How alternative data can help unbanked population acquire traditional loans

By Dmitry Borodin, Head of Risk Analytics at Creditinfo Group

In societies of Digital Nomads, working from home Millennials, global migrations and emerging economies, lenders are often facing a shortage of relevant data to score and assess a big pool of population. Consequently, lenders are often unable to make decisions on so called ‘thin files’ due to a lack data. Thin file customers then remain excluded from formal finance.

Assessing credit risk of SME’s and how credit scoring can transform SME’s

Paul Randall was recently at the Kafalah SME Financing Conference in Riyadh, Saudi Arabia, and he tackled these 2 questions during the panel discussion.

What are the specific challenges of assessing credit risk of SMEs as compared to larger firms and how can fintech can help lenders address those?

Creditinfo expands regionally, stores information in Jamaica

In his interview with The Gleaner, CEO of Creditinfo Jamaica – Craig Stephen highlighted on the regional success and the goal to venture into other caribbean markets in the near future.

How to use your credit score to negotiate better terms with your financial institution

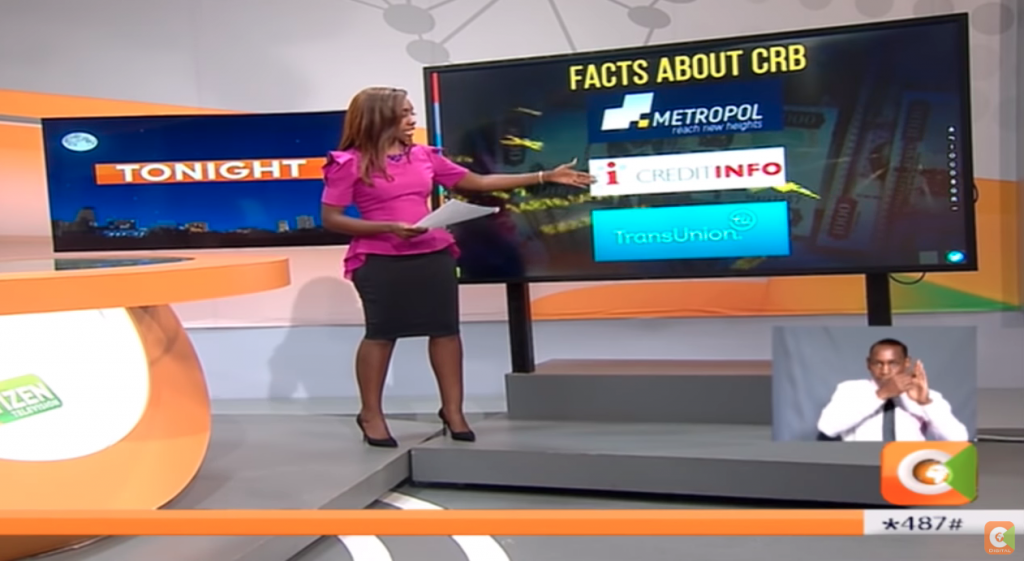

Last week, a leading TV station in Kenya – Citizen TV did a story on Digital Lending Apps and their impact in Kenya. There has been a sharp rise in the number of mobile lending apps in the country and the worry is about how people are accumulating debt and borrowing from the various apps simultaneously and defaulting therefore affecting their credit score.

Jamaicans urged to take credit scores seriously

Creditinfo Jamaica – Craig Stephen was interviewed by The Jamaica Gleaner on importance of Credit Scores

Credit reporting in Jamaica -Discussion with Creditinfo CEO- Craig Stephen

The Exchange on Jamaica News Network – Credit Reporting in Jamaica. CEO of Creditinfo Jamaica Limited- Mr. Craig Stephen along with Chief of Credit Risk Management, JN Bank Limited-Mrs. Keisha Melhado-Forest and Managing Director of a local microfinance company, Paradigm Capital Limited-Ms. Gail Dixon sat down to discuss Credit Reporting in Jamaica.

“Smartphone information can be sufficient to make a credit decision”

ARTICLE – IQ MAGAZINE INTERVIEW IN LITHUANIA WITH STEFANO STOPPANI

ECONOMICS | DATA ECONOMICS

“Smartphone information can be sufficient to make a credit decision”

Millennials will eventually stop from carelessly distributing information about themselves, but accessible data have a bright side too, thinks Stefano M. Stoppani, the CEO of “Creditinfo Group”, uniting 33 credit bureaus around the world. A discussion held by IQ reporter, Vilius Petkauskas.

Recently, “The Economist” compared data to oil and affirmed that the importance of the former in the XXI century will overpower the black gold. Would you agree with such a statement?

Consumer lenders in Latvia obliged to exchange full positive credit history via Credit Bureaus

PRESS RELEASE

Changes in Consumer Protection Law adopted by Saeima (Latvian Parliament) obliging consumer lenders to exchange positive credit information about consumer and to use this information in assessment of creditworthiness is a positive step, said “Kredītinformācijas Birojs”.

Agrifinance and Scoring: Georgia’s Case

When you walk down lively Tbilisi downtown all your senses are filled with a mixture of western and eastern cultures. You can see something amusing on every corner — an old orthodox church, sulfur baths and of course many street traders selling all kind of stuff. You should try churchkhela, candle-shaped candy made of nuts and grape juice. Small traders together with farmers, shop owners and craftsmen are the hallmark of Georgia and they are a vital part of country’s economy.

Psychometric Solution Already Available at Kenyan Credit Bureau

The Kenyan market is amongst the first in Africa to benefit from a fully integrated psychometric module within a credit bureau system, thus enabling more accurate credit decisioning and broader access to finance, thanks to an additional layer of information on the consumer, coming from the consumer himself/herself: information on one’s personality.