Creditinfo launches SME blended scorecard in Kenya

Credit information leader launches pan-African SME initiative, ahead of global rollout

LONDON, UK, 21st July 2021 – Creditinfo Group, the leading global credit information and decision analytics provider, is today announcing the launch of a scorecard solution tailored for small to medium-sized enterprises (SMEs). Through its unique approach to data and algorithms, this scorecard will help financial institutions improve their credit assessment and facilitate financing to the SME market, which has typically been less able to access finance.

Creditinfo, recognizing the importance of SME risk assessment across the world is aiming to roll out a global solution to address this challenge. The company will first launch the SME scorecard in Kenya, ahead of a wider rollout across countries in Africa, and several other key economies across the globe.

The unique modeling approach Creditinfo have developed significantly reduces, and in some cases eliminates, the human effort needed to assess customers’ risk profile based on credit data. It is delivered in a software platform which unifies, streamlines, automates and centralizes the risk evaluation process. Creditinfo’s SME scorecard is considerably stronger at predicting business failure than existing traditional models.

Burak Kilicoglu, Director of Global Markets at Creditinfo, commented, “SMEs drive innovation and push digitalization forward for many people by providing services to underserved segments of the population and creating job opportunities. SME scorecards will accelerate access to finance for the benefit of whole economic ecosystem. At Creditinfo we have access to a wealth of credit bureau data as a starting point, and so are uniquely positioned to offer this solution in global markets.”

Kamau Kunyiha, CEO of Creditinfo CRB Kenya, added, “Kenya is the most dynamic and receptive market for SME lending innovation, demonstrated by the successful adoption of mobile wallets and microloans. We look forward to seeing the economic impact of this new solution as it comes into full effect and we see more capital flowing through the SME economy.”

-ENDS-

About Creditinfo

Established in 1997 and headquartered in Reykjavík, Iceland, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

PR contacts:

Marketing Manager/ PR for East Africa

Phidi Mwatibo

Email: Phidi.mwatibo@creditinfo.com

Increased use of credit bureau data in Lithuania

The use of credit bureau data is growing along with economic activity, although businesses tend to undertake additional precautions

The INTRUM EPR 2021 survey published in June reported on the growing demand for pre-payments against a decreasing trend of conventional risk management measures, such as credit history screening, insurance and factoring.

The current situation in the business sector could benefit from some clarifications and comments. In turbulent and uncertain times – and lockdown could rightly be said as being one of these – entrepreneurs tend to undertake additional safeguards, e.g. pre-payments. However, any quantitative easing measures, such as material support offered in the form of soft credits or subsidies, enabled many businesses to maintain their liquidity at least for some time. This is why the corporate performance results were not as devastating as they were during the Great Recession, when manufacturers importing commodities were forced to allocate all of their funds for pre-payments to their suppliers.

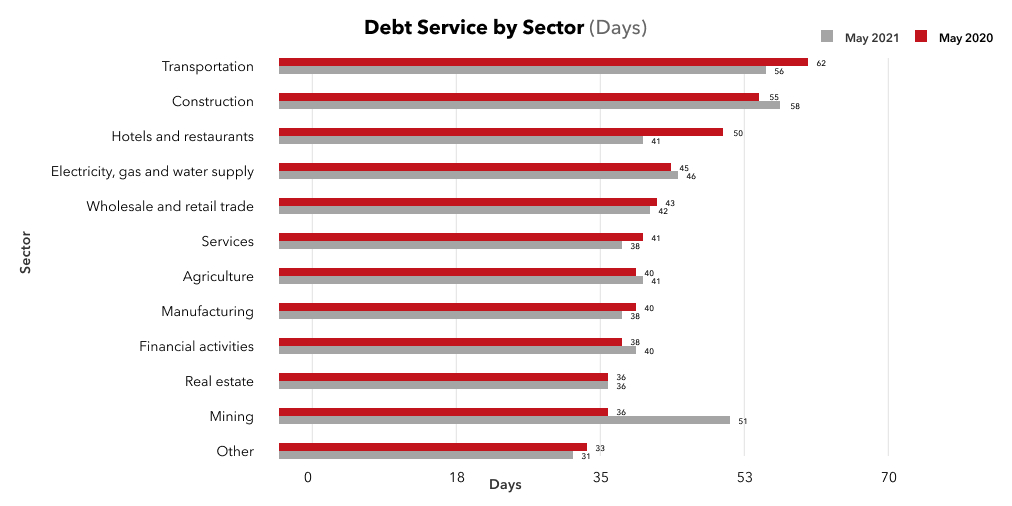

Meanwhile, the statistics demonstrates some late payments to the partners in 2021 in the sector of hospitality industry (by 9 days, from 41 to 50), in transport (from 56 to 62 days), in services (from 38 to 41 days), in processing industry (from 38 to 40 days). In contrast, in the financial operations sector, the payment terms have become shorter.

Quite reasonably, one may wonder what are the reasons behind shorter payment terms – can these be explained by precautions taken by the suppliers or by an improving economic situation?

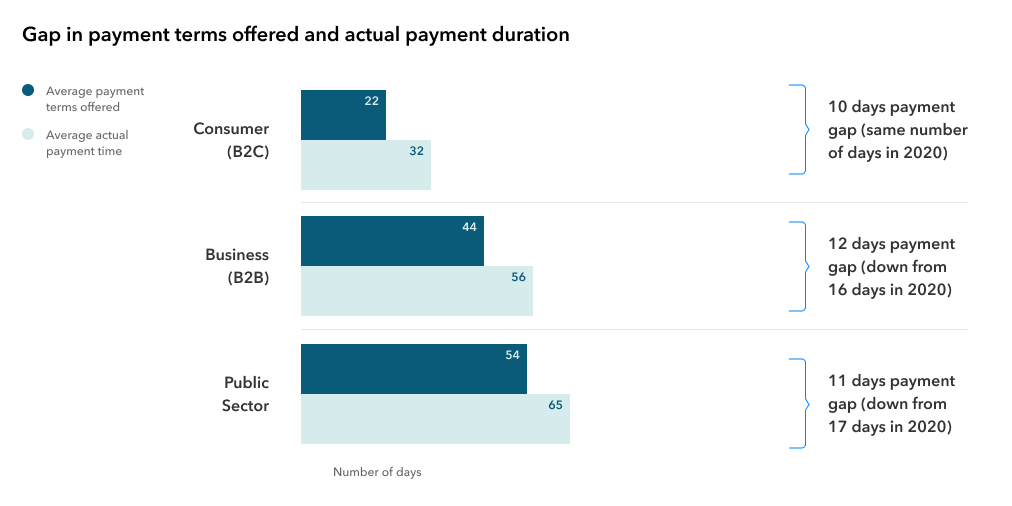

I would like to draw the attention to the fact that in the times of the pandemic shareholders would recommend public sector representatives tightening payment gaps to enable the business sector to improve liquidity in the private sector. In the private sector the medium-term payment gaps were affected by a more resilient economic structure, as businesses suffering from liquidity shortage made only a fraction of all businesses.

Moreover, account needs to be taken of the fact that as many as 60 percent of companies responding to the INTRUM survey in Lithuania admitted anticipating recession in contrast to economic forecasts showing a clear recovery.

Lithuanian business market is rather optimistic: the economic evaluation index in Lithuania has already reached its pre-pandemic level (116 vs. 110), this indicator was higher only in 2007 on the eve of the Great Recession. In addition, all sectors last May demonstrated a growing confidence index. Commercial confidence index grew by 9 percentage points, while in the service, industry, and construction sectors it grew by 7, 4, and 1 percentage points, respectively. Only the consumer confidence index dropped by 3 percentage points.

In parallel, a rapid growth in the real estate prices and demand is being reported along with the signs of growth in the prices of commodities and inflation. All these factors may signal the approaching peak in an economic cycle, which explains the lingering anxiety about a possible recession due to the phasing-out of economic stimulus measures.

One of the most popular support measures – tax deferrals – are drawing to an end: default interests and tax recovery procedures will not be calculated until 31 August 2021 and for two subsequent months; one may expect to see a more realistic state of business health towards the end of the year.

Nevertheless, the following conclusion has to be drawn as a comment on the use of credit office information systems by the organizations: the number of inquiries recently has been changing along with the economic activity – within the first 5 months the number of inquiries increased by 12 percent compared to 2020 year-on-year, and by as many as 25 percent compared to 2019 year-on-year.

Jekaterina Rojaka,

Head of Business Development and Strategy,

Creditinfo Lithuania.

The ‘Cornwall Consensus’ – A Credit Bureau Perspective

From a credit bureau perspective, a close partnership between government and business has always been essential to ensure the economic goals of a country are achieved. It was therefore interesting to see this relationship being promoted as part of the ‘Cornwall Consensus’ last week at G7.

Gillian Tett of the Financial Times was discussing this concept in a recent article which considered the ‘profound, reset under way of the relationship between business and government.’ Tett describes the change by which ‘companies were regarded as independent actors competing with one another, without state involvement,’ to a relationship which would result in more of a ‘“partnership” between government and business.’

From a credit bureau perspective, this is a familiar concept and one that has been central to the proliferation of bureaus across the globe over the last 15 years. It has been very successful in ensuring that emerging markets have the necessary financial infrastructure to support the growth of MSMEs and SMEs, to provide banking stability and deliver access to regulated financial services for all rather than it just being the reserve of the wealthy middle classes.

Private international investment is at the heart of this partnership with government by creating a sturdy financial infrastructure and sharing technical knowledge with local institutions. This is closely overseen and regulated by the governments and central banks with further support given by the World Bank. Creditinfo has been one of the leading global experts that has made significant investments in setting up new credit bureaus in green field markets under the regulation of local central banks.

The support of governments has been critical to accelerate access to finance for the “invisible” unbanked by introducing regulation to require the inclusion of “alternative data” such as utility data and mobile or nano loans. The benefit of this is that it enables a broad section of the population to create a financial footprint upon which they can build a credit history for the future. This was further endorsed by recent research from the PERC group.

The relationships between businesses and governments should see the development of new solutions to support SME and MSME growth as companies of this size are the backbone of many economies, especially in developing markets. Government departments will often have registers of companies which can be used in supervised environments to facilitate improved assessment of loans or credit making it faster and easier for SMEs to access financial support.

Government-investor partnerships may be seem like new vision emerging from the pandemic when state support was essential, however, for investors like Creditinfo that have been working within such a framework for many years, it is a proven method to achieve social, economic and business goals.

How to build an impeccable credit history

Within the first days of our lives, we are all issued a birth certificate which becomes the first document of the pile that we are to collect during our lifetime. Birth certificates are followed by passports, then graduation certificates, college or university diplomas. Reaching the age of majority entails, among other things, responsibility not only for one‘s professional career, but also for financial decisions which are reflected in the credit history. In other words, credit history is a yearbook of one‘s financial obligations, which is read by banks, leasing companies or other institutions in order to assign you to the categories of either reliable or less reliable clients and decide whether they are willing to accept you for credit.

No Credit Without Credit History

According to the surveys, more than half of the adult population of Lithuania are active users of credits to finance purchase of the real estate, vehicles, household appliances, furniture, PCs, phones, etc.

To get a credit, you apply to the banks or leasing companies. They first look into your credit history which shows how well you performed our financial obligations in the past, including consistency of timely payments for electricity, telecommunication services or garbage removal, also timely repayment of other credits and any overdue debts.

A good or bad credit history determines whether you will be accepted for credit to buy a new refrigerator instead of an old broken one, whether sellers will agree to sell you a new phone just after signing an agreement on payment in installments over the next two years. If the credit history is sound, you can expect the most favorable conditions and trust of the seller. A poor credit record means that you may have to pay the entire amount at once.

A History of Amounts and Discipline

The credit history reflects two types of information. The first one is an account of financial obligations, credits in the banks, consumer loans from credit institutions or peer-to-peer lending platforms, leasing, etc. Lenders use this information to assess the client‘s budget sufficiency, i.e., the percentage of income spent for servicing the existing debts. The second type of information is the track record of repayment of debts indicating the discipline of making payments for credits, mobile phone, internet, cable TV and other bills.

Banks Favor Positive Rather than Empty Credit History

The staff of the credit bureau is often asked what a good credit history is. One may think that lenders favor those who never had a loan, leasing or credit card, and never delayed payments to service providers, hence their credit history is empty. Yet the lenders‘ approach is different. On the one hand, an empty credit record may indicate that you had no need to borrow or to buy on lease in the past. On the other hand, who is more trustworthy: a client who repaid his lease or loan in time, or a person who never had any financial obligations? A survey conducted by “Mano Creditinfo“ revealed that banks tend to be more favorable towards clients who had financial obligations in the past as they are more predictable.

Financial institutions tend to trust clients with good credit history and offer them better conditions, such as a lower down payment, lower interest rate and more flexible repayment terms. For instance, Swedbank‘s Institute of Finances earlier advertised that good credit history may save up to several thousand euros in interest on home loans. Good credit history will save you up to EUR 500 on a loan for a EUR 5,000 worth car, or up to EUR 1,700 on a EUR 10,000 worth car lease.

Can You Fix a Bad Credit History?

Yes, you can, but it will take time and effort. There are several factors that determine a bad credit history, including high financial obligations, excessive and unreasonable borrowing, borrowing to service outstanding debts, delayed payments and other. If your credit history contains any such events, you have to brace yourself for a hard time, as cosmetic adjustments will not erase or eliminate them. If you tend to assume too many financial obligations, you will have to reduce their number and curb your appetite for borrowing for some time at least. If you have any overdue payments, you are recommended to make the payments as soon as possible and never delay them again.

Financial institutions usually analyze the credit history of the recent 2 or 3 years, and the negative impact of the sins of the past gradually fades away over time. Thus, if you have a poor credit history and decide to change your approach towards your financial obligations today, financial institutions may still have questions about your past financial behaviour for a couple more years to come.

Mistakes to be Avoided

Information about the financial relations and obligations will accompany you throughout your entire life telling a story of either a high financial discipline or lack of it. If you decide to borrow, you must carefully assess your ability to cover the debt and think about the ways to ensure the repayment even if you lose your income. Negative records appear in your credit history very quickly, within a month from the day the payment was due. Erasing this record from your credit history will take years, though.

Aurimas Kačinskas,

CEO – Creditinfo Lietuva.

KYC: How compliance can improve business performance – post event summary

Know Your Customer (KYC) is not just a set of regulations to comply with. With the right data, processes, and technology, it can be a valuable tool to understand our customers better and thus be able to support them throughout their challenges, while at the same time shielding business owners from unnecessary risk. We wanted to delve a little deeper into this issue and so hosted a webinar with leading experts on the regulatory environment and financial crime to delve into the topic. Our panel of experts discussed what organizations need to do to de-risk their operations and how they can set themselves up for future success.

Our expert panel was made up of Graham Barrow, Director and Presenter of the Dark Money Files podcast, Viljar Kähari, Co-founder of PWC Legal Estonia and Gandolfo Iacono, CEO of LexisNexis Russia CIS & Eastern Europe.

Chaired by our Director of Global Markets, Brynja Baldursdóttir, the webinar drew in over 500 registrants and 300 attendees from 33 different countries, all eager to better understand the opportunities compliance technologies can bring to a business.

Brynja began the session by explaining that KYC is not just a box ticking exercise, it is a necessity for better business in 2021. The key thing to consider is that KYC is all about trust.

Dark Money

To begin, Graham contextualized the important role that KYC plays in protecting the financial system from ‘dark money’. Dark money, “which is any money that enters the financial system for which you cannot show for certain where it comes from”, has real victims that do not show up on paper. Dark money must come at a cost to somebody. Better KYC processes are not just protecting customers and businesses, it also protects taxpayers in corrupt countries and potential victims of money laundering all over the world.

Part of the issue with stopping or at least resisting the flow of dark money according to Viljar Kähari, is that “banks interpret KYC requirements very differently. It seems that client onboarding and monitoring processes are sometimes much more important than actually understanding a client’s business and monitoring transactions.” This alludes to what Graham believes the larger problem to be, that, “there really is a big difference between banks being compliant in terms of the anti-financial crime requirements, and stopping dirty money entering the system.”

Understand your customer

To shift from just being compliant with regulations to stopping financial crime with compliance we must progress from Knowing Your Customer to ‘Understanding Your Customer’ (UYC), a phrase Graham coined during the discussion. He commented that this is “because if people are intent on laundering money, they will provide beautiful documentation to get into the financial institution, but that documentation will need to be lies.” If we can go beyond knowing our customer to understanding them, then we can see through even the best lies. “Because if you force people and criminals to lie when they create the accounts documentation, you then have good documentation to monitor the downstream transactions. And that is the control. It is getting them to say in detail what they want you to hear and then monitor in detail what they actually do. It’s the difference between those two things, which is your control.”

Data, data, data

Our panelists agreed that the bridge between KYC and ‘UYC’ is data. Graham commented that “the ability to take KYC data, and feed it into your transaction monitoring system intelligently, is probably the single most important thing we can do. But we must sell one idea to all our customers. The idea that KYC is not an ordeal we have to put the customer through. It is the most important thing we can do to protect them.”

There are barriers that compliance teams need to break through to get to this next level of KYC. Gandolfo says, “the issue is that we see compliance or AML as a cost centre”. Compliance departments need to be seen as an asset hat needs serious data and software,” and many managers are not aware of this. Managers need to see the value that effective compliance brings in potential fines avoided. Viljar concurred, “compliance departments are overloaded. They do not have the resources they need; they do not have access to different databases.”

Perception

The perception of compliance needs to change for organizations to allocate the resources teams need to resist the flow of ‘dark money’. Viljar stated that “changing the mindset of compliance officers from an inspector to a business advisor is more important and necessary today. Because we cannot assume that all clients are criminals unless they can prove otherwise. It is the common understanding now because you need to provide a massive amount of information and documentation to show that you are getting your money legally. And that is why I’m thinking that the compliance function must become more proactive at finding practical solutions rather than just saying ‘that this work cannot be done.’”

To make this organizational culture shift it will take time, but our panel agreed that a realistic alternative is to outsource KYC and AML, provided there is not a “homogenization of risk appetite”. Viljar noted that when a company does not have access to a public register, “there are several service providers who can easily help to solve this problem. Just the banks and other regulated financial institutions must trust service providers and user services.”

Change of mindset

Summarizing the event Brynja rounded up the discussion by pointing out that the most important takeaway from the webinar is that as an industry, we need to start changing our mindset from knowing our customer, to understanding our customer. We need to vastly improve international cooperation in terms of legislation and regulation, and we can refine processes around KYC in terms of increasing shared services, using data and technology in a smarter manner which ultimately should make sure that we as businesses make our processes reflect our appetite for risk. It is time to make the switch from simply knowing, to understanding our customers.

Learn more

This virtual event was a huge success from our perspective which gathered an incredibly engaged audience. Thank you so much for all your brilliant questions – our panel enjoyed the lively debate!

If you would like to re-watch the session, or if you were unable to attend, please use this link to learn about the benefits KYC compliance can bring to your business.

Number of bankruptcies up by 26% in Estonia

Creditinfo’s bankruptcy survey revealed that the amount of bankruptcies grew last year for the first time in ten years and increased 26% compared to 2019 in Estonia.

Last time the number of bankruptcies grew significantly was due to the global economic crisis in 2008 and 2009 when the growth measured up to 150% in annual comparison. There was marginal growth (+2.4%) in 2017, but this was a shift by eight companies. In 2020, the number of bankrupt companies increased from previous year’s 271 to 341 ( 26%). The share of companies that have gone bankrupt is at 0.15% of all registered companies.

“The amount of bankruptcies remained at a low level in 2020, but there was still a trend of significant growth in the number of bankruptcies that we have not seen since the beginning of the previous great economic crisis. It may be assumed that this was partly due to the effects of the corona crisis, but since the bankruptcy process is long-term, we will probably see the greater effect here next year,“ explained Creditinfo Estonia’s analyst Helen Tinkus.

There was also growth in the last decade’s continuous downtrend of the number of asset-less companies, where bankruptcy rates dropped due to the absence of assets. During 2010-2019 the number of dropped bankruptcies decreased on average by 14% yearly. In 2020, the number of asset-less companies increased by 49%.

“This might have been caused by the fact that the economic environment had become insecure because of the corona crisis. More business plans failed completely and the companies were unable to gather any assets at all before the insolvency situation developed. At the same time, there were also some asset-less companies that showed substantial turnover numbers in the years prior to the bankruptcy,“ Tinkus added.

The areas with the highest rate of bankruptcy are still hospitality and catering, manufacturing industry and construction. The rate of bankruptcy was above the average in wholesale and retail as well.

“There have been no changes in the fields of activity with the highest bankruptcy rate in the recent years. But the share of bankrupt companies in the hospitality and catering sector grew faster than in others, both compared to other fields of activity and to previous periods. These are the fields that was influenced the most by the corona crisis and the restrictions. Based on the payment defaults and wage compensations statistics, we can predict a greater effect of the crisis on the companies operating in the field also in the coming years,“ Tinkus stated.

Creditinfo Estonia Ltd has conducted bankruptcy surveys about Estonian companies since 2000. During the 20 years the number of bankruptcies has both increased and decreased in waves, reaching the peak level in 2009 as a result of the global economic crisis. In 2011 the number of bankruptcies fell by a remarkable 40%, in 2012 by 20%. Bankruptcies have decreased steadily also in the following years, reaching the pre-crisis low level in 2015.

Ends.

Media Contacts:

Rain Resmeldt Uusen, Head of Marketing – Creditinfo Estonia

Email: turundus@creditinfo.ee

Tel: +3725018998

Credit Post-Covid

Historically, every time that there was a crisis, lessons were learnt. The Authorities, be they political or financial, rushed in to introduce and implement corrective regulations and legislation to either block legislative loop-holes or correct oversights that permitted players in their respective fields, but especially in the financial sector, to take advantage of same for their own individual benefit with little regard for the rest.

The lessons and improvements implemented by regulators and financial institutions since the from the last financial have stood the banks and financial services in stronger position when facing the financial crisis which is following the health crisis. Banks are reacting by using data insights through monitoring and early warning solutions to address problem debts before they escalate.

A few years later, with the introduction of strict regulatory measures, the requisite confidence and stability in financial markets was gradually established. Central banks are now closely monitoring these, issuing directives on a regular basis to further stabilize and impose tighter controls to prevent a repeat. Regulating banks is difficult, unfortunately, and there is always the risk that a similar crisis raises its head again.

This is a very simplistic reference to the Financial Crisis of 2007-2009, which forced changes and tighter controls on the global financial markets.

Changing the scenario to the present day, COVID-19 pandemic, although different, in that it is more of a medical beast, has impacted the global population and, as a result, the global economy has turned out to be messier than the Financial Crisis of 2007-09. Individuals who own and control both global economic and non-economic practices are the victims this time. Through its secondary effects, the pandemic, may also be considered as a financial crisis. The policies put in place to control and ultimately curtail the pandemic, have so far had limited success in curbing the spread, but they did manage to create havoc with the global economies. Some industries, such as food distribution, benefited from rising demand, while others, such as telecommunications and pharmaceuticals, were unaffected and continued their operations, although maybe at a slower pace but certain sectors took a heavy beating.

The airline, travel, hospitality, leisure, and entertainment sectors have been hit the hardest with dramatic reduction in activity and with closures being the norm.

The airline industry, on its own, according to a KMPG report, estimate a revenue loss worth USD200 billion in 2020 and to prevent a total collapse, government assistance, worth USD200 billion is being considered.

However, the airline industry is just the beginning. One has also to consider other businesses that are directly and indirectly linked. Millions of individuals are affected – loss of jobs or reduced hours of work translate into less consumer spending, higher risks, defaults and similar. At this point, the Great Depression comes to mind, but the true impact of the pandemic will be gauged towards the end of 2021 and throughout 2022.

In these turbulent times, with losses expecting to continue until 2022 and possible, even beyond, risk management is crucial and extremely critical for all industry players. Despite, corporate bankruptcies still being rather low, further pandemic waves with the relative lockdown and restrictive policies would deplete remaining cash reserves and eventually increase bankruptcies.

The new normal will set in at different speeds as lockdowns are lifted, but this will also depend on the recession in each country and on the effect of restrictions on demand and supply. Recoveries may vary by sectors, but severe economic necessities may induce Governments to loosen their restrictive policies in an effort to kick-start certain activities, in particular, the airline industry and travel, which indirectly would also re-activate the hospitality, leisure and entertainment sectors.

It is now more critical than ever that financial institutions and other market participants, recognize the value of using tools like a Credit Bureau. These credit bureaux deliver insights in the data such as credit scoring and financial transparency, that can identify riskier projects/individuals/businesses, and thus prevent defaults to the benefit of the lender and national stability, in general.

Now is the time to gain a better understanding of our local marketplace, and the speed in which information changes. We have to comprehend how our local marketplace will perform in the post COVID era. It is better to be informed than to continue blindly as the future is changing and businesses and individuals must adjust and act accordingly.

In the immediate future, credit risk assessments, will be based on real-time monitoring of sectoral and sub-sectoral situations, making historical data in previous known environments less important – COVID has taught us a tough lesson

Remy Damato,

Credit Reporting Manager, Creditinfo Malta.

Creditinfo Group enters collaboration with Společnost pro Informační Databáze (SID) in Czech Republic

Czech Republic, Prague, April 22nd 2021- Creditinfo Group, the leading global credit information and decision analytics provider, and Společnost pro informační databáze (SID), service provider of SOLUS Credit bureau, have agreed to partner in the areas of data transformation, decisioning engines, data analytics and scorecards development. The agreed partnership enables SID to use the global credit risk management expertise of Creditinfo Group as well as its solutions and analytical capabilities to better service members of SOLUS Credit bureau, one of the two largest credit bureaus in the Czech market.

“We are proud to have been chosen by SID as it’s partner for members of the SOLUS credit bureau and are looking forward to leverage our global experience as well as presence of our group IT development, global data analytics, and consultancy centre in Prague for Czech banks and financial services players, members of the SOLUS credit bureau” says Seth Marks, Regional Director of Creditinfo Group.

“With Creditinfo Group we materially strengthen our portfolio of software, decisioning and analytical solutions available for both SOLUS members and for the wider Czech financial sector. Connecting its global experience with our strong local presence in the Czech market enables our existing and new customers to further increase efficiency and including improved credit risk decisioning speed, says Ján Hurný, CEO of SID.

– Ends-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

About SID

SID is an exclusive service partner and facilitator of SOLUS credit bureau, one of the two largest credit bureaus in the Czech Republic with more than 50 members from banks and financial services. SID enables efficient data exchange among bureau members thus strengthening their insights and decisioning capabilities. More information are available on www.sid.cz and www.solus.cz

Creditinfo Group Awarded World Bank Tender

São Tomé and Príncipe, São Tomé, 19th, April 2021 – Creditinfo Group, the leading global credit information and decision analytics provider, today announces that it was awarded a tender by the Central Bank of São Tomé – represented by AFAP (Agencia Fiduciaria de Administracao de Projectos) who will be handling a project on the delivery and support of Public Credit Registry, financed by the World Bank.

Sao Tome is working with the World Bank with the aim of improving the financial infrastructure in the market, increase access to finance and enhance market stability. Creditinfo has already supported many markets in achieving this goal and was identified as a trusted and reliable partner.

Creditinfo will provide CBS (Credit Bureau Solutions), including Value-Added Products such as the Statistical Score, MyCreditinfo, Benchmarking and Monitoring – the latest and modern cutting-edge products and services in the credit industry, to help the Central Bank of São Tomé in implementing the Public Credit Registry.

Samúel Ásgeir White, Director of Direct Markets, Creditinfo Group is excited about this opportunity. “The important part is the knowledge transfer and our active approach – direct help to the Central Bank of São Tomé, with the whole implementation process of our modern services in São Tomé and Príncipe, since we have years of experience from the Central Banks around the world that we provide the same products and services to,” he said.

The competition was organized by AFAP as a fiduciary agency responsible for the management of the World Bank’s financial support, in favor of the Central Bank of São Tomé and Príncipe as a borrower, with Creditinfo being elected as winner, among 4 bidders.

On behalf of AFAP, Carlos Bonfim, technical advisor, intervened to congratulate on the conclusion of the contract with Creditinfo, a company whose references allow the prospect of a satisfactory result regarding the updating of the credit risk center of the Central Bank of São Tomé and Príncipe. He ended by expressing the wish that the quality of the partnership between all stakeholders will continue, in order to create a favorable cooperation climate for the implementation of the project.

-Ends-

About Creditinfo

Established in 1997 and headquartered in London, UK, Creditinfo is a provider of credit information and risk management solutions worldwide. As one of the fastest-growing companies in its field, Creditinfo facilitates access to finance, through intelligent information, software and decision analytics solutions.

With more than 30 credit bureaus running today, Creditinfo has the most considerable global presence in this field of credit risk management, with a significantly greater footprint than competitors. For decades it has provided business information, risk management and credit bureau solutions to some of the largest, lenders, governments and central banks globally to increase financial inclusion and generate economic growth by allowing credit access for SMEs and individuals.

For more information, please visit www.creditinfo.com

About AFAP

AFAP was created in 2004 with the aim of managing funds made available by the technical and financial partners of the Government of São Tomé and Príncipe, of which the World Bank stands out in particular. It has an effective and motivated team and is respectful of the best practices for regulating tenders, and today has a portfolio of projects and partners in constant growth. Within the framework of its performance, the main projects such as the installation of fiber optics in Sao Tome Principe to provide high-speed internet services, education and health for all, improvement of the energy system can be cited as an example of success. electricity, namely hydrocentrals, introduction of alternative energies as well as rehabilitation of main roads, etc.

For more information, the following AFAP website can be viewed: www.afap.st

How Creditinfo supports Fintechs

The COVID-19 crisis had a profound financial and social impact across the globe, with several different industry sectors impacted. Curfews limited the effective utilization of physical branches, forcing financial services firms to turn to online channels. Few organizations were ready to make the transition to ‘digital lending’ smoothly, but this is where the Fintechs excelled. Capitalizing on their technical competencies, agility, and focus on specific niches they triggered substantial advances in online lending – ranging from streamlined, friction free customer experience to KYC processes.

Instead of focusing on internal operational efficiencies like traditional banks, Fintechs driving digital lending started to construct an ecosystem of services that evolved around their customers. Regulators, who have been observing the significant growth of digital lending started to weigh in; either requiring compliance with existing regulations or developing new regulations to be met. These steps had a wide-ranging impact from data quality to having a prudent credit risk management framework, including analytics, risk management tools, policy and procedures.

Creditinfo is well positioned to support Fintechs, helping them remain focused on providing an outstanding customer digital lending experiences, while ensuring a proven credit risk management framework. Our approach consists of 4 key services:

- Data: the first step to perform a credit risk assessment is done by collecting all relevant Depending on circumstances, this can be traditional (Credit Bureau) or non-traditional (transactional) data. Data quality checks need to be performed to derive the maximum insight from it. Operating in 45 countries and providing Credit Bureau services in 23 of them, we define industry standards on data quality. We know how to combine traditional and non-traditional data to be used in decisioning that meets your risk appetite.

- Analytics: deriving insight from data is our expertise. Our highly predictive models underpin objective, prudent credit risk decisions. By combining non-traditional and traditional, we are able to improve predictive power by over 50%.

- Decisioning: implement your scorecards with ease in our decisioning system. Streamline and eliminate manual processes to ensure quick and consistent decisions to your customers, providing you a competitive edge.

- Business know-how: we know how to adapt global best practices within your local environment. We are ready to discuss with you how we have improved lending for one of our customers by over 20% or reduced non-performing loans by 15%.

Please get in touch with us to discuss how we can make a positive step change in your business.