The Creditinfo Chronicle

Micro-lenders should work with regulators

Recently, there has been much publicity about the 1.5 million Kenyans who have been negatively listed on the Credit Reference Bureau (CRB) as a result of borrowing from micro-lenders.

— by Kevin Mutiso

Icelandic company shows how fintech can lift people out of poverty

Read the article by IBS intelligence on how Coremetrix is launching a new service that could lift many of the ‘unbanked’ of developing nations out of poverty through an alternative method of credit assessment.

Are we there yet? Big Data and the Quest for Financial Inclusion

At financial sector conferences, you come across talk about the use and application of big data and the same question pops up – are we there yet? Are financial services’ providers applying data analytics in their daily management to streamline decision-making and improve efficiency?

Working with CREDO Bank

In 2017, we were approached by CREDO Bank to help them reviewing credit process for small urban and rural household customers. Having around 220,000 active clients can be a challenging task, especially maintaining a high retention rate in such a competitive environment as agricultural and individual consumer credit lending.

BUSINESS DAILY: Creditinfo unveils scoring system based on personality in Kenya

“The integration of innovative credit evaluation solutions based on personality features with a robust credit bureau system such as CBS will enable the Kenyan market to have a tangible competitive advantage in the area of credit,” said Kamau Kunyiha, CEO of Creditinfo Kenya. In partnership with Coremetrix.

Feels good to be #1 – the most widespread credit bureau provider

Feels good to be #1: with 33 credit bureaus running today, Creditinfo appears to be the most widespread global partner in this field worldwide. Most of Creditinfo bureaus are powered by the credit bureau system CBS, which is a flexible solution enabling to easily integrate most various sources of information.

Psychometric Solution Already Available at Kenyan Credit Bureau

The Kenyan market is amongst the first in Africa to benefit from a fully integrated psychometric module within a credit bureau system, thus enabling more accurate credit decisioning and broader access to finance, thanks to an additional layer of information on the consumer, coming from the consumer himself/herself: information on one’s personality.

Finance Companies In the Eyes of Banks

Happy partner of the Indonesian Financial Services Association in hosting the “Finance companies in the eyes of banks” event in Jakarta. Even happier to meet >250 industry professionals and looking forward to new opportunities for better financial inclusion. Thanks Johnny Lim for the snapshots and looking forward to follow-up meetings in our Singapore office or anywhere in the region, at your convenience.

Creditinfo’s Breakfast Seminar in Guyana

On Friday, April 27, 2018, Creditinfo Guyana hosted, current and potential subscribers from a broad range of utility, financial and other commercial entities, at a Breakfast Seminar in Georgetown to coincide with the visit of the Group CEO, Executive Director and Regional Manager for Latin America and the Caribbean. In attendance were representatives from 23 institutions.

Creditinfo’s Business Solutions Breakfast Seminar in Jamaica

Creditinfo Jamaica organised its first Business Solutions Breakfast Seminar, which was held in Kingston, Jamaica. The Seminar was held with a view of exposing subscribers and other critical industry officials to Creditinfo’s Value Added Products.

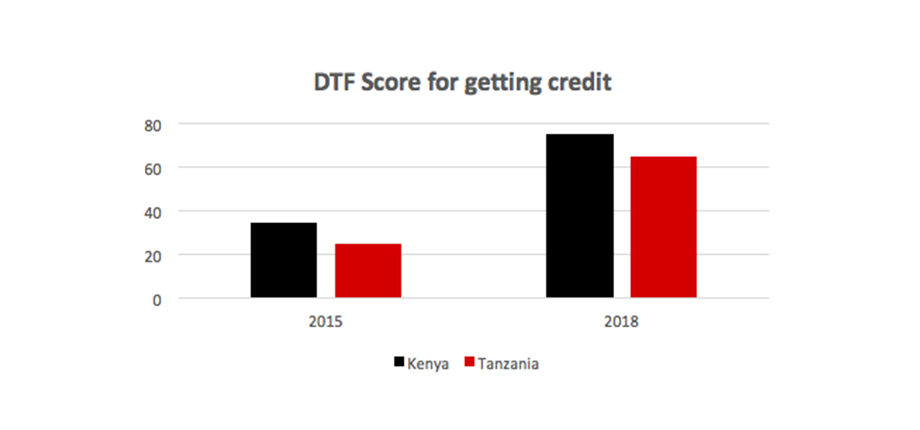

Proof that Credit Bureaus Improve Countries’ Distance to Frontier Score for Getting Credit

Within the Credit Bureau industry, we often talk about better financial inclusion and ways to facilitate access to finance, especially in light of the 2 billion “unbanked” population – a number reported in the Worldwide Findex Database by the World Bank and escalated by many industry players.

Atlas Mara instantly increased their credit limits thanks to Instant Decision Module

Our decision to partner with Creditinfo for Risk Management Services is hinged on their innovative value-added services, risk consulting and overall commitment of the leadership team. Creditinfo is a leader in automated risk-decisioning systems, data analytics and scoring services. Their risk consulting services is world class and manned by the best.

We use Instant Decision Module (IDM), their flagship product for risk-decisioning in our micro-lending business. IDM provides us the means to securely protect our risk decisioning rules, which, equates to our IP; IDM also enables us to set risk decisioning rules at granular level, and to track/measure outcomes for post-mortem reviews. It has a web-service interface that enables our loan application to interact with it in real-time. With IDM, risk becomes measurable and controllable.

— Ikedichi Kanu, Country Head at Atlas Mara Digital, Kenya

Bank Al-Maghrib signs an agreement for the Centralization Service for Irregular Checks

In order to contribute in strengthening the credibility of checks and reducing the risk of unpaid checks, Bank Al-Maghrib has signed an agreement, with Creditinfo Checks, for the management of the Irregular Check Centralization Service (SCCI), following expressed interest.

Creditinfo & Alternative Circle

Creditinfo Kenya has been instrumental in helping us build our mobile lending platform – Shika, which is a micro-lending app, through assisting us with building our credit rating technology that we use to score our users when giving out loans. They have been extremely helpful partners with a team that is committed, reliable and solution driven. We are glad to be associated with them.

— Kevin Mutiso, CEO Alternative Circle

Working with Creditstar

Creditstar has experienced a significant growth in business over the last years. The company has successfully entered new markets such as Spain, making financial products easily available to a population of more than 120 million people. In 2017, Creditstar approached Creditinfo to help them to review their loan origination processes for operations in Spain, Sweden and United Kingdom. Creditstar wanted to make sure that they were doing things according to the industry best-practice.

Creditinfo consultants reviewed underwriting policy, usage of internal and external data sources as well as usage of decision support tools and scorecards. Based on valuable insights supported by a rigorous analysis of data that were provided, Creditstar has implemented several improvements in their credit processes that led to higher operational efficiency, better risk management and more transparency. Creditstar implications also helped to enrich key reports structure and lay ground for future automation. Reviews during and after the project enabled practical outcome and helped to focus on the most important aspects.

— Aaro Sosaar, CEO of Creditstar