The Creditinfo Chronicle

Creditinfo combats Synthetic Identity Fraud for the Kenyan mobile lending market

PRESS RELEASE

According to a recent article by Mckinsey, many fraudsters are now using fictitious, synthetic IDs to draw credit. Applying for credit using a combination of real and fake, or sometimes entirely fake, information creates synthetic IDs. The act of applying for credit automatically creates a credit file at the bureau in the name of the synthetic ID, so a fraudster can now set up accounts in this name and begin to build credit.

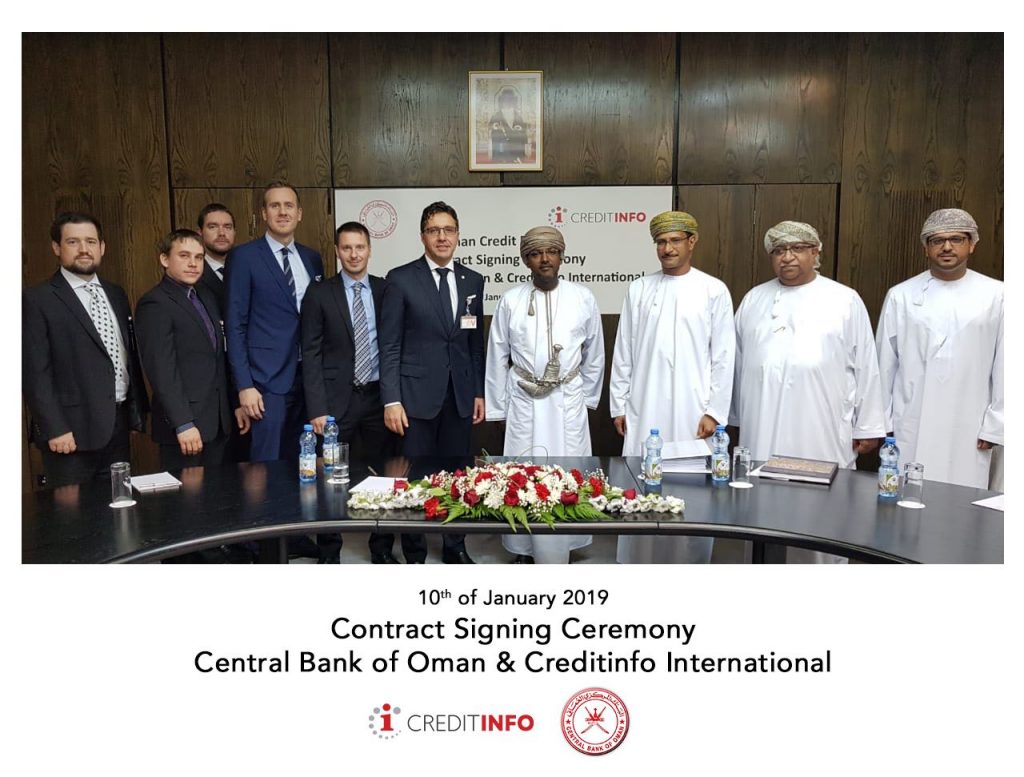

Creditinfo Group wins contract with Central Bank of Oman for the Implementation & Support of Oman Credit Bureau “OCB”

PRESS RELEASE

Creditinfo joins forces with Central Bank of Oman (CBO) to implement a world class Credit Bureau in the Sultanate

PRESS RELEASE: Know your credit score to make better informed financial decisions

PRESS RELEASE

DPI, Guyana, Thursday, November 22, 2018

– all lending agencies are mandated by law to share all credit data with the credit bureau

– “a lender cannot pull your credit report without your consent”

– know your credit score – it prevents over-indebtedness and encourages responsible borrowing and brings stability to the financial sector

– credit bureau was established in 2013 and operates under the Credit Report Act of 2010 and the Credit Reporting [Amendment] Act of 2016

Creditinfo inks contract with Housing Finance Kenya

The Housing Finance Company in Kenya have introduced mobile lending this summer and chose to use Creditinfo’s Instant Decisions as the one and only decision-making tool. They chose an in-house installation back in June and then, after several weeks of consultancy and strategy design project, we have come together with the customer to the point where we have a very complex strategy with 3 different Credit Limit Allocation matrices, matching competition’s limit and limit allocation as a function of previously received loans. After successful pilot in July, August they opened it for a wider population, and just recently, in November, to the entire Kenyan population, through all channels – iOS, Android and USSD – and they had a big marketing campaign for USSD customers that had its apogees last week, starting November 18th 2018.

Guyana – Successes driven by One Creditinfo at Work

Creditinfo from data provider to trusted industry leaders; a case study from Guyana

Ben Riley, Global Consultant Creditinfo and David Falconer, Sales Manager Creditinfo Guyana

In many ways the country of Guyana is unique. Considered part of the Caribbean region even though it is on the South American mainland. The only English speaking country in South America more interested in cricket than football. On the lowest population density countries on earth (just behind Iceland) but with 30% of that population residing in the capital city of Georgetown. However in the area of Credit, Guyana is proving again that a Creditinfo Credit Bureau can by the driving force behind market development and the opening up of affordable credit to all.

Consumer lenders in Latvia obliged to exchange full positive credit history via Credit Bureaus

PRESS RELEASE

Changes in Consumer Protection Law adopted by Saeima (Latvian Parliament) obliging consumer lenders to exchange positive credit information about consumer and to use this information in assessment of creditworthiness is a positive step, said “Kredītinformācijas Birojs”.

Creditinfo Estonia celebrates the 25th anniversary

Creditinfo Estonia – the oldest company in the Creditinfo Group – celebrates the 25th anniversary this year. Creditinfo Eesti AS was established in 1993 (operated under the name Krediidiinfo AS until December 2016). Many years’ experience has helped the company to become the largest and most professional Estonian supplier of credit information.

Creditinfo Estonia has been a loyal long-term partner to Estonian companies helping them to make smart and intelligent business decisions. Creditinfo Eesti AS is the Estonian market leader in the sector of information collection, processing and intermediation.

On 17th of October, Creditinfo Estonia celebrated its 25th anniversary with the clients in a client-conference: Creditinfo 2.0.43. Our goal was to look back to the eventful history, and to begin with the creation of a new version of Creditinfo Estonia for the next 25 years – Creditinfo, version 2.0.43!

The main topics of the conference covered the preview into the next years – possibilities of using alternative data solutions in credit ratings and cross-border data exchange, we talked about innovations and advances in data ecosystems and analytics. Additionally, we took a closer look into what is happening in the credit-industry in the world.

The conference was a perfect thank you gesture for all the clients, who are the roots of our success. Trust and loyalty from the clients give us the inspiration and courage to create innovative solutions impacting the business and social environment around us.

From Unemployed to Financially Empowered: Meet Dorah, Creditinfo Success Story

So many great stories on financial inclusion across the globe are left untold. So rewarding to be able to share with you at least some of those, where Creditinfo can contribute and make a difference. Watch the story of Dorah.

Creditinfo featured by FORBES on Financial Inclusion and Innovation

How can citizens across Central and Eastern Europe access finance without a credit history? Our very own Paul Randall spoke with FORBES and Joe R. Wallen to explain. Read the full article.

Creditinfo Georgia has successfully passed a Registration Process by the National Bank of Georgia

Since September 3, 2018, Creditinfo Georgia is an officially registered credit information bureau by the National Bank of Georgia. Creditinfo Georgia, founded in 2005 by leading banks and Creditinfo International, is the only credit bureau operating in Georgia. Its mission is to support and assist the credit organizations in simplification and refinement of their lending process and managing credit. Creditinfo Georgia assists financial organizations by providing all necessary tools and information for credit risk management, and at the same time strives to increase financial literacy among existing or potential borrowers. Creditinfo Georgia helps National Bank of Georgia in improving credit management and lending process, by providing all necessary data, which is used by the National Bank to identify problems and weaknesses in lending sector and make information decisions for solving these problems.

National Bank accepted a road map provided by the company regarding implementation of all necessary procedures to comply to regulatory requirements. Creditinfo Georgia continues its operations and plans activities in two major direction: increasing of credit education in the country and delivering necessary instruments, information and expertise for credit risk management.

Traditional banking is history with the introduction of new data sources and increased access to data

Our CEO Stefano M. Stoppani was interviewed by Pétur Hreinsson from ViðskiptaMogginn, one of the main business newspapers in Iceland. We are uploading an English translation of this interview.

Agrifinance and Scoring: Georgia’s Case

When you walk down lively Tbilisi downtown all your senses are filled with a mixture of western and eastern cultures. You can see something amusing on every corner — an old orthodox church, sulfur baths and of course many street traders selling all kind of stuff. You should try churchkhela, candle-shaped candy made of nuts and grape juice. Small traders together with farmers, shop owners and craftsmen are the hallmark of Georgia and they are a vital part of country’s economy.

IFRS 9 — Why Credit Bureaus Are The Ideal Partner?

Financial institutions around the globe are feeling the heat from the introduction of IFRS 9 impairment reporting. Credit Bureaus offer the most effective solution for compliance and harnessing the benefits of Credit Risk Scoring and PD estimation.

Dublin fintech Trezeo clinches vital UK regulatory approval

Gig economy fintech Trezeo has just become the first income-smoothing service to receive authorisation from the Financial Conduct Authority, the UK’s financial regulator.

How to identify the right VC’s for investment: The do’s and dont’s

I wrote an article last week on the key lessons I have learnt so far in the tech business and some people reached out to me to provide some advice when negotiating with a venture capitalist (VC) or an investor. This is from my own personal experience and observations and thus critical feedback and debate are welcome, particularly from investors themselves.

— by Kevin Mutiso