“Smartphone information can be sufficient to make a credit decision”

ARTICLE – IQ MAGAZINE INTERVIEW IN LITHUANIA WITH STEFANO STOPPANI

ECONOMICS | DATA ECONOMICS

“Smartphone information can be sufficient to make a credit decision”

Millennials will eventually stop from carelessly distributing information about themselves, but accessible data have a bright side too, thinks Stefano M. Stoppani, the CEO of “Creditinfo Group”, uniting 33 credit bureaus around the world. A discussion held by IQ reporter, Vilius Petkauskas.

Recently, “The Economist” compared data to oil and affirmed that the importance of the former in the XXI century will overpower the black gold. Would you agree with such a statement?

Creditinfo Group Expands Middle Eastern Presence with New Regional Office

PRESS RELEASE

Creditinfo opens new facility in Muscat, Oman to enhance services offered to customers in region

Muscat, Oman, 12 March 2019 – Today, Creditinfo Group, a leading provider of global credit information and fintech services, announces that it is expanding its footprint in the Middle East with the creation of Creditinfo Gulf, the organisation’s regional hub in Muscat, Oman. The new office will support current and prospective Creditinfo clients, with access to a wealth of global expertise, knowledge and technology to enhance the existing financial infrastructure in the region.

Credit Information Bureau of Sri Lanka strengthens financial infrastructure with Creditinfo Group

PRESS RELEASE

Credit Information Bureau of Sri Lanka (CRIB) and CreditInfo enter into strategic partnership to enhance its credit bureau services in the country.

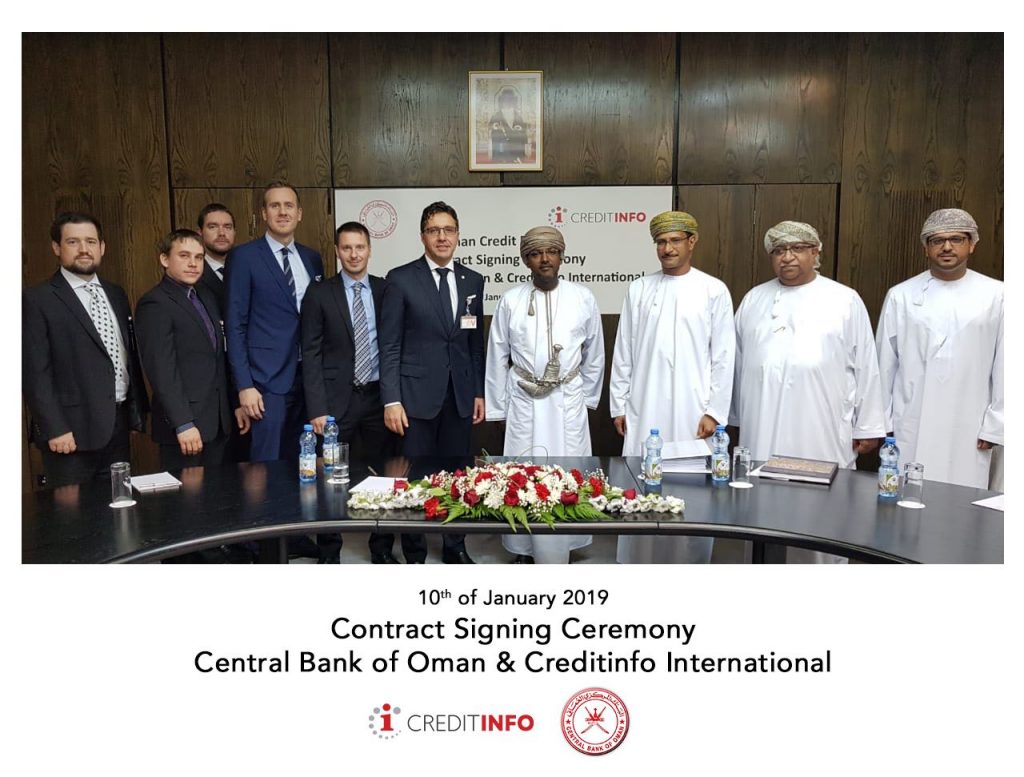

Creditinfo Group wins contract with Central Bank of Oman for the Implementation & Support of Oman Credit Bureau “OCB”

PRESS RELEASE

Creditinfo joins forces with Central Bank of Oman (CBO) to implement a world class Credit Bureau in the Sultanate

From Unemployed to Financially Empowered: Meet Dorah, Creditinfo Success Story

So many great stories on financial inclusion across the globe are left untold. So rewarding to be able to share with you at least some of those, where Creditinfo can contribute and make a difference. Watch the story of Dorah.

Creditinfo featured by FORBES on Financial Inclusion and Innovation

How can citizens across Central and Eastern Europe access finance without a credit history? Our very own Paul Randall spoke with FORBES and Joe R. Wallen to explain. Read the full article.

Creditinfo Georgia has successfully passed a Registration Process by the National Bank of Georgia

Since September 3, 2018, Creditinfo Georgia is an officially registered credit information bureau by the National Bank of Georgia. Creditinfo Georgia, founded in 2005 by leading banks and Creditinfo International, is the only credit bureau operating in Georgia. Its mission is to support and assist the credit organizations in simplification and refinement of their lending process and managing credit. Creditinfo Georgia assists financial organizations by providing all necessary tools and information for credit risk management, and at the same time strives to increase financial literacy among existing or potential borrowers. Creditinfo Georgia helps National Bank of Georgia in improving credit management and lending process, by providing all necessary data, which is used by the National Bank to identify problems and weaknesses in lending sector and make information decisions for solving these problems.

National Bank accepted a road map provided by the company regarding implementation of all necessary procedures to comply to regulatory requirements. Creditinfo Georgia continues its operations and plans activities in two major direction: increasing of credit education in the country and delivering necessary instruments, information and expertise for credit risk management.

Traditional banking is history with the introduction of new data sources and increased access to data

Our CEO Stefano M. Stoppani was interviewed by Pétur Hreinsson from ViðskiptaMogginn, one of the main business newspapers in Iceland. We are uploading an English translation of this interview.

Agrifinance and Scoring: Georgia’s Case

When you walk down lively Tbilisi downtown all your senses are filled with a mixture of western and eastern cultures. You can see something amusing on every corner — an old orthodox church, sulfur baths and of course many street traders selling all kind of stuff. You should try churchkhela, candle-shaped candy made of nuts and grape juice. Small traders together with farmers, shop owners and craftsmen are the hallmark of Georgia and they are a vital part of country’s economy.

Micro-lenders should work with regulators

Recently, there has been much publicity about the 1.5 million Kenyans who have been negatively listed on the Credit Reference Bureau (CRB) as a result of borrowing from micro-lenders.

— by Kevin Mutiso