Digitalization Helps Lenders Overcome Challenges Caused By COVID-19

The rapid spread of the Coronavirus is impacting economic growth and market volatility is increasing thus impacting the industry through weakening investment returns and potentially adverse impact on the capital position of financial institutions around the world. A sustained economic slowdown triggered by the outbreak will put negative pressure on revenues and lead to a material increase in credit risk and a potential spike in claims including for health, credit and event cancellation insurance.

How alternative data can help unbanked population acquire traditional loans

By Dmitry Borodin, Head of Risk Analytics at Creditinfo Group

In societies of Digital Nomads, working from home Millennials, global migrations and emerging economies, lenders are often facing a shortage of relevant data to score and assess a big pool of population. Consequently, lenders are often unable to make decisions on so called ‘thin files’ due to a lack data. Thin file customers then remain excluded from formal finance.

How to use your credit score to negotiate better terms with your financial institution

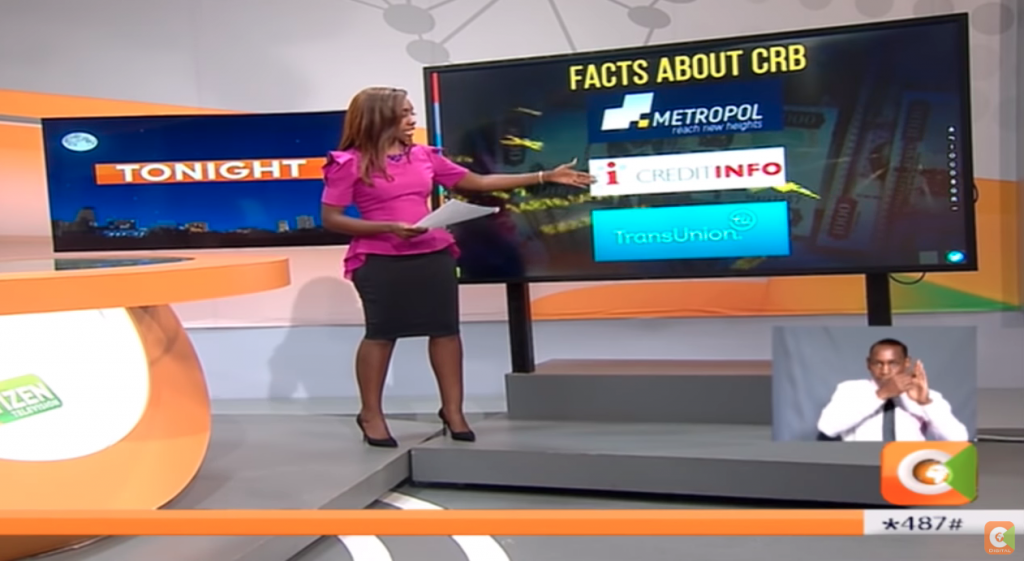

Last week, a leading TV station in Kenya – Citizen TV did a story on Digital Lending Apps and their impact in Kenya. There has been a sharp rise in the number of mobile lending apps in the country and the worry is about how people are accumulating debt and borrowing from the various apps simultaneously and defaulting therefore affecting their credit score.

Creditinfo combats Synthetic Identity Fraud for the Kenyan mobile lending market

PRESS RELEASE

According to a recent article by Mckinsey, many fraudsters are now using fictitious, synthetic IDs to draw credit. Applying for credit using a combination of real and fake, or sometimes entirely fake, information creates synthetic IDs. The act of applying for credit automatically creates a credit file at the bureau in the name of the synthetic ID, so a fraudster can now set up accounts in this name and begin to build credit.

Creditinfo inks contract with Housing Finance Kenya

The Housing Finance Company in Kenya have introduced mobile lending this summer and chose to use Creditinfo’s Instant Decisions as the one and only decision-making tool. They chose an in-house installation back in June and then, after several weeks of consultancy and strategy design project, we have come together with the customer to the point where we have a very complex strategy with 3 different Credit Limit Allocation matrices, matching competition’s limit and limit allocation as a function of previously received loans. After successful pilot in July, August they opened it for a wider population, and just recently, in November, to the entire Kenyan population, through all channels – iOS, Android and USSD – and they had a big marketing campaign for USSD customers that had its apogees last week, starting November 18th 2018.

From Unemployed to Financially Empowered: Meet Dorah, Creditinfo Success Story

So many great stories on financial inclusion across the globe are left untold. So rewarding to be able to share with you at least some of those, where Creditinfo can contribute and make a difference. Watch the story of Dorah.

Atlas Mara instantly increased their credit limits thanks to Instant Decision Module

Our decision to partner with Creditinfo for Risk Management Services is hinged on their innovative value-added services, risk consulting and overall commitment of the leadership team. Creditinfo is a leader in automated risk-decisioning systems, data analytics and scoring services. Their risk consulting services is world class and manned by the best.

We use Instant Decision Module (IDM), their flagship product for risk-decisioning in our micro-lending business. IDM provides us the means to securely protect our risk decisioning rules, which, equates to our IP; IDM also enables us to set risk decisioning rules at granular level, and to track/measure outcomes for post-mortem reviews. It has a web-service interface that enables our loan application to interact with it in real-time. With IDM, risk becomes measurable and controllable.

— Ikedichi Kanu, Country Head at Atlas Mara Digital, Kenya

Creditinfo CRB Kenya launching its risk management products and services

Creditinfo CRB Kenya Ltd. is a credit reference bureau licensed by the Central Bank of Kenya. Recently, the company has launched its risk management products and services into the market. You can read more in the article by Stellar Murumba following this link.

“Queen of the Slum” visits Creditinfo Iceland

Lucy Odipo, better known to most as “Mama Lucy” or the “Queen of the Slum”, is a truly amazing woman. Mrs. Odipo is the initial founder of The Little Bees Children Self Help Group and currently serves as Director. A Kenyan national, Mrs. Odipo has played a vital role in establishing vital projects in Nairobi, such as The Little Bees School a Nursery School & Daycare to provide critical care and support for deprived children.. Through the school and related projects , Mrs.Odipo and her team provide much needed education and help to individuals and families to access medical care and to secure shelter.

Lucy lives amongst the 500,000 inhabitants of the slums of Mathare in Nairobi, Kenya. Most of the people live in tiny, one-room homes made from whatever materials they can find. Conditions are dismal with sewage and trash flowing through the streets along with crime, sickness and death running rampant. There are no government services like water or electricity. Continue reading »