Never Has There Been Stronger Evidence for Mobile Loans in West African Economic and Monetary Union region

With many countries in the West African Economic and Monetary Union (WAEMU) region in lockdown, bank branches empty and movement constrained; the case for a true, robust mobile lending ecosystem is stronger than ever. In global markets where mobile lending is nascent or inexistent, and the credit market is relegated to physical interaction between underwriter and customer, physical confinement and countrywide lockdowns are the equivalent of death sentences. Credit markets are frozen because critical communication is impossible. On the other hand, where digital wallets and e-money are common, no such barriers exist.

How alternative data can help unbanked population acquire traditional loans

By Dmitry Borodin, Head of Risk Analytics at Creditinfo Group

In societies of Digital Nomads, working from home Millennials, global migrations and emerging economies, lenders are often facing a shortage of relevant data to score and assess a big pool of population. Consequently, lenders are often unable to make decisions on so called ‘thin files’ due to a lack data. Thin file customers then remain excluded from formal finance.

The financial inclusion conundrum in developed economies

By Stefano Stoppani – CEO, Creditinfo Group

Last month, consumer champions Which? revealed the findings of research into the state of the UK banking sector – with a somewhat bleak conclusion. The top line of the study? A third of all UK bank and building society branches have closed over the last four and half years. Of those that remain on our high streets, opening times have narrowed.

Creditinfo And Artificial Intelligence (AI)

Artificial Intelligence (AI) is currently growing at a fast rate, and is becoming a hot subject in the industry globally. Individuals and organizations alike, are now moving towards that direction in order to increase efficiency and maximize on profits while lowering costs for themselves and their businesses.

Credit Bureau: Towards a new generation of services

Translated version of the interview with Sidimohamed Abouchikhi, CEO of Creditinfo Morocco.

Image credit: Finance News.

Interview by Momar Diao

Assessing credit risk of SME’s and how credit scoring can transform SME’s

Paul Randall was recently at the Kafalah SME Financing Conference in Riyadh, Saudi Arabia, and he tackled these 2 questions during the panel discussion.

What are the specific challenges of assessing credit risk of SMEs as compared to larger firms and how can fintech can help lenders address those?

Paul Randall at the Kafalah SME Financing Conference 2019

Kafalah SME Financing Conference was held in Riyadh, Saudi Arabia where they discussed current financing for SME’s in Saudi Arabia,how to build relationships between private and public FIs, government agencies and legislative bodies that support financing, current and future finance opportunities for specific business sectors and how to increase awareness of the most current international practices for financing SMEs.

Creditinfo expands regionally, stores information in Jamaica

In his interview with The Gleaner, CEO of Creditinfo Jamaica – Craig Stephen highlighted on the regional success and the goal to venture into other caribbean markets in the near future.

When challenge meets opportunity: Meet Ruby, a Creditinfo success story

The true spirit of an entrepreneur comes down to passion and determination. At Creditinfo, we meet entrepreneurs every day, and it’s our goal to support these budding business men and women with the appropriate tools, knowledge and access to finance.

How to use your credit score to negotiate better terms with your financial institution

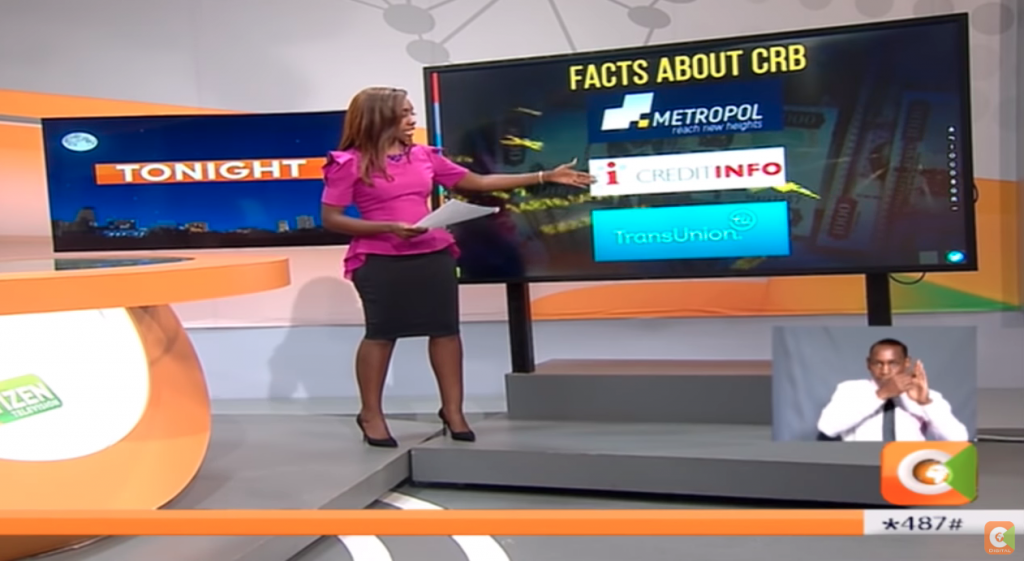

Last week, a leading TV station in Kenya – Citizen TV did a story on Digital Lending Apps and their impact in Kenya. There has been a sharp rise in the number of mobile lending apps in the country and the worry is about how people are accumulating debt and borrowing from the various apps simultaneously and defaulting therefore affecting their credit score.