and reduce the high cost of credit to a sector that is considered an engine of growth for the future.

SME lending is rapidly growing, and by putting the customer needs first and using new solutions and data, we can begin to shift the status quo. Globally there is a shift toward digital lending solutions, which can support a level playing field for SMEs. By transforming this lending sector as a whole, we can make it more accessible for small businesses to grow and continue making a difference.

Joe Bowerbank – Business/Commercial Development, Creditinfo Group.

Angola’s first licensed credit bureau in partnership with Creditinfo to provide millions with access to finance

- Private credit bureau will support responsible lending and economic growth

- Millions of unbanked citizens and small businesses to gain access to lending for the first time

Luanda/London, 16th May 2022 – Creditinfo Group, the leading global service provider for credit information and risk management solutions, today announces plans to open Angola’s first licensed credit bureau, with Bureau Central Privada de Informação de Crédito SA (Bureau). This long-term strategic partnership, represents a vote of confidence and major investment into Angola’s buoyant economy, unlocking access to credit for millions of micro-to-medium sized businesses and citizens – many of whom are currently unbanked.

To deliver a world-leading private credit bureau solution, Creditinfo will combine Bureau‘s local knowledge with its own extensive experience delivering private credit bureau solutions in developing markets – including across Sub-Saharan Africa. The project’s initial remit will include Creditinfo’s most popular products and services, including CBS. Based on market appetite, further value-added products will be introduced.

Samúel White, Regional Director at Creditinfo said: “Accessing credit has long been a challenge across Sub-Saharan Africa. By opening Angola’s first private credit bureau, we’ll enable banks and other lenders to extend credit to citizens and businesses, helping to build and develop its already thriving economy. Supporting the unbanked to access finance requires a specific set of experiences and insights which Creditinfo has honed over decades of working across the region. We’re proud to be a leader in this space and can’t wait to open for another dynamic market together with our strategic partners.”

Cristiano Monnerat, Director at Bureau Central Privada de Informação de Crédito S.A. added: “Boasting significant untapped opportunities for wealth creation and a young, dynamic population, Angola represents an attractive investment for us. As such, we’re excited to be able to draw on Creditinfo’s global expertise to build a private credit bureau that’s run by local people, for local people. All in all, this marks a major step forward for Angola’s growing economy.”

-ENDS-

About Creditinfo

Established in 1997 and headquartered in Reykjavík, Iceland, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For

decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals. For more information, please visit www.creditinfo.com

About Bureau Central Privada de Informação de Crédito S.A.

Established in 2021, the Bureau Central Privada de Informação de Crédito S.A. (Bureau) supports access to finance in Angola – with a focus on underserved segments of society with no formal access to credit facilities. Bureau is led by a highly qualified team of Brazilian advisors based in Angola. In February 2022, the Bureau received its operational license from the Central Bank of Angola, fulfilling all of the legislative and regulatory requirements.

The long-term strategic partnership with Creditinfo Group will provide Bureau with the necessary insights and industry best practices from similar markets to increase economic growth and improve financial inclusion across Angola.

Media Contacts:

Jack Benda

Red Lorry Yellow Lorry for Creditinfo Group creditinfo@rlyl.com

+44 (0)7760 291 679

Open Banking in the MENA region

We recently sat down with the Commercial Director at Creditinfo Group, Gary Brown, where he highlighted his thoughts on Open Banking in the MENA (Middle East and North Africa) region. These were some of his insights:

What is Open Banking?

Open Banking is a service that provides third-party financial service providers open access to consumer banking transactional data from banks and financial institutions using application programming interfaces (APIs). Open Banking is growing with popularity globally and in the MENA and could soon become the latest source of FinTech to shape the banking industry.

Delivered through open banking, banks allow access and control of customers personal and financial data to third-party service providers. Of course, customers are required to grant consent to allow the bank access and permission to share. Lenders are then able to use customers data and transaction history to drive insights such as spending habits and regular payments. This will enable more competition and innovation to financial services which will lead to better products to help consumers manage their money.

What are the benefits to Open Banking?

Open Banking allows lenders to add an additional layer of data and complete a more accurate and comprehensive picture of a customer’s financial situation to offer more competitive and profitable loan products. It can also benefit the consumer and help them manage their own expenses and accounts. An open Banking application can display all the consumers banking accounts in one place and display their spending habits and behaviors.

Open Banking is a straight-forward solutions with low integration costs that can greatly benefit large and established banks, small banks and digital banks. It can reduce operational costs and provide a wider customer outreach through digital channels, hugely important in the MENA with such a high percentage of the population with access to a digital smartphone. This new technology can strengthen customer relationships and customer retention by helping consumers manage their expenses and connect with them through digitalization.

How will Open Banking improve the customer experience in the MENA?

With such high smartphone usage across MENA, Open Banking will provide consumers the ability to have full control over their finances under one view, as well provide them with a better range of products and services personalized to their financial situation. Consumers across the MENA are requesting more flexible and forward-looking systems that support fintech innovation. Open Banking allows consumers to be in control and empowers them and small businesses by creating a simple platform for accessing, controlling, and sharing their data so they can benefit from it. With connected accounts across the financial services landscape, consumers and small businesses can put their data to work, whether it’s for one specific purpose or across multiple apps and services.

Data exchange is crucial across any financial ecosystem and Open Banking plays a vital role by providing a new additional layer of data. Enabling a secure and safe flow of data across accounts and apps efficiently will fuel innovation for banks and provide many new benefits across the industry, such as improving financial literacy and extend financial inclusion to the underserved.

Can you explain the differences between Open Banking and Open Finance?

Open Banking and Open Finance are the latest buzz topics when it comes to fintechs and innovations in the Banking industry. Open Finance has been developed from Open Banking and will provide an extra layer of data available to consumers and organizations, Open Finance will include other financial data, such as mortgages, savings, pensions, insurance, utilities, etc. This will enable consumers to provide access to their entire financial footprint and provide them with an even better customer experience.

To better serve the unbanked or underserved, Open Finance will further level the playing field and make it easier for these consumers to have access to affordable and sustainable credit, providing everyone access to the services they require and deserve. With more access to finance, we can expect to see better economic growth across MENA.

Paul Randall marks 15 years at Creditinfo Group

We recently sat down with our CEO, Paul Randall and asked him 15 questions to mark his 15 years at Creditinfo Group. Get to know a little more about Paul as he celebrates this milestone:

- Describe yourself in 3 words? Competitive. Curious. Optimistic.

- What was your first job? JD Williams in Manchester -a clothing retail outlet that sold clothes on credit.

- How many countries have you worked in? Over 50 countries and counting.

- How long have you worked in the credit industry? Over 35 years; not only just the credit industry, but also in telcos, retail, and utilities.

- What has been your most shocking discovery working in this industry so far? I think some of the practices on collections. I feel that collections processes need to be more humane. There is also the fact that there are additional costs to customers particularly those who are borrowing short term. There is a place for short term lending, which has a higher cost than low risk lending, however this needs to be done fairly.

- What has been your highest moment working at Creditinfo Group? Meetings with central banks particularly in West Africa in Senegal. The BCEAO is very prestigious organization, which is very well respected, and for us to demonstrate that we could provide meaningful services to that region, was very important. Other great moments were winning major tenders with organizations such as Pefindo and Safaricom.

- Out of all the markets we are present in, which one intrigues you the most and why? So many markets intrigue me in different ways. I think the variety is what intrigues me the most – working from SME’s, business lending, all the way to trade credit, and everything in between.

- Working at Creditinfo opens doors to meeting a lot of personalities to look up to. Who have you met so far that has influenced your career? There are a number of personalities in the in industry that I’ve met and worked with. I have been lucky to have had a lot of good leaders. I have also learnt from team members, that gave me important feedback. When I was in banking, I had a risk management director Caroline Hendra, who was really inspiring as she went into a very male dominated banking environment in the 90’s, and through her intelligence, she transformed the business. Graham Platts, was also a big influence in terms of understanding of risk management and credit scoring. When I was at Experian, Mark Gaudart made it clear that it’s not only about having knowledge, but also how you communicate that information that is critical to ensuring that the message is passed. I have also learnt a lot from Reynir Grétarsson on being entrepreneurial, taking risks and having emotional intelligence when it comes to negotiation.

- How do you as Paul maintain the equilibrium between work and life? I spend my spare time on sporting activities (practicing and watching). I also make time for my family and friends, and this to me brings balance.

- As our Group CEO, how can you say this role has transformed you? I’ve learned a lot about business; understanding the appropriated strategy and how to make that happen; dynamics of people within the business and I have also been so impressed by the quality of the teams that we have and how hard they work.

- What has been your greatest motivation? Seeing the success of team members will always continue to motivate me. Witnessing their growth in different stages is always something that pushes me as well so that we all excel in the end.

- What are you currently reading? True History of the Kelly Gang – Winner 2001 Man Booker Prize (UK).

- What is your morning routine? Training in the morning – through zoom videos while overlooking the sea at 7:00 o’clock in the morning as the sun is rising is quite fantastic!

- What fun fact can you share that we don’t know about Paul Randall? As you can see from the countries I have been in, I am curious and always learning about new cultures and trying out different cuisines (anything with seafood always a favorite!)

- Parting shot? Give us a quote in Paul’s words. I like the phrase – “It is better to have fought and lost than to have never fought at all.” But I like to win!

Closing the lending gender gap

To make our economy truly financially inclusive, there are many things we need to address – from ensuring people are paid equally to removing biases from the financial ecosystem. One of those biases that urgently needs to be tackled is in the lending market, to ensure that women are not disproportionately prevented from accessing credit and financing products.

Women are key contributors to the economy, making up 40 percent of the world’s workforce – particularly in developing economies. Not only are women typically responsible for the bulk of household purchasing, but their employment falls in sectors that are crucial for economic growth and development.

That said, we often find that women’s involvement in the flow of capital around the economy to be less than we might expect – with reasons stemming from cultural barriers to participation to structural issues in the financial ecosystem. While cultural issues may be more difficult to overcome, there are things we can be doing to address these structural issues holding back the female economy.

The credit industry, from regulators to lenders and to credit bureau all contribute to make changes. In this article, we discuss some of the challenges of the current situation to some of the potential solutions.

In some markets, the gender pay gap is particularly pronounced – a Creditinfo analysis of the Lithuanian market found that of the 81 sectors into which economic activity breaks down, men are paid more than women in 72, and average pay for men often exceeds women by 30-50 percent. In some sectors, such as air transport, gaming, and gambling, men’s pay can be up to 127 percent above their female colleagues. Closing this gap is going to be key to rebalancing the economy and realising a more financially inclusive world. There is work being done as part of the ESG initiatives (ESG = Environmental, social and corporate governance) that is starting to make salary gaps more transparent, as well as representation of women on company boards. Credit bureau, such as Creditinfo Lithuania, are providing specific segments on credit reports to ease access to this information.

However, even outside of pay issues, there are significant problems in the lending markets – and here data can help provide a way forward.

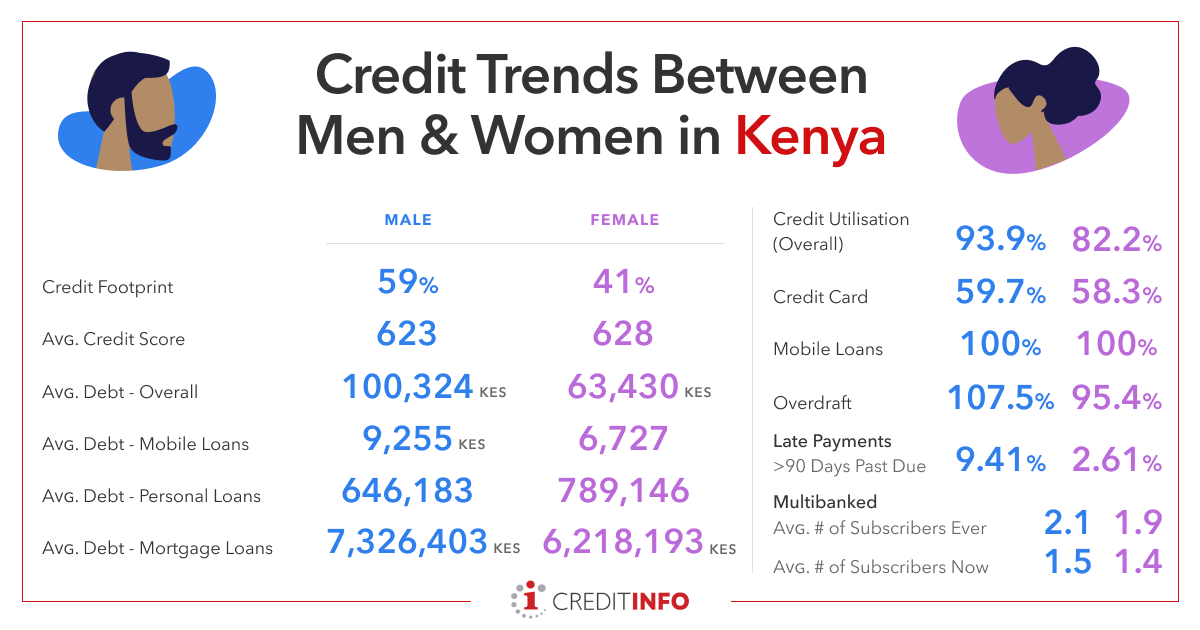

Creditinfo analysis of the lending market in Kenya yielded some very interesting findings. Despite women having higher average credit scores than men (628 vs 623), they have significantly smaller credit footprints (41% vs 59%) and utilisation (82.2% vs 93.9%). This is quite a marked difference and can have a widespread adverse impact.

If women are not able to access financing on a personal level, then their spending power is diminished and their non-participation in the economy will be felt. If they are not able to access financing on a professional level too, the effects are compounded – and the economic imbalance will continue to hold back economic growth and development.

Many other developing economies are experiencing the same issues. In Morocco, for example, the lending market similarly favours men, with women only making up 31% of the active borrowing market.

This needs to change.

To make our world fairer and our economy work for everyone, we need to remove these structural barriers to financing. In general moving to digital lending and minimising subjective human intervention in lending vastly improves the equality. Credit scores will reflect the actual risk of individuals based on actual data. It is important that historic bias is not built into algorithms, model developers need to be aware of the potential of this and remain vigilant.

Regulators have a role as well, over dependence on DTI (debt to income) in their supervisory rules can build in a strong gender bias. The evidence has already been shown that women are lower paid. With DTI rules, large proportions of women can be forced to high interest rate lending or pushed out of formal market to the informal credit market without legal protection.

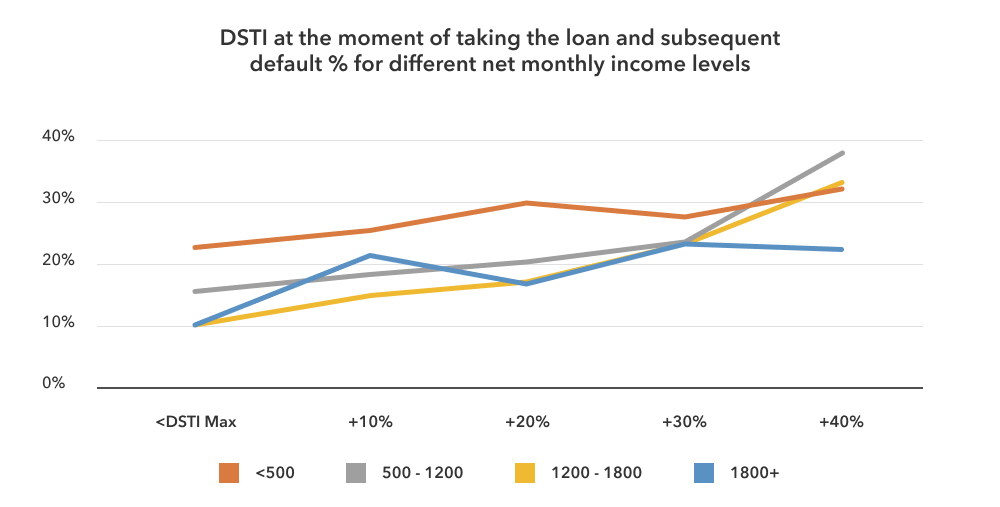

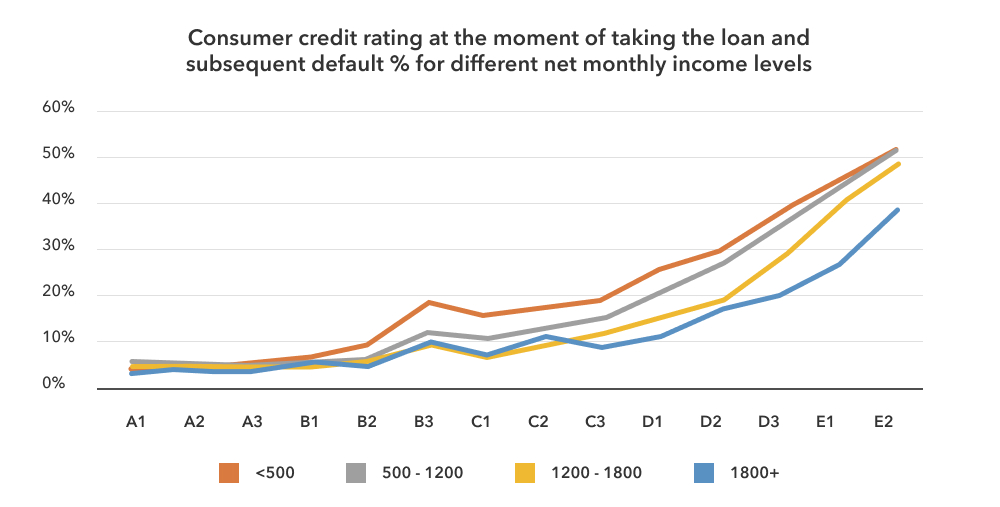

We see the evidence from Latvia where the credit score (fig 1) is highly predictive of future non-payment and should be a significant element of credit decision, it is proven to be predictive at all income levels. DTI ( Fig 2) is much less predictive and would eliminate many lower income women from formal credit where strict rules around DTI exist.

The best way to start making changes is by using data, whether ESG information or credit scoring. If we can understand the situation clearly and how the picture needs to change, we can begin to address it. We can also measure and manage progress against key performance indicators.

For lenders, this can be a significant opportunity – that a whole section of the economy, with good credit scores and low credit utilisation has been continually underserved, means they can be very targeted with new products and services that cater to that nascent market and generate new revenue streams while tackling financial inclusion.

This is something we believe very strongly in and are working with partners to help address. If we can help de-risk the lending ecosystem, we can make the economy fairer for all and reap the significant benefits that unlocks.

Visit www.creditinfo.com for more information.

Emma Camilleri,

HR Director, Creditinfo Group.

Top trends that will shape banking in 2022

We sat down with our Direct Markets Director at Creditinfo Group, Samuel White, to discuss some of the key trends that will shape banking in the MENA and Asia region. These were some of his thoughts:

New market players from non-traditional lenders such as telco or payment providers

We are seeing an increasingly number of non-banks entering the markets. There has been a clear sign that these companies have a wealth of internal data through their platforms and usually e-wallet transactions. It has been proven that this data is extremely valuable during the risk assessment process.

SME finance

SMEs are playing an instrumental role in local economies but still struggle to receive the access to banking products in a timely fashion. In the region every country is looking at how better to serve these customers and provide them with the solutions they require.

Digital Banks, Neo Banks, Born Digital Banks

Many of the traditional lenders are based on legacy technologies and we have seen an accelerated approach to digital transformation over the last 2 years. We have also seen some banks create new digital arms to their organization setup with new technology away from legacy portfolios. These Born Digital Banks are increasing in the region, and anybody left behind can expect to lose some market share in the future.

BNPL

Buy Now Pay Later (or as some are calling it Save now pay later) is not a new concept but there is no doubt it is growing with popularity. The demand for flexible payment offerings is at an all-time high. Typically, these smaller value loans are based on impulse buying so lenders must make sure they have the process in place to offer instant decisioning.

We also asked him how Creditinfo is playing a role in shaping these trends:

How is Creditinfo helping banks lead in the digital era?

At Creditinfo we are focusing on helping banks streamline and improve the credit process across the full credit lifecycle, from origination through scoring, risk, decisioning and portfolio management. We are offering enhanced digital channels to meet the customer demands and reach the underserved or unbanked segments. We recognize it has become more accessible for individuals and SMEs to make use of digital financial services and by working with Banks we can develop software and applications to deliver services that are more transparent and automated.

What is Creditinfo’s business model and how do you see this model shaping the banking industry?

Creditinfo is a provider of credit information and risk management solutions worldwide, one of our primary goals is to help facilitate access to finance. We have built credit bureaus globally and across different markets, giving us key insights and knowledge into best practices. Creditinfo has a vision to create successful partnerships with lenders, governments, central banks to help increase financial inclusion and generate economic growth by allowing credit access for individuals and SMEs.

Creditinfo wants to continue building products and working with partners to add further solutions and data to enable lenders to further lend in a responsible fashion. Lenders are shifting their attitude towards FinTechs to keep pace with change and remain competitive. There is a huge variety of FinTech offerings available today using wide range of data that’s delivered through applications to provide lending decisions in only a few seconds.

Internet safety tips

Safer Internet Day this year is being celebrated on 8th February 2022, and it is already the 19th edition, since its introduction on 6th February 2004. The first one was celebrated in 13 EU countries and Australia, and today in approximately 200 countries worldwide. As the name suggests, the purpose of this campaign is to spread awareness and make the internet a safer place for its users.

In recent years, the awareness on cyber security, hackers, and the need to secure your digital identity have grown significantly but there is still a lot that goes unnoticed. Social networking, inappropriate content and finally, cyberbullying are still a threat to many non-vigilant users. Among the people who are the most vulnerable online there are children and the elderly. These are the groups I would suggest families to focus on.

Talk to your kids and elderly about the risks they can face on the internet and social media and explain to them for the start that:

- There is a reason for privacy and security settings so do set those up properly on browsers and social media

- If something is personal, keep it that way. Don’t post pictures of your kids, your holiday schedule, full address, or phone number, remember: “Once posted, always posted”

- You never know who is watching, check your privacy setting often and just share your news with a trusted group of people

- Make sure you know the people you are in contact with online

- Your online reputation is important also for your future career or business venture, so think before you post

If you happen to come across something disturbing, most countries have Safer Internet Centers where you can report any inappropriate content (https://www.saferinternetday.org/en-GB/in-your-country), do not hesitate to do so. There may be some case where authorities or police should be involved as well.

For further insights on how social media and algorithms use your information online, I suggest you watch the Netflix documentary “Social Dilemma” and acknowledge the impact of your actions online.

There is a lot happening in the cyber environment daily, so always stay vigilant. I wish you safe browsing and safe online interactions.

Jakub Burian,

Chief Security Officer, Creditinfo Group.