Creditinfo and PT PEFINDO Biro Kredit Sign Long-Term Strategic Partnership Agreement in Indonesia

PRESS RELEASE

Creditinfo Group, the leading global credit information and fintech services provider has today announced that it has signed a long-term strategic partnership agreement with PT PEFINDO Biro Kredit (PBK) to further support financial and non-financial institutions in Indonesia. Using Creditinfo’s knowledge and experience, PBK will enhance its consultancy and analytical services to provide customers with additional value-added risk management solutions and support.

Creditinfo And Artificial Intelligence (AI)

Artificial Intelligence (AI) is currently growing at a fast rate, and is becoming a hot subject in the industry globally. Individuals and organizations alike, are now moving towards that direction in order to increase efficiency and maximize on profits while lowering costs for themselves and their businesses.

Credit Bureau: Towards a new generation of services

Translated version of the interview with Sidimohamed Abouchikhi, CEO of Creditinfo Morocco.

Image credit: Finance News.

Interview by Momar Diao

Assessing credit risk of SME’s and how credit scoring can transform SME’s

Paul Randall was recently at the Kafalah SME Financing Conference in Riyadh, Saudi Arabia, and he tackled these 2 questions during the panel discussion.

What are the specific challenges of assessing credit risk of SMEs as compared to larger firms and how can fintech can help lenders address those?

Paul Randall at the Kafalah SME Financing Conference 2019

Kafalah SME Financing Conference was held in Riyadh, Saudi Arabia where they discussed current financing for SME’s in Saudi Arabia,how to build relationships between private and public FIs, government agencies and legislative bodies that support financing, current and future finance opportunities for specific business sectors and how to increase awareness of the most current international practices for financing SMEs.

Creditinfo expands regionally, stores information in Jamaica

In his interview with The Gleaner, CEO of Creditinfo Jamaica – Craig Stephen highlighted on the regional success and the goal to venture into other caribbean markets in the near future.

When challenge meets opportunity: Meet Ruby, a Creditinfo success story

The true spirit of an entrepreneur comes down to passion and determination. At Creditinfo, we meet entrepreneurs every day, and it’s our goal to support these budding business men and women with the appropriate tools, knowledge and access to finance.

How to use your credit score to negotiate better terms with your financial institution

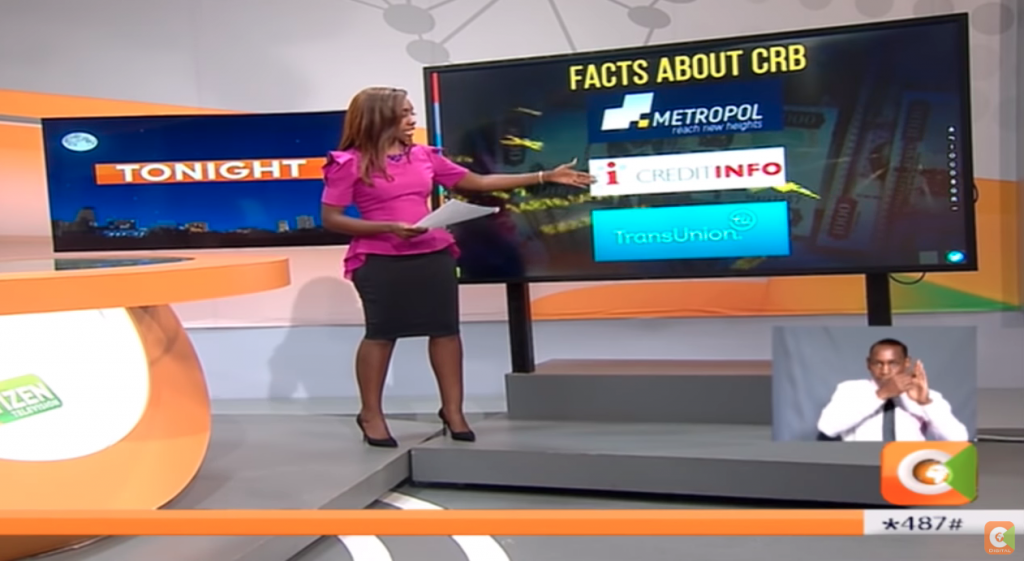

Last week, a leading TV station in Kenya – Citizen TV did a story on Digital Lending Apps and their impact in Kenya. There has been a sharp rise in the number of mobile lending apps in the country and the worry is about how people are accumulating debt and borrowing from the various apps simultaneously and defaulting therefore affecting their credit score.

Creditinfo Group awarded the Knowledge Prize 2019

The Association of Business and Economics has chosen Creditinfo as the Knowledge company of the year 2019. Creditinfo Group was chosen as the Knowledge Company of the Year by the Association of Business and Economics. During the selection process, companies that have excelled in their international markets in the recent years were considered. Other companies that also came at the top include CCP, Marel and Nox Medical.

Jamaicans urged to take credit scores seriously

Creditinfo Jamaica – Craig Stephen was interviewed by The Jamaica Gleaner on importance of Credit Scores