“Smartphone information can be sufficient to make a credit decision”

ARTICLE – IQ MAGAZINE INTERVIEW IN LITHUANIA WITH STEFANO STOPPANI

ECONOMICS | DATA ECONOMICS

“Smartphone information can be sufficient to make a credit decision”

Millennials will eventually stop from carelessly distributing information about themselves, but accessible data have a bright side too, thinks Stefano M. Stoppani, the CEO of “Creditinfo Group”, uniting 33 credit bureaus around the world. A discussion held by IQ reporter, Vilius Petkauskas.

Recently, “The Economist” compared data to oil and affirmed that the importance of the former in the XXI century will overpower the black gold. Would you agree with such a statement?

Creditinfo Group Expands Middle Eastern Presence with New Regional Office

PRESS RELEASE

Creditinfo opens new facility in Muscat, Oman to enhance services offered to customers in region

Muscat, Oman, 12 March 2019 – Today, Creditinfo Group, a leading provider of global credit information and fintech services, announces that it is expanding its footprint in the Middle East with the creation of Creditinfo Gulf, the organisation’s regional hub in Muscat, Oman. The new office will support current and prospective Creditinfo clients, with access to a wealth of global expertise, knowledge and technology to enhance the existing financial infrastructure in the region.

Utilizing subscriber training to inform sales strategy

CREDITINFO GUYANA

In an emerging economy where the credit reporting industry is in a fledgling state the requirement for awareness building extends beyond general consumer awareness to educating the community of potential subscribers. Given its experiences in developing the credit reporting market, Creditinfo Guyana has taken the decision that in addition to implementing a general public relations programme to also embark on an extensive ‘training’ programme for current and potential subscribers.

Credit Information Bureau of Sri Lanka strengthens financial infrastructure with Creditinfo Group

PRESS RELEASE

Credit Information Bureau of Sri Lanka (CRIB) and CreditInfo enter into strategic partnership to enhance its credit bureau services in the country.

Creditinfo combats Synthetic Identity Fraud for the Kenyan mobile lending market

PRESS RELEASE

According to a recent article by Mckinsey, many fraudsters are now using fictitious, synthetic IDs to draw credit. Applying for credit using a combination of real and fake, or sometimes entirely fake, information creates synthetic IDs. The act of applying for credit automatically creates a credit file at the bureau in the name of the synthetic ID, so a fraudster can now set up accounts in this name and begin to build credit.

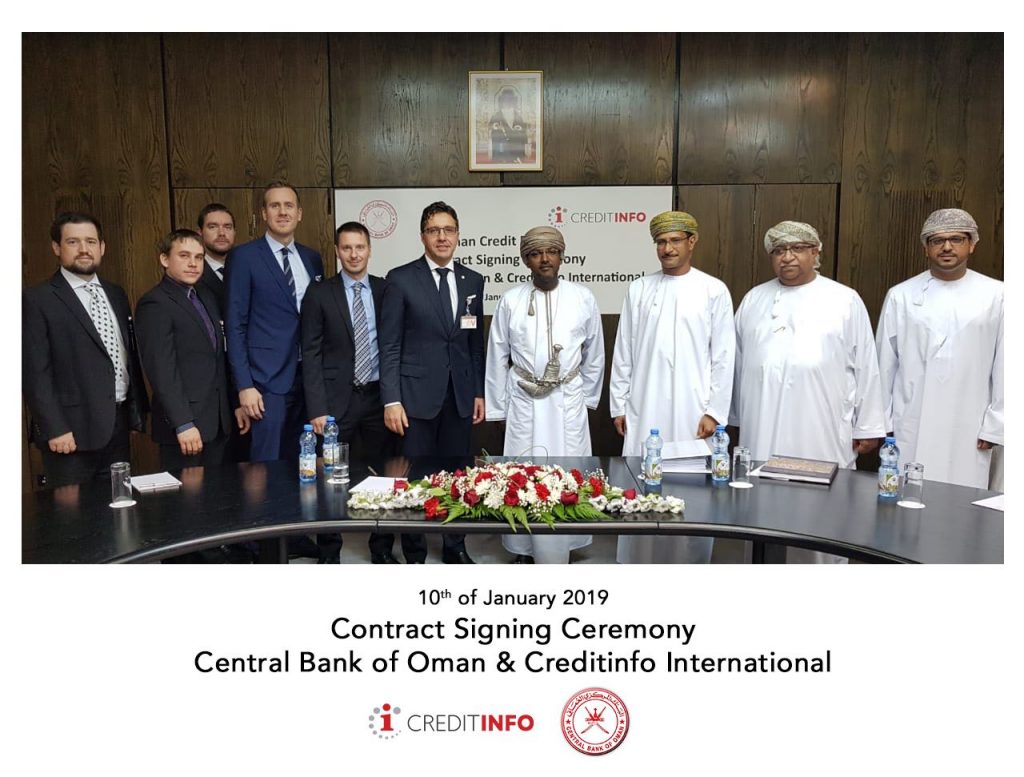

Creditinfo Group wins contract with Central Bank of Oman for the Implementation & Support of Oman Credit Bureau “OCB”

PRESS RELEASE

Creditinfo joins forces with Central Bank of Oman (CBO) to implement a world class Credit Bureau in the Sultanate

PRESS RELEASE: Know your credit score to make better informed financial decisions

PRESS RELEASE

DPI, Guyana, Thursday, November 22, 2018

– all lending agencies are mandated by law to share all credit data with the credit bureau

– “a lender cannot pull your credit report without your consent”

– know your credit score – it prevents over-indebtedness and encourages responsible borrowing and brings stability to the financial sector

– credit bureau was established in 2013 and operates under the Credit Report Act of 2010 and the Credit Reporting [Amendment] Act of 2016

Guyana – Successes driven by One Creditinfo at Work

Creditinfo from data provider to trusted industry leaders; a case study from Guyana

Ben Riley, Global Consultant Creditinfo and David Falconer, Sales Manager Creditinfo Guyana

In many ways the country of Guyana is unique. Considered part of the Caribbean region even though it is on the South American mainland. The only English speaking country in South America more interested in cricket than football. On the lowest population density countries on earth (just behind Iceland) but with 30% of that population residing in the capital city of Georgetown. However in the area of Credit, Guyana is proving again that a Creditinfo Credit Bureau can by the driving force behind market development and the opening up of affordable credit to all.

Consumer lenders in Latvia obliged to exchange full positive credit history via Credit Bureaus

PRESS RELEASE

Changes in Consumer Protection Law adopted by Saeima (Latvian Parliament) obliging consumer lenders to exchange positive credit information about consumer and to use this information in assessment of creditworthiness is a positive step, said “Kredītinformācijas Birojs”.

Creditinfo Estonia celebrates the 25th anniversary

Creditinfo Estonia – the oldest company in the Creditinfo Group – celebrates the 25th anniversary this year. Creditinfo Eesti AS was established in 1993 (operated under the name Krediidiinfo AS until December 2016). Many years’ experience has helped the company to become the largest and most professional Estonian supplier of credit information.

Creditinfo Estonia has been a loyal long-term partner to Estonian companies helping them to make smart and intelligent business decisions. Creditinfo Eesti AS is the Estonian market leader in the sector of information collection, processing and intermediation.

On 17th of October, Creditinfo Estonia celebrated its 25th anniversary with the clients in a client-conference: Creditinfo 2.0.43. Our goal was to look back to the eventful history, and to begin with the creation of a new version of Creditinfo Estonia for the next 25 years – Creditinfo, version 2.0.43!

The main topics of the conference covered the preview into the next years – possibilities of using alternative data solutions in credit ratings and cross-border data exchange, we talked about innovations and advances in data ecosystems and analytics. Additionally, we took a closer look into what is happening in the credit-industry in the world.

The conference was a perfect thank you gesture for all the clients, who are the roots of our success. Trust and loyalty from the clients give us the inspiration and courage to create innovative solutions impacting the business and social environment around us.