Jamaicans urged to take credit scores seriously

Creditinfo Jamaica – Craig Stephen was interviewed by The Jamaica Gleaner on importance of Credit Scores

Creditinfo Group Expands Middle Eastern Presence with New Regional Office

PRESS RELEASE

Creditinfo opens new facility in Muscat, Oman to enhance services offered to customers in region

Muscat, Oman, 12 March 2019 – Today, Creditinfo Group, a leading provider of global credit information and fintech services, announces that it is expanding its footprint in the Middle East with the creation of Creditinfo Gulf, the organisation’s regional hub in Muscat, Oman. The new office will support current and prospective Creditinfo clients, with access to a wealth of global expertise, knowledge and technology to enhance the existing financial infrastructure in the region.

Credit Information Bureau of Sri Lanka strengthens financial infrastructure with Creditinfo Group

PRESS RELEASE

Credit Information Bureau of Sri Lanka (CRIB) and CreditInfo enter into strategic partnership to enhance its credit bureau services in the country.

New insurance claims database launched in Iceland

As of January 15 2019, the four Icelandic general (non-life) insurance companies will start using a new claims database for the Icelandic Financial Services Association (SFF) run by Creditinfo. The database will be used to counter organized insurance fraud, as it has been on the increase in relation to organized crime. According to a statement by the Icelandic Police, these groups seem to have found a loop hole in insurance fraud cases in Iceland.

Creditinfo combats Synthetic Identity Fraud for the Kenyan mobile lending market

PRESS RELEASE

According to a recent article by Mckinsey, many fraudsters are now using fictitious, synthetic IDs to draw credit. Applying for credit using a combination of real and fake, or sometimes entirely fake, information creates synthetic IDs. The act of applying for credit automatically creates a credit file at the bureau in the name of the synthetic ID, so a fraudster can now set up accounts in this name and begin to build credit.

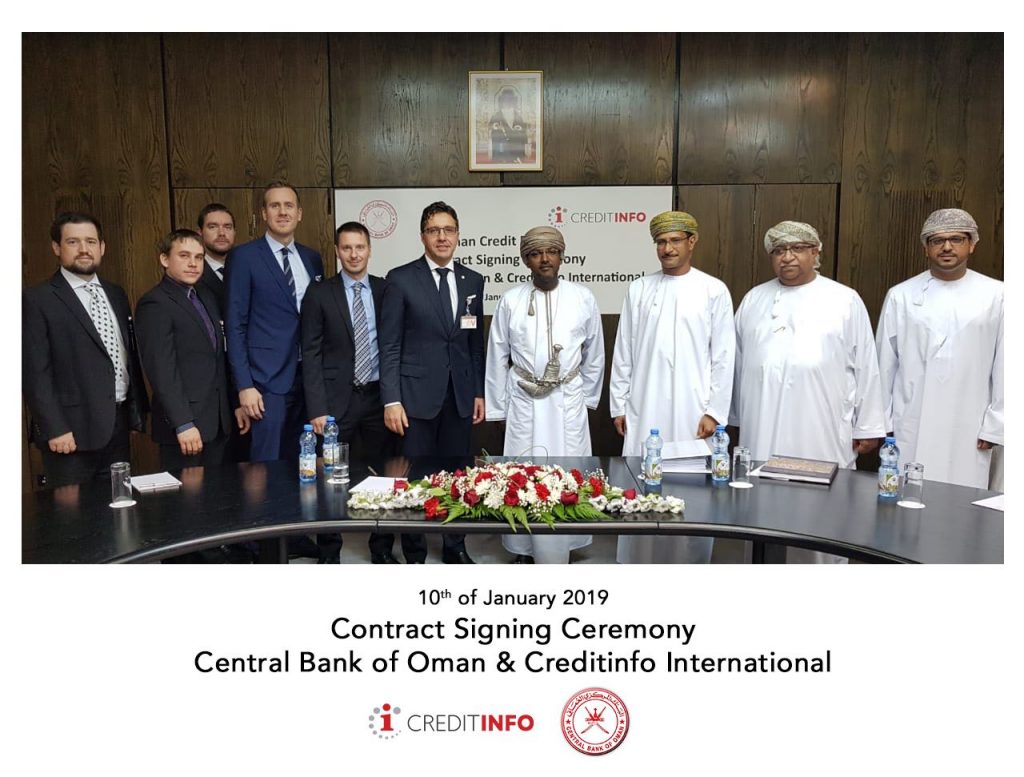

Creditinfo Group wins contract with Central Bank of Oman for the Implementation & Support of Oman Credit Bureau “OCB”

PRESS RELEASE

Creditinfo joins forces with Central Bank of Oman (CBO) to implement a world class Credit Bureau in the Sultanate

Creditinfo inks contract with Housing Finance Kenya

The Housing Finance Company in Kenya have introduced mobile lending this summer and chose to use Creditinfo’s Instant Decisions as the one and only decision-making tool. They chose an in-house installation back in June and then, after several weeks of consultancy and strategy design project, we have come together with the customer to the point where we have a very complex strategy with 3 different Credit Limit Allocation matrices, matching competition’s limit and limit allocation as a function of previously received loans. After successful pilot in July, August they opened it for a wider population, and just recently, in November, to the entire Kenyan population, through all channels – iOS, Android and USSD – and they had a big marketing campaign for USSD customers that had its apogees last week, starting November 18th 2018.

Guyana – Successes driven by One Creditinfo at Work

Creditinfo from data provider to trusted industry leaders; a case study from Guyana

Ben Riley, Global Consultant Creditinfo and David Falconer, Sales Manager Creditinfo Guyana

In many ways the country of Guyana is unique. Considered part of the Caribbean region even though it is on the South American mainland. The only English speaking country in South America more interested in cricket than football. On the lowest population density countries on earth (just behind Iceland) but with 30% of that population residing in the capital city of Georgetown. However in the area of Credit, Guyana is proving again that a Creditinfo Credit Bureau can by the driving force behind market development and the opening up of affordable credit to all.

Creditinfo Estonia celebrates the 25th anniversary

Creditinfo Estonia – the oldest company in the Creditinfo Group – celebrates the 25th anniversary this year. Creditinfo Eesti AS was established in 1993 (operated under the name Krediidiinfo AS until December 2016). Many years’ experience has helped the company to become the largest and most professional Estonian supplier of credit information.

Creditinfo Estonia has been a loyal long-term partner to Estonian companies helping them to make smart and intelligent business decisions. Creditinfo Eesti AS is the Estonian market leader in the sector of information collection, processing and intermediation.

On 17th of October, Creditinfo Estonia celebrated its 25th anniversary with the clients in a client-conference: Creditinfo 2.0.43. Our goal was to look back to the eventful history, and to begin with the creation of a new version of Creditinfo Estonia for the next 25 years – Creditinfo, version 2.0.43!

The main topics of the conference covered the preview into the next years – possibilities of using alternative data solutions in credit ratings and cross-border data exchange, we talked about innovations and advances in data ecosystems and analytics. Additionally, we took a closer look into what is happening in the credit-industry in the world.

The conference was a perfect thank you gesture for all the clients, who are the roots of our success. Trust and loyalty from the clients give us the inspiration and courage to create innovative solutions impacting the business and social environment around us.

Creditinfo acquires VisualDNA Credit & Risk business for psychometrics and alternative data

Creditinfo, the international credit information and risk management solutions’ provider, announces the acquisition of VisualDNA’s Credit and Risk business, a leader in the development and use of psychometrics and alternative data to assess behavioural risk in the consumer lending, insurance and retail sectors. Continue reading »